In the world of algorithmic forex trading, the Stochastics trading strategy stands out for its effectiveness in identifying market reversals and entry points based on overbought and oversold conditions. Using trading strategy builders like Expert Advisor Studio, traders can efficiently generate and test multiple stochastic-based strategies, ensuring robustness before deployment. In this article, we’ll dive into the setup, testing, and deployment of a Stochastics trading strategy using EA Studio, focusing on key steps that traders can take to refine and validate their approach.

This guide is especially suited for those interested in building algorithmic trading systems using stochastic indicators, leveraging advanced tools for strategy generation, and prioritizing demo testing to ensure successful live trading. Stay with us to grab the FREE Robots and Collections.

Table of Contents:

- Understanding the Stochastic Oscillator in Forex Trading

- Setting Up EA Studio to Generate Stochastics Trading Strategies

- Filtering and Validating Stochastics Trading Strategies in EA Studio

- Demo Testing Stochastics Trading Strategies

- Enhancing Stochastics Trading Strategies with Additional Indicators and Tools

Understanding the Stochastic Oscillator in Forex Trading

Check out the video below to see how you can create this Stochastics trading strategy in EA Studio. And if you like it, you can download for FREE the ready-to-use EAs here.

How the Stochastic Oscillator works

The Stochastic Oscillator is a momentum indicator that compares a specific closing price to the price range over a set period. This oscillator helps traders detect overbought and oversold levels in the market. This typically indicates potential trend reversals or opportunities for trend continuation. In forex trading, the stochastic oscillator’s overbought and oversold signals help define entry and exit points.

Core Components of the Stochastic Oscillator:

- %K Line: This is the primary line representing the latest closing price relative to the range of high and low prices over a specified period, typically 14. This line reacts to market changes rapidly, signaling when price moves approach the range’s high or low boundaries.

- %D Line: A moving average of the %K line, usually calculated over three periods. Known as the “slow” line, it smooths out fluctuations, providing clearer signals and reducing the impact of market noise.

- Overbought and Oversold Zones: Readings above 80 typically indicate an overbought condition, signaling a potential sell. At the same time, readings below 20 suggest oversold conditions, indicating a potential buy.

Optimizing Stochastic Oscillator Settings

To optimize the Stochastic Oscillator, traders can adjust the %K, %D, and “slowing” settings based on the currency pair, timeframe, and specific market conditions. This customization helps in capturing accurate signals tailored to particular trading environments. For example, in short-term trading, settings may be adjusted to quickly respond to price changes, while longer periods smooth out fluctuations, ideal for trending markets.

The oscillator’s adaptability makes it a valuable tool for traders using automated strategies. By leveraging EA Studio, traders can automate strategy generation, testing, and filtering processes, transforming stochastic insights into actionable trading systems.

Do you want to learn how to create your own stochastics trading strategy without any programming skills required? Make sure to enroll in our 21-Day Free Algo Trading Course—an intensive 3-week free algo trading program to learn everything about Expert Advisors, Strategy Builders and Algorithmic Trading! As part of the 21-Day Free Algo Trading Course, you will receive an exclusive 15-day free trial access to EA Studio, where you can generate and export as many Expert Advisors as you wish.

Setting Up EA Studio to Generate Stochastics Trading Strategies

EA Studio is a sophisticated tool that simplifies the strategy generation process. Due to that traders can focus solely on their chosen indicator—in this case, the Stochastic Oscillator. Below is a step-by-step guide to setting up EA Studio for stochastic-based strategy generation.

Step 1: Import Historical Data and Define Timeframes

- Data Selection: Begin by importing historical price data from reliable brokers, such as Darwinex or BlackBull Markets, into EA Studio. This data should include comprehensive historical information for your chosen currency pairs, such as USD/JPY or EUR/USD.

- Choose a Timeframe: Shorter timeframes, such as M30 or H1, often work well with stochastic strategies because they allow the oscillator to capture minor reversals. Using these timeframes also ensures that signals are frequent enough to provide ample trading opportunities, making the strategy effective for short- to medium-term trading.

Step 2: Configuring Entry and Exit Rules with the Stochastic Indicator

EA Studio’s Generator feature allows you to define specific parameters for strategy generation.

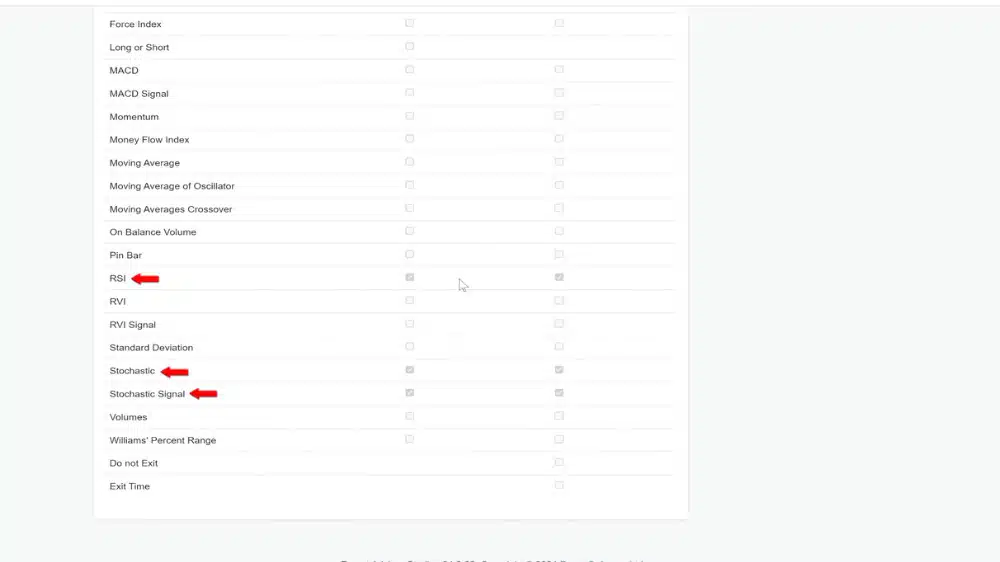

- Indicator Selection: In the indicator settings, turn off all other indicators except the Stochastic Oscillator. By isolating the stochastic, EA Studio generates strategies based solely on this indicator, ensuring that trades are triggered based on overbought and oversold levels.

- Define Stop Loss and Take Profit: Set ranges for both Stop Loss and Take Profit, typically between 20 and 200 pips depending on volatility. Adjusting these levels is essential to maintain an appropriate risk-to-reward ratio. Traders using volatile currency pairs might opt for wider ranges, while more stable pairs can use tighter stop levels.

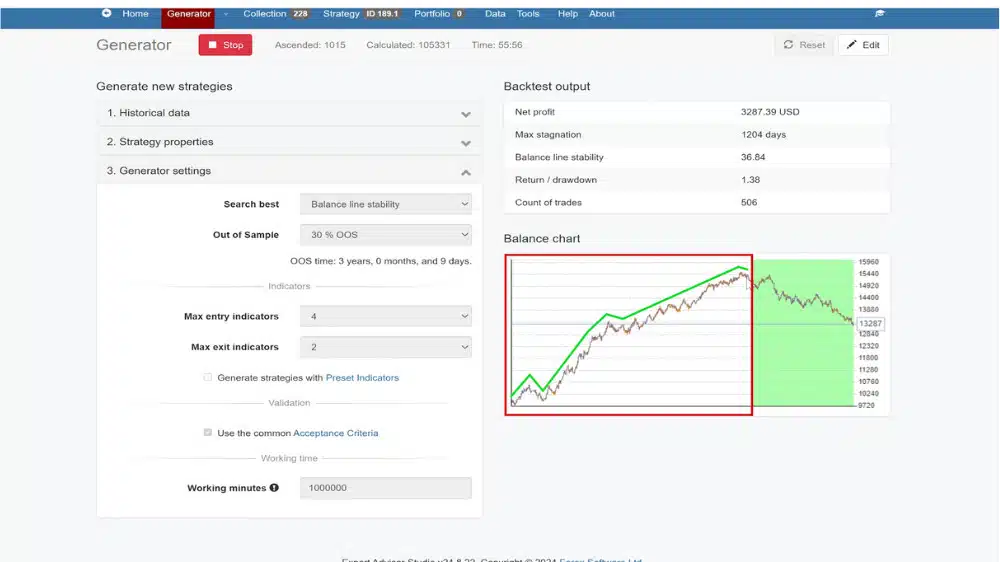

- In-Sample and Out-of-Sample Split: A split of 70/30 between in-sample and out-of-sample data allows for robust testing, helping the system assess how well strategies adapt to unseen market conditions.

Step 3: Set Acceptance Criteria for Effective Stochastic Oscillator Strategy Generation

In EA Studio’s Generator settings, input acceptance criteria to guide the generation process:

- Minimum Profit Factor: A minimum profit factor of 1.2 ensures that generated strategies meet a baseline profitability level.

- Trade Count Requirement: Set a minimum trade count of 100 to ensure the strategy’s reliability. The number of trades should provide enough data points for statistical validity, making it easier to assess the strategy’s true performance.

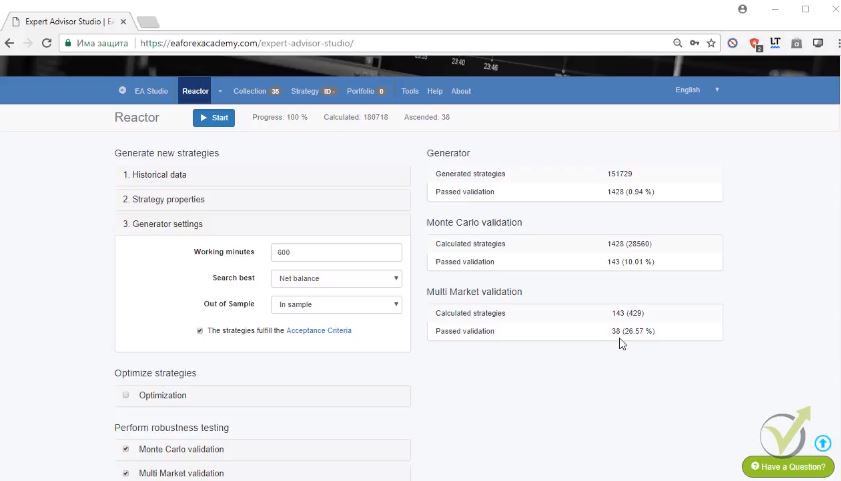

- Generator Run Time: Allow the generator to run for an extended period (at least one hour) to gather a diverse range of stochastic oscillator strategies. The more strategies generated, the more options you’ll have for selecting and filtering reliable candidates.

This setup ensures EA Studio generates a robust collection of stochastic-based strategies, which can then be filtered and tested further.

EA Studio is a sophisticated tool that simplifies the strategy generation process. Generate thousands of Expert Advisors with EA Studio and benefit from the emotions-free advantage of the trading robots/ Expert Advisors.

Filtering and Validating Stochastics Trading Strategies in EA Studio

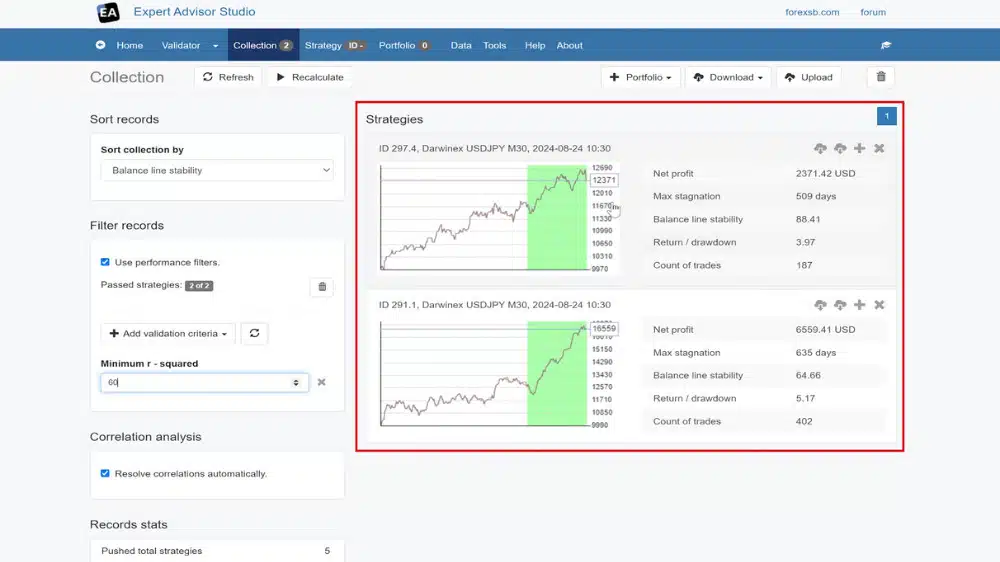

Once EA Studio has generated a collection of strategies, the next step is to filter and validate them, narrowing the selection to those with the greatest potential for profitability. This filtering process is essential in ensuring strategies remain robust under varying market conditions.

1. Out-of-Sample Testing

Out-of-sample testing is essential for identifying strategies that can perform in unseen market conditions. Using the 30% out-of-sample data split, assess each strategy’s performance and filter out those that fail to maintain profitability.

- Profit Factor and Stability: Retain strategies with a minimum profit factor of 1.1 in the out-of-sample data. Strategies showing consistent stability in out-of-sample segments indicate a lower risk of overfitting and greater adaptability.

- Drawdown Management: Pay close attention to drawdown levels. High drawdown in out-of-sample testing may indicate vulnerability to market shifts, while moderate drawdown levels point to better resilience.

2. Multi-Market Testing for Broader Adaptability

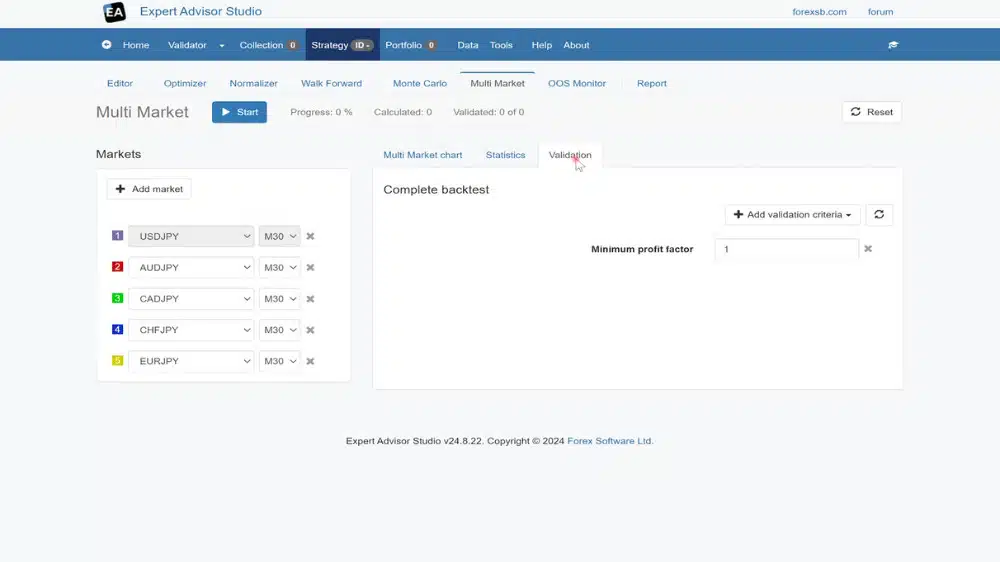

By testing your strategies on alternative markets or currency pairs, you can determine if they maintain profitability across varying conditions.

- Cross-Currency Testing: Test the strategy on similar currency pairs, such as GBP/USD, to assess cross-market viability. Strategies that perform well across different pairs show flexibility, which is valuable for adapting to changing market conditions.

- Broker Data Testing: Different brokers can have slight data variations. Running strategies on alternative data sources, such as BlackBull and Darwinex, ensures they aren’t overly sensitive to minor data discrepancies.

3. Advanced Filtering Options

EA Studio’s advanced filters, such as R-squared, can help refine the selection further.

- Use R-squared for Consistency: Setting R-squared > 70 can focus the selection on strategies with smooth equity curves, minimizing fluctuations.

- Manual Inspection: Review strategy equity curves and performance metrics manually, dismissing those with erratic patterns or excessive volatility. Strategies with smooth curves are more likely to perform consistently in live trading.

Following these filtering methods results in a smaller, more reliable selection of Stochastics-based strategies, ready for demo testing.

Demo Testing Stochastics Trading Strategies

Testing strategies on a demo account allows for risk-free performance validation under real-time market conditions. This step is critical to confirm strategy effectiveness before transitioning to live trading. To test the stochastic oscillator strategy on the demo account, you need to:

1. Export to MetaTrader and Configure for Demo Testing: Export each validated strategy to MetaTrader 4 or MetaTrader 5. Configure settings such as lot size, timeframe, and currency pair to match the setup used in EA Studio, ensuring accuracy and consistency during demo testing.

2. Monitor Performance Over a Set Period: Track performance for at least 4-6 weeks to capture different market conditions. Observe profit factor, win rate, drawdown, and other metrics. If certain strategies struggle in demo trading, consider making adjustments to parameters, such as lowering risk exposure or modifying Stop Loss and Take Profit levels.

3. Assess Criteria for Live Deployment: Before transitioning to live trading, ensure that strategies meet specific benchmarks. Strategies with a profit factor above 1.2, a drawdown below 10%, and a stable equity curve indicate better live performance potential. Retain only those meeting these criteria, as they are likely to provide consistent returns.

Enhancing Stochastics Trading Strategies with Additional Indicators and Tools

Improving Stochastic strategies can be achieved by combining them with additional indicators or using advanced techniques to adapt to market dynamics.

Combining Stochastic with Indicators like CCI or MFI

- Adding complementary indicators can improve the reliability of stochastic signals. For example, combining the Stochastic Oscillator with the Commodity Channel Index (CCI) ensures that trades align with momentum. Such combinations help filter out false signals and make the strategy more resilient in volatile conditions.

Use Walk-Forward Optimization for Continuous Adaptation

- Walk-forward optimization is a technique that tests the strategy over different market segments, evaluating and updating parameters in response to evolving market conditions. This process reduces the impact of market seasonality and adapts strategies to current conditions, enhancing long-term profitability.

Implement Risk Management Rules

- Set parameters like a daily loss cap (e.g., 3% of account balance) and a limit on the total number of open trades. A tiered risk management system helps control exposure during volatile periods, protecting your account against sudden market shifts.

Seasonal Adjustments and Volatility Filters

- Forex markets experience seasonal shifts, such as increased volatility during major economic events. Adding a volatility filter, like the Average True Range (ATR), allows strategies to adjust to these shifts, improving performance during high-volatility periods.

Conclusion: Building a Reliable Stochastics Trading Strategy

Developing a Stochastics trading strategy with EA Studio provides traders with a methodical way to create and refine automated strategies. By leveraging EA Studio’s generator and filtering tools, traders can build strategies tailored to their risk tolerance and market conditions. This guide provides a roadmap for creating, testing, and optimizing a Stochastics trading strategy, from understanding the oscillator to implementing robust risk management practices.

As you develop your strategy, remember the importance of thorough testing and realistic expectations. Even the most advanced strategies require careful monitoring and adaptation to maintain their edge in the market. By following these steps, you can build a reliable and adaptable Stochastics trading strategy, positioning yourself for long-term success in algorithmic forex trading.

If you find this guide useful, you might also be interested in checking our guide about How to Create a Moving Average Crossover Strategy Using EA Studio or watch Sam’s video (also including FREE robots) here.