Forum Replies Created

-

AuthorPosts

-

Jojo

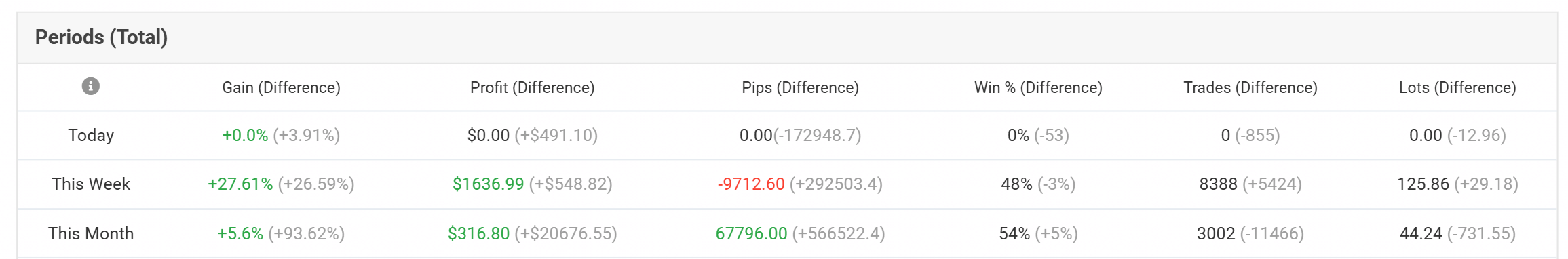

ParticipantI ended the week with +$1600 on just over 8,000 closed trades.

What I’ve started to notice is that even though strategies begin trades at different times and on different days, when they all close at the same time, due to having all the same exit criteria or if the market moves heavily within a pair, strategies begin to open trades at the same time.

So, rather than a single strategy opening 0.01 lots on different days and times, the same strategy will begin opening trades simultaneously across Portfolio EAs and across various accounts, effectively having many 0.01 lots opening simultaneously for a pair. This creates more significant swings than I would like. To try and smooth this back out, I will utilize the New Filter and add random times to each chart, creating windows when the specific chart can open trades.

We’ll see how next week goes. Hopefully, you don’t mind me using this thread as a personal journal… Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

Jojo

ParticipantIt’s the 1st of Nov, where I’m currently (Japan), and I’m thinking of posting results periodically for this month, as I’m pretty sure I’ll hit my goal of 10,000 closed trades in a day, as yesterday I did about 4,000 closed trades.

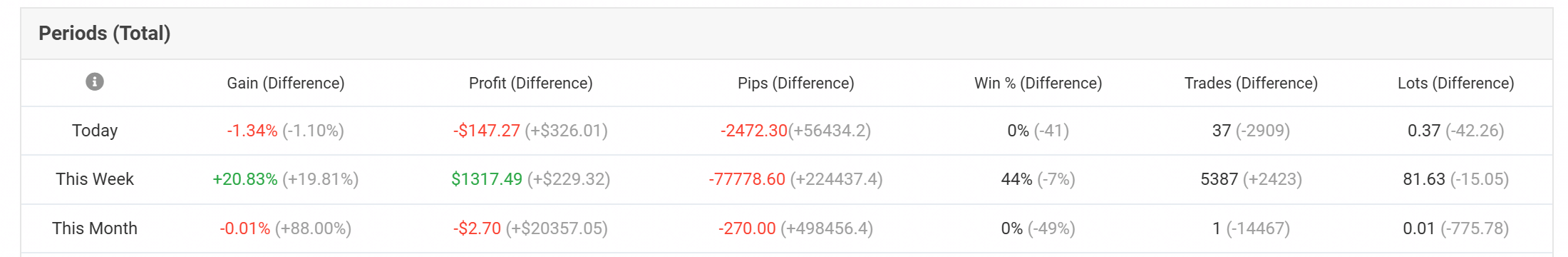

Yesterday was relatively volatile, with my Overall Daily Portfolio as low as -$2,500. The main culprits were the JPY and GBP pairs. BTC and Gold stepped up to balance this out a bit and ended the day with roughly -$1000; even with a diverse set of trades, it won’t be in a straight line.

I’ve considered giving more weight to specific pairs to try to curtail the volatility within the Overall Portfolio, but I’m not sure if that’s possible in the long term. If someone could chime in on that, I would appreciate it.

Below are the results of over 5,000 trades from the Top 10 App, using the strategy in the Original Post. Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

Jojo

ParticipantHello!

I wanted to start a thread about your thoughts on this strategy I’m currently using with the Top 10 EAs. I’ve been testing and refining it for a short period ( only two or three weeks so far).

Below are high-level bullet points – I wanted to keep this original post short and high-level.

Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

Thank you!

Strategy:

- I download all the EAs from each pair, besides Silver, into their respective Portfolio EA

- I add them into an MT account with 0.01, except ETH, which I set to 0.05

- I’ll spread this task out at different times, three or sometimes four times a day, and let them run.

My Thought Process:

- These EAs have been rigorously back-tested, Monte Carlo, and essentially forwarded tested. In the long run, over thousands of trades, they should produce more profits than losses.

- By adding more strategies that make it to the Top 10, the Overall Portfolio becomes more diverse and balanced.

- EAs that continue to stay in the Top 10 will have higher weights within my Overall Portfolio.

- Spreading out when the Portfolio EAs are added diversifies the Overall Portfolio, as even if I add the same strategy, they can potentially take different trades, as strategies can be locked out from entering new trades for up to weeks if they currently have a trade open.

Goals:

- A balanced Overall Portfolio, with a graph moving smoothly to the top right.

- As the Topic Title suggests, I want to get to 10,000 closed trades a day.

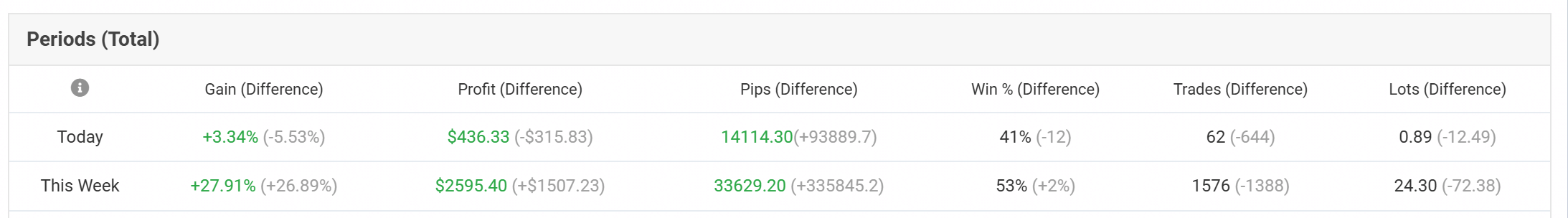

The screenshot below of my MyFXBook’s Overall Portfolio for this week is attached, which includes just over 1500 closed trades across 9 pairs, different strategies within each Portfolio EA, starting at different times. This is across 14 different MT accounts, as you can imagine adding 9 Portfolio EAs several times a day includes opening a good amount of charts daily and it can take up space, hence why I’m currently using 14 different MT accounts. It’s taken at 11:30pm NY Time – That’s a few hours over 2 FX trading days:

Jojo

ParticipantWill changing the Entry Lot Size setting higher or lower have any affect with the current open orders’ exit criteria in any way?

I’m assuming not, but I want to make sure. Thanks.

Jojo

ParticipantWhen choosing which Robots to add to the Portfolio, I would like a way to remove Robots from the Portfolio set that’s ready to download

Next to each Robot there is an Add feature, but also having a Remove feature would be very helpful

For example, if I add the Top 10 from the 5 Year, I can then go to the 1 Week view and click Remove on certain Robots that may not be performing well in that timeframe.

This would stop me from having to copy Magic Numbers, searching different timeframes to make sure they’re not there and do my own filtering, back and forth, before downloading a Portfolio set.

Jojo

ParticipantRisk per trade in % would be a great addition!

If you were to put something like 1%, the lots would be calculated so that the most you would lose via SL would be 1% of the account.

Every pair and strategy will risk different amounts when setting the same standard starting lot, having a % Risk Per Trade would help with the calculations!

-

AuthorPosts