Home › Forums › Prop Firms › FTMO Challenge › FTMO Challenge – 25K

- This topic has 28 replies, 1 voice, and was last updated 1 year, 7 months ago by

Samuel Fernandes.

-

AuthorPosts

-

-

October 30, 2023 at 17:21 #208468

0xBitpool

ParticipantHi guys!

Today is the day I’m starting my very first FTMO challenge!!! I went for the Swing 25K.

I will use the top 3 performers from the 7 FTMO bots and will update this thread as the challenge progresses.

Here is a link to a live updating myfxbook if you want to follow: https://www.myfxbook.com/portfolio/ftmo-challenge-25k-top-3/10505789

Quick question though: can you confirm that 0.75 is the correct lot size for a 25K account?

-

October 30, 2023 at 18:07 #208479

Alan Northam

ParticipantYes this is correct if you want to limit your risk to 1% for each EA. However, if all three EAs start trading then your overall risk will be 3%.

Alan,

-

October 30, 2023 at 20:14 #208510

0xBitpool

ParticipantActually Petko used 1 lot on his passed 25K challenge here: https://www.myfxbook.com/members/PetkoA/ftmo-robot-top-3-25k/10493707, so I’m a little confused lol

-

October 30, 2023 at 21:08 #208519

Alan Northam

ParticipantFTMO daily loss limit is 5% so 3% risk is still OK. I am just pointing out the risk so you are aware of it!

Alan,

-

-

November 2, 2023 at 5:08 #209124

0xBitpool

ParticipantRemoving the EURAUD bot for now as it’s not been really performing well last week. Just keeping AUDNZD and EURUSD for now. These are my winners and will help reduce the risk

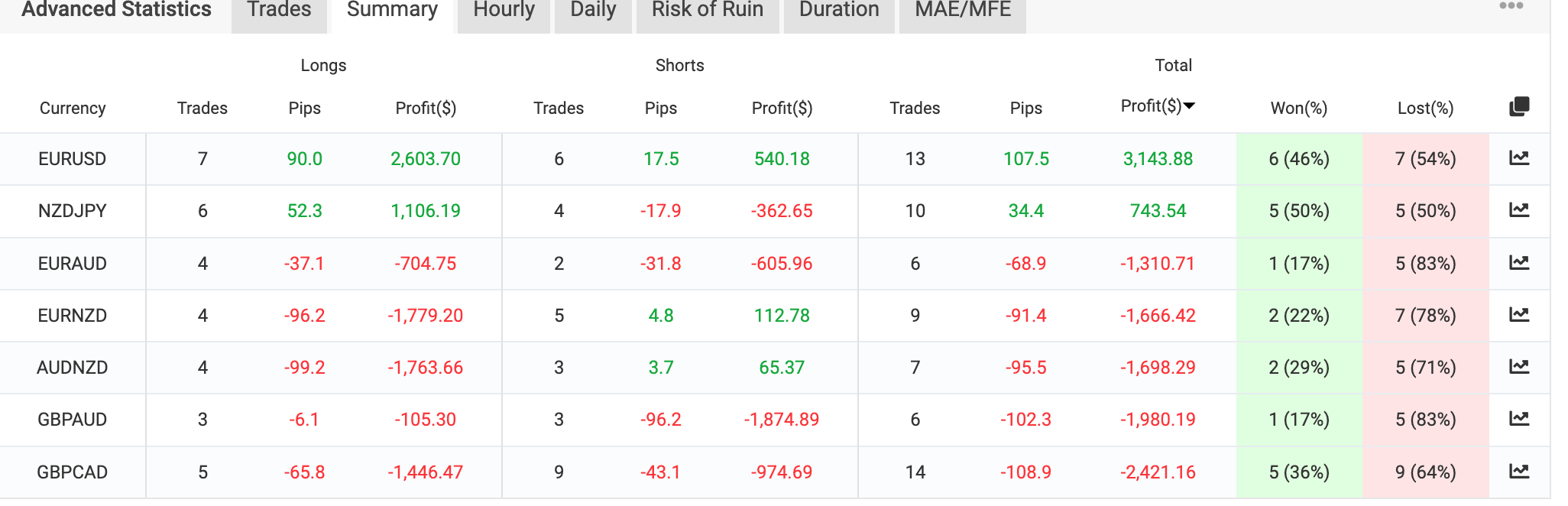

(This pic is from the 200K FTMO Trial account that I keep to check all 7 EAs performance)

-

November 2, 2023 at 16:25 #209251

0xBitpool

ParticipantReintegrating EURAUD after thinking a little more: I want to keep the top 3 (despite the facts that the tests EAs are all in the negative except for one for now)

-

November 2, 2023 at 17:07 #209262

0xBitpool

ParticipantMy FTMO trial account blew up, so I need to start fresh. I’m not gonna be able to see which ones of the 7 EAs are the best for the next week. What would be the good move here? What are your top 3?

-

November 4, 2023 at 14:56 #209671

dusktrader

ParticipantHi 0xBitpool,

can you let me know the reason your trial blew up? Is it because you used too many lots?

I am thinking to run all 7 bots on (regular) demo using a small lot amount so that I can get the FX Blue analytics. Then after that first week I should be able to identify which 3 are the top performers.

I was also thinking to continue monitoring the demo account (that runs all 7 continuously) and then every weekend I could consider swapping-in the top 3 performers to the actual FTMO account for trading in the upcoming week.

-

-

November 3, 2023 at 0:45 #209356

0xBitpool

ParticipantTo prevent too much risk in the trial account, I reduced the lot size from 6 to 1 (200k account). It’ll still be good to see the results

-

November 3, 2023 at 19:18 #209522

Olivier Roversp

ParticipantWhy not use a ic market demo ? It is not limited to 14 days like a free trial challenge from ftmo

-

November 3, 2023 at 19:21 #209523

Olivier Roversp

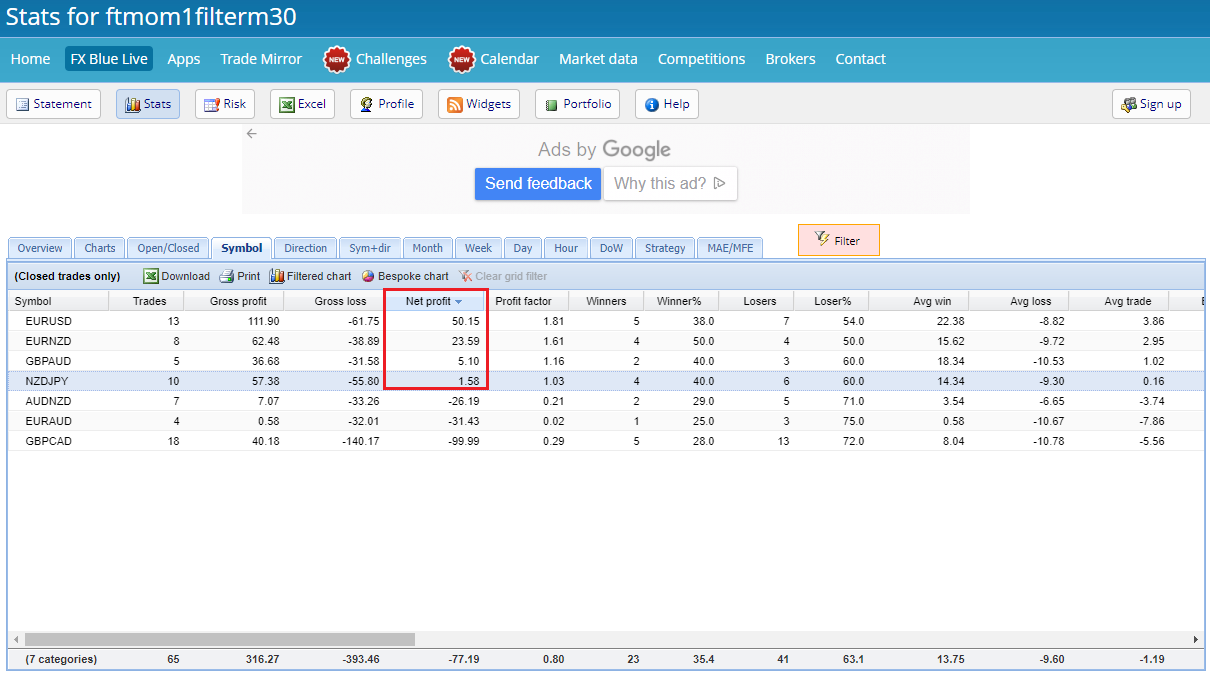

Participantand to answer you the only two robots which are positive this week are eurusd and nzdjpy

-

November 3, 2023 at 23:58 #209555

0xBitpool

ParticipantThank you! That’s interesting, I didn’t have NZDJPY as a top performer. What’s your broker?

-

November 4, 2023 at 10:40 #209619

Olivier Roversp

ParticipantThis is an IC Market account with standard spread, not raw. The results are similar to those I had with the ftmo free trial. Good luck for your chalenge

-

November 4, 2023 at 14:21 #209662

Alan Northam

ParticipantTop performers are going to depend upon which broker you are using as when testing the same EA on different brokers you will get different results because their historical data is not exactly the same. Also top performers will depend upon how you have the EA set up. For example, does the EA just close when it hits TP or SL, or does it add to the lot size or does it reduce the lot size. Also do the open trades close when the account falls below a certain price level.

Now since the prop firms have unlimited time period I have started to test my FTMO EAs using a $10K Challenge account. I set my lot size to 0.05 lots so the account size does not fall below the minimum amount that would cause the Challenge to fail while at the same time provide information as to which EA’s are the best performers. By using an FTMO account I will be using the same historical data as I would be using with a larger FTMO Challenge and larger lot sizes while at the same time giving the most accurate info as to which EA’s are performing the best.

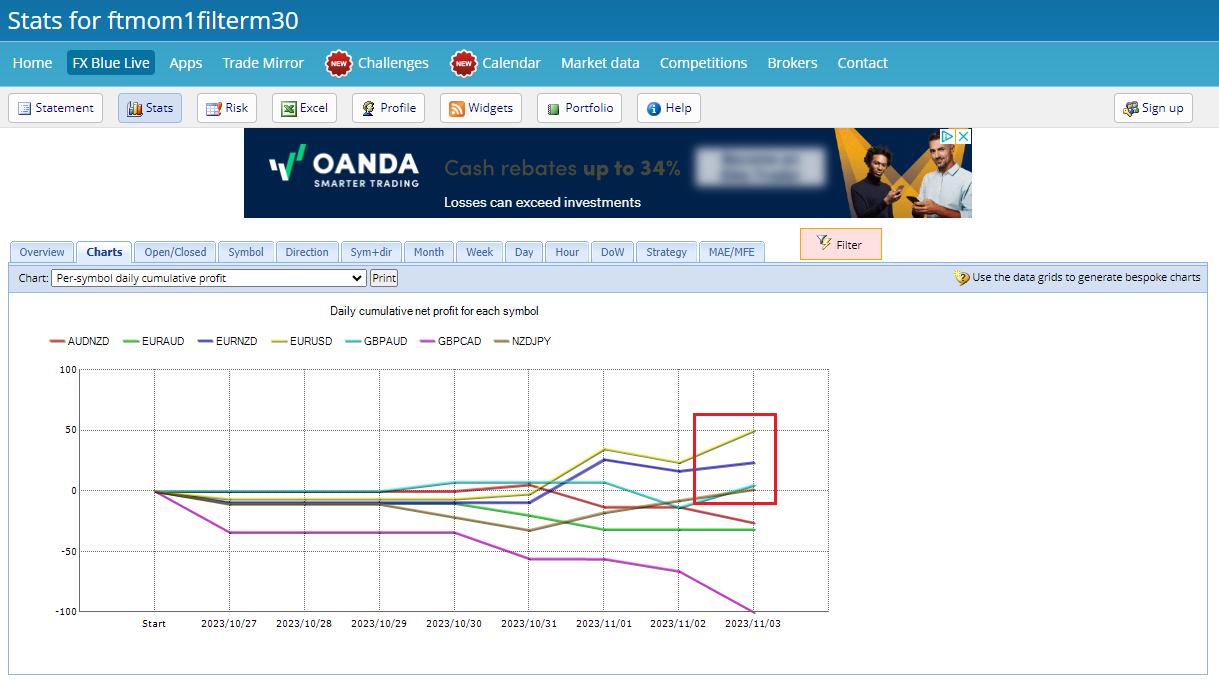

The following chart shows the Top performers when using FTMO historical data. The EAs are set to close at TP or SL and do not add or reduce nor am I manually closing any trades or changing lot sizes:

The following chart shows 4 EAs trending upward. EURUSD, EURNZD and NZDJPY have been trading upward over the last 3 days, therefore I would expect them to continue to move upward during this next week. However, GBPAUD has only started to to trend upward over the last one day. Therefore I would not consider this EA as being one of the top performers. I would wait to see if it continues to trend upward over the next two or three days before considering it as one of the top performers.

As a result, just looking at which EAs have profited over the last week or so is not really sufficient data in deciding which EAs are top performers can be misleading as they can show profit at the end of the week but can be trending downward and could cause a trader to lose money over the next week or so. It is important to also look at the direction of the trend of each EA showing profit at the end of the week or whichever time period you are using to determine top performers.

So in reality, I would consider EURUSD, EURNZD and NZDJPY as the top performers over the previous week even though NZDJPY ended the week with less profit than GBPAUD. The difference is that NZDJPY has been trending upward whereas it is not determined if GBPAUD is trending upward as moving higher for just one day does not determine a trend.

Alan,

-

November 4, 2023 at 22:47 #209794

0xBitpool

ParticipantWow thank you so much for this detailed answer Alan! It’s really useful and makes total sense. The idea to use a real FTMO account with a reduced lot size is honestly a very smart move!

-

November 5, 2023 at 14:04 #209941

Alan Northam

ParticipantThere is actually another level of complexity in the solution as to what are the real Top performers, and this comes from the fact that the pip value for all assets (currency pairs) are not the same. For example, it is recommended that for a 10K account the lot size should be 0.33 lots to limit the risk to 1%. So if you are going to trade the top 3 assets you would think to split the lot size equally between all three assets and make each asset have a lot size of 0.11 lots. However, in reality this does not evenly split the risk as the pip value for each asset is not the same. Another is considering how many pips each asset gained in a given period of time. So there are various ways to determine which assets are the top performers.

Having said this, Petko has kept it simple for new traders by just keeping to lot sizes the same and determining the top performers based upon the profit of each asset over a given time period. It works just as well as any other method!

Alan,

-

November 5, 2023 at 18:54 #210007

0xBitpool

ParticipantI’m curious how to calculate the pip value now :)

-

-

-

-

-

November 4, 2023 at 22:51 #209795

0xBitpool

ParticipantHere is the decision for the weekend:

– I’ll reduce the lot size so that the risk is 1% for the whole account and not each individual EA. That means each EA will use 0.25 lots instead of 0.75.

– Next week I’ll start a 10K FTMO challenge with all EAs using a minimum lot size, and that will be the account I’ll be monitoring the EAs performance to select the top 3 performers. Big shout out to Alan for this idea ! -

November 7, 2023 at 18:32 #210539

0xBitpool

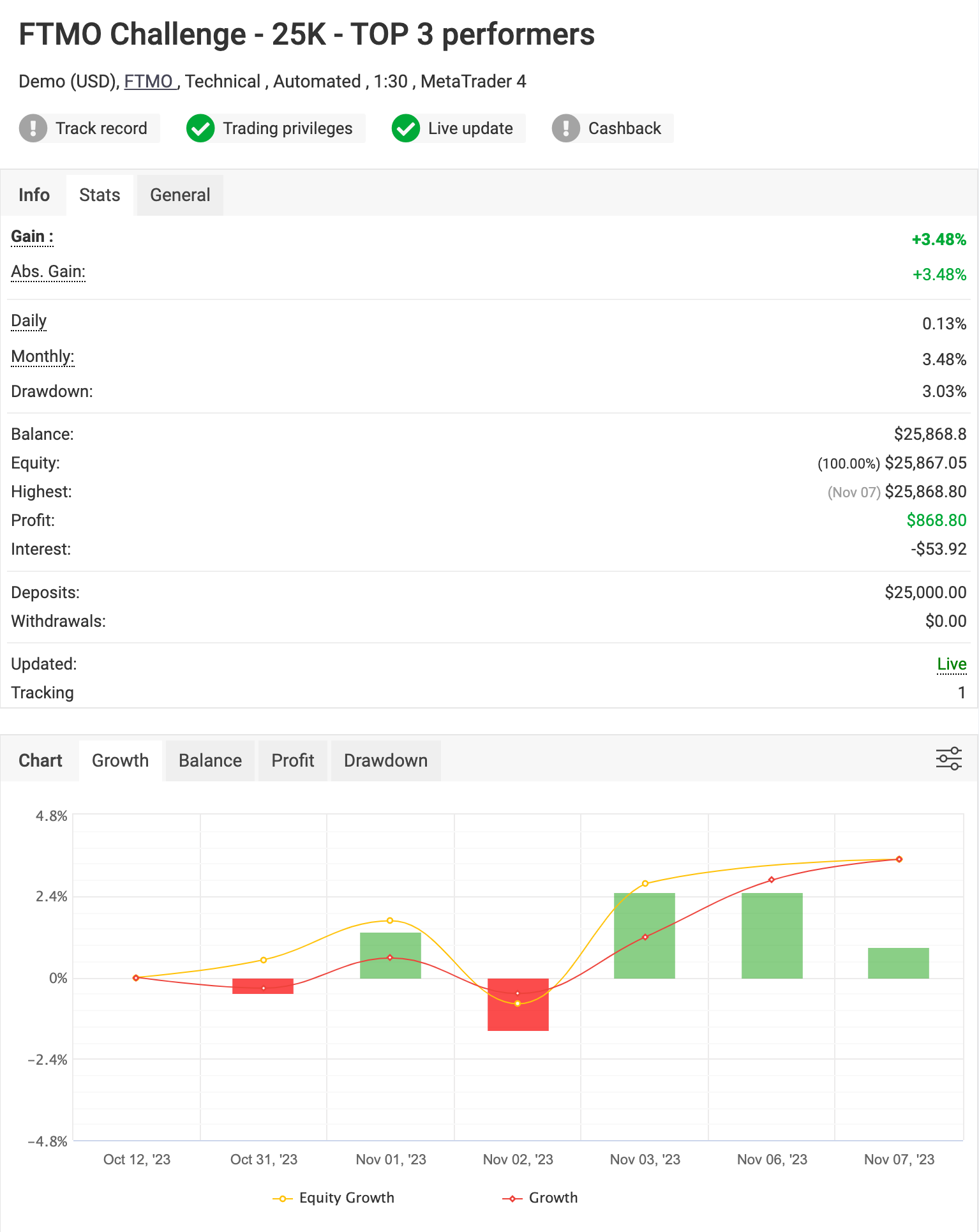

ParticipantChallenge update!

For the moment, all seems to go pretty well.

-

November 8, 2023 at 0:48 #210638

0xBitpool

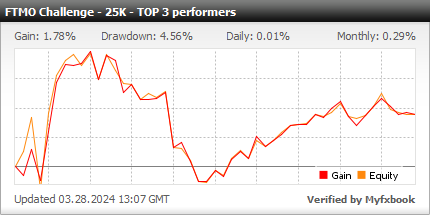

ParticipantSad I can’t edit the first post, but I thought inserting the myfxbook widget here would be cool.

-

November 8, 2023 at 11:56 #210742

Alan Northam

ParticipantHi OxBitpool,

Did the 3% drawdown occur when all 3 EA’s each retraced by 1% or was it because just one or two EA’s did. If it was not caused by all 3 EA’s that would suggest your risk is a little high. If the 3 assets (example EURUSD, etc) were to go through a more severe drawdown you could lose the account. Don’t try to complete the challenge in a short period of time as this could cause you to lose your account. Be mindful of risk! Remember the tortoise won the race.

Alan,

-

-

November 22, 2023 at 14:07 #215158

Samuel Fernandes

Participanthi. Did you pass the challenge?

-

-

AuthorPosts

- You must be logged in to reply to this topic.