Home › Forums › Ready-to-use Robots › Prop Firm Robots › Backtest results do not align at all

- This topic has 12 replies, 6 voices, and was last updated 2 months, 1 week ago by

Marin Stoyanov.

Marin Stoyanov.

-

AuthorPosts

-

-

December 1, 2024 at 11:31 #381639

Richard Lawrie

ParticipantGood day EA Trading academy

I have been using the Prop firm robots & the USDJPY & XAUUSD Top 10 robots app for a couple of months now.

I must say that I have not been impressed with the overall performance and that the performance does not align with what is being showcased on the website. I do understand that the Set files posted in the Prop app and the Top 10 App are merely backtests and these do not gaurentee future success but I have also taken into my own hands to actually backtest the sets I am using on my Eightcap Standard account. Eightcap has great spreads and is one of the industry leading brokers. The backtest results come out very different compared to what is being posted on your website. I am using all of the correct settings for the backtesting i.e. 15 min timeframe, open prices only and I back test for the same periods i.e. 1 month, 1 year, 5 years and the results still come out very different.I would just like to know if anyone (Besides Petko) has had any success with the Prop Robots or Top 10 robots. Has anyone been seeing consistent profits and growth, has anyone actually passed phases of prop challenges and gotten funded with some payouts? I have been part of EA Trading academy for more than 1 year and I am yet to see this from anyone else besides Petko.

A detailed response and some advice/guidance would be a greatly appreciated.

Thank you

-

December 1, 2024 at 11:57 #381650

Carl Collins

ParticipantSame nothing but losses and blown accounts. Had them for well over a year and they’ve never worked. Tried them on FTMO, 5ers and another one I car remember all multiple times. One 5ers account passes when silver was flying only to blow the funded account the next week. The results on YouTube are definitely not what really happens.

-

December 1, 2024 at 12:06 #381651

Richard Lawrie

ParticipantI think we deserve to see some testimonials from actual EA Trading academy customers instead of only seeing video’s of Petko passing.

I have spent a large amount of money and an even larger amount of my time (which is far more valuable than money) with EA Trading academy. I would prefer to know if I am wasting my time on all of this so I can move onto something bigger and better.

I do feel it is the responsibility of the support team to answer these kinds of questions and give some guidance as we are their customers.

Perhaps a live stream with Petko & support is a good option so we can ask relevant questions etc.

-

December 1, 2024 at 12:18 #381659

Carl Collins

ParticipantThe best thing I did was stop using them and learnt how to trade myself

-

December 1, 2024 at 14:53 #381697

Angel Borisov

ParticipantWell,

I got 5 demo (free) bots, and tried on Demo, and all went…very bad (nullified my accounts).

Not sure if this really works.

Sadly.

-

December 1, 2024 at 15:27 #381705

Alan Northam

ParticipantHi Richard / Guys!,

I am a successful trader using EA’s I created using EA Studio. You might consider following how I use EA’s successfully. Click here! You can use the same method with Prop Firm robots or the Top 10 robots. The problem is not the EA’s, it is how you are using them. Fifty percent of all the EA’s I create are losers. The secret is for me to find the ones that are profitable. To do this I create a demo account with the SAME broker/Prop Firm I plan on using and put all my EA’s into it. I then let the EA’s trade for one month in the demo account. I then filter the demo account using FXblue.com to find the top performing three or four EA’s. I then trade these EA’s.

Alan,

-

December 1, 2024 at 17:11 #381729

Angel Borisov

ParticipantHi Alan,

thanks for the info.

So, you are saying, if someone already bought Prop firm robots, have to buy again EA Studio, spend a lot of time, testing on demos and then ..maybe…then, have some success? (isn’t that supposed to be ready-solution, so not to spend a lot of time…) How this sound logical? I mean, spending money on “supposedly” working bots…to see they are not working and buy again something else…non-logical.

Thanks anyway.

-

December 1, 2024 at 17:51 #381739

Alan Northam

ParticipantHi Angel,

No I am not suggesting buying EA Studio. What I am saying is I use EA Studio to create my EA’s. You do not need to create EA’s if you already have EA’s from the Prop Firm app. What you are missing is that the Prop Firm robots were created using BlackBull historical data. When using other data sources other than BlackBull the EA’s will perform differently. To have direct success with the Prop Firm robots it is necessary to use prop firms that are compatible with the BlackBull historical data. It looks like Petko is having success using FTMO and the 5ers and maybe one or two others. But if you are using other prop firms or brokers you might not have success with the top performing Prop Firm robots. So how do you determine which prop firm EAs to use if your prop firm / brokers historical data is not compatible with BlackBull? The way I have found to determine the best performing prop firm EAs with the broker / prop firm I intend to use is to test the prop firm robots myself.

The prop firm robots are not the problem, the problem is the way you are using them. I have simply offered a solution. It will take you some time to discover which robots work best with the broker/prop firm you want to use but the results will be worth it. Again you can follow my methodology and you will most likely have success. Again, since you already have prop firm robot EAs you do not need to create them with EA Studio or use EA Studio in any way.

Follow my methodology shown in the above link using the robots from the prop firm app or the top 10 app instead of creating EAs with EA Studio and you should have success.

When following my methodology my account has gained 10.5% in 21 days which is good enough to have passed a prop firm challenge. What I am going to do after one more week of trading in the demo account is to start using my demo account to copy trade to a prop firm account.

Learning to trade successfully is not a sprint, it is a marathon!

Alan,

-

-

-

December 1, 2024 at 16:31 #381721

Richard Lawrie

ParticipantGood day Alan

Thank you for the feedback.

Much appreciated.So I am using a combination of the top performing Prop firm EA’s which I have selected based on monthly, yearly and 5 year cross checks. I have specific criteria that I am looking for when selecting the EA’s I am using. I am also using some of the Top 10 USDJPY robots and XAUUSD robots with a similar selection criteria to the Prop robots. So ultimately I am trading the Prop EA and Top 10 Robots App on 1 Eightcap Standard account. This Eightcap standard Demo is my Master account and I am using Social Trader Tools to copy to 2 x Darwinex Zero accounts at the moment.

Some of the Top 10 robots I am using actually look much better than the Prop EA’s I am using but they don’t seem to be performing as well as they indicate. I am using a fairly large number of robots on the account. The bot’s have been setup for 0.25% risk and not 0.5 % or 1% risk. This is so the robots can hedge one another and that will hopefully mean that the drawdown limits will be kept low. This has been the case, the drawdown has been nice and low but the robots have really not been performing well and the account balance has been dropping conistently over the last 3 weeks.

This is why I am reaching out though. To get some guidance and to hopefully see what is/isn’t working for others.

Are you only using the Prop Robots and not the Top 10 robots. Based on the results on the EA Trading academy website it also looks like the Top 10 EA’s are performing very well and this is also why I have included them in the master account.

Hope this all makes sense.

-

December 1, 2024 at 17:58 #381741

Alan Northam

ParticipantHi Richard,

Sounds like you have found a methodology that works great for you. Congratulations! The only thing I can suggest is that you might look at the EAs in your account and purge out the ones that are not performing well. Then maybe replace these EAs with better performing EA’s in prop firm and top 10 apps. I do this with my accounts once a week. The other thing you could do is to create a demo account and put all the prop firm and top 10 robots in it and let it trade for at least one month and then start selecting the EAs from it instead of from the prop firm and top 10 apps. In my demo account, which I call my pool of EAs, is to the 5 year performance of my EAs. Then when I select EAs from this pool once a week I use the last one month performance.

Alan,

-

-

December 1, 2024 at 21:55 #381765

Sand0r

ParticipantHi Richard, Hi Alan,

thanks a lot for sharing your thoughts and strategies!

I have been using the Prop Firm Robots App for 3 months now. For the first 2 months I saw steady wins (of course with some losses in between) with around 3-5% of gain per month on medium risk. I used the top 3-5 weekly or monthly performers and switched them once a week.

I then switched my strategy, using the top 3-5 performers per week and changed them on a daily basis and that gave me a huge boots and I passed FTMO and 5%ers first phases in 2 weeks.

Unfortunately since 2-3 weeks nothing goes right. I almost lost my accounts and just saw losses with my strategy. I also created a couple of posts here, complaining about the overall performance – and so did others.

I am very aware about the fact that we are using bots based on historical data and that some strategies work better in some market phases and some work worse. Nevertheless I have the feeling that in the current market phases nothing worked for me.

Also one of the Admins (@marinski) posted a FX Blue link, showing the top 3 FX performers on a monthly basis and the resulsts were absolutly NOT convincing: https://www.fxblue.com/users/top3fxpairson1m

I am currently putting the risk down to 0.25% – 0.5% and trying to survive this phase, hoping for the bots to perform better in the future. Actually I am quiet coninced that the ideas in general work..

Best,

Sandor

-

December 2, 2024 at 13:44 #381892

Alan Northam

ParticipantHi Sandor,

I like the idea of you switching out the robots once a week as this should help to minimize drawdowns, at least in theory. However, once in a while you will still suffer drawdowns as you experienced. For this reason it is a good idea to keep risk under control. So, again I liked the idea you reduced risk after having undergone a large drawdown. In the future I would suggest keeping risk low. To keep risk low when you first place the robots in MetaTrader look at the drawdowns for the EAs in the Prop Firm or Top 10 app for each robot you plan to trade and make sure their total drawdowns to not exceed the loss limit you are willing to accept. If total drawdown is greater than the loss limit you can accept adjust the lot size. Good job!

Alan,

-

December 2, 2024 at 14:13 #381901

Marin StoyanovKeymaster

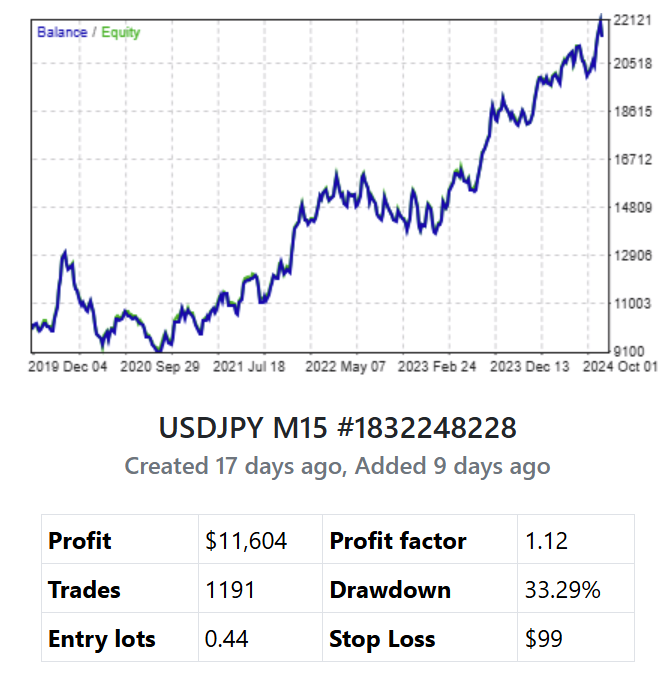

Marin StoyanovKeymasterHey Richard, the EAs from the Prop Firm Robots App/Top 10 Robots App/EA Studio all trade at the opening of the bar so for the backtest you should use the “Open Prices Only” model like it’s shown below. You can adopt your leverage and account size as per your needs but for the purpose of this post, I used the below settings which are the default in my accounts. Also I ran the backtest for the last 5 years because this is the maximum period that we can see in the apps so this will make the comparison more reliable.

So I performed several tests to show the results of a random strategy from one of the apps. For the tests I picked the below strategy from the Prop app, and I downloaded it for a $10,000 account size.

<span style=”text-decoration: underline;”>Prop Firm Robots app 5Y stats</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (EightCap)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (BlackBull)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (Darwinex)</span>

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on EightCap</span> (beacuase of the wider image the balance chart looks more flawless but you can obviously see the drawdown at the beginning similar to what you see in EA Studio’s backtests)

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on BlackBull</span>

As you can see from all backtests, with the proper settings, the strategies show very similar performance. The difference comes from the count of trades that is different with different brokers because they use different liquidity providers and have different quotes and commissions and spreads.

Thanks to Alan and Sandor for sharing their strategies and systems. It’s always nice to see how different users are using the robots from the apps as the way we use them is our own system but it doesn’t mean that this is the only way to manage the robots.

The system we follow with the robots from the apps is shown in every video and on the challenges or live accounts pages, but I’ll write it here once again to have more context for future readers of this thread. We start by picking 3 to 5 EAs and trading them on our accounts. We keep an eye on how well these EAs are performing both in the app and in our trading accounts by tracking their magic numbers. If we notice that one of our EAs is no longer among the top 3 performers in the app, we swap it out for a new top performer to keep our trading strategy effective. This way, we always use the best-performing EAs. We check the EAs performance daily and the highest success we had by picking the top performing EAs from the monthly or yearly charts. We see ups and downs in the accounts and this is quite expected as market is not a straight line and the strategies also show losing trades in the backtests and on the apps charts as well. It’s normal to have such periods in trading.

There is also one other thing which can have impact on the actual performance compared to the backtest and this is valid for absolutely every EA out there. To understand the differences between backtest results in the app and actual performance, it’s important to consider the role of order flow in live trading. Backtests use historical data to simulate market conditions, but they don’t account for real-time factors like order flow and market liquidity, which impact actual trade execution. In a live trading environment, other traders’ orders affect price movements and can lead to slippage (difference between expected and actual trade prices). These factors often cause discrepancies between backtests and live trading results, especially in fast-moving markets or with larger positions. So, while backtests are a useful tool for evaluating a strategy, actual performance will inevitably differ due to these dynamic market influences. You can expect a similar performance but it won’t be the same as the backtest (that’s applicable to the MetaTrader strategy tester as well).

Still, until we find a better system to manage the EAs for ourselves, we will keep using the system that works well for us at the moment and we have plenty of live accounts and passed challenges so far that prove for us that the system it’s working. I know a lot of users who have success with our robots because they write to us via email but when we ask them to share this publicly in the forum, many refuse because they prefer to have some privacy. You all know that many people use VPNs, fake/hidden emails, proton emails and etc. to hide themselves, and I can assure you from my experience in the Academy, that in trading the number of such people is very high.

Kudos to Alan and Sandor who shared their success, I know other users who passed challenges and have great performance with our robots. Recently we launched a reward program for the Prop Firm Robots App users to reward their performance and stimulate them to share their experience and by the end of the year we will do a similar thing for the users of the Top 10 Robots app as well.

-

-

AuthorPosts

- You must be logged in to reply to this topic.