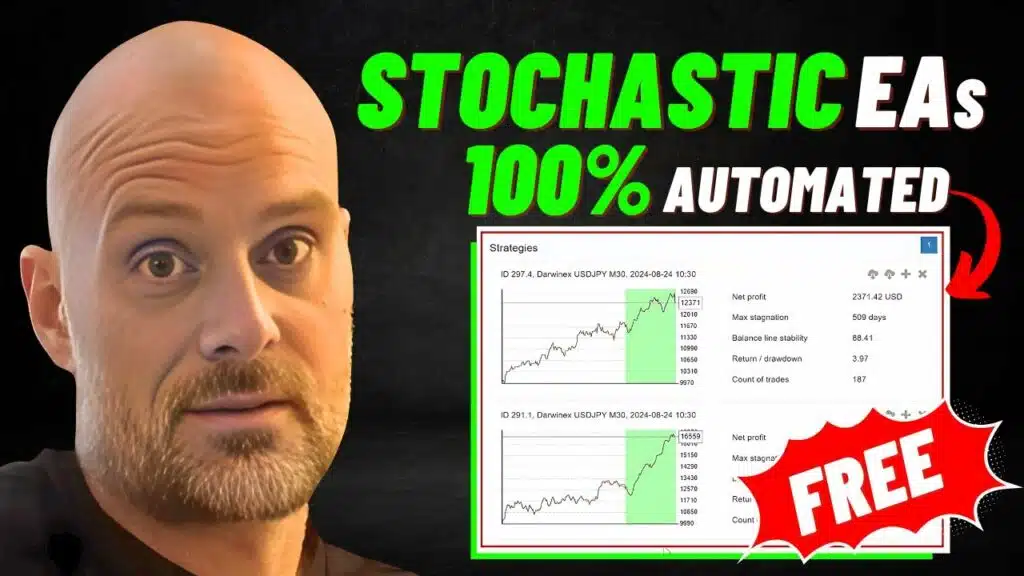

Forex Swing Trading Strategy Explained + FREE USDJPY Robot

Are you looking for a trading approach that allows you to capitalize on market movements without the constant screen-watching that […]

Forex Swing Trading Strategy Explained + FREE USDJPY Robot Read More »