Home › Forums › EA Studio › Generator in EA Studio › The Generator Cannot Find Strategies (please help)

Tagged: Generating strategies, generator, reactor, Settings, spread, symbol settings

- This topic has 10 replies, 1 voice, and was last updated 4 years ago by

Anonymous.

-

AuthorPosts

-

-

December 1, 2020 at 15:45 #68154

Anonymous

InactiveHi Petko,

Having problems generating good strategies with EA Studio, let alone generating strategies at all.

What’s wrong?

Is it my settings?

Are my brokers’ spreads too high?

Attached, please check my settings.Followed your settings (to the letter) in the following course:

Algorithmic Trading – The Complete Expert Advisor Bootcamp

Apart from “Broker” and “Symbol settings”, the “Reactor” had the exact same settings. Nevertheless, I get the message:

The Generator Cannot Find Strategies.It’s almost the same with any currency pair I choose. Either the generation is too slow or I’m not generating any strategies at all.

Of course if I don’t select any Acceptance Criteria, no Monte Carlo, no SL or TP, then I can generate many strategies.

But even with minimum criteria like:

Minimum count of trades of 300 (for M15 and 3,6 years of period)

or

Minimum profit factor of 1,1 (for generating only winning strategies)

… I’m still having problems generating strategies.PLEASE HELP!

Thanks.

-

December 1, 2020 at 16:57 #68172

Anonymous

InactiveAttempt to attach the lost screenshot… (Edit: obviously successfully this time)

-

December 2, 2020 at 0:23 #68264

Anonymous

InactiveHey Asser,

That is super strange. There is no reason to have no strategies even with PF of 1.1…

The quality of the pic is not very clear but as far as I can see it, all looks good.

Did you try generating strategies with MetaTrader-Demo data with only PF of 1.1?

If it still fails then it is something in your generator settings that you are missing.

Can you send me screenshots of your settings there? (in separate posts)

-

December 2, 2020 at 4:15 #68267

Anonymous

Inactive -

December 5, 2020 at 15:30 #69091

Anonymous

InactiveHey Petko,

Thank you for looking at the screenshots and for suggesting to me to set the starting amount to $10,000 and the entry lot to 0.1.

That would have generated strategies but not for my account and might not solve my problem.As I showed you in the screenshots, both my brokers are from AU (not from the UK) and the leverage is 1:500 (not 1:30).

My initial capital is only $1,000 (with each of my two brokers) because Corona had (and still has) a huge impact on my private finances. $10,000 is not realistic at all for me.You’re right, I am “missing a little bit of the Forex basics. 1 lot = $100,000 trading units“… I’m still a beginner and can easily miss something – but did you take into consideration that my account has high leverage?

I’ll try to look (again) into generating strategies with 0.01 lot – but have tried that already and it’s only a partial and and limited solution – which is why I asked for help in the first place.

– Are there any Forex settings suitable for generating strategies with $1,000 and 1:500?

– Would I be better off if I reduce my leverage to 1:30 or lower?

– Can anyone put me on the right track please?Thank you in advance.

-

December 6, 2020 at 10:14 #69104

Anonymous

InactiveHello Asser,

Glad to hear from you again.

If you are with the AU broker then you can have the 1:500. Actually, I think 1:100 is just enough.

You were not getting strategies because you were using 1 lot in a 1000k account. Even your leverage is big, in a few trades you will hit the margin call. And you require 300 trades as a minimum….do you understand what I say? You CAN NOT trade with 1 lot in $1000 account no matter what type of trading you are doing.

This is pure gambling if you open the first trade to go on a profit, and the second and the third…and on 4th, for example, you will blow your account. That is why EA Studio can not find you strategies – it is meant for real Forex trading with appropriate risk in the account.

So keep your account to $1000 in the settings but select 0.01 lot. And this is how much you should be using after that as well.

To see strategies in your account:

- put 0.01 lot in $1000

- min 300 counts of trades

- 1.1 Profit Factor (increase if you see t many)

- Monte Carlo 20 tests and 80%

-

December 6, 2020 at 22:27 #69122

Anonymous

InactiveThank you Petko.

Glad to hear from you too.

You’re right: I totally missed the relationship between lot size and initial balance when I copied the 1 lot size from your course. Thank you for putting me on the right track.

YES, I do understand that 1 lot and $1000 account is gambling.

Actually, I was generating strategies quickly (for testing purposes) on 0.01 lot only on 2 brokers and different length of historical data for two weeks. However, I was able to generate very little or no strategies at all when I decided to follow your steps and copied the 1 lot size from your above-mentioned course. As it turned out (thanks to your reply) I totally missed the relationship of the lot size with the initial amount and am so glad you pointed this out for me.

I may also have found two other reasons for little or no strategies:

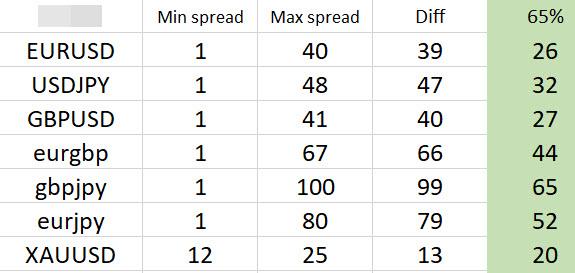

1. Spread value in symbol settings doesn’t have to be so set as high as I did. I took the highest value and round it up to factor 10. That’s too much. For example: If my broker’s GBPUSD is between 0 and 41, I set the value in “Symbol settings” to 50. That’s good but too high to generate strategies. I found that a more realistic value would be at 66% or 2/3 of their value as in the following table:

2. From your (Petko’s) comments to others in this forum, I understand that (everything else being equal) generating strategies slowly isn’t a necessarily a bad sign. Sometimes we have to be patient and wait longer for good strategies to appear.

As to the leverage, I’m not keen on reducing it to less than 1:500 for now. I need the high leverage because I’m unable to increase my initial amount and hope to become good at working with calculated risk at least until my account is big enough.

Thanks.

-

December 8, 2020 at 1:55 #69146

Anonymous

InactiveWell, no more

1:500leverage in Australia as per 29. March 2021.

I just received an email from my broker announcing that ASIC decided to follow Europe’s, UK’s and Japan’s regulatory authorities and drop the leverage of CFD for retail traders to 1:30 for Forex pairs, 1:20 for Metals and 1:2 for Crypto-currencies. They don’t like people like us shorting the market. -

December 8, 2020 at 8:10 #69151

Anonymous

InactiveYes. I live in Australia and got the same from my brokers….. I am now looking at alternatives. We have a few months to sort out alternatives…. Let me know what you come up with and I will do the same. So far Dukascopy is looking good. There leverage is 1:100 but can go to 1:200. I would love to find a trustworthy 1:500 broker.

It seems that if you are a wall street banker you can have all the rules and regulations changed so that you can use massive leverage and get a free bail out when you get it wrong, but the small retail trader is the one that can’t be trusted to manage his own money…….. Oh well that’s the way it goes. The other thing that I am following closely is the talk of another Bretton Woods agreement and the likely restructure of the forex markets as we know them in the next few years….. I think we will all need to be able to adapt quickly in the next few years to keep doing what we are doing here…… Just my opinion…

-

December 8, 2020 at 11:46 #69160

Anonymous

InactiveHey guys,

I think the reduced leverage will become real all over the world in the next years. They “protect” the traders this way…

However, that doesn’t mean they will protect the newbies from the Scam brokers, because they still scam the people by not allowing them to withdraw.

Asser, I was able to help you. Keep the spread to 2pips. That is fine.

-

December 8, 2020 at 15:41 #69215

Anonymous

InactiveThanks Petko.

You are a good teacher (so is Ilan) and you help me a lot as you always do – only sometimes I misunderstand you… Hey I’m human :-)

What do you mean by: Keep the spread to 2 pips?Sure Richard.

The only alternative would be offshore brokers. Contrary to popular belief, having an offshore account is not illegal and you need not to hide it from the tax authorities. I know I’ll probably be bashed saying this, but good offshore brokers that are regulated, just not under the well-known regulatory entities, could be just as secure because ESMA, CySec, FCA, etc. often mean nothing for many traders. The so-called highly regulated brokers can still get away with anything. The problem with offshore brokers is that there are many crooks who establish an offshore broker website just to suck traders’ money and vanish. We have to find offshore brokers that have been in business for quite some time and have good satisfied customers.My own challenge with one good offshore broker is that my bank (a large and well-known bank) didn’t allow me to fund my account with that broker. That’s the same bank that was exposed in my country for having helped laundering billions to their customers in their offshore branch, go figure! My bank can harm me by terminating my loan any time they like if I don’t follow their rules. What a world we’re living in!

-

-

AuthorPosts

- You must be logged in to reply to this topic.