Trailing Stop Loss Strategy

In this lecture, I will show you 2 examples of Trailing Stop Loss that I have when selling Bitcoin. I was actually in Japan when I was trading these positions. I was a speaker at 2 seminars: one in Osaka and one in Tokyo the day after that.

And actually, I had a long flight and I missed to trail Stop Loss so I will show you what happened. But it happens obviously. We cannot be in front of the screen for 24 hours but since there is a Stop Loss, I don’t worry about the trades.

So here is our setup.

You can see where is the Countertrend line. First, we had the cross of the EMAs and then we had the break of the recent low and we had the break of the Counter trend line.

So what happened then is the price made a new lower low, a new lower high and then a lower low breaks.

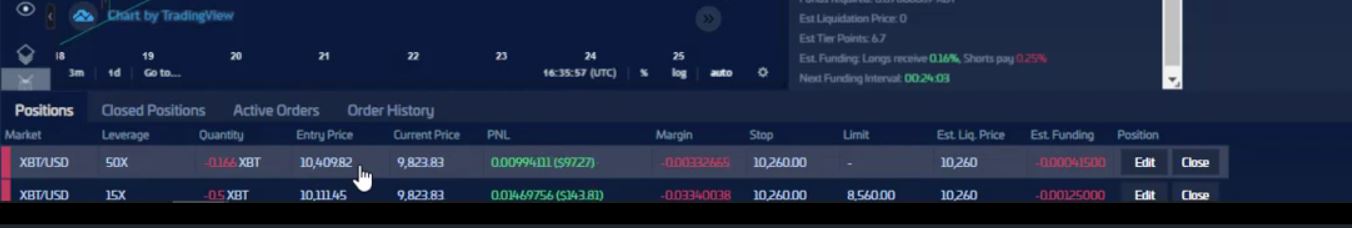

And it happened just before I left but I couldn’t record it. However, I succeeded to trail Stop Loss and for both positions, it is at $10,260.

Now, I will move it slowly to show you what happened after that. The price formed another lower high and another lower low.

Stop Loss

So this low was broken, this lower high was confirmed and I was supposed to move the Stop Loss at 9,970/9,980.

However, I would always put it above the 10,000, above the round number like 10,060. But, one more time, I missed to trail it because I was on board.

Actually, the price went up, it broke this high.

So if I was having the trailing Stop Loss here I would be out. And actually, I would be out on profit with the 2 positions because you can see where my entry price is, at 10,409 and at 10,111.

And now the price actually continued lower

which makes me think that at the current moment, this level of 10,200, 10,150, or the range between 10,150 up to 10,250 is important for the current market situation and the price fails to take it for the third time. 1 time, 2 times, 3 times. But at the same time, this lower high was broken.

And it was broken very aggressively which gives me the sign that the price might reverse upwards. So I have 2 options now, one is to leave the Stop Loss where it is because I have missed to trail it.

And it will be above these levels. Second is I will drag it where it was supposed to be trailed. 10,060, for example, or 10,000.

Trailing Stop Loss secures more profits

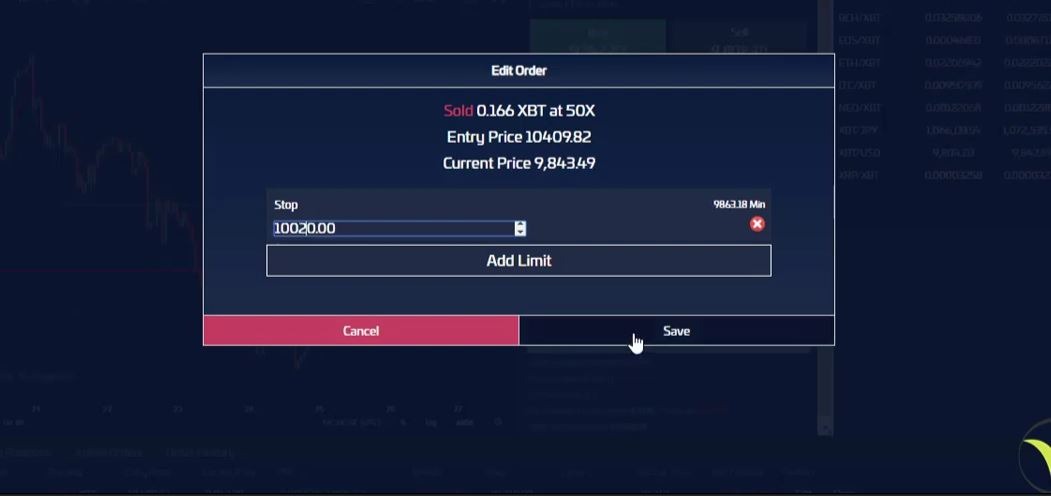

I think 10,060 will be too high, probably about 10,030 or 10,020. I want to be above the round number. So if I move the trail Stop Loss there, I will still give the chance for the 2 positions to go on a profit if the price continues lower.

And at the same time, if the price reverses, I will have the 2 positions on profit. I will make it a little bit lower at 10,020.

I don’t want to give another $40 there. So 10,020, you can see it’s above this high and at the same time, it’s above 10,000 round number.

Anyway, it was broken but still, it is 10,000. So, one more time, this is how it was supposed to be. I was supposed to trail stop loss and the 2 positions were supposed to be closed. So what I will do, I will just leave it there and see what happens.

If it hits the Stop Loss and the 2 positions close, this is like I’m following the strategy as it was to happen. But at the same time, I will give the chance now to the price to go downwards and I will continue trailing it if the price continues downwards. So let me just modify now to 10,020.

Feel free to ask questions

I will modify here 10,020.

And I click on save. And then I will edit the other one 10,020, I click on save and the stop is right here now.

So I will continue when the price either breaks the trailing Stop Loss or when it continues lower. One more time, it happens that we will miss the trail, the Stop Loss, or you will miss taking some profit.

This is part of the trading. But having the trailing Stop Loss is important and it makes me relaxed even when I’m traveling. Because, if the price goes against me, I’m not risking a lot of the capital.

And in this way, when I’m using the trailing Stop Loss at this level of 10,020, I actually don’t risk anything right now.

If the price goes upwards and hits this level, I will be out even on a profit. So no losses. And I think the chance the price to reverse upwards is huge because, one more time, this high breaks here aggressively.

And I can see the price failing here to take the new low and we’ll see what happens. I will continue with the example. Don’t hesitate to ask questions if you have in the Forum.

Cheers guys.