Home › Forums › Prop Firms › FTMO Challenge › FTMO Challenge – 25K › Reply To: FTMO Challenge – 25K

Top performers are going to depend upon which broker you are using as when testing the same EA on different brokers you will get different results because their historical data is not exactly the same. Also top performers will depend upon how you have the EA set up. For example, does the EA just close when it hits TP or SL, or does it add to the lot size or does it reduce the lot size. Also do the open trades close when the account falls below a certain price level.

Now since the prop firms have unlimited time period I have started to test my FTMO EAs using a $10K Challenge account. I set my lot size to 0.05 lots so the account size does not fall below the minimum amount that would cause the Challenge to fail while at the same time provide information as to which EA’s are the best performers. By using an FTMO account I will be using the same historical data as I would be using with a larger FTMO Challenge and larger lot sizes while at the same time giving the most accurate info as to which EA’s are performing the best.

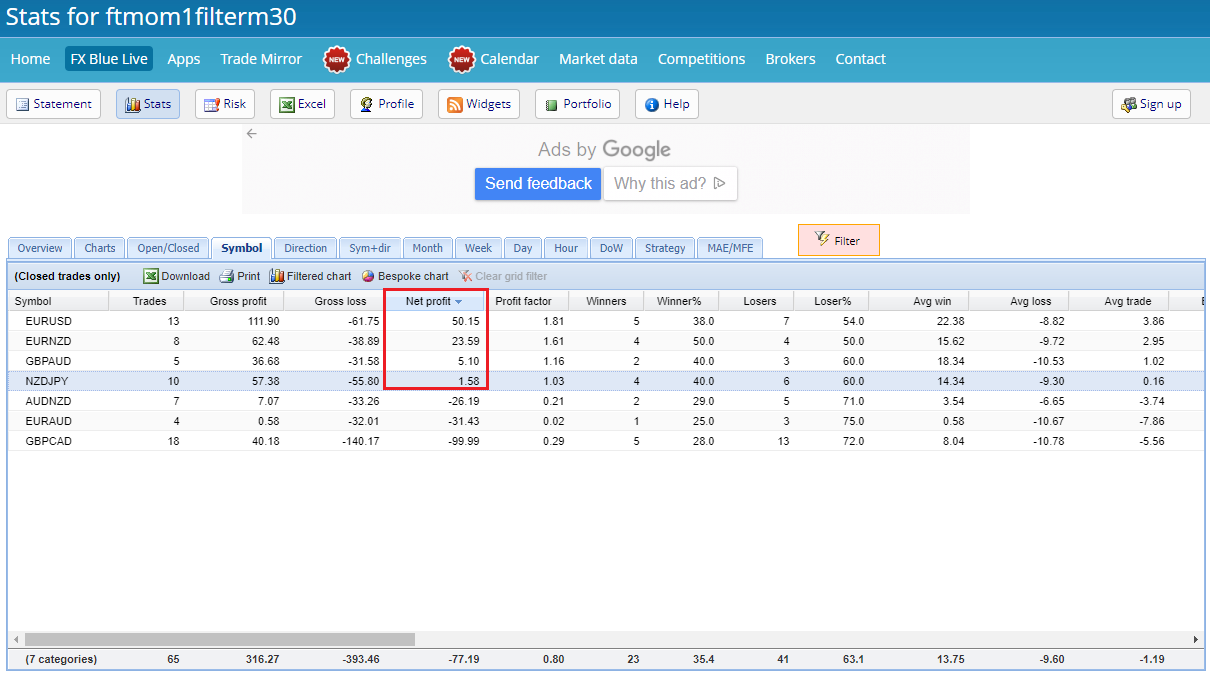

The following chart shows the Top performers when using FTMO historical data. The EAs are set to close at TP or SL and do not add or reduce nor am I manually closing any trades or changing lot sizes:

The following chart shows 4 EAs trending upward. EURUSD, EURNZD and NZDJPY have been trading upward over the last 3 days, therefore I would expect them to continue to move upward during this next week. However, GBPAUD has only started to to trend upward over the last one day. Therefore I would not consider this EA as being one of the top performers. I would wait to see if it continues to trend upward over the next two or three days before considering it as one of the top performers.

As a result, just looking at which EAs have profited over the last week or so is not really sufficient data in deciding which EAs are top performers can be misleading as they can show profit at the end of the week but can be trending downward and could cause a trader to lose money over the next week or so. It is important to also look at the direction of the trend of each EA showing profit at the end of the week or whichever time period you are using to determine top performers.

So in reality, I would consider EURUSD, EURNZD and NZDJPY as the top performers over the previous week even though NZDJPY ended the week with less profit than GBPAUD. The difference is that NZDJPY has been trending upward whereas it is not determined if GBPAUD is trending upward as moving higher for just one day does not determine a trend.

Alan,