Are you looking for a trading approach that allows you to capitalize on market movements without the constant screen-watching that day trading demands? Swing trading strategy might just be the strategy you’re after. Known for balancing flexibility with profitability, swing trading strategy focuses on capturing short- to medium-term price changes. This strategy gives traders the chance to catch significant “swings” within larger trends, all while holding positions for days or even weeks.

In this article, we’ll uncover the fundamentals of swing trading and break down everything you need to start your trading experience with swing trading strategy. Expect to discover:

- What swing trading strategy really is and why it’s a popular choice for traders seeking a middle ground between day trading and long-term investing.

- Essential indicators used in swing trading to spot prime entry and exit points.

- Timeframes best suited for swing trades and how to adapt these to different market conditions.

- How expert advisors (EAs) can automate swing trading strategies for greater precision and consistency, even as you sleep.

- A practical example of a USD/JPY swing trade EA that you can backtest and deploy in real time (there is a link in the section to get the FREE robot) .

Whether you’re a trader eager to refine your strategies or someone intrigued by algorithmic trading, this article will guide you through executing swing trades with efficiency and confidence. Let’s begin!

Table of Contents:

What Is Swing Trading Strategy

Swing trading is a medium-term trading style that captures short-term price movements within a larger trend. Due to this, it suits perfectly traders looking to avoid the intensity of day trading but also not committed to long-term investing. Unlike day trading, which requires constant monitoring to open and close positions within a single day, swing trading allows positions to remain open for several days or weeks. This approach gives traders time to capitalize on price movements across multiple sessions. To do it, they rely heavily on technical analysis for market entry and exit decisions.

The primary objective of swing trading is to take advantage of price swings—distinct upward or downward movements in price. Swing traders aim to predict these shifts by examining chart patterns, historical performance, and momentum indicators. Then they make strategic entries when conditions are favorable. While it doesn’t require as much time commitment as day trading, swing trading still benefits from periodic monitoring to adjust strategies as market conditions change.

Swing trading is a medium-term trading style focusing on capturing price movements within a broader trend, with trades lasting from days to weeks. It often uses technical indicators for strategic entry and exit points, making it popular among traders seeking balance between day trading and long-term investing.

Key Indicators Used in Swing Trading Strategy

Effective swing trading requires a reliable set of indicators that can provide insights into price trends, potential reversals, and overbought or oversold market conditions. Below are some of the most common indicators which traders use in swing trading:

MACD (Moving Average Convergence Divergence): MACD is widely used for identifying shifts in momentum, which can signal reversals. By tracking the difference between two moving averages (usually 12-day and 26-day), MACD helps traders spot buy and sell signals as the shorter average crosses above or below the longer average.

Moving Averages: Moving averages, particularly the 50-day and 200-day averages, help in identifying long-term trend directions. For example, when the 50-day moving average crosses above the 200-day average, it suggests an upward trend—a signal swing traders may consider as an entry point.

Relative Strength Index (RSI): RSI measures the magnitude of recent price changes, signaling overbought or oversold conditions. When the RSI exceeds 70, it indicates the asset may be overbought, signaling a potential reversal. Conversely, an RSI below 30 suggests the asset is oversold, presenting a possible buying opportunity.

Selecting the Ideal Timeframe for Swing Trading

To select the right timeframe is crucial in swing trading. Different timeframes cater to different trading goals and risk tolerance levels. Swing trading generally operates within higher timeframes than day trading, balancing detail and long-term insight.

- Common Timeframes: Swing traders typically work with 4-hour to daily (1D) charts. These timeframes offer detailed information on market trends and avoid the “noise” often present in shorter timeframes. Using these larger windows helps capture sustained price swings, reducing false signals that can occur in highly volatile, low-timeframe data.

- Key Tips for Selecting Timeframes:

- Higher Timeframes: For traders aiming to minimize screen time, a daily timeframe might be suitable, enabling a less hands-on approach.

- Mid-Level Timeframes (4H): For those looking to balance trade frequency and detail, 4-hour charts offer a clearer picture of price trends without as many minor fluctuations.

- Lower Timeframes (M15): While not traditional for swing trading, shorter timeframes are also an option in specific strategies, especially in high-volatility assets.

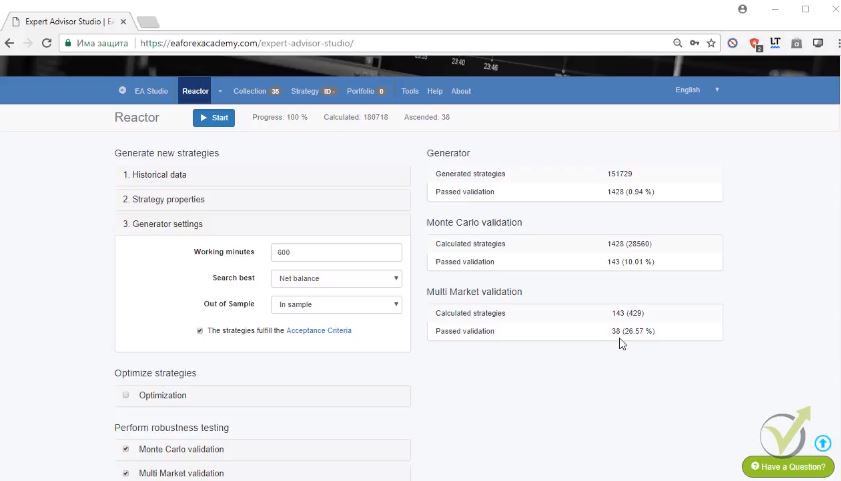

Ready to explore the benefits of algorithmic swing trading strategy ? With Expert Advisor Studio you can generate your own EAs tailored for swing trading. Using the strategy builder, traders can backtest and refine their strategies, paving the way for automated, efficient, and successful swing trading.

Algorithmic Swing Trading

The integration of algorithmic trading with swing trading strategies provides a powerful synergy. It combines swing trading’s focus on medium-term price moves with the precision and consistency of automated systems. With the employment of expert advisors (EAs) to handle the entry, exit, and management of swing trades, traders can enhance both the effectiveness and efficiency of their strategies.

Efficiency Through Automation

Swing trading relies on technical indicators and price patterns, often demanding timely execution to capitalize on each swing. Algorithmic trading enables this by automating these trades, removing the need for traders to constantly monitor charts. EAs execute trades immediately when criteria are met, increasing the likelihood of capturing profitable swings without delay.

Enhanced Precision and Objectivity

One of swing trading’s challenges is maintaining objectivity amid fluctuating price moves. EAs resolve this by following strict, pre-set rules without emotional biases. This precision is particularly advantageous in swing trading, where hesitation or impulsive decisions can significantly impact outcomes. With algorithmic trading, every trade is executed according to the strategy’s logic, leading to consistent results over time.

Continuous Operation and Opportunity Capture

The nature of swing trading involves holding positions for days to weeks. Round the clock oversight is pretty much impossible for manual traders. Algorithmic trading ensures trades are monitored and managed continuously, even when the trader is offline. EAs can automatically adjust stops, close positions, or open new trades according to evolving market conditions. Like this, they utilize every swing trading opportunity.

Streamlined Backtesting and Optimization

Algorithmic systems like Expert Advisor Studio allow swing traders to rigorously backtest their strategies on historical data, refining parameters for better performance. This not only builds confidence in the strategy but also offers insights into potential adjustments, ensuring the swing trading strategy remains effective across different market scenarios.

In short, algorithmic trading amplifies the efficiency, precision, and consistency that are essential in swing trading. Because of this, it is a valuable tool for traders looking to capitalize on market swings without manual effort.

Practical Example: USDJPY Algorithmic Swing Trading Strategy from Expert Advisor Studio

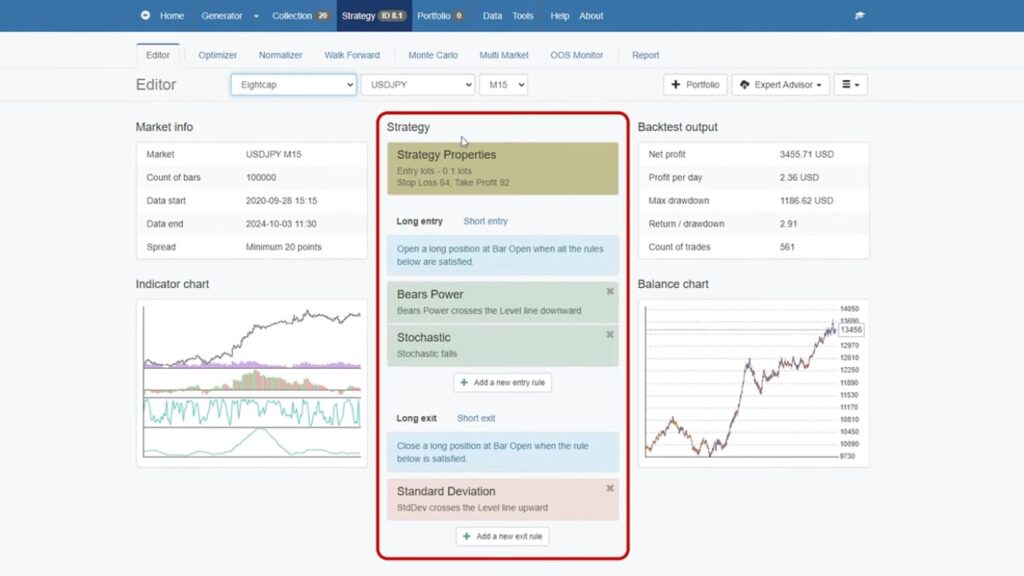

This practical example, derived from EA Trading Academy’s Top 10 Robots App, illustrates how swing trading can be set up and tested in real-time using Expert Advisor Studio. The example highlights a strategy designed for the USD/JPY currency pair, using specific indicators to capture profitable price movements.

- Strategy Overview:

- Indicators Used: The strategy utilizes two main indicators—Bears Power and Stochastic—to determine entry and exit points.

- Entry Signal: A long position is initiated when the Bears Power indicator crosses a defined level downward. At the same time Stochastic shows a downward trend as confirmation. This two-indicator combination aims to ensure that the trade is entered during a low point, capturing upward price momentum.

- Exit Signal: The strategy uses the Standard Deviation indicator to exit trades when it crosses upward. This safeguards profits or cuts losses as the trade completes its swing.

- Risk Management: With a stop loss of 64 pips and a take profit of 92 pips, this strategy is designed to maintain a balanced risk-reward ratio. It supports effective risk management while pursuing profit opportunities(Swing Trading Strategy).

- Testing and Execution:

- Backtested using Eightcap data, the strategy has demonstrated strong performance over a one-year period, delivering a reliable setup that adapts to various market conditions. Once generated in EA Studio, the strategy’s code can be exported to MetaTrader 4 or 5. And it is ready for immediate deployment in either a demo or live trading environment.

- Note: The example highlights the advantages of algorithmic trading for swing traders, as EAs automate entries, exits, and other parameters, allowing for smoother trade management without manual oversight.

Check out this video for to see how we discovered and analyzed this swing trade ea.

And if you want to test this robot yourself, you can download it completely for FREE from this link.

Conclusion: Swing Trading Strategy with Algorithmic Precision

Swing trading offers a flexible way to profit from market movements over short to medium-term periods. By automating the strategy with tools like EA Studio, traders can enhance their efficiency and remove the emotional aspects of trading.

For those interested in automated trading solutions, check out EA Studio and start experimenting with this swing trade EA today. Don’t forget to backtest on demo accounts and optimize the strategy to suit your trading style!