Crypto trading can be exciting and potentially very profitable, but it can also be confusing and complicated, especially for novice investors. There is a wealth of online information to help, as well as a mass of tools that can help. But, with such a selection, it can even be difficult to find the right tools to help. Below, we look at websites, apps, and software that can help with every element of crypto trading from research to taxes, suitable for users from beginner to expert.

Cryptocurrency is highly volatile. That means traders can lose a lot of money, but it also means there is the potential for huge potential profits. The likes of Bitcoin and Ethereum are the most popular currencies and the most easily traded, but some of the best meme coins have seen the greatest gains in the past couple of years. According to crypto writer Kane Pepi, some meme coins have experienced explosive growth and have gone on to have multi-billion dollar market capitalizations. Traders should know their risk aversion level and only trade with money they can afford to lose, but having access to the right tools can help.

Wallet

You can store your crypto balances on exchanges. But, just because you can doesn’t mean you should. Storing your coins in a decentralized wallet offers greater security and it means you own the keys to your own cryptocurrency.

There are a lot of different wallets, including hardware wallets as well as those that are installed on your PC or cell phone, and you will need one that is appropriate for the cryptocurrency or currencies you intend to hold, or choose a multi-chain wallet that offers support for thousands of different coins.

Crypto Exchange

The exchange is where you will exchange fiat currency for crypto and where you will trade one crypto for another. Centralized exchanges like Coinbase offer a simple buying process but it can be expensive. If you’re looking to get in on currencies that have yet to hit major exchanges, you might need to look at decentralized exchanges.

Exchanges like Uniswap don’t have the tutorials or the educational tools of Coinbase and Binance, but they do offer access to lesser-known coins.

AI Trading Tools

AI trading tools use historical data and learning algorithms to help them identify potential signals. They can be set to automatically buy and sell cryptocurrency for the trader and have the potential to bring in profits. However, they aren’t infallible and traders use them at their own risk. They can be a good way to learn signals and further your education on cryptocurrency trading, by following signals without necessarily automatically trading them.

Some major exchanges, like Kraken, incorporate AI trading features. The exchange still makes money, whether you make a profit or loss, so just because a trading bot is made available by an exchange does not guarantee success. As well as those found on major exchanges, there are both free and paid Bitcoin trading bots.

Crypto Tax Management

Crypto traders are subject to tax in most if not all countries and jurisdictions. Failing to pay these taxes could land you with a significant fine and potentially even other penalties. As such, as well as learning about the tax laws for your region, it can be beneficial to use a tax management tool that calculates profits and losses, tax exposure, and capital gains levels.

Make sure you use a tax management tool that is relevant to your jurisdiction, or that enables you to choose appropriate tax laws. CoinTracking is a useful tool that manages many elements of your portfolio including tax exposure.

Charting

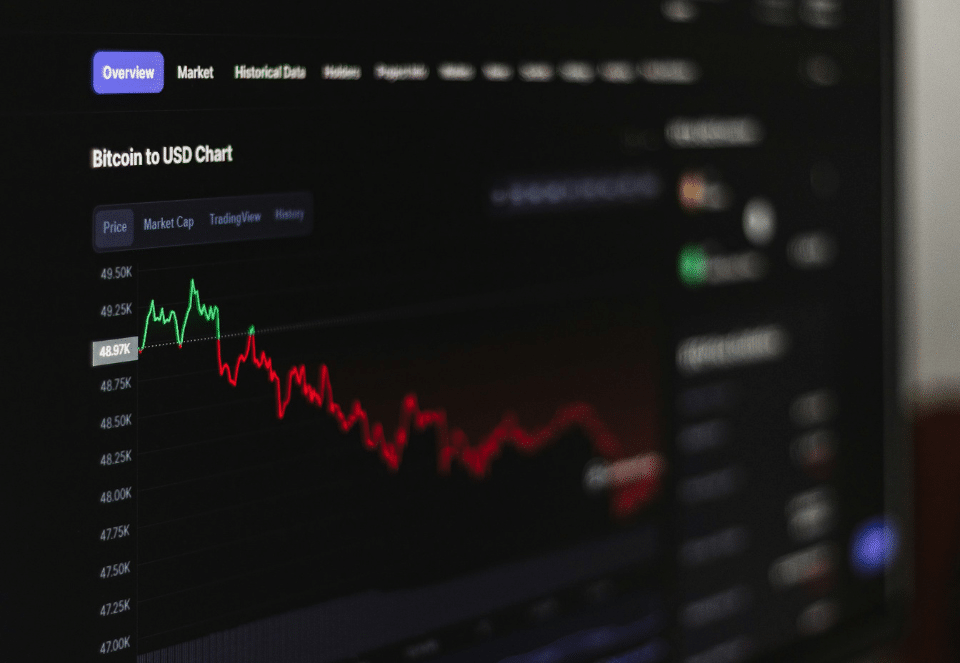

If you’re looking to buy Bitcoin and hold it until it reaches the $1 million price, you don’t necessarily need powerful charting tools. If you want to learn Elliot Wave Theory or trade head and shoulders chart patterns, you will need advanced charting software.

Charting software like Tradingview lets you study technical charts, add alerts, and even look at the charts of other users who might have identified potential buy and sell signals. Beginners will need to learn how to use charting software because it can be overwhelmingly complicated at first glance, but there are lots of sites and tutorials out there.

Portfolio Management

There are more than 13,000 cryptocurrencies on the market, although that figure does include more than 3,000 dead and defunct tokens. There are also presales for new tokens launching nearly every month. And, most investors find, after dabbling in a bit of Bitcoin, they want to expand their horizons and enhance their crypto portfolio with a wider variety of coins.

Your wallet and exchange balance will give you some information regarding your portfolio, but a tool like CoinTracking gives more in-depth data and can even help with calculating your crypto portfolio taxes, and monitoring your overall performance.

Education

Before you even invest in your first Satoshi, you should research cryptocurrency and learn as much as possible about the technology. You will also need to learn about exchanges, wallets, and coins. Even experienced traders benefit from picking up new knowledge. Fortunately, there are a lot of useful educational tools and websites out there.

99Bitcoins was launched in 2013 and, as well as already having considerable information for the would-be trader, it is also launching its own cryptocurrency, having just completed the presale stage. The learn-to-earn token will incentivize cryptocurrency education by giving rewards to those who complete courses and other educational content on the site.

Research And Analytics

Investors are not only encouraged to check out the past performance of coins they invest in, but also to look at details like the management team, tokenomics of a project, the whitepaper, news, and more. Social media sentiment can also prove a major driving force behind cryptocurrency price movements, especially when it comes to meme coins.

Most projects have websites that offer access to all the information required, but it would take a long time to sift through thousands of project websites to find the information you’re looking for, and even longer to determine social media sentiment. Token Metrics is one of several useful research tools that bring all of this information together for better fundamental analysis.

Community Tools

The crypto community is a thriving one, and there are a lot of people that have strong opinions. Some of those opinions can be beneficial and may help drive you towards better investments, although you should always do your own research before investing in any trade.

Telegram is an extremely popular communication tool used in the cryptocurrency industry, and users can find trading groups, meme coin groups, and groups specific to individual coins or projects. It can be downloaded on phones and other mobile devices and is a convenient way to become part of the cryptocurrency community.

Conclusion

Whether you’re investing in cryptocurrency to benefit from greater privacy and anonymity, to make online purchases, or to profit from the latest meme coins, efficient trading is important. There are a lot of tools that can be beneficial to cryptocurrency traders from those designed to enhance communication and collaboration to charting and research tools. These tools can help improve knowledge while others can improve your trades to minimize losses or improve gains. Some are more administrative, assisting with important facets of trading like taxes.