Navigating the world of prop firms can be daunting, especially when you’re trying to find the best one. Just like many are on the hunt for the ideal expert advisor, the quest for the perfect prop firm is equally essential. Today, I’ll share my recent discovery: InfinityForexFunds, and how to pass their prop firm challenge.

Discovering InfinityForexFunds

While exploring various prop firms, InfinityForexFunds caught my eye. What makes them stand out? They offer both algo evaluation and standard evaluation. This distinction means they separate high-frequency trading robots from standard manual trading. A smart move that ensures clarity and fairness in their evaluations.

How to Pass Prop Firm Challenge: Diving Deeper: Evaluation Options

Scrolling through their platform, you’ll notice two clear options: algo evaluation and standard evaluation. The algo evaluation is particularly intriguing. Why? It comes with a single phase and a target of 10%. If you possess a profitable EA capable of achieving this 10% target, you’re set to pass the challenge. The best part? There’s no time limit or maximum trading days. This flexibility is a game-changer for many traders.

My Strategy: Using Perceptrader AI

Now, let’s talk strategy. How do I plan to pass the prop firm challenge? By leveraging the power of Perceptrader AI. Some of you might recall this tool from my previous videos. It’s the latest expert advisor from Valerie Trading, a blend of Waka Waka and ChatGPT AI. My tests on a demo account have shown promising results. Within just a month and a half, I’ve observed steady trades, all with a low volume of 0.01. Only once or twice did the expert advisor increase the lots to recover from losing trades. Nothing that poses a significant risk to the account.

How to Pass Prop Firm Challenge: Why Perceptrader AI?

You might wonder, why choose Perceptrader AI? Based on my experience, it’s probably the best third-party EA to attempt passing a challenge fully automatically. If you’re curious, you can test the robot for free. I’ve provided a link in the description for easy access. Plus, its current price of sixteen hundred and twenty dollars is below the average of all Valerie’s EAs. But act fast, as they increase the price with every ten licenses sold.

Comparing the Prices

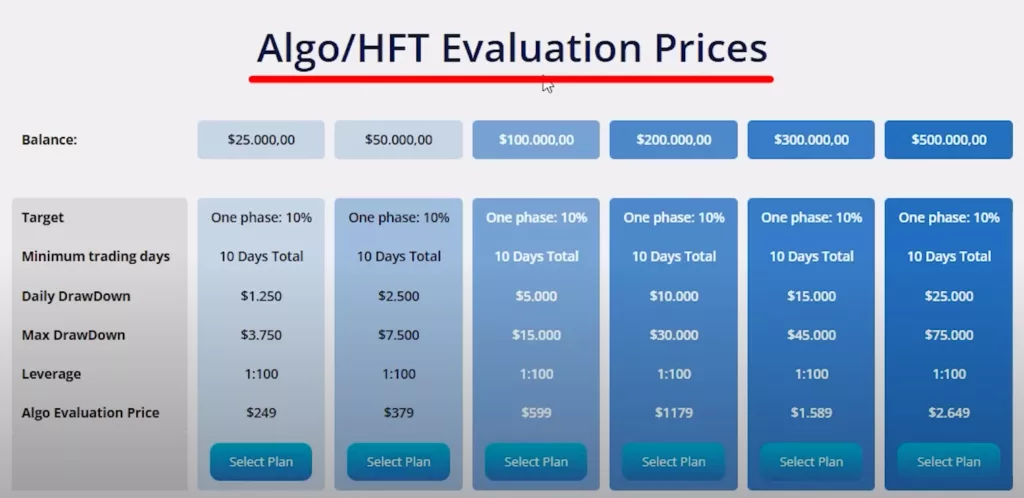

Heading back to InfinityForexFunds, it’s time to pick a plan. Here’s a quick price breakdown:

- $25,000 challenge: $249

- Standard evaluation for the same: $169

- $200,000 challenge (standard): $899

- $200,000 challenge (algo): $1179

You’ll notice algo evaluations are pricier. But since I’m using a robot, it’s the logical choice.

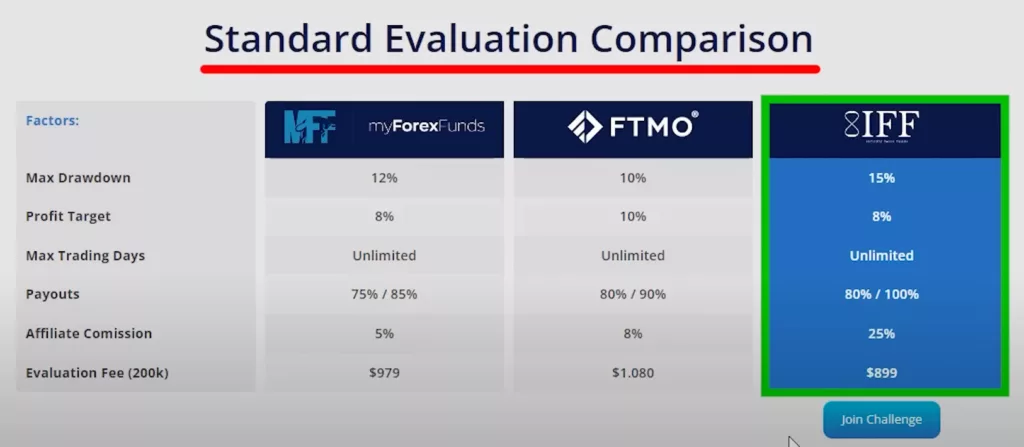

InfinityForexFunds vs. Others

Scrolling further, there’s a comparison between InfinityForexFunds, FTMO, and MyForexFunds. The standard evaluation at InfinityForexFunds is more affordable. My strategy? Start with the $25,000 challenge at 249 Euros. This is my approach with every new prop firm. If all goes well, especially with payouts, I’ll aim higher, perhaps even the $200,000 challenge.

How to Pass Prop Firm Challenge: Special Discounts for My Subscribers

Adding the challenge to my cart, there’s an enticing offer: spin a wheel for a 10% discount. But here’s a treat for my growing community: a special 10% discount without the spin. Just use the code PETKO10 at checkout.

Starting the Challenge

After entering my billing details, I’ve officially purchased the challenge. A swift email from InfinityForexFunds followed, providing essential details like account number, master password, and investor password. Next up? Downloading MetaTrader 4 for desktop.

How to Pass Prop Firm Challenge: Setting Up on a VPS

With MetaTrader installed on my VPS (I use ForexVPS, by the way – link below), it’s time to get things rolling. On this VPS, I already manage four accounts:

- King Robot (demo account)

- Waka Waka (FTMO funded account)

- Waka Waka (live account with Darwinex)

Now, the challenge with InfinityForexFunds begins. I’ll be deploying the Perceptrader AI.

Performance of Perceptrader AI

Before diving into the settings I’ll use, let’s discuss Perceptrader AI’s performance. In its standard mode with five pairs, this robot has shown impressive results. Stay tuned as I delve deeper into its capabilities and how it can help in the quest to pass the prop firm challenge.

How to Pass Prop Firm Challenge: Performance Overview

The main account with Perceptrader AI kicked off in May 2023. Fast forward to the end of August, and it’s achieved a whopping 100% in just three months. However, it’s essential to note that while it hit nearly 100%, there were some drawdowns. These might be acceptable for standard CFD accounts, but prop firms have stricter criteria.

Adjusting for Prop Firms

With prop firms, risk management is paramount. Their trading objectives often require traders to minimize risks. On my demo account, where I’ve been testing Perceptrader AI, I’ve maintained a low-risk setting. There’s a myriad of parameters available for tweaking, ensuring optimal performance tailored to specific needs.

How to Pass Prop Firm Challenge: Seeking Expertise from Valerie’s Support

One of the standout features of Valerie’s EAs is the robust support. If you’re ever in doubt, their team is just an email away. I reached out, seeking a set file tailored for the Infinity prop firm challenge. They promptly provided one, ensuring my strategy aligns with the prop firm’s requirements.

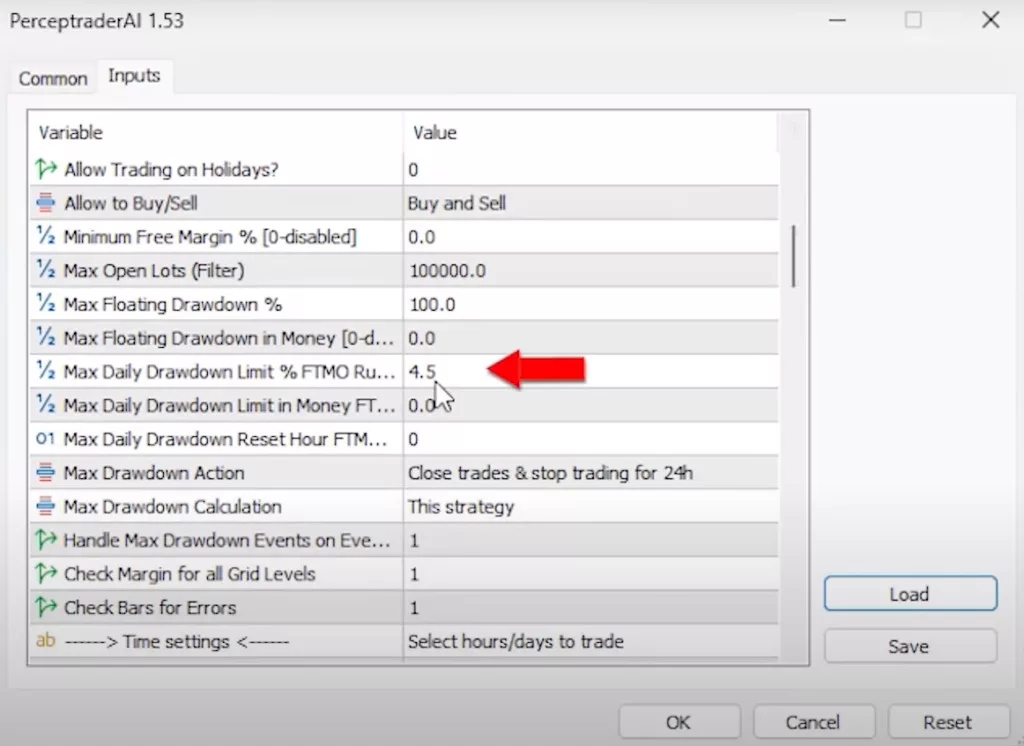

Key Settings for the Challenge

Diving into the settings, here’s a snapshot:

- Trading fixed lot at 0.01

- Dynamic lot based on balance

- Deposit load at a mere 0.25

- Spread protection set to five pips

Further down, the maximum daily drawdown limit is capped at 4.5%. This aligns perfectly with InfinityForexFunds’ requirements. For the $25,000 challenge, the daily drawdown is precisely 1125.

How to Pass Prop Firm Challenge: Trading Parameters

The expert advisor will be trading specific currency pairs during designated trading hours. The best part? You only need to set it on one currency pair, ideally on the M5 timeframe. As you delve deeper into the settings, you’ll find machine learning setups, take profit configurations, stop loss parameters, and much more.

A Comprehensive Guide for Users

While I’ve highlighted some key settings, there’s a lot more under the hood. If you’re considering testing the robot, you’re in luck. It comes with a comprehensive manual detailing every aspect. This ensures even beginners can hit the ground running, maximizing their chances to pass the prop firm challenge with the expert advisor.

Crunching the Numbers: What to Expect from Perceptrader AI

How to Pass Prop Firm Challenge: Diving into the Details

Let’s get a bit technical. I want to set clear expectations regarding the time frame in which the expert advisor should pass the challenge, given the settings I’ve shared. On a standard account, there was a significant drawdown of 16.76% – a figure we can’t risk with prop firms. So, I conducted a backtest with my settings.

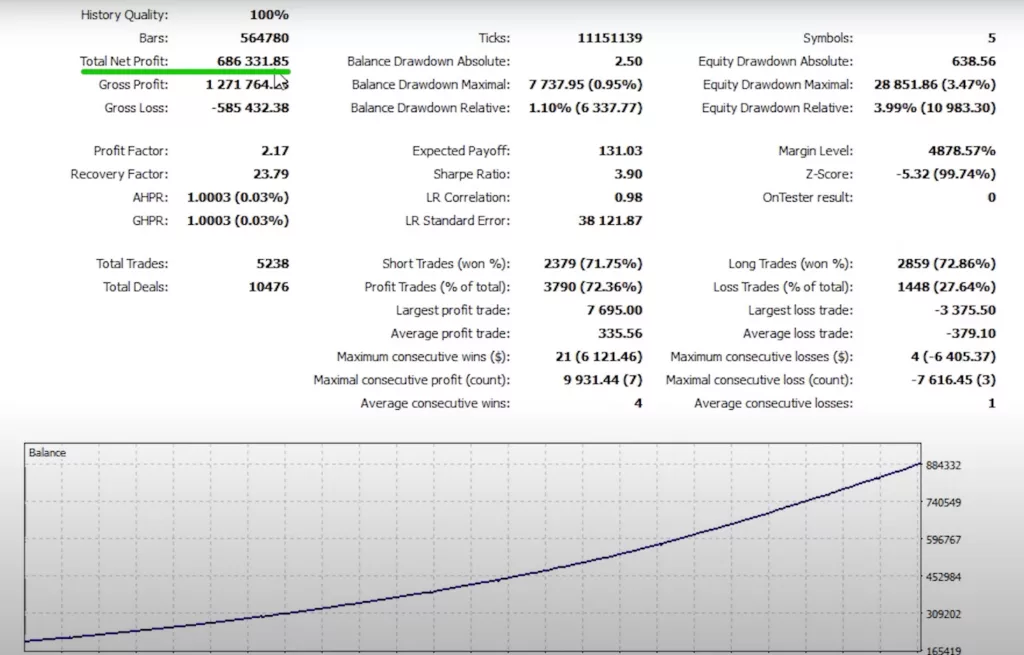

Backtest Results

The results? A net profit of $686,331 over a span of more than seven years. This translates to a profit factor of 2.17, with a consistent performance line across over 10,000 trades. To break it down:

- I ran the expert advisor in unique mode with the set file since 2016.

- Over seven and a half years, the EA generated over $600,000 in profit.

- The average yearly result is approximately 21.95%.

- The average monthly result stands at 1.67%.

How to Pass Prop Firm Challenge: Time Frame for the Challenge

Using the compound interest formula, it’s estimated that the EA will take about 6 months on average to pass the challenge. Thankfully, InfinityForexFunds doesn’t impose a maximum trading day limit. With certainty, there will be at least 10 trading days.

The Power of Automation

The beauty of Perceptrader AI? It’s fully automated. Partnered with ChatGPT for the latest market forecasts, it operates seamlessly without manual intervention. So, even if it takes six months to pass the challenge, it’s a waiting game I’m willing to play. Once funded, the rewards will be automated, ensuring a passive income stream.

How to Pass Prop Firm Challenge: Conclusion

In the world of trading, patience and strategy are key. While the Perceptrader AI might take its time to pass the challenge, the end game is worth the wait. Automated systems, when set up correctly, can yield significant returns without constant oversight. I hope this deep dive provided clarity and wasn’t too technical. A big thank you for sticking with me through this detailed analysis. Happy trading!