In this article, we will talk about Forex Demo Account and why it is better to start trading with a Forex trading demo account first before you jump into investing real money.

Forex trading has inherent risks, no matter how experienced you are. Forex trading is the exchange of foreign currencies, and you invest some of your own money (and some time control much more than what you personally invest).

With every trade, you risk losing money if you make a mistake or do not predict the changes in the market correctly.

While this risk exists at all levels to a degree, there are ways that you can minimize the chances that you will lose money. Many of the things you can do to minimize risk happen before you ever even trade real currency such as completing personal research, taking a course on how to Forex trade, and opening an online Forex trading demo account.

Opening a Forex trading demo account is generally the final step before you start actual Forex trading. And it is one of the most important things you can do because practice makes perfect.

What is a Forex Demo Account?

In the 21st-century, online Forex trading by private individuals became more and more popular and along with it, online Forex demo accounts grew in popularity.

Today, they are a common and great first step for demo users, but they also work as a great tool for a variety of other people. It is important to fully understand what a Forex trading demo account is before you sign up for it so that it will be the most beneficial to you.

To learn about the specifics for a particular demo account, you will have to look into the company, but below you will find a general explanation of what a Forex trading demo account is.

Typically, Forex demo accounts are a way for new traders to test out the user experience, a variety of features, and perhaps a trading platform that is specific to that broker.

A Forex demo account is basically a simulation where you can practice Forex trading without risking any money.

You basically trade with fake money (the digital version of Monopoly money), but it runs through real-world market situations (perhaps even exactly what is happening depending on the service you use).

This way, you will be able to see exactly what makes you money, what causes you to lose money and the real risks of Forex trading. As you practice Forex trading, you should find yourself making more and more accurate predictions about the market and, therefore, not lose money (or, in this case, fake money) as often.

There are a few great reasons that a person will open and use a Forex demo account other than testing the features and user experience of certain brokers.

First, if there is someone interested in Forex trading, but they do not currently have the money to do so, they can practice with a Forex demo account until they do. This will give them the feeling of doing what they want to do and will also cause them to be much better prepared when they are actually ready to start trading real money.

Second, a person who has the money to invest but does not know how or where to start. The truth is, this is most, if not all, new traders. No matter how much research and knowledge they have, they cannot really know what to do until they start actually practicing.

In the beginning, they may find themselves to be wrong in their predictions more often than not and therefore lose money. It is so much better to do this in a Forex trading demo account than a real one.

Forex demo account gives the trader time to figure out what features, brokers, and platforms they want to use.

Finally, even a seasoned trader may use a Forex demo account to test new strategies. A seasoned trader understands the inherent risk that comes with every trade and they may also be trading with a lot of money due to leverage.

For this reason, even if they have a real account, they may go back to using a demo account to test out a new strategy a few times before actually using it. If it goes well, they will start trading with it. If it goes poorly, there is no real harm done.

How Does Forex Demo Account Work?

For a long time, Forex demo accounts were not really a plausible option for traders. They had to jump headfirst into making trades with their own money.

But with the development of highspeed internet, online Forex demo accounts are now completely possible. Forex trading demo accounts are a simulation and therefore work like other simulations.

It is code that mimics (or perhaps replicates exactly) real-time market conditions before and after a person makes a trade or, in this case, a fake trade. This simulation allows people to see exactly how trades would go without putting any real money at risk.

Each Forex trading demo account will probably work slightly differently from other Forex demo accounts, but there are some basics that you can expect.

First of all, you can expect to have access to fake money or simulated money. This may be limited to a certain amount, but it often is not because it is fake.

Either way, it is recommended to trade with a realistic amount based on what money you actually have, how much leverage you will be able or feel comfortable using, and the minimum deposit amount the broker you are considering requires.

You will also have access to information and charts that show the current market conditions, and you will then make your predictions on how the market will shift. You should learn about what shifts and indicators they are before you even open a Forex demo account.

After you make your prediction, you will begin to make trades. As you wait to see the results of your choice, you will be able to see if the strategy works with you or if you need to keep practicing before you start trading with real money.

Forex Trading Demo Account – Pros and Cons

Pros

It is cost-free.

It is a tool that is absolutely free for you to use and practice with. This is great, especially if you are new and are unsure of how much you really want to invest yet. It also opens Forex trading to a whole new group of traders who could not afford to do so before.

Risk.

The risk in a Forex demo account is a benefit in two ways. First of all, as mentioned above, there is no real risk of you losing money if you make a mistake or wrong prediction.

However, it still gives you a fairly accurate depiction of what risk lies in real trading. You will see accurate reports of how your trade would have worked out. You will be able to see the amount of money you are actually risking if you are wrong. This is not meant to scare you but rather help you make smart instead of careless trading decisions.

Learn the platform.

Whether you are new to Forex trading entirely or simply trying out a new platform, a Forex demo account will allow you to learn all the specific tricks and features of a trading platform.

If you are unsure which platform you want to use, opening an online Forex demo account will allow you to figure that out by practicing, which each one in question.

Experiment and learn the market.

A Forex demo account will allow you to practice Forex trading making predictions based on the market trends and specific indicators. No matter how much you research and learn about these things, there is no way to truly learn how it works without practicing.

You will learn how to great to volatile markets, capitalize on price fluctuations, and use strategies. As you experiment, you will be able to calibrate the strategy so that when you trade with real money, you can be confident that it will work.

Cons

Slippage.

When you are trading on the real market, you will come across something known as slippage. Due to the fast changes in the market, the price may change between what you see on your screen, and when you actually click to make the change.

This means that calculations may be harder in real situations then they are on a Forex trading demo account.

Money.

Often in a Forex demo account, you are able to choose how much money you invest, and because it is fake, you can trade with a lot more money than you will have when you start trading with your money. This can create an unrealistic experience, and therefore the practice will not be as beneficial.

Leverage.

Similar to the money you invest, some Forex demo accounts allow traders to trade with a higher amount of leverage than they will be able to use in a real account. Once again, this can create an unrealistic experience, and therefore the practice will not be as helpful.

Rejection.

Your trade will always go through when you are using a Forex demo account, but this is not always the case with real trades. Real trades can be rejected due to price changes and other factors. You need to be prepared for this to happen, even if it never does in your Forex trading demo account.

Tools.

Some brokers will allow users to use tools in their online Forex demo accounts that cost additional money in the real account. If a person begins to lean on this tool for help, they may find themselves unable to make good trades when they switch over unless they spend additional money.

Emotions.

There are certain emotions like fear, hope, and greed that are associated with Forex trading, but because of the knowledge that the money is fake, you will not experience these emotions, which can affect how you trade.

You will not be able to experience how these emotions can lead to you making costly mistakes. You need to learn how to control your emotions to be a better Forex trader, but you cannot practice Forex trading that with a Forex demo account.

Habits.

Because you know the risk is less, you may take more risks or start to over trade. while this is fine when you are not losing any money, it can cause you to form habits that will lead to loss when you start trading on a real account.

How to Open a Forex Demo Account

Below you will find some tips on how to open a Forex trading demo account:

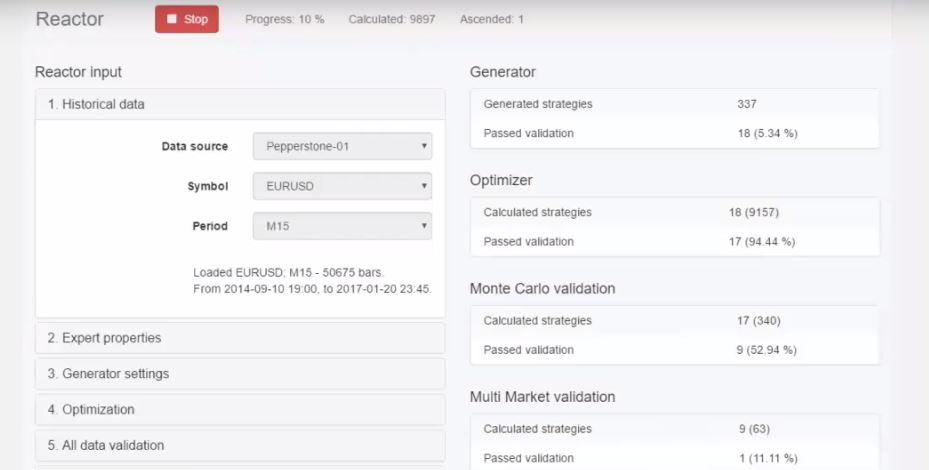

When you open a Forex demo account, it is a good idea to open both a demo account and an unfunded real account. Preform a backtest and see if the results are the same if they are not the demo account will probably prove to be useless.

This is important because you will be wasting your time if you practice Forex trading with a simulation that does not show you accurate results as there is a chance that when you switch over, a strategy that worked in the Forex trading demo account could be devastating in a real one.

Practice Forex trading with multiple brokers.

Because Forex demo accounts are free, you can open them with multiple brokers. Knowing how to use several brokers will prove helpful if you ever need to switch in a hurry. It will also simply help you be completely confident in which broker you pick. You have to be selective in which one you choose because you are trusting them with your money. You should consider how they operate, the experience, the cost, the regulations, etc.

Look into what tools and features come with the level of account you plan to buy into.

Only practice Forex trading with those features and tools in the online Forex demo account so it will be an accurate and helpful practice. If you are unsure what level you really want to use, you can start by practicing with the base level tools and features and then slowly add more until you reach a point where you are happy with what you have.

Only trade with realistic situations.

This means that the amount of fake money that you trade should be realistic to what you could invest. It also means that you should trade with an accurate leverage amount. While it may be fun to pretend to trade with an insane amount of money, it will not help you become a better Forex trader unless you have said money.

MetaTrader Demo Account

MetaTrader 4 and 5 are the two most common platforms, so it is a good idea to practice Forex trading with those. Because they are so popular, most brokers offer options for both the MT 4 demo account and the MT5 demo account.

While the Forex demo account can be used for all those things, it can also be used as a tool to learn and practice Forex trading, even if you are already sure that you want to use the specific broker for whatever reason.

Moving to Real Money

You want to start moving from a Forex demo account to real money by assigning an amount that is above the minimum required deposit amount by your broker but that you can deal with losing.

That means you should not start by trading your entire life savings if that would leave you homeless or with serious problems if you lose it all. It can be helpful to do this before you ever even open a real account, and perhaps while you are still using the demo (or before).

After you assign the said amount, you want to open your real account. When you move to a real account, it can be scary because you will start to deal with real risks. Now you get to start practicing how to control those emotions to avoid mistakes. The only way to do this is to start trading.

Use all the skills that you learned while practicing on the Forex trading demo account, such as what strategies to use, how to make predictions, etc. and also pay attention to learn how you can control your emotions and avoid mistakes in the slightly different conditions of a real account.

Conclusion

Forex trading is a great option for almost anyone to make some money either as a side job or full time, but it is important to go about starting in the correct way. Using a Forex demo account is an important part of this process, just like Forex education through personal and guided research is.

You should spend plenty of time practicing with the Forex trading demo account until you are confident in your skills. Afterward, you can start trading with real money and leverage with confidence. Even then, you should return to the Forex demo account when you want to try a new, untested strategy to ensure that it works. This will protect you from unnecessary risk and loss, no matter what experience you have as a trader.

Forex trading can open up a whole new world of income for you. You could use it to supplement your current income and get to do more than you currently do or pay off debt. You can use it to gain the freedom to work from anywhere that you want.

No matter who you are or what your goals are, Forex trading could be a great option for you. Start today by opening your own FOrex demo account and before jumping into the real world of Forex trading.

How to trade Forex?

Before you start trading Forex you need to have a general understanding of major terminology and the markets. The next step is to find a broker where you will place your trade. Then you need a device with a good internet connection where you will download the trading platform you prefer or the trading platform your brokers works with. After downloading the trading platform you have to open an account and fund the account. It’s better to start with a Forex demo account and practice Forex trading for a while before you open a real trading account and fund it. Once you’re confident enough you can place your first trade on the live account.

Are Forex demo accounts accurate?

When you open a Forex demo account, it is a good idea to open both a demo account and an unfunded real account. Preform a backtest and see if the results are the same – if they are not, the Forex demo account will probably prove to be useless.