Forum Replies Created

-

AuthorPosts

-

Tanya Jay

ParticipantHi Sam,

I understand about short-term and long-term filter. 2 weeks and 1 month is, like you said, very similar. As the time passing by, I should be able to do 2 weeks and 3 months. It’s just that right now my demo account is 1.5 months old.

About building the pools over time, it sounds good to me. I don’t quite understand it just yet until I actually put my hands on them as the time goes.

I think as of now I will create more EAs on different pairs. And I will check them again every three months. This is probably the best I can do at the moment, unless you have something else you recommend me to do while waiting for the time goes by so I can use short term filter and long-term filter to move EAs to mock live account?

I just don’t like sitting and doing nothing for 3 months while waiting to practice moving EAs.

Thanks!

Tanya

Tanya Jay

ParticipantHey Sam,

It’s been awhile! Hope you’re doing well 🙂

Your answer always WOW-ed me. I don’t know how you store all these info in your brain haha. Also, I appreciate your prior answer to Petko.

Q: You have at least a month of trading on the demo and at least a few trades when deciding how to move EAs right?

A: About 1-1.5 months I believe. I need to see at least 5-6 trades before I decide to move them.Q: How many EAs are you putting on your mock live at a time?

A: The last time there were only 6 EAs that matched the winning criteriaQ: Also you could try a few different mock live accounts at the same time and trial a few different selection methods?

A: GREAT idea! I will start doing soMy advice would be to maintain a pool of collections and then check them every 3 months or so using the validator for the most recent three months of data, then remove the ones that don’t perform well over the last three months and keep doing this ongoingly.

– Let me rephrase it and please let me know if I understand correctly; every 3 months, I will validate the EAs using Validator and remove the ones that underperformed. Then I generate new collections using reactors to replace the underperforming ones and to add more into the collection? Because the market is changing all the time, it’s possible to have the same kind of pool over time?Very best,

TanyaTanya Jay

ParticipantHey Petko,

Nice to e-meet you and thanks for your reply.

Below is my answer. Please feel free to give me some tips and your honest feedback 🙂

1. Do you use the same broker for both accounts, and which is the broker?

– Yes, I do use the same broker for both accounts (as Sam already mentioned). It’s IC markets.2. What rules do you follow to move EAs from the Demo to the mock live, and what rules you follow to remove the EAs from the mock live?

– Rules to move EAs from demo to the mock live: I look back 2 weeks AND 1 month data, PF 1.2, trade number 5 or more. Rules to remove, whichever EAs that don’t fall into the criteria I just mentioned. I check and move EAs every 2 weeks.3. How did you choose these pairs GBJPY, AUDCAD, EURGBP, USDCHF?

– Sam advised me to choose uncorrelated pairs and I came up with these four.All the best,

TanyaTanya Jay

ParticipantHey Samuel,

– So, you use both short filter (1 week) and long filter (1-3 months) to pick the winning EAs. My question is, isn’t 1 week filter too short, let’s say for H1? Maybe 1 week is good for M5 and M15, but not for H1 and H4 due to the number of trades?

– Speaking of time and effort, I myself have a lot of free time every day, however, I don’t want to trade M1 or M5 if the results aren’t as consistent as higher TF (maybe because of the news or other factors). I noticed on my demo account that when I picked M1 and M5 using 1 week and 1 month filters and put them on a live mock account, they didn’t perform as well as the previous week. I’m not sure if it’s because the market condition changes too fast or something else.

– Another question I have is that you mentioned it’s ideal to run a full month on a demo before moving the winners to a live account. After 1 month, do you run Reactor to generate complete new EAs (let’s say 10 portfolios with 30 EAs each)? OR do you optimize the parameters of the previous month’s EAs?

– How often do you generate new EAs using Reactor?

– Just curious, what is FSB for? When to use them? Do I REALLY need FSB when I already have Expert Advistor Studio? How do we put both of them into use and benefit each other?

Tanya Jay

ParticipantHey Samuel,

Thanks for the insights. I will use 10 portfolios with 30 EAs in each portfolio as a ballpark and a starting pool then. And after that, I will pick about 12 winning EAs to run in live/mock demo.

Tanya Jay

ParticipantLet me recap…

– The ballpark for 10K account is 12 EAs @0.1 lot size

– M15 and H1 tend to combine well for the same assets

For picking the winning EAs, how many days of performance do you look back before moving them into the real account? What are the criteria do you like to see? (I know IIan and Petko have their methods, I just wanna hear yours 🙂 )

Tanya Jay

ParticipantThanks for the tips!

– May I ask the reasons why you use fixed SL instead of keeping it open? (can be fixed or trailing or don’t use it at all)

– When running Reactor, how many strategies should I aim for per 1 pair per TF to build a solid pool? What’s your ideal number?

– After getting collections, do you recommend adding the strategies into a portfolio? For example, EURUSD M15 portfolio and EURUSD H1 portfolio. Or it’s better to run it as an individual EA?

If there are other tips about using EA studio expert and/or building strategies, pleaseeeee share them away! 🙂

Tanya Jay

ParticipantAnother question I have is, what would be the best settings for TP and SL?

May use?

Fixed or trailing?

10 – 100? 10 – 300?Tanya Jay

ParticipantThanks for the recommendations.

I have no intention of trading anything less than M15 as well.

I will use 300 trades, 20% OOS, and 20/80 Monte Carlo as a start then.

Tanya Jay

ParticipantThanks again Samuel for your response. Truly appreciate it 🙂

To answer your questions:

What EAs are you running?

– Forex Trading with 30 Strategies: Walk Forward Optimization (June) – EURJPY, GBPJPY, USDJPY

– Forex Trading with 30 Strategies: Walk Forward Optimization (July) – EURGBP, GBPJPY, EURJPY

– 100 Forex Strategies + Portfolio Expert Advisors Monthly (June) – EURUSD

– Cryptocurrency Algorithmic Trading + 50 Robots Monthly (June) – BTCUSD

– Cryptocurrency Algorithmic Trading + 50 Robots Monthly (July) – BTCUSD

– Top 5 Gold Trading Strategies in 2022 + 10 Robots Included (April) – XAUUSD

– Algorithmic trading with Dow Jones Expert Advisors + 10 EAs (June) – US30

– Forex Algorithmic Trading + 100 GBPUSD Trading Strategies (July)

– Automated Forex Trading + 99 Expert Advisors Every Month (July) – EURJPY, EURUSD, USDJPYHow many are you allowing to trade on your mock demo account?

– Only 3 sets of EAs that past 2 weeks test, the rest of them are still in the incubator period (first 2 weeks)

– Total EAs that past PF 1.4 and more than 3 trades are 10 EAs

– Out of 10 EAs, I chose 7 EAs to balance out the portfolio. I make sure they have equal weight. And I picked them based on net profit (Imitate IIan’s method here)What is the balance between symbols an timeframes on your mock demo account?

– All EAs I got from Udemy course are M15

– The symbols are GBPJPY, EURUSD, BTCUSD (All M15)Also what is the size of your mock demo account and what Lot size are you trading?

– It’s a 10,000 USD starting balance. The minimum lot size is 0.5.Any recommendations?

Tanya Jay

ParticipantUnderstood. I will try your recommendation.

I have 2 more questions:

1. Based on your experiences, do you recommend running walk-forward optimization AND Monte Carlo validation? Does it necessarily mean it will generate better results/strategies, compared to 20% OOS AND Monte Carlo validation?

2. For M15, how far back of the data horizon should I choose to create strategies? 6 months? 1 year? 3 years?

Thanks!

TanyaTanya Jay

ParticipantThat makes sense!

It’s been 3 weeks since testing the EAs on demo accounts. So far, no luck yet. Still unprofitable from picking winning EAs in the past 7 days AND in the past 30 days (IIan’s method).

I will keep them running for another month and see if they will perform better. If not, I might have done something wrong haha

Tanya Jay

ParticipantThanks everyone for the comments!

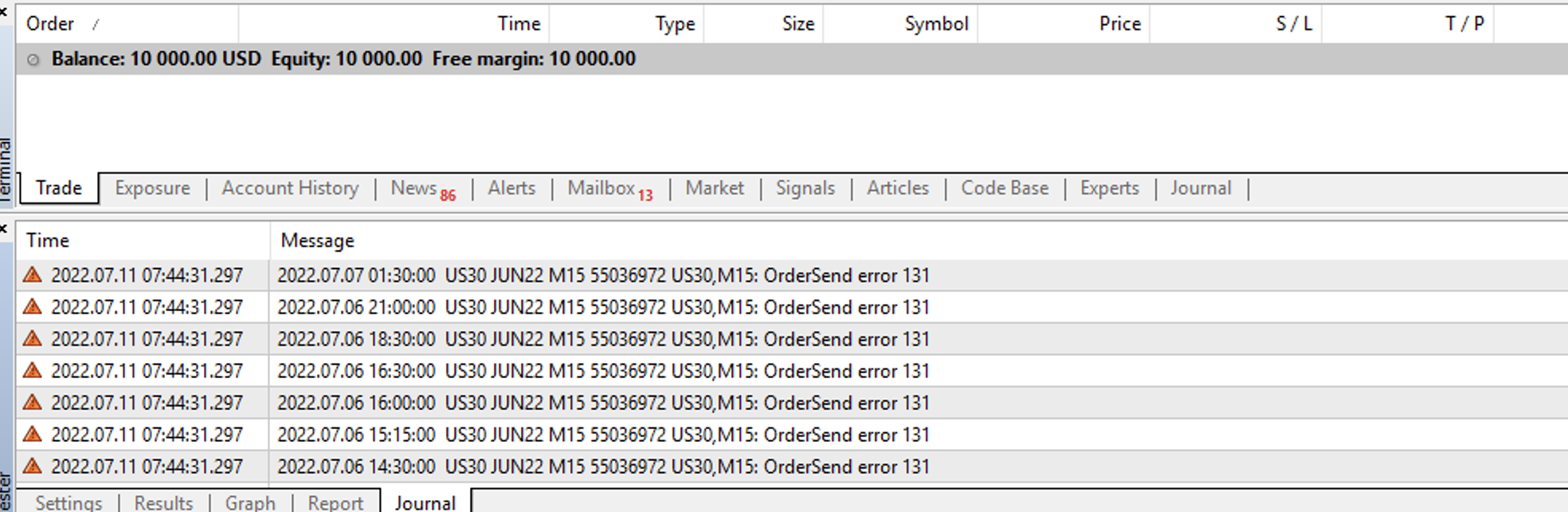

I somehow just realized that I should have tested in the strategy tester on MT4. I did that and looks like I found an issue here. It says “Ordersend Error 131”. Any idea what that means?

No wonders why the EAs didn’t take trade in the past 2 weeks.

Tanya Jay

ParticipantHey Samuel,

I tested with a lot size of 0.1 and it didn’t work. However, I checked my broker lot size for US30; the contract size = 1.

So, the minimum lot size I have to put on input is 1. It works!

Thanks for your help 🙂

Tanya Jay

ParticipantDo you mean we will delete the old EAs after running the new EAs for a full month?

That means, the parameters of EAs that are uploaded for the current month, for instance, July, will be used in the real account next month which is August? Is that right?

-

AuthorPosts