To begin this Automic Trader on Steroids review, I want to ask you: Have you ever heard of a trading robot that works like magic? Let me introduce you to Automic Trader, a robot that has shown remarkable results. In just eight months, it achieved a stunning 318% profit! This caught my attention, and I knew I had to try it out. In this post, I’ll share everything about my experience with Automic Trader.

Error: Invalid Partner ID or the post is not a Partner.

Automic Trader on Steroids Review: Impressive Performance Statistics

The Automic Trader robot is not just any ordinary tool. Since March 2023, it has consistently performed well. In fact, it averages a 21% monthly gain. However, it’s important to note that the drawdown, or the decline in account value, is 44.32%. This means while the gains are high, there is also a significant risk involved.

Testing the Automic Trader

Before using it in a real account, I decided to test Automic Trader in a demo setting. This way, I could see its performance without any real financial risk. The vendor’s account started with $30,000 and made about $95,000. These numbers are impressive, but remember, past performance doesn’t always predict future results.

Automic Trader on Steroids Review: Understanding the Updates and Licensing

As of my last check on November 3rd, the latest update from Automic Trader was on October 16th. There’s a gap of two weeks where I don’t have data. To get live updates, which are crucial for real-time decision-making, there’s a fee. It costs $50 per year for a single license or $60 for a flexible one. This fee is something to consider if you’re thinking about using Automic Trader.

The Reason Behind Non-Green Live Updates

I noticed that the live update feature wasn’t always green, indicating real-time data. There are two possible reasons for this. First, the vendor, LeapFX, might not want to pay the annual fee for each of their many accounts. Or, they might only update the account when it’s profitable. This is something to keep in mind when evaluating the robot’s performance.

Delving Deeper: Advanced Statistics of Automic Trader

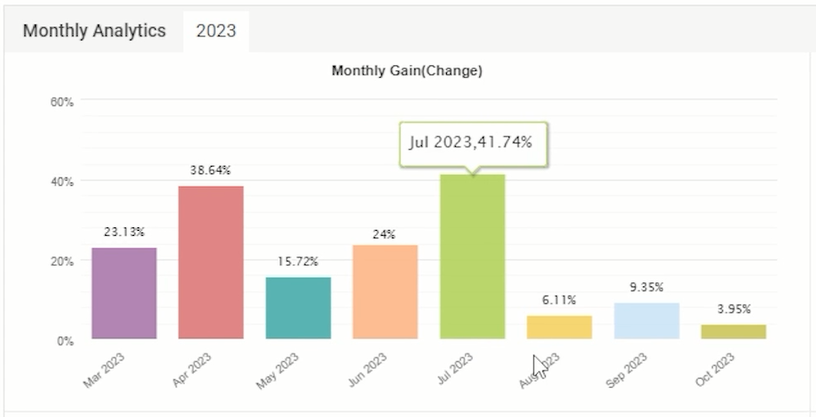

As we explore Automic Trader further, let’s look at some advanced statistics. This robot has achieved over 6,274 Pips, which is quite impressive. The Profit Factor stands at 2.80, indicating strong profitability. Monthly statistics reveal some fascinating trends. For instance, in July, the robot achieved a whopping 41.74% profit, and April was also strong with a 38.64% gain.

Automic Trader on Steroids Review: Understanding Recent Performance Trends

However, it’s interesting to note that recent months have shown profits below 10%. This suggests that the risk strategy might have been adjusted. Possibly, the trading amounts were reduced, leading to lower profits but also potentially lower risks.

Risk Management Strategies

The Automic Trader manual offers insights into risk management. For high risk, it recommends 0.1 for every $1,000 in the account. Medium risk is set at 0.01 for every $3,000 to $5,000, and low risk is advised at 0.01 for every $5,000 to $10,000. These guidelines help in balancing the potential gains against the risks involved.

Setting Up the Robot for Trading

Now, let’s talk about how to set up Automic Trader. I’ve prepared a new demo account with FXview on one of my Virtual Private Servers (VPS). I plan to use this account to test the Automic Trader expert advisor. This setup will give us a clear idea of how the robot performs under different market conditions.

Automic Trader on Steroids Review: Choosing Currency Pairs and Risk Levels

In my testing, I will select specific currency pairs to trade with Automic Trader. The choice of pairs can significantly impact the robot’s performance. Also, I will be deciding on the level of risk I’m willing to take. This decision is crucial as it will define both the potential profit and the level of risk involved.

Tracking Performance on MyFXbook

For transparency and real-time tracking, I will link my demo account to MyFXbook. This way, you can follow the robot’s performance live. Whether you’re watching this video today or months from now, you’ll have access to up-to-date information about how Automic Trader is performing in my demo account.

Setting Up Automic Trader: Currency Pairs and Risk Management

In my journey with Automic Trader, I’ve decided to focus on six major currency pairs, all traded on the M15 timeframe. Setting up is straightforward – I simply drag and drop the robot onto the GBP/USD (Pound Dollar) chart. In the settings, I can control various aspects like the starting lot, which I’ve set at 0.1. However, aiming for low risk, I adjust this to 0.01 in my 10K account.

Automic Trader on Steroids Review: Configuring the Robot with Vendor Settings

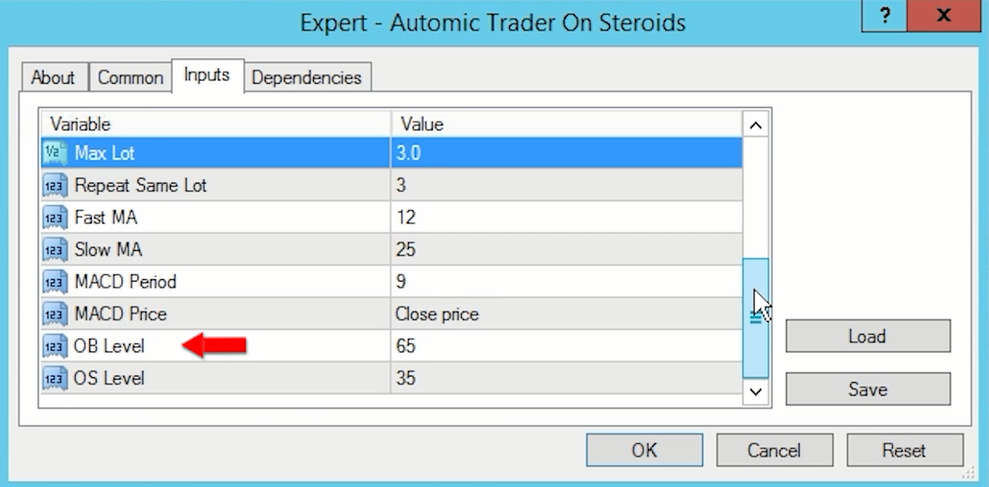

Next, I load the set files provided by the vendor, specifically selecting the GBP/USD pair. Scrolling through the settings, there are options like a lot multiplier, a stop loss of 100, and a take profit of 50. The robot also uses technical indicators like fast and slow moving averages, MACD, OB level, and OS level. Before finalizing, I ensure to allow DLL Imports in the common settings.

Importance of Broker Selection for Expert Advisors

Choosing the right broker is crucial when trading with expert advisors like Automic Trader. A broker with low spreads is essential – anything below 10 points or one pip for major currency pairs is ideal. Good brokers where the spread for the Euro/Dollar starts from 1 point, and offer a commission starting at $1 for every lot traded is ideal. It’s important to use a regulated broker that offers tight spreads and low commissions for the best results.

Automic Trader on Steroids Review: Comparing Demo and Live Account Spreads

Before starting, I compared the spreads between my demo and live accounts. It’s vital to have similar quotes and spreads in both. If there’s a significant difference, testing any expert advisor on a demo account might not be useful. You could see positive results in demo, but face different outcomes in a live account, leading to frustration.

Monitoring Spread Fluctuations

Just before recording, there was news from Germany causing a slight increase in spreads. This is a reminder of how external factors can impact trading conditions. It’s important to monitor such changes, especially when trading with expert advisors.

Exploring Automic Trader on the Vendor’s Website

Let’s take a closer look at Automic Trader on the vendor’s website. There, you’ll find extensive information about this trading robot. One key feature that stands out is the 30-day money-back guarantee. This guarantee is crucial for me, and I generally don’t consider purchasing a robot without it. It offers a safety net, allowing you to test the robot and decide if it meets your needs without financial risk.

Automic Trader on Steroids Review: Understanding the Purchase Options

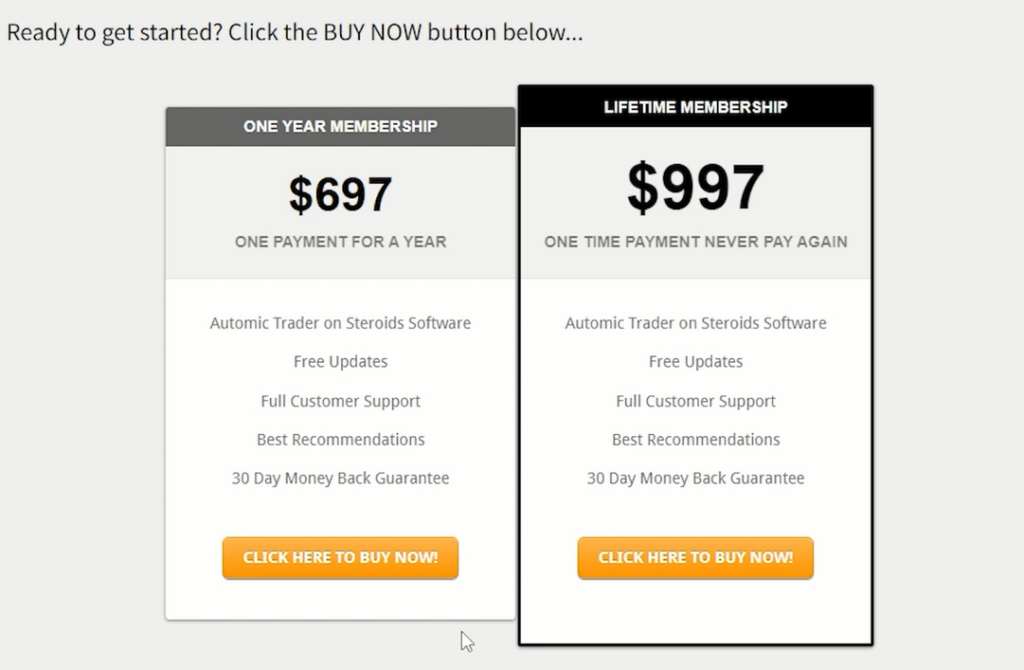

However, there’s a catch with Automic Trader. LeapFX, the vendor, doesn’t offer free trials. To try the robot, you need to opt for either a one-year membership or a lifetime license. The good part is that you still have those 30 days to test the robot and make a decision.

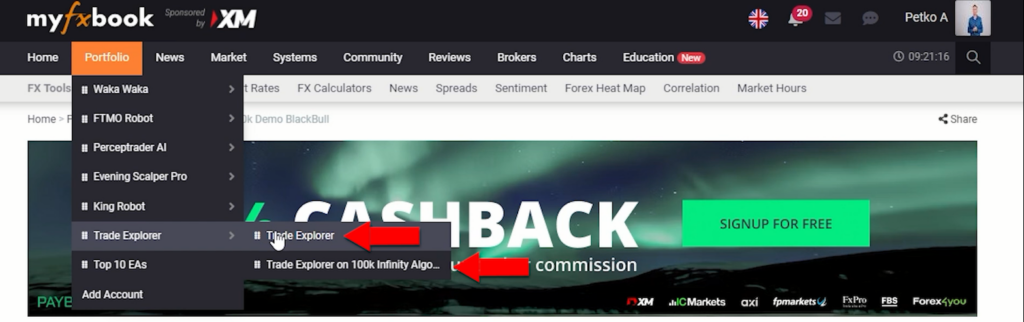

My Experience with Other Robots from the Same Vendor

I have experience with two other robots from LeapFX. The first one is King Robot, which I’m currently testing on a demo account and planning to connect to MyFXbook soon. The second is Trade Explorer, which I’m using on two different accounts. One is a 100K challenge account I recently started, and the other is a funded account where Trade Explorer has been performing well in recent months.

Connecting Automic Trader to MyFXbook

As mentioned above, I plan to connect the demo account for Automic Trader to MyFXbook. This will allow me, and anyone interested, to track its performance transparently. I’ll leave the link below, so you can check its progress on my account whenever you watch the video.

Automic Trader on Steroids Review: Keeping Track of Performance

Monitoring the performance of trading robots like Automic Trader is essential. By connecting to MyFXbook, I can keep an eye on how the robot performs under different market conditions. This real-time tracking is invaluable for making informed decisions about whether to continue using the robot or not. This is the reason I have connected all robots I am trading with on my live accounts.

Final Insights on Automic Trader

As we wrap up our exploration of Automic Trader, a few key points stand out. This trading robot has shown impressive statistics, with significant gains in certain months. However, its performance also reflects the inherent risks and volatility in trading. The setup process, involving the selection of currency pairs and risk management, is straightforward yet crucial for optimal performance.

The vendor’s 30-day money-back guarantee offers a safety net for testing the robot, although the absence of a free trial might be a drawback for some. My experience with other robots from LeapFX, like King Robot and Trade Explorer, has been a mix of ongoing tests and successful runs, which adds context to my expectations with Automic Trader.

Connecting the robot to MyFXbook for real-time performance tracking is a step I highly recommend. It provides transparency and helps in making informed decisions based on the robot’s performance in live market conditions.

Automic Trader on Steroids Review: Conclusion

Automic Trader presents as a potentially powerful tool for traders seeking to leverage automated trading strategies. While it comes with its set of challenges and risks, proper setup, risk management, and continuous performance monitoring can make it a valuable asset in a trader’s arsenal. As always, remember that past performance is not indicative of future results, and it’s essential to trade responsibly. Stay tuned for more updates and insights as I continue exploring the capabilities of Automic Trader.