Passing a prop firm challenge can be…well, challenging. Many developers have created robots or tools with claims ranging from assisting a trader to pass to guaranteeing a pass. One such robot is the Prop EA. I’ve been using it as an automated trading system specifically designed to assist in passing these challenges. I’d like to share my experience with its performance, features, and practical application in this Prop EA review.

Introduction to Prop EA

The Prop EA is an Expert Advisor (EA), commonly referred to as a robot or more casually, bot. It’s been designed to help traders pass Prop Firm Challenges by using a unique hedging strategy. This involves having 2 accounts trading simultaneously – a challenge (master) account and a live (slave) trading account. When a trade is opened on your Prop Firm Challenge account, the Prop EA simultaneously opens the opposite trade on your live account. If the challenge account experiences a loss, the live account compensates with a win, and vice versa. This review focuses on how the Prop EA performs in real-world trading situations. Particularly in helping traders pass Prop Firm Challenges without breaking the rules and meeting the required goals.

How Prop EA Works

Prop EA Review: Trade Execution and Hedging Strategy

The core functionality of the Prop EA lies in its hedging strategy. This strategy involves opening opposite trades on two accounts: the Prop Firm Challenge account and a live trading account. For example, if a buy position is initiated on the challenge account, the EA will execute a sell position on the live account simultaneously. This mirroring of trades ensures that any loss on the challenge account is offset by a corresponding gain on the live account, and vice versa. The result is a balanced approach that reduces overall risk while meeting the specific profit targets set by the Prop Firm.

Real-World Examples of Performance

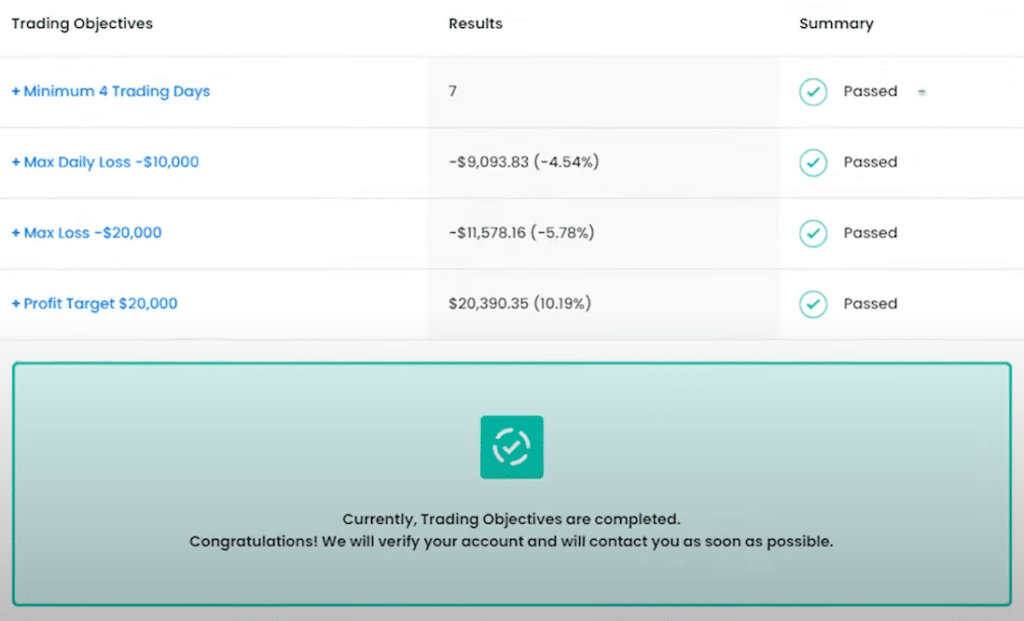

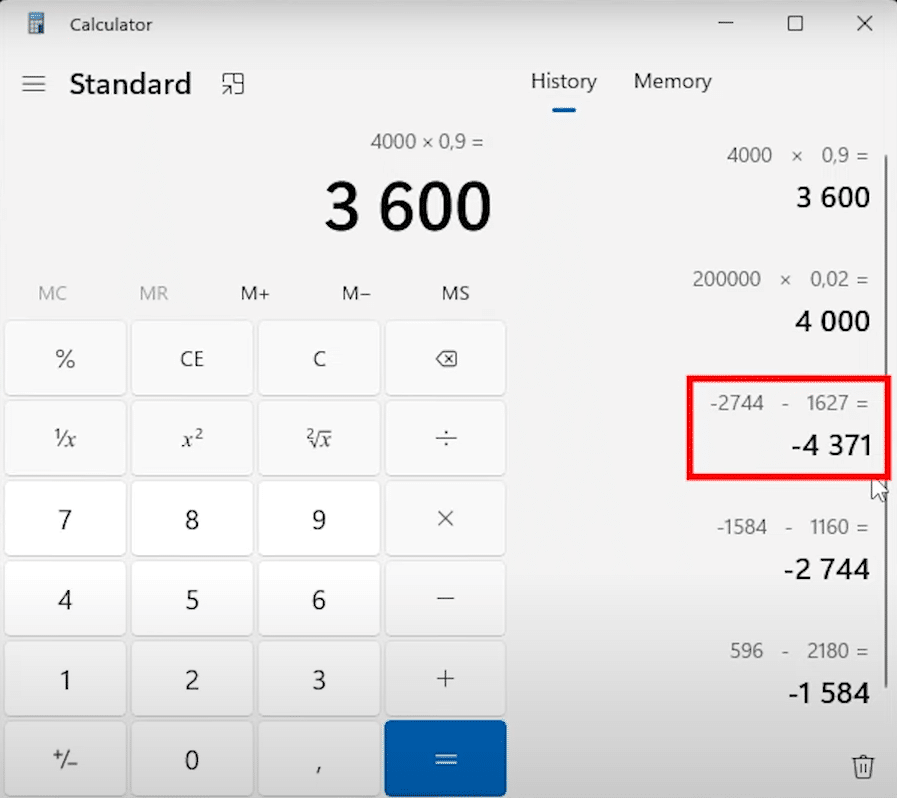

The effectiveness of the Prop EA is best explained through actual trading scenarios. In one instance, I used the Prop EA to pass a $200,000 Prop Firm Challenge. The EA initially opened a short trade on the challenge account, which unfortunately resulted in a loss. However, at the same time, the EA executed a long trade on my live account. This generated a profit of $596. As trading continued in the accounts, the EA executed additional trades, resulting in a significant, and importantly, the required passing amount with a profit of $20,390 on the challenge account. Despite this success, my live account incurred a loss of $2,180 from the opposite trades.

During the second phase of the same challenge, the Prop EA managed to produce a profit of $10,019 on the challenge account. This time, the corresponding loss on the live account was $1,627. The cumulative cost of using the EA, considering both the challenge fees and the losses on the live account, amounted to $4,371. These examples demonstrate how the Prop EA can help traders achieve the profit targets required by Prop Firm Challenges while effectively managing risk through its hedging strategy.

It’s important to note at this stage, that while I did incur losses in my live account, these are acceptable to me, and I believe I can recover these losses fairly quickly through trading in my newly-acquired funded account. Let’s take a closer look at the total costs.

Prop EA Review: Cost Analysis

One of the most critical aspects of using the Prop EA is understanding the associated costs. As mentioned above, the total cost of using the Prop EA for the $200,000 Prop Firm Challenge was $4,371. This amount includes both the fee for the challenge itself, which was $1,160, and the cumulative losses incurred on the live account during both phases of the challenge.

Despite these expenses, the Prop EA allowed me to meet the challenge’s profit targets. It worked within the rules set by the Prop Firm. This would have been difficult to achieve through manual or algorithmic trading alone. The EA’s hedging strategy effectively spread the risk between the two accounts. This made the overall trading process more manageable and increased the chances of success in the Prop Firm Challenge.

It’s crucial to understand that the Prop EA does not guarantee that you will pass your Prop Firm Challenge on the first try. The idea is that even if you fail the challenge, you will recover the cost of the challenge through the profits in your live account. Should you pass a challenge, you will incur costs in your live account, which can later be recovered through profits earned in your funded account. An example of this is included later in the post.

Prop EA Review: Risk Management and Performance

Managing Losses

The primary function of the Prop EA is to manage risk by balancing losses between the challenge and live accounts. This is crucial when dealing with the strict rules of Prop Firm Challenges. Breaching daily or monthly drawdown rules can result in failure. For instance, in the earlier scenario, the EA generated a substantial profit on the challenge account. However, this was balanced by a loss on the live account. This system ensures that even if the challenge account suffers losses, the overall impact on your trading capital is minimized through opposing trades in your live account.

Performance Consistency

My experience using the Prop EA has been balanced with consistent performance across various trading conditions and Prop Firm Challenges. This consistency is due to the EA’s ability to dynamically adjust trade sizes and positions based on real-time market conditions. For example, during the second phase of the $200,000 challenge, the EA adjusted its trades to secure the required $10,019 profit on the challenge account. It managed the corresponding loss on the live account automatically. This adaptability is critical for maintaining steady performance, particularly in the volatile Forex trading environment. Conditions can change quickly, often before a trader has time to react.

Prop EA Review: Adaptability and Strategy

One of the key strengths of the Prop EA is its adaptability. The EA automatically adjusts its trading strategy based on the account’s history and the current market conditions. For instance, the EA is designed to detect losses and re-calibrate the trade sizes to either recover the costs or achieve the target profit. This capability was evident in the scenario where the EA opened a series of trades that led to a $20,390 profit on the challenge account, despite the challenging market conditions.

The EA also adjusts its strategy by varying trade sizes and positions depending on the market environment. In more stable markets, the EA might increase the trade size to take advantage of favorable conditions. Conversely, in volatile markets, it may reduce trade sizes to limit potential losses and protect the account. This makes the Prop EA unique, not only in it’s approach as a hedging strategy, but also in it’s ability to automatically adjust to changing conditions to achieve the trader’s desired results.

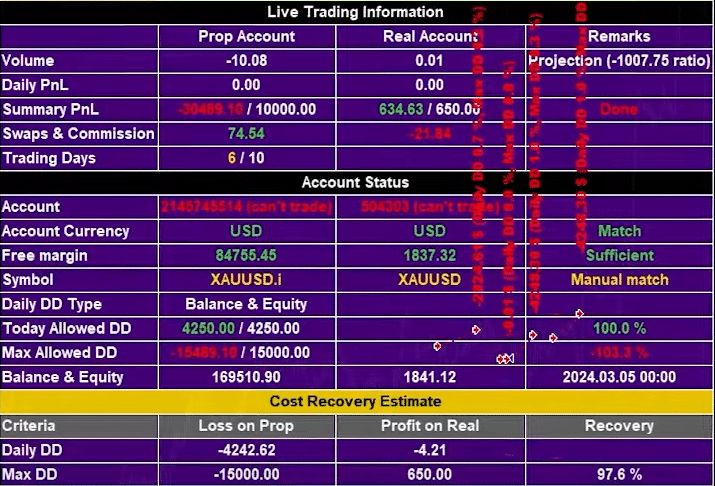

Example of a Losing Trade Scenario

Like any trading environment, not all scenarios result in profits, and it’s essential to understand how the Prop EA handles losses. In one case, the EA was used on a $100,000 Prop Firm Challenge account that had already lost nearly 4%. The EA opened a short trade on the challenge account and a corresponding long trade on the live account. Despite the EA’s efforts, the challenge account ultimately failed, breaching the challenge rules and incurring a loss of $15,244. However, the live account managed to recover the cost of the challenge by generating $650 from the opposite trades. This example illustrates the EA’s ability to mitigate losses even in unfavorable market conditions, proving its risk management capabilities.

Prop EA Review: Customizing the Prop EA for Optimal Use

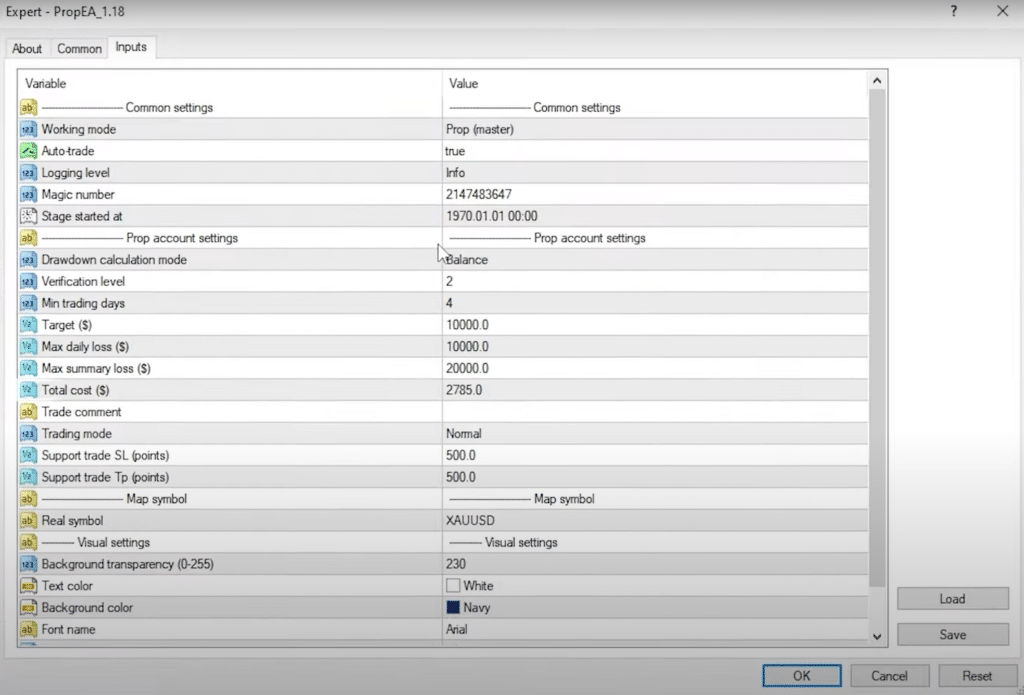

Adjusting Trade Parameters

The Prop EA offers a range of customization options that allow traders to tailor its performance to their specific needs including challenge sizes, drawdown rules and challenge costs. One of the most important aspects of customization is adjusting the trade parameters, such as lot sizes and stop-loss levels. For example, when markets are volatile, for example after major news events, reducing the lot sizes can help minimize potential losses. Conversely, in more stable market conditions, increasing the lot sizes can enhance profitability.

Prop EA Review: Real-World Example of Adjusting Settings

In a practical scenario, I set the Prop EA to target a $10,000 profit on a $200,000 funded account. The EA automatically adjusted the live account’s trades to ensure that if the funded account reached this target, the live account would incur a $3,000 loss. While there was a chance I would incur this loss, the overall results would be a substantial profit which, in anyone’s book, is a win.

Another example of customization involves setting the EA’s stop-loss levels. By adjusting the stop-loss to suit your personal risk tolerance, you can ensure that the EA exits trades before losses become too large and stressful. This feature is particularly useful for traders who want to maintain tighter control over their trading activities, especially during volatile market conditions.

Example of Using the EA Across Multiple Challenges

The flexibility of the Prop EA also extends to its use across multiple Prop Firm Challenges. For instance, after successfully using the EA to pass a $200,000 challenge, I applied the same strategy to a different Prop Firm’s challenge. By adjusting the EA’s settings to match the new challenge’s specific rules and conditions, I was able to achieve similar success. This adaptability makes the Prop EA a valuable tool for traders who’ frequently participate in various Prop Firm Challenges.’s goal it is to take, and pass multiple Prop Firm Challenges.

Prop EA Review: Final Thoughts

The Prop EA is a specialized tool designed to help traders pass Prop Firm Challenges by using a hedging strategy. At worst, it can help recover the cost of the challenge and provide funds to take another. Through real-world examples, we’ve seen how the Prop EA can effectively manage risk and meet the profit targets required by Prop Firms. Despite the associated costs on the live account, the Prop EA has proven to be a practical and efficient solution for traders aiming to succeed in these challenges.

For those serious about passing Prop Firm Challenges, the Prop EA offers a unique and customizable approach to trading. It can improve your chances of success. By understanding how the Prop EA works, customizing its settings to fit your trading style, and applying it strategically across different challenges, you can maximize its potential. This can significantly enhance your overall trading performance.

FAQs

1. What is PropEA?

PropEA is an expert advisor designed to help traders pass Prop firm challenges and manage funded accounts efficiently. It is compatible with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offering automated trading solutions tailored to meet the specific requirements of various Prop firms.

2. How does PropEA work?

PropEA operates by executing trades automatically based on pre-configured settings, which align with the trading rules of your chosen Prop firm. It manages both your Prop (master) account and your Slave (real) account, ensuring that the trading strategies and risk management protocols are adhered to consistently.

3. What are the key features of PropEA?

- Automated Trading: PropEA can place and manage trades on your behalf, based on your trading rules.

- Drawdown Calculation: It supports different drawdown calculation modes tailored to your Prop firm’s requirements.

- Compatibility: Works with both MT4 and MT5 platforms.

- Account Management: Simultaneously manages both Prop and Slave accounts, maintaining consistent trading actions across both.

- Customizable Settings: You can adjust trading speeds, SL/TP settings, and more to suit your trading style and the Prop firm’s rules.

4. How do I install PropEA?

After purchasing a license, you will receive a confirmation email with a download link. Once downloaded, you need to install it on both your Slave (real) and Prop (master) accounts. Installation involves copying the PropEA file to the respective MT4/MT5 folders and configuring the settings in the terminal as per your trading strategy.

5. Does PropEA support all types of Prop firm challenges?

PropEA supports 1-phase and 2-phase Prop firm challenges but does not support 3-phase challenges. Additionally, it doesn’t support certain drawdown types like Trailing/Relative/Smart Max Drawdown and consistency rules, so it’s important to confirm the compatibility of your Prop firm’s rules with PropEA before using it.

6. What should I do if I encounter issues during setup?

Ensure all installation steps are followed correctly, particularly the configuration of your Prop and Slave accounts. If you encounter issues like license validation errors or insufficient margin alerts, double-check that all required settings are correctly applied, and both accounts are on the same VPS without other terminals running.

7. How do I update PropEA?

PropEA offers an auto-update feature, allowing you to receive new versions automatically. It’s advisable to enable this to ensure you are always using the latest version with the most up-to-date features and fixes.