Automated trading software – create Expert Advisors without programming skills.

Automated trading software is something trendy in the Forex market from the beginning of this century. Algorithmic trading is more preferable the traders because it eliminates emotions in trading. Nowadays, you do not need to be a developer or to learn coding to build a website, a simple calculator online, or a trading robot. There is the auto trading software which we can use to automate our trading strategies. But why do we need to do it?

When traders do manual trading, two emotions make them lose.

These are fear and greed.

Fear comes when we are on the negative with our current opened trades. We close the position before it reaches the stop loss order take profit. We are afraid that the price will go more negative and we will have a more significant loss in our account. Also, fear could be seen when we are on a profit with our position, and we hurry to close the trade because we don’t want to lose this profit. We are afraid to lose the profit, and we close the trade. This way, we don’t give a chance to the price to reach our take profit.

Automated trading software does not have any emotions. It follows the exact extry and exit rules that are inside the code. So what are the other feelings?

Greed is the feeling that the trader feels when having a couple of consecutive trades.

When we do profitable trades, we get greedy to trade with a higher lot. Many beginner traders break their risk management and place higher lots on the next trades. Every strategy has losing trades, and after having consecutive profitable trades, the chance to hit a losing trade with the higher lot is enormous. Usually the losses at this moment are higher than the profits with the previous trades.

There are many more emotions that are involved in trading, and even you have a profitable strategy, sometimes the fault is not with the market, not with your broker, not with the strategy, but with yourself.

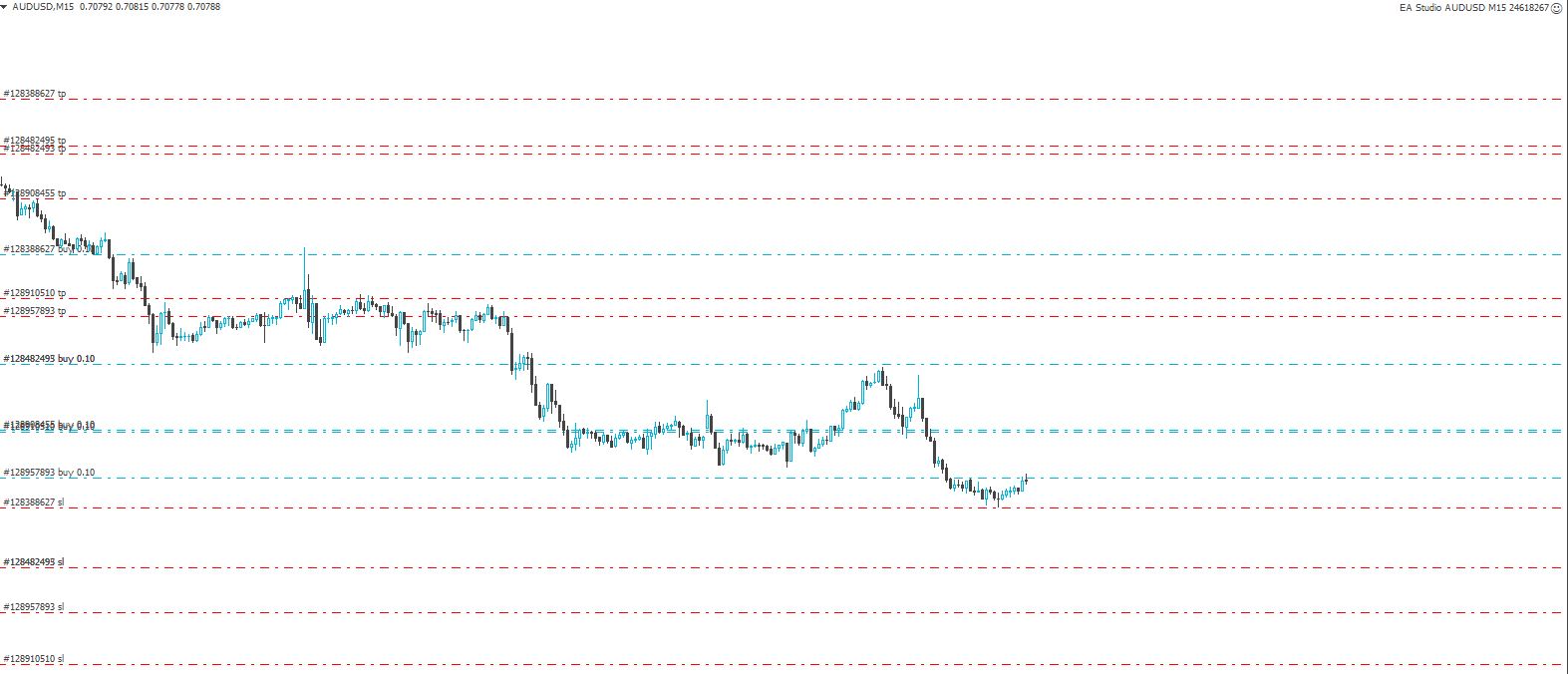

The solution is trading with Еxpert Аdvisors. When we trade with Expert Advisors, we don’t do any manual trading, and we depend on these automated strategies.

There are different methods to create your Expert Advisor, but the easiest is to use a professional Automated Forex Trading Software. It will allow you to build EAs even you have 0 IT skills. With such a program, you can place different entry and exit conditions, you can create the strategy from scratch. After you are ready and satisfied with the backtest statistics, you can export it with one click as Expert Advisors. Available code!

That is the easiest and fastest way, and still, a limited number of traders are using such Automated Forex Trading Software.

These are the very same strategies for manual trading, but they are coded, and once attached to the trading chart they trade alone:

How to create Expert Advisors?

- You are a developer, and you can code your Forex strategy

- Hire a developer to code the expert advisor for you

- Use automated trading software

Automated trading software has an important first step that many beginner traders and developers miss. That is the proper Historical data.

How to download the right Forex Historical Data?

- First of all, Meta Trader does not load all the historical data available what you need to do it to go to each time frame and each pair that you like to use and press Home Key. Hold it until Meta Trader stops loading. Usually the brokers provide between 2 and 6 months of data on M1 and more extended periods on the higher time frames.

- Second, if you use automated trading software, you need to export the data from the platform. If you use the download button in the History center, you will end up having data from Meta Quotes and not from your broker. Why is it essential to have the date from your broker? When using automated trading software, it is essential to use historical data not only from your broker but from the same server that you will trade with your live account. There is always a difference between each server’s data on the same broker.

- The next important thing you need to keep in mind is to collect historical data. If you want to generate profitable strategies, you need to have created the strategies with the Automated trading software on a more significant number of bars. If you are using 20 000 – 50 000 bars on the small time frames, you will end up with an over-optimized strategy. For example, on the M1 chart, we suggest you go for a minimum of 200 000 bars data.

How do we export the Historical data for the Automated trading software?

If you use FSB Pro – the professional automated trading software, we receive two scripts also. With the first one, we export the details from the server – the spreads, swaps, commissions, etc. It is very important to have the exact parameters of your broker. We place the file in the System folder of our Automated trading software. This way, you will see all the pairs from your broker with the exact parameters in FSB Pro.

With the second script, we export the historical data ( after we have loaded it on each time frame on each pair with the Home Key. Since we keep the platforms running 24 hours, we collect the data with the time. All we need to do is to drag the script over the chart, and it updates the new data on our Automated trading software.

Make sure to use the right historical data. For more information on how we collect the data, please check our course Portfolio of 100s Forex Strategies.

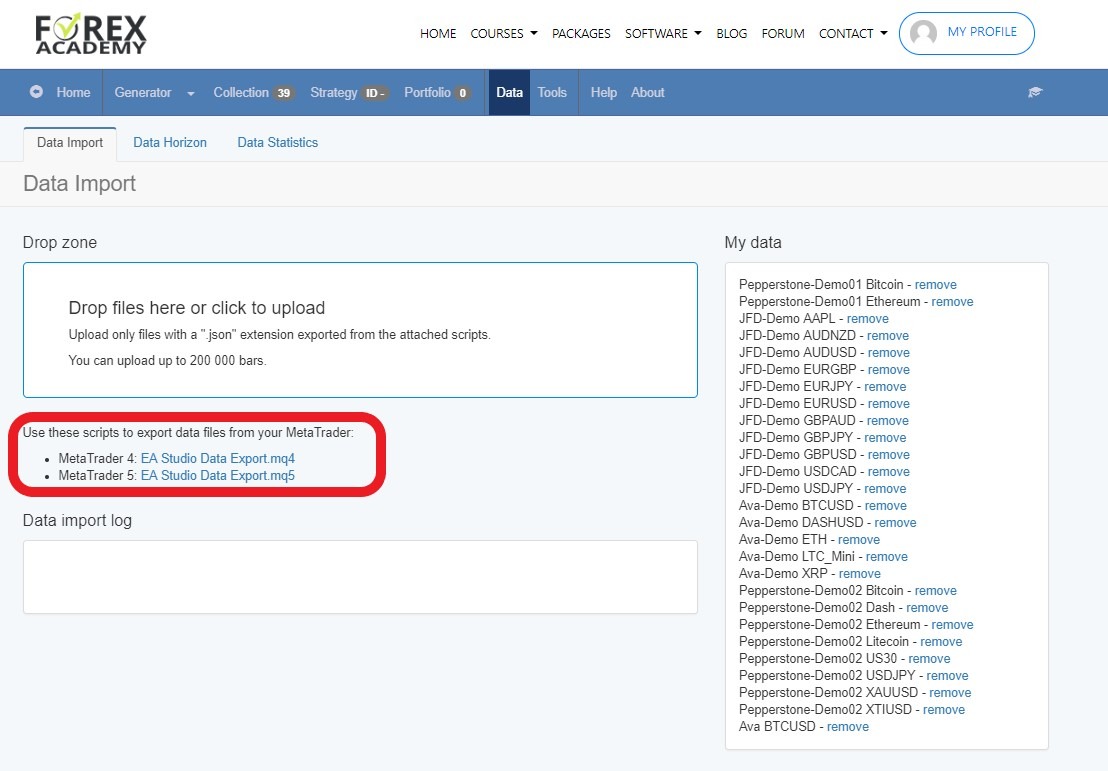

If you use EA studio – you can download from the app the two scripts for Metatrader 4 and Metatrader 5. What you need to do is to place them in the Script folder in Metatrader.

After that, drag it over the chart once you see the Script displayed.

With the script of EA studio, you will export the number of bars, the commission, and the spread.

After that, you need to drop the exported files in the box where you see drop files here or click to upload. Your data will be loaded, and you will be able to generate strategies over this data.

How many bars do you need to generate strategies with Automated trading software?

Keep in mind that the brokers at the beginning don’t provide a vast number of bars, which is an issue for the beginner traders. If you load your historical data for the first time, you will notice that on the M1 chart, there are a maximum of 65000 to 75000 bars. And this is normal. Obviously the broker does not want us to have a vast number of bars when we start algorithmic trading. On the higher time frames, you will see even a lower number of bars.

What you can do is to leave your Metatrader opened. For a couple of months, it will collect for you enough bars to trade all time frames.