Home › Forums › Ready-to-use Robots › Top 10 EAs › Top 10 EAs: Properties & Settings

Tagged: 4 major pairs, EUR/USD top 10, lot size, Missing Portfolio Code, negative take profit, spread protection, Top 10 Gold EAs, Top 3, W1, weekly

- This topic has 58 replies, 8 voices, and was last updated 7 months, 4 weeks ago by

Scoot.

-

AuthorPosts

-

-

September 5, 2023 at 21:55 #250747

Marin StoyanovKeymaster

Marin StoyanovKeymasterThis topic focuses on in-depth conversations about the properties and settings of the Top 10 EAs. Discuss topics like take-profit levels, maximum spread protection, and any other configuration aspects. This topic is your go-to resource for configuring your EAs effectively.

P.S. Please use the Reply button if you want to reply to a specific comment. This would make the topic organized and easier to navigate through and will reduce number of duplicate questions.

-

September 5, 2023 at 21:55 #196220

Janek

ParticipantHi,

Do you use a fix spread protection for all pairs the same e.g. 30 points?

Or individually for every pair? If individually how to calculate it?Thanks,

Janek -

November 20, 2023 at 14:51 #214657

Michael

ParticipantHi,

I prefer to backtest on MT5. But to trade with MT4. Are the strategies in MT5 and MT4 folders matches each other?

So, for Nov set, is 3339890equal to 3341450, 3339891 to 3341451, etc?

-

November 23, 2023 at 14:33 #215420

Ilan VardyModerator

Ilan VardyModeratorHey Michael,

The EAs are identical for MT4 and MT5. When downloading them from EA Studio, we download an MT4 and MT5 version of the same strategy.

Cheers,

Ilan

-

April 17, 2024 at 12:00 #249381

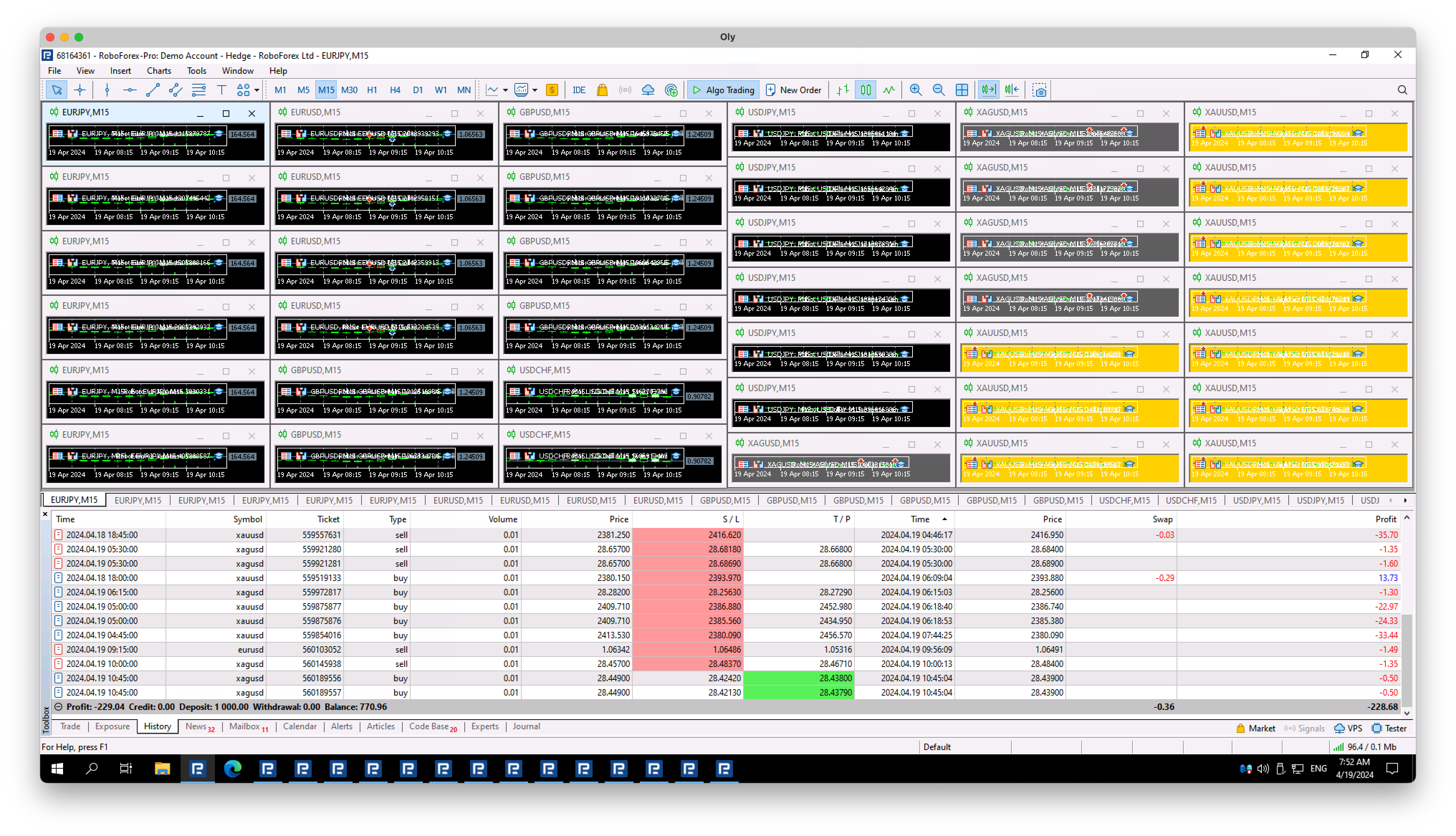

Oly

ParticipantWhy is the take-profit useless in this screenshot?? What’s the point of that?

-

April 17, 2024 at 12:17 #249388

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Oliver,

So, from what I can understand, the take profit was placed below the opening price of the position.

There is a reason for that and probably it’s because the trend changed the robot just placed the take profit a little below the opening price.

Another reason could be the spreads, you need to check what are the spreads of the account and what does the broker offers in spreads.

Hope that helps!

If you have any more questions, let me know!

Kind Regards,

Nikos -

April 17, 2024 at 12:59 #249396

dani schmitz

ParticipantSo recently I got the xauusd trading ea’s and I saw that in properties at tp there is no tp set, my question is: do I need to put in a tp and so what is a good tp point or do they exit the trade themselves bc the eurusd bot has a tp and the gold bot did a trade, went in a good profit but it didn’t close it and a few hours later it hit the sl.

-

April 17, 2024 at 14:26 #249415

stewart

ParticipantI already had the same problem. Why sometimes XAUUSD has TP, Sometimes TP shows 0 ?

-

April 17, 2024 at 14:31 #249421

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Dani,

The robots should have a tp point set already but in case there is not one set as you mentioned, you just need to set it manually. In my opinion, a good tp point is about 2% but this is not a recommendation. You can set your own tp point with which you are happy!

Hope this helps!

Kind Regards,

Nikos -

April 17, 2024 at 14:36 #249426

stewart

Participantin the properties, these is no TP parameter to adjust ,

please check and solve it.

I use the top 3 XAUUSD.

-

April 17, 2024 at 14:46 #249427

Oly

ParticipantOK, well, I think it’s a failure for me. How do I get my money back?

-

April 17, 2024 at 15:50 #249438

stewart

ParticipantAs i use Portfolio. there is no parameter to adjust the TP.

Also What is the actual TP it set for the performance to get the top 3 EA or top 10 EA.

Not to tell us to set TP by ourselves.

-

April 17, 2024 at 15:56 #249439

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello Stewart,

In the portfolio EA, you cannot change the tp but mostly the lot size but in the EAs the take profit parameter is set already!

If you use them individually, you can set the take profit and stop loss in the inputs as well as other inputs!

Hope this helps!

Kind Regards,

Nikos -

April 17, 2024 at 16:02 #249442

stewart

ParticipantThe EA should have TP set.

How can it get the top 3 XAUUSD EA if there is no TP parameters set.

So please you should check the TP parameters, not me to set by myself.

-

April 17, 2024 at 16:04 #249444

stewart

ParticipantPlease you download the top 3 EA XAUUSD (monthly and weekly) by yourself and to see which one has no TP set.

-

April 17, 2024 at 16:17 #249446

Marin StoyanovKeymaster

Marin StoyanovKeymasterThe tp is set but what I meant is if you want to change it, you can do in the inputs but that is only in the individual EAs. There is no tp input in the portfolio EAs as they are set in the individual ones and the portfolio EAs are made by the single EAs.

Hope this helps!

Kind Regards,

Nikos -

April 17, 2024 at 16:33 #249452

stewart

ParticipantThe following in XAUUSD top 3 Monthly has TP set 0.

Robot XAUUSD M15 2059931762.mq4 (Monthly )

-

April 17, 2024 at 17:20 #249464

Marin StoyanovKeymaster

Marin StoyanovKeymasterAfter checking, I can see that there is indeed this robot that you mentioned without TP.

However, please know that this strategy that the robot is set to work, is working better without tp. In this case, there are other rules that make the robot exit the position when they are all met.

Hope this helps!

Kind Regards,

Nikos -

April 17, 2024 at 17:39 #249469

stewart

ParticipantThanks! That clear my questions.

-

April 17, 2024 at 17:42 #249471

Marin StoyanovKeymaster

Marin StoyanovKeymasterYou are welcome!

Kind Regards,

Nikos -

April 18, 2024 at 10:42 #249620

Miroslav Popov

ParticipantIt is more simple than that.

Your broker, RoboForex, uses 5 decimal digits for the XAGUSD quotation.

On the other hand, the Top-10 strategies for XAGUSD are developed and tested on BlackBull data with 3 decimal digits.

In your case, you must simply add 2 zeroes to the SL and TP of your strategies for XAGUSD.

-

April 18, 2024 at 13:50 #249669

Oly

ParticipantI should do that for the forex, too, right? I’m going to backtest everything on Roboforex Cent accounts now to make sure I get this right. I really want this to work. I have all of Petko’s courses on Udemy!

-

April 18, 2024 at 13:52 #249671

Oly

ParticipantPlease confirm, thanks

-

April 18, 2024 at 14:32 #249678

Miroslav Popov

ParticipantThe Forex symbols will most probably work out of the box.

Here are the quotation decimal digits we use:

- EURUSD – 5 digits

- GBPUSD – 5 digits

- USDCHF – 5 digits

- EURGBP – 5 digits

- EURJPY – 3 digits

- USDJPY – 3 digits

- XAUUSD – 2 digits

- XAGUSD – 3 digits

- USDBTC – 2 digits

- ETHUSD – 2 digits

You can easily compare the decimal digits by looking at the prices in the ticker.

Please note that the SL and TP for the strategies are in Pips (not in Points).

-

April 18, 2024 at 15:01 #249691

Oly

ParticipantYep, it’s a pain. After backtesting everything, I’m glad I did; it’s a blood bath. Everything is in the red.

-

April 18, 2024 at 15:51 #249704

Andrew G

ParticipantHi – I have recently purchased the new Top 10 EAs App

After testing the EAs as part of a portfolio and selecting the profitable ones, how do you determine the lot size?

I always use a lot size calculator to assess the lots / account balance / desired risk – however to do this I need to know the distance the Stop Loss is set from Entry. Without seeing the stop loss value I am unable to carry out this calculation.

Input is appreciated. Thanks

-

April 18, 2024 at 16:07 #249710

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Andrew,

So, regarding the lot size, that depends on the account size. For example in an account of ours that we have 500$ in, we trade 0.01 lot size. That is our preference as we think this is low risk trading.

To see the distance for the stop loss, it’s good if you use a risk or pips calculator as this should display the distance in pips so that you can set the correct pips for the stop loss on the pair you want to trade!

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos -

April 18, 2024 at 21:52 #249802

Oly

ParticipantAll the EAs I use from MQL5 work perfectly with Roboforex; believe me, I’ve tested hundreds of them, and I’ve never encountered this problem. So I don’t understand what you’re talking about. Can you send me a screenshot or a video of how I should change anything? For €895, I think I should deserve a clear explanation of what I’m doing wrong. I’m using everything out of the box, the latest best performing bots, but I’m clearly in the red… a bit of a joke…

-

April 19, 2024 at 0:23 #249823

Andrew G

ParticipantHi Nikos

Thank you for the response however that doesn’t answer the question.

To use a Lot Size Calculator the Stop Loss distance is required in pips. As the stop loss is not visible in the Portfolio EA then an accurate trade cannot be made.

The example of 0.01 lots to $500 does not set a trade with an accurate risk.

It seems as though the options are use the individual EAs to accurately determine lot size or use the Portfolio EAs and guess the lot size.

Cheers

-

April 19, 2024 at 10:10 #249867

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Andrew,

I am really sorry for the late reply.

So, you can see this stop loss and take profit calculator here: https://www.fxblue.com/market-data/tools/sltp-calculator

You set the amount of your account, the lot size, the open price and the pair or instrument you want to trade and then that calculates the distance between the take profit and stop loss you need to have.

Hope this helps!

If you have any more questions, let me know!

Kind Regards,

Nikos -

April 19, 2024 at 10:56 #249874

Oly

ParticipantDay 2, now I’m running it on a standard demo account, not a cent account… and the results speak for themselves LOL. Best 10 bots of the last 30 days…

-

April 19, 2024 at 11:20 #249881

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Oliver,

I see the results. In this case, I would ask you to also try in a different broker and see if that has different results. But it could be due to the market conditions as well.

You can see what brokers we are using and try to use the robots in one of them: https://eatradingacademy.com/trusted-brokers/

Kind Regards,

Nikos -

April 29, 2024 at 18:35 #252312

Pak

ParticipantHi team,

Would you please to explain the protections feature in the Portfolio EAs please?

Also any tips and best practices would be appreciated.

Thanks

Pak

-

May 14, 2024 at 11:33 #254938

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Pak,

I am so sorry for the late reply.

So, in portfolio EA, you get 3 settings for the protection that are:

Max spread (points): What it does is that you set a limit on the spreads which means for example if you set it at 10 and the spread of the pair is 15, it will not open a trade.

Minimum equity (currency): So, minimum equity means that the trades that are open will close if they reach to that amount that you have set. If let’s say you have a balance of a 1000 and you have set the minimum equity to 850, what it will do is that if you have an open trade and from it is on a loss of 150$, the trade will close automatically and there will not be another trade unless you set it to a lower amount.

Maximum daily loss (currency): It is almost the same as the minimum equity but the difference is that it just close the trades for the day if they reach the amount you have set. Once the next day comes, it will trade again.

Hope this helps!

If you have any other questions, let me know!

Kind Regards,

Nikos -

May 15, 2024 at 12:51 #255131

dani schmitz

ParticipantHello, I was wondering if anyone here could help me out with this question that I have.

so in the top 10 robots app you have the ea’s and underneath are a few things listed like:

Profit

$8,083

Profit factor

1.32

Drawdown

9.34%

Count of trades

935

R squared

86.57

Return to DD

4.65just as an example I listed the above, but on what account size and lot size is the DD, profit and the rest calculated so I know what I am risking and how much DD it has on what lot size.

Thanks in advance.

-

May 15, 2024 at 13:41 #255136

Alan Northam

ParticipantHi dani,

The problem as to account size is used in determining the drawdown of the asset in question is resolved by expressing the drawdown as a percentage. So whatever your account size is the drawdown will be 9.34%. As an example, a $1000 account would have a drawdown of $93.40.

Alan,

-

May 15, 2024 at 13:47 #255137

dani schmitz

ParticipantHello Alan,

I understand that but let me rephrase my question better,

Lets say I have a $10.000 account and in the app it says the draw down for the bot is 2.5%

2.5% of 10k would be $250, what lot size would I use to get a maximum of 2.5% drawdown so I know I don’t blow the account.

Thanks in advance,

Dani

-

May 15, 2024 at 14:27 #255147

Alan Northam

ParticipantHi dani,

You would use a lot size calculator. The following is the one I use all the time:

https://www.forextime.com/eu/trading-tools/trading-calculator/pip-calculator#pip-calculator

Alan,

-

-

-

May 18, 2024 at 12:25 #255521

Boyan Todorov

ParticipantHello Alan,

as to the risk calculation I am using these two

https://www.myfxbook.com/forex-calculators/position-size/XAUUSD

https://www.babypips.com/tools/position-size-calculator

How do you use the pip calcuclator?

And one more thing in the Export Options in the App you can pre-set the properties for the exported EAs, but how can you predefine the Entry lots, since you don’t know the SL of the EAs in advance and the Entry lots are actaully calculated based on the account size, which is not being taken in consideraion in the Export Options? Can you please explain, thanks!

kind regards

Boyan

-

May 18, 2024 at 12:40 #255606

Alan Northam

ParticipantHi Boyan,

No sure I understand your question but I will give it a try:

You do not pre-set the entry lot size in the app. You do this when you add the robot to the chart. During the install process onto the chart a properties box will show up. Click on Inputs. Here you will find the Loss in pips. Use this Stop Loss in the Calculator to find the Entry Lots. Then enter the lot size into the properties box. Click OK.

Alan,

-

May 21, 2024 at 10:24 #256140

Boyan Todorov

ParticipantHi Alan,

if you open the Export Options you will see, that right on the top there is a prompt for the Entry lots, this is what I meant. However I downloaded the EAs with the default setting 0,1 and then I calculated my risk according to the pair and the SL from the properties fron the EA and then I changed the 0,1 value in the properties with the result from the calculator. I assume I did everything right?

kind regards

Boyan

-

May 21, 2024 at 11:25 #256154

Alan Northam

ParticipantHi Boyan,

I see what you mean. Kind of hard to set the lot size if you don’t know the risk. During the process of adding the EA to the chart there is a box that shows up on the screen. If you click on inputs then you can see the SL and calculate the risk before the EA is actually attached to the chart. When I want to change the lot size of an EA already installed on the chart then I right click on the smiley face or the blue hat in the upper right corner of the chart. Then I select properties and from there I can see the SL and I can calculate and add the lot size.

The way you eventually did it works!

Alan,

-

-

June 17, 2024 at 13:30 #261631

Jeremiah Say

ParticipantI plan to trade 4 major pairs top 3 on the W1 meaning there will be a total of 12 triggers.

What is the recommended account size for 0.1 default lot?

-

June 17, 2024 at 20:33 #261680

NIKOS KYRIAKOU

ParticipantHey Jeremiah,

I believe 5-10k is more than enough as you will be more safe, actually if they are just forex pairs.

If you plan to trade metals, like Gold, Silver etc., I think it’s better to have a bigger account if you want to trade with this lot size as the account can be blown easily if things go wrong.

Kind Regards,

Nikos -

June 25, 2024 at 19:52 #263116

Tsholo Monyausi

Participanthi Guys

i would like clarification on the following in your top 10 app. in simple terms, can you explain the follwong

R Squared

Return to DD

Profit Factor

What would you suggest as the good parameters to have on the above in order to select a strategy

And ideally, on a weekly basis, how many trades should an EA do to be considered good.

Regards,

Tsholo

-

July 3, 2024 at 10:21 #267430

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, let me address all the properties one by one.

R-Squared is a statistical measure that can be useful to gauge how the strategy’s performance is influenced by broader market movements. An R² of 0 means that none of the performance can be explained by the index used for comparison. An R² of 50 for example, suggests that approximately 50% of the strategy’s performance can be explained by fluctuations in the benchmark. Please check this post and the linked video to learn about R-Squared (this is a complex statistical measure and it’s not that simple to explain so better read the post and watch the video).

Return to DD (Return to Drawdown) is a measure that helps evaluate the risk-adjusted return of the trading strategy. This ratio is calculated by dividing the total return by the maximum drawdown experienced during the observed period. For example a ratio of 0.99 suggests that for nearly every 1% of drawdown experienced, the strategy generated an equivalent increase in value. With another example, if Return to DD is 3.57 it indicates that the strategy earned about 3.57 times the maximum percentage decrease experienced in account value. This high ratio is a positive sign, showing that the returns significantly outweigh the risks taken (measured by drawdown).

Profit Factor is the ratio of gross profits to gross losses over the specified period. It helps to understand how well the strategy performs in terms of profitability.

Regarding what would be good values, we don’t put that much attention to the actual values of the above parameters. The way we use the app is just to pick the top 3/5 for from the weekly/monthly charts and trade with them. Then we check the performance on a daily basis and make amendments to the strategies we trade with if there are new top performers in the top 3/5 for the period we’re looking at. This is the system we follow and it works for us but this is not a recommendation or the only way to do it. Some traders might use the above properties to select their strategies or might have their own way to manage the EAs.

-

-

July 3, 2024 at 11:31 #267451

Marin StoyanovKeymaster

Marin StoyanovKeymasterI see. Thank you again for the comprehensive explanation. i will check out the post and video.

-

July 3, 2024 at 14:16 #267476

Marin StoyanovKeymaster

Marin StoyanovKeymasterSorry Marin

just one more question, from your own trading experience with EAs, do you ever close your positions when you meet your objectives, or do you advise allowing the EA to close on its own, either through SL, TP or EA settings.

Regards

Tsholo

-

July 12, 2024 at 15:30 #269860

Marin StoyanovKeymaster

Marin StoyanovKeymasterIf the EA meets my objectives I would close the position of course. But my objectives might be different than yours.

If we’re talking about long-term objectives, with the Top 10 EAs usually our traders close the positions at the end of the day if the strategy that has an open position is no longer in the top performers in the app and needs to be replaced. If the strategy is still in the top 3 or top 5 (depending on the initial setup we started with), then they keep the position open until it closes automatically or the EAs is no longer in the top performers in the app.

-

July 12, 2024 at 17:55 #269885

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Marin.

THank you.

Please explain what you mean here. “If the strategy is still in the top 3 or top 5 (depending on the initial setup we started with),”

So, ive noticed that the top 3 is changing all the time. If im always going with what is on the top 3, which is based on historical performance, how do i know if its about to become negative in the next trades. is there anything you look out for, just from experience, to determine if the top 3 will remain winning in the next trades.

Regards,

Tsholo

-

July 13, 2024 at 16:40 #270042

Marin StoyanovKeymaster

Marin StoyanovKeymasterWe check the app every day and if the top 3 are different from what we’re trading on our accounts, then we replace the running EAs. If we have open traders in the account with EAs which are no longer in top 3 in the app, we close them manually and replace these EAs. If we have open traders in the account with EAs which are still in top 3, we keep them running until they drop from the top 3 in the app. In short, everyday we trade with the top performing EAs from the app.

Noone can predict how the EAs will perform in the future. That’s why we pick the EAs which perform the best in the most recent market. And we update them daily if there are new top performers in the app.

-

-

-

-

July 13, 2024 at 17:52 #270051

Marin StoyanovKeymaster

Marin StoyanovKeymasterOk.

so Ive notices that sometimes you use the top weekly EAs and sometimes, like at the moment, you use the top monthly.

what informs your decision to either go with top weekly, or monthly EAs.

And lastly, i heard Petko say he would not trade the EURUSD at the moment, is it because of market trends, or is it just not a good pair for EA trading.

-

August 23, 2024 at 10:10 #302213

ka ho yat chan

Participanthi

i want to ask about how to set these?

i have see the youtube video,but still not understand what they mean for.

any help?

-

August 23, 2024 at 17:47 #302270

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello, please check the following sections in our Knowledge Base, they cover the inputs and the UI of the Top 10 App.

Also you might read the Top 10 Robots app complete guide.

Should you need additional information, please reply in the thread and we’d be happy to assist you.

-

October 16, 2024 at 17:17 #315948

Zoran Čuturilo

ParticipantHello!

Can somebody clarify me entry lot size settings for portfolio EAs. What is usually good practise regarding to account size, number of EAs, etc.

Also, do you have prefered browser for eatradinacademy.com? Sometimes I have issues as Firefox user.Thanks,

Zoran -

October 18, 2024 at 0:32 #316224

Mark Kamrath

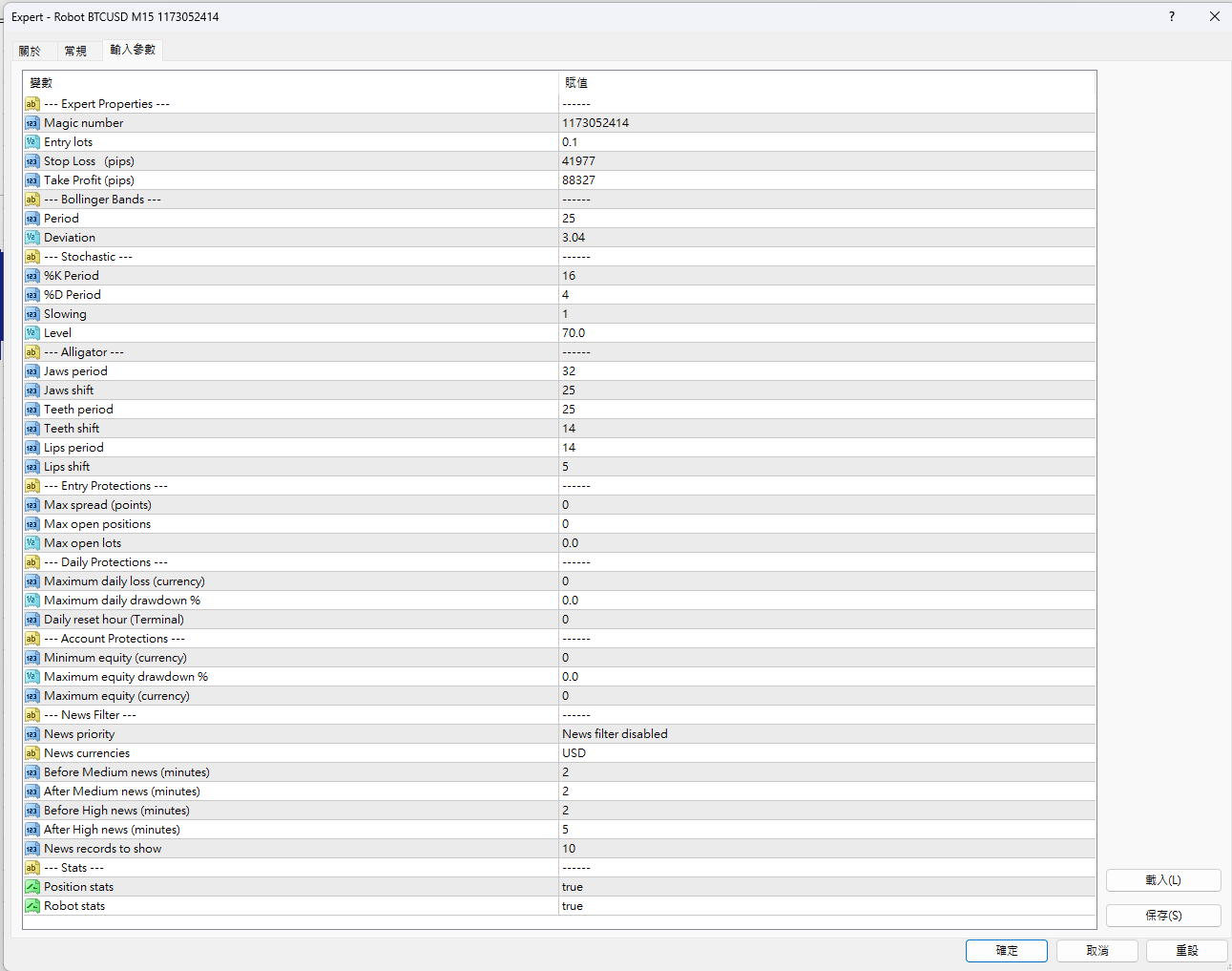

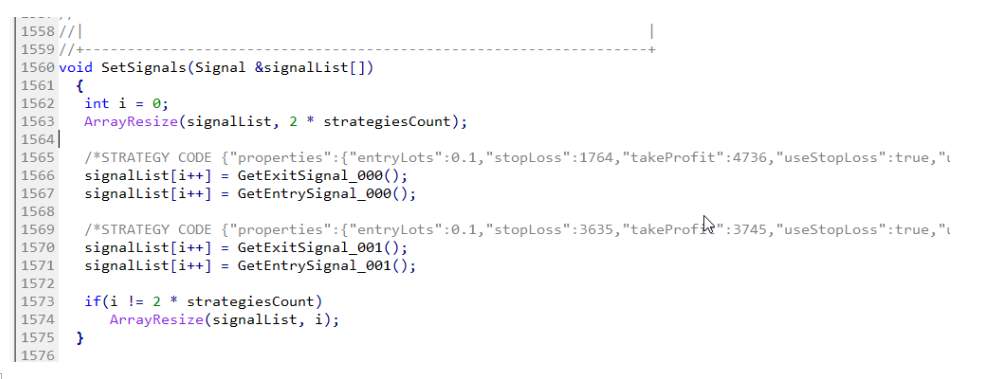

ParticipantHello. In both the MT4 and MT5 version of the portfolio manager, I can’t see all 10 Gold EAs to enable or disable them. I only see the first two (ooo and 001), per the screenshot below. Can you tell me where I get the rest of the EA codes? Thx

-

October 19, 2024 at 11:22 #316587

Jojo

ParticipantWill changing the Entry Lot Size setting higher or lower have any affect with the current open orders’ exit criteria in any way?

I’m assuming not, but I want to make sure. Thanks.

-

October 19, 2024 at 15:30 #316639

Alan Northam

ParticipantHi Alexius,

Changing the lot size will not have any affect on open positions but will affect your account risk and margin!

Alan,

-

January 8, 2025 at 17:12 #425134

Scoot

ParticipantDo the top 10 EUR/USD robots all go on 15 min timeframes or on the times that are individually allocated?

Kind regards

Scott

-

-

AuthorPosts

- You must be logged in to reply to this topic.