Home › Forums › Ready-to-use Robots › Prop Firm Robots › My FTMO Strategy

Tagged: FTMO ROBOTS

- This topic has 43 replies, 1 voice, and was last updated 7 months, 3 weeks ago by

Anonymous.

-

AuthorPosts

-

-

November 18, 2023 at 15:04 #214046

Anonymous

InactiveIn my strategy to passing the FTMO challenge I use Petko’s robots and robots I create. I also use 10K challenges. I will start a new challenge every two weeks. There are periods when the markets trend upward, move sideways, and trend downwards. By opening a new challenge every few weeks I spread the risk caused by these different market conditions. Also, if I fail a challenge the replacement cost is not so high. Right now I have six 10K challenges running all with different strategies. This spreads the risk. I also test the EAs using a live 10K challenge for one month using small lot sizes so as not blow the account. During a typical month the market will go through periods of drawdowns. Testing for one month then allows to determine maximum account drawdown. I then increase the lot size for the account to a more appropriate size based upon the drawdown during the test to complete the challenge. My trading strategy is not to try and complete the challenge quickly but to control risk.

Some Observations:

I tested FTMO v4.1 in a demo account where I had to restart it every 14 days. It took 3 months to pass the challenge. I then moved it to a 10K challenge but it is currently going through a drawdown period.

I currently have v4.3 in two challenges. One challenge uses all the EAs and the other challenge uses the top 3. What I am currently observing is that the challenge with all the EAs is doing better than the challenge with the top 3. I find that interesting.

I also started v5.0 this week. One 10K challenge has all 8 EAs running with a small loss for the week. A second 10K challenge with the Top 3 EAs has a small profit for the week.

I also have my own portfolio of 10 EAs trading in a challenge that is up 2% for the month.

Alan,

-

November 18, 2023 at 21:35 #214183

Anonymous

InactiveWhat are your V5 top performers for next week?

-

November 19, 2023 at 11:29 #214296

Anonymous

InactiveI don’t have sufficient real time trading results with my FTMO account to determine top performers. All I can go on is backtesting the v5 EAs using EA Studio.

There are only two top performers over the last 1 month, they are USDCHF and AUDUSD. These two EAs have upward sloping balance lines with pullbacks less than 1%. Trading for these two EAs were typically flat over the last one week. Typically after a period of trading flat trading can go in either direction in the future. Typically what you need to do is to monitor these two EAs to see which direction they start to trade in and then make trading decisions on those initial movements.

Over the last one week there were two EAs that had the deepest pullbacks of approximately 1.5%, they are EURUSD and GBPAUD. Typically after a large pullback or drawdown, same thing, trading starts to resume in the direction it was trading before the pullback started. What is unknown is if the pullback is now complete. With a pullback of 1.5% my guess is that it is close to being complete. Again, what needs to happen is to watch these two EAs to see if they start to make profitable trades again and then start trading them.

Having said all of this I don’t worry about what will happen over the short term such as one week as EAs will either be profitable, flat, or in drawdown. What the EAs do over the short term is unknown! What I look for is the longer term performance knowing that over the short term the EAs will either be profitable, flat or in drawdowns. I am interested in being profitable over the next several months and longer.

This is what I am interested in:

*This chart is from my own portfolio of 10 EAs.

Notice the periods in which this balance line moved higher (profits), moved sideways (flat), and moved downward (pullback or drawdown)? However, over the longer term the balance line moves upward indicating long term profits. In this case it shows approximately a 12% profit in just over one month. This is what I look for is a nice upward profitable balance line over the long term. Keeping your eye on the short term is fruitless, in my opinion.

Keep in mind there are no absolutes, only possibilities in trading.

Hope this helps!

Alan,

-

-

November 19, 2023 at 19:22 #214427

Anonymous

InactiveAwesome answer, thank you!

-

November 21, 2023 at 10:11 #214866

Anonymous

InactiveYour 10 EAs are not here?

-

November 21, 2023 at 11:32 #214880

Anonymous

InactiveHey Alan

Thanks for this, seems like a solid strategy. Unfortunately, I do not have the money to open a new 10K account every two weeks. Have yet to pass one challenge and hopefully build from there.

I have my own strategy which I trade manually. But it is a VERY slow process. That is why I bought this FTMO EA. I was hoping it would help me achieve success a bit faster.

Unfortunately to date, this has not been the the case. I have been running the EA’s on a test account for two weeks, no clear winner except maybe AUDUSD, which I have enabled on my live 10K account with ZERO trades opened to date.

I have to be honest, been burned so many times, especially in the EA space, HUGE promises, and then you buy the EA, then basically nothing happens or there’s excuses. It is sort of beginning to feel like that here now as well.

I think it would make quite a bit of sense for Petko and team to update us weekly on which EA’s to use, which ones are best performing currently. Not everybody can afford a VPN running and testing all the time. MANY of us here are beginners taking on our first challenges, that’s why we are here…but alas. Not a positive experience to this point for me.

-

November 21, 2023 at 11:56 #214887

Anonymous

InactiveHey Nicholas,

I understand your concerns completely. But, the market determines the results. Some weeks are incredible, with massive gains. Others, are very slow. The key is constancy. Keep the EAs on a demo account, Monitor their performance and move the best performer/s to your challenge account. The reason we, as the team at EA Trading Academy, don’t simply publish the best performers, is because the broker and trading conditions play a big factor. We may have better results with one EA than another, but that doesn’t mean the results would be the same with another broker.

I know you’ve been running the EAs for 2 weeks, and this seems like a long time, but really, it’s not. That’s the reason most prop firms have removed the time limit. It can be almost impossible passing in just 30 days, while still adhering to all the rules. Be patient. Follow the strategy. Don’t take unnecessary risks. Trade only EAs that have performed well. If none have in that week, don’t trade any. You will be successful. If this was easy, everyone would pass easily.

Good luck,

Ilan

-

November 21, 2023 at 14:46 #214932

Anonymous

InactiveHey Ilan

But you see, that’s what I do not get. We DO NOT use different brokers, we all use FTMO. Or at least in THIS forum, it is an FTMO EA that does ONLY FTMO.

So why can you not publish to this community focused on FTMO, the best-performing pair for FTMO. FTMO is the same anywhere in the world.

Explain this to me please? And do not say since brokers are different and some people may use different brokers. I think most people here would be intelligent enough to KNOW that the best performing EA’s you are really supposed to send to us is actually for FTMO.

Note the name of the forum: “FTMO Robot”

So why not just share on a weekly basis the best performing EA’s? And that’s what I get really angry with, on these “EA’s” – there is always some bloody excuse why they do not work as SOLD. We paid for the FTMO bot. We have the EA files. Give us the best weekly performing EA’s as tested by you, a professional team, and we can then swop out as required. SIMPLE. Those that cannot afford a VPS but runs on their local systems now ALSO have the weekly best performers.

-

-

November 22, 2023 at 9:58 #215121

Anonymous

InactiveThat’s a valid point

-

November 22, 2023 at 11:10 #215134

Anonymous

Inactive+1

-

-

November 23, 2023 at 6:38 #215342

Anonymous

InactiveI will need to answer here to clarify it! :)

As far I understand you got ‘angry’ because we do not publish the trial/testing account with the FTMO Robots so everyone can see which is the top performer.

To do this, it should be on myfxbook, with all green checks and Live updates (which is easy to do).

BUT if we do this it will become a signal provider – a FREE Signal provider. It will be easy for everyone to copy the trades. Which is something we want to avoid.

Plus, it is super easy for everyone to open a trial account with FTMO and place the 8 EAs and track the performance. It’s nothing hard, and everyone can do it.

And I don’t think you saw fake promises with us because we never said that we would provide the weekly performers. You can not find in the landing page of the FTMO Robot, and it has never been in there.

So I hope you understand why we can’t do publicly BUT we will try to figure it out how to make it private for everyone who purchases the FTMO Robot. Then even if one uses it for signals, that is alright. We will let you know.

But don’t be angry, because we never promised that! :)

-

November 23, 2023 at 7:50 #215352

Anonymous

InactiveHello Petko

I am NOT angry about you not posting top results. Although your comment on signals does NOT make sense AT ALL. Here is your post from earlier called “FTMO v5 results” what am I missing? Is this not “signals” but asking for top performers are signals…sorry, but you would have to give me a better answer. I do not care about MyFX and green ticks and all that jazz. Are you not constantly testing the FTMO Robot on your end to ensure you can make updates etc? If you are not, this would be VERY concerning. Please share these results with us on an ongoing basis. Why not? Do you NOT trust your results?

Here is what IS making me super angry though. And this comes from my past experience with EA sellers that make big promises and then do not deliver. As a reminder, please read your sales page.

You state: The Robot will help you pass challenges faster and stress-free!

It has NOT been stress-free AT ALL. In fact, it has been very stressful. I do not get answers, I do not get clear and concise guidance, I have to DO MY OWN TESTING. I mean…really. And then I get statements from you and your team like:

We cannot provide the top performers because tomorrow this might change. So what is the point of running a bloody three-week “test” and then “oh but wait, we cannot take responsibility, since this might change tomorrow” – bullshit.

Another favorite response from you and team: Test the robot on a testing account and use the top performers. I have been “testing” for three weeks now, no clear winners.

Another one: The market might change and the robot might stop working. Might, might, might. No. I remind you: The Robot will help you pass challenges faster and stress-free!

And the best one yet, we cannot provide the best performers because people might be using other brokers. WHAT! Really, on an FTMO Robot forum, this is an answer we get from your team. No, we are NOT using other brokers. We are using FTMO

The Robot will help you pass challenges faster and stress-free!I have yet to even make a small dent using your robot in any live account. No accounts passed yet. Not stress-free. None of your promises on your sales page have applied. But, and I am purposefully being SUPER sarcastic here. I have probably not passed any challenges because: I have not tested enough. I might be using a different broker. The market might change. All these excuses are either me not doing things right or some external factor. Not you and your team NOT delivering on the promises on your sales pages.

THAT is what is making angry.

I am NOT passing challenges stress-free, instead, I am constantly in the bloody forum asking for help and writing essays for answers!!!!!

-

November 23, 2023 at 19:42 #215520

Anonymous

InactiveHey Nicholas,

I’m sorry to see you had bad experiences in the past from other sales, and I’ve seen a lot of people angry after they lost money.

However, we did not make any promises that we did not keep. A promise would be to say” You will pass the challenge 100% in 2 weeks’ time”.

I’ve built the system to help others pass challenges. Sometimes it takes longer, that is where patience comes in place. I actually launched this FTMO Robot publicly after FTMO Removed the 30-day period.

And indeed, I trade absolutely stress-free. I follow the results, and If I see winning assets I use them. If not I wait. That’s it.

If you or anyone else doesn’t like the system, we have a 30-day money-back guarantee.

I really do not have time and the energy to argue or explain why I did it this way.

PS We are already discussing putting the FTMO Robots on a dedicated VPS and sharing the account with everyone who purchased the Robot but it won’t be public in the forum or the website. It will just save the efforts of everyone to test them. And if you don’t know how one public account can become a free signal, please do the research.

-

November 24, 2023 at 10:38 #215680

Anonymous

InactiveHello Petko

Firstly, thanks for responding, it is much appreciated. I understand that there are things I do not understand about the signal aspect you mentioned. All good there, there no need for me to understand anyways, I accept their insight I do not have on this point.

It is fantastic news that you guys are busy setting up a VPS, thank you for listening to us here. Looking forward to that getting in place.

I do not want a refund. I want to robot tat helps me pass challenges and continue to make money after I did pass the challenge.

I am listening to you concerning the patience aspect. I hear you. It has been a frustrating journey to this point. I do not have enough capital of my own to start trading sensibly. Thus the choice to take the prop firm road. But it is slow, frustratingly slow. I will practise my patience though.

Thanks for clarifying and listening.

-

-

November 26, 2023 at 12:34 #216139

Anonymous

InactiveHi Nicholas,

I have been on vacation the last week. Just got back and trying to catch up on the Forum. I saw your responses to this Topic. Sorry to hear about your frustration with the FTMO Challenge and the robots. I have been trading the FTMO V5 robots on a live FTMO Challenge now for just a little over one week now. Or, I should say I have been testing the robots on a live FTMO Challenge. I currently have the lot size for each robot set about 1/5 of the normal set file size during my forward testing. Over the last week I see that the account has been going through a drawdown period. This is normal. All robots will go through a period of profit, a period of moving sideways, and a period of drawdown as I have explained before. My plan, right now, is to wait for the account to move back above breakeven. This will tell me the robots are in a profitable period. Once the account breaks even I will adjust the lot sizes upward. Not sure if I will increase lot sizes back to the set file amounts. Might wait until account reaches 1% or 2% but I will increase lot size to some larger amount once the account breaks even.

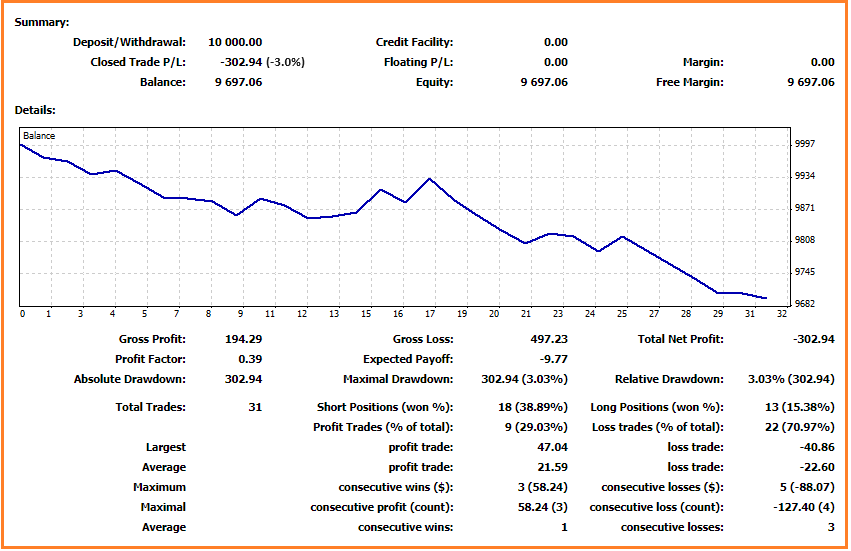

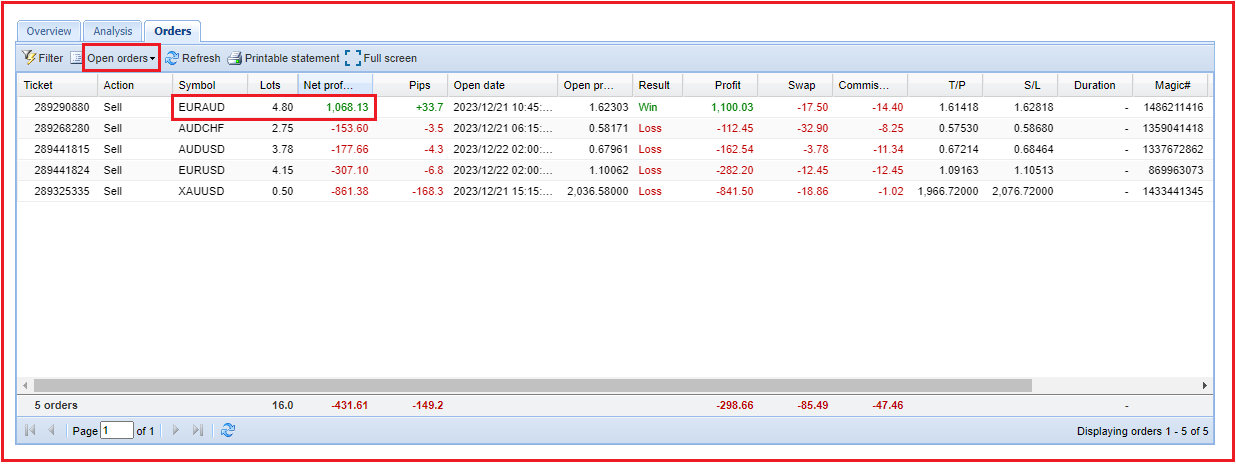

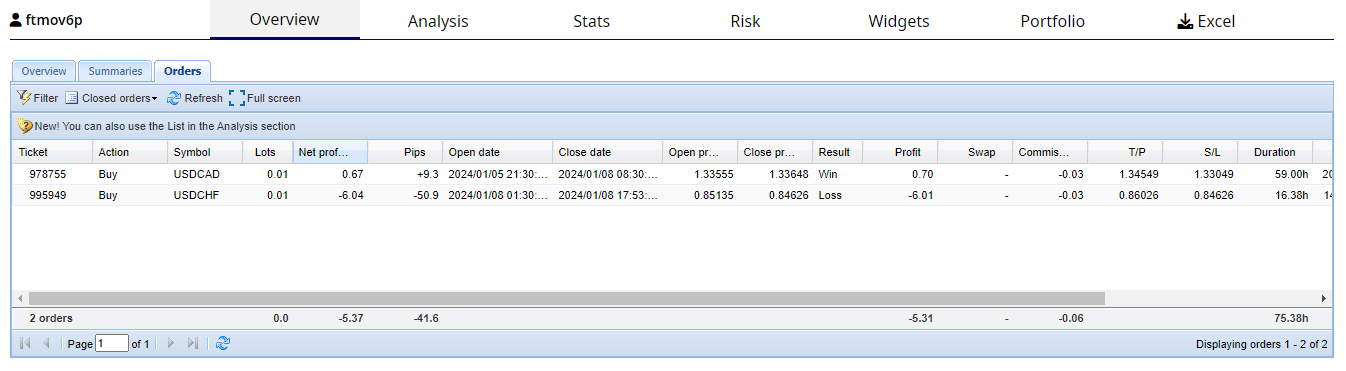

The following is my MT4 Detailed Account summary:

So, hang in there, and lets take this journey together!

Alan,

-

November 30, 2023 at 7:20 #217287

Anonymous

InactiveHey Alan

Thank you for taking the time and responding. And thank you for your detailed response. It is appreciated. This trading journey has been a tough one. Hundreds of hours of practise and strategies and videos etc. One gets to a point where you just want to feel you are moving forward. And by that I mean, actually start making some money on a consistent basis.

Thus the reason why I turned to prop firms. Many warned me it is a scam mostly to get the “challenge fee” and then make it almost impossible to pass and easy to fail.

But I do not have the capital to enter trades that will at least give me the chance to earn significant money and get out of the rat-race, because that is the goal…

Thus the reason for turning to EA’s. I have been testing this EA on other funded challenges on 0.01 lot sizes, but the EA is not successful there. Really does only seem to work best on FTMO. I am not getting super clear winners and results yet. AUDUSD seems to be the only real winner.

But I march forward three steps and get knocked back two steps and so we go :)

-

December 3, 2023 at 12:23 #218703

Anonymous

InactiveHi Nicholas,

I don’t expect the EA’s to do well from mid December and early January. This time period will most likely see low volatility in the markets as the big traders will be on vacation for the holidays. So don’t get discouraged during this time period.

Alan,

-

December 3, 2023 at 12:40 #218705

Anonymous

InactiveHi Nicholas,

I wanted to respond to your statement “Thus the reason why I turned to prop firms. Many warned me it is a scam mostly to get the “challenge fee” and then make it almost impossible to pass and easy to fail.”

It is a well established risk management rule that successful traders use that when a trade losses 2% in one day that the trade is closed out. Also, if an account losses 6% all trades are closed and the trader takes a break from trading for a period of time, normally one month. This is done with the hope the markets will change back in favor of the traders strategy.

So in comparison, FTMO does not close out your account until you lose 5% in one day instead of the established risk management rule of successful traders which is 2%. Also, FTMO does not close out and account until the drawdown reaches 10% versus the established management rule of successful traders which is 6%.

So, in contrast between the established risk management rule of successful traders and the risk management rule of FTMO, FTMO’s risk management is quite relaxed to give beginning traders a more opportunity to be successful while at the same time protecting their account from unnecessary risk.

So, its not about scamming, its about risk management!

The one thing FTMO does that other prop firms don’t is they provide a free demo account for traders to use until they feel confident in their strategy before committing to the fee of a Challenge. So again, in my opinion, FTMO is trying to help the trader to become successful. Having success full traders trading their account helps FTMO spread their risk as the various traders trade different strategies.

Alan,

-

-

-

November 30, 2023 at 7:03 #217285

Anonymous

InactiveYes, Petko, It will be better for us if you provide us result of both backtest and forward test of each version, and updated weekly.

So we can decide for ourselves which the top performers we use, the long term one (monthly or yearly) or even the short one (weekly).

-

December 3, 2023 at 13:25 #218713

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V5.0

One of the FTMO strategies I am using is Petko’s FTMO v5.0. This strategy has been losing lately and has currently drawn down my FTMO 10K Challenge account by -3%. This is not a significant draw down of the account as it only takes a profit of 3.1% to get back to breakeven. What is a serious drawdown would be for an account to drawdown by 50%. In a $10,000 account this would mean the account value would then be $5,000. An account would then have to profit by 100% to get back to breakeven. This could take considerable time and that time represents a period of time where the trader is not able to use to grow his/her account from $10,000 to a larger amount. With a drawdown of 50% the cost to a trader is time and profit lost.

Since this account has only drawdown by 3% I will continue to trade FTMO V5.0 in my current 10K Challenge and see if it will start to move back upward.

I will not be adding any new FTMO 10K Challenges until after the first week of January due to the expected slow down in volatility during the holiday season!

-

December 3, 2023 at 16:15 #218743

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V4.3

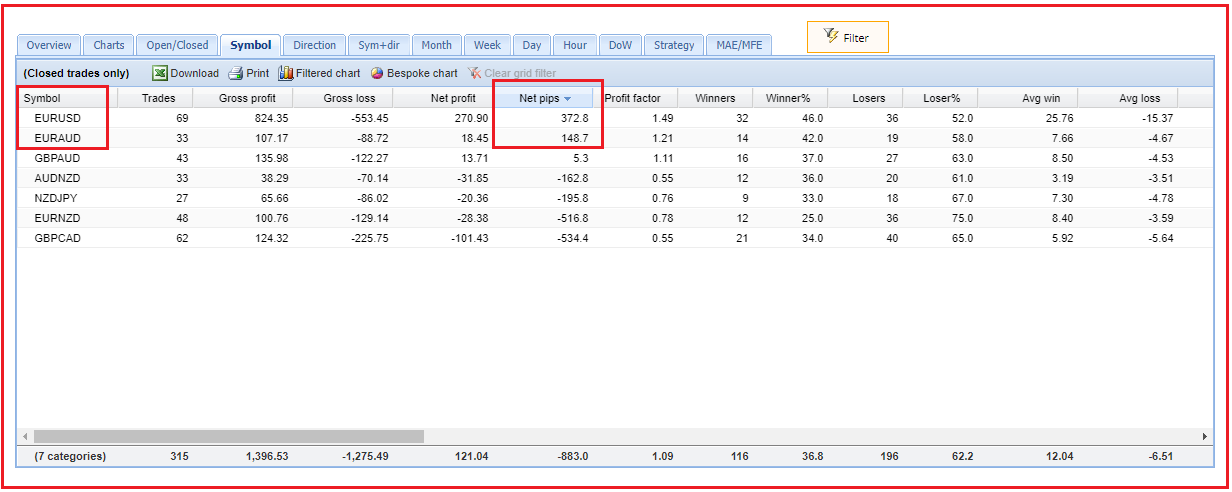

From October 26 through November 15 I was testing this strategy using 0.01 lot size. In mid November I found EURUSD was performing the best. I then increased the lot size from 0.01 to 0.1 for EURUSD. Unfortunately, from mid November through today the account has gone through a drawdown of about -1.5% but has regained most of that loss. This will happen from time to time when you enter a market or increase a lot size the market goes through a drawdown; this is normal!

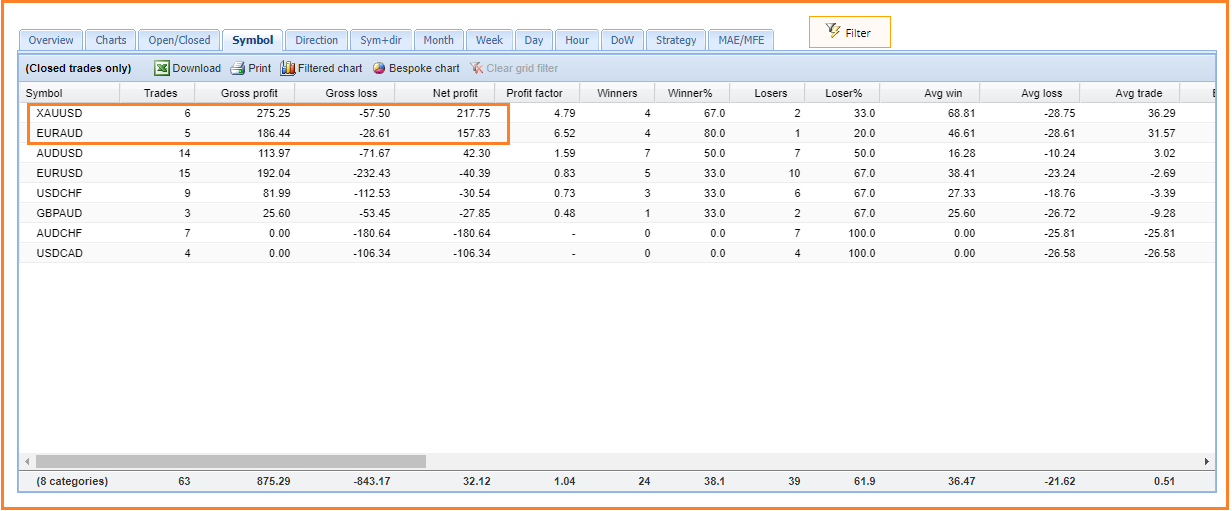

Looking to see how all the symbols in the strategy are doing I cannot go by looking at New Profit. The reason for this is that EURUSD lot size is 10 times the lot size of all the other symbols and will obviously generate most of the profit. So, how to do you compare all the symbols equally? To do this I look at Net pips. Looking at the table below I see EURAUD is now in second place. I will now increase its lot size from 0.01 to 0.1 lots. I don’t want to get more aggressive than this so I want to keep EURUSD and EURAUD at 0.1 lots as I am expecting low volatility in the market until after the first week of January.

Alan,

-

December 14, 2023 at 14:07 #220711

Anonymous

InactiveCi potete mostrare tutti gli knputs?A quanto pare dal video nin riusciamo a capire. Grazie

-

December 14, 2023 at 14:53 #220714

Anonymous

InactiveThanks all , this Forum is being an eye opener for me. I was going to buy the FTMO EA Course that comes with Robots, but I would rather wait until a participant passes the challenge with V5 and the default settings provided in set file. @Nocholas – if you EVER pass the challenge with EA then please share the time EA took to pass the challenge, I myself hoping no more than 2 months duration.

Thanks

-

December 16, 2023 at 13:53 #221012

Anonymous

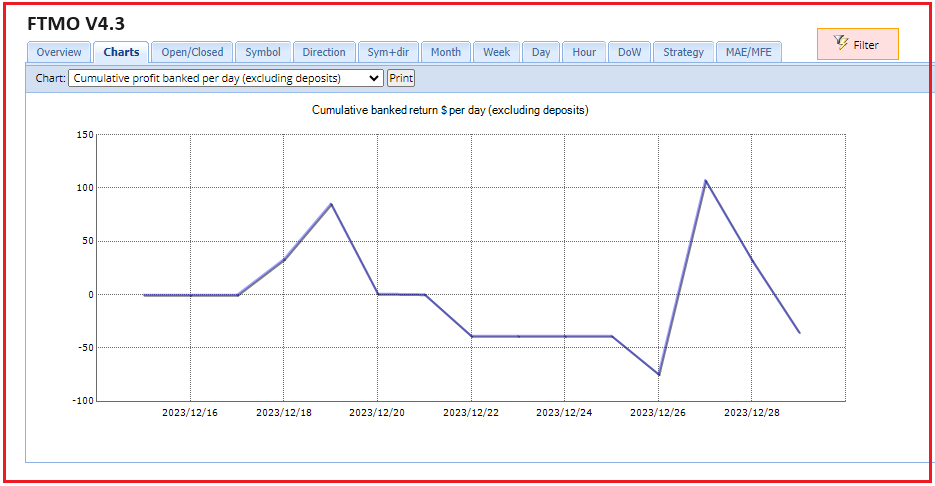

InactiveUPDATE ON MY FTMO STRATEGY V4.3

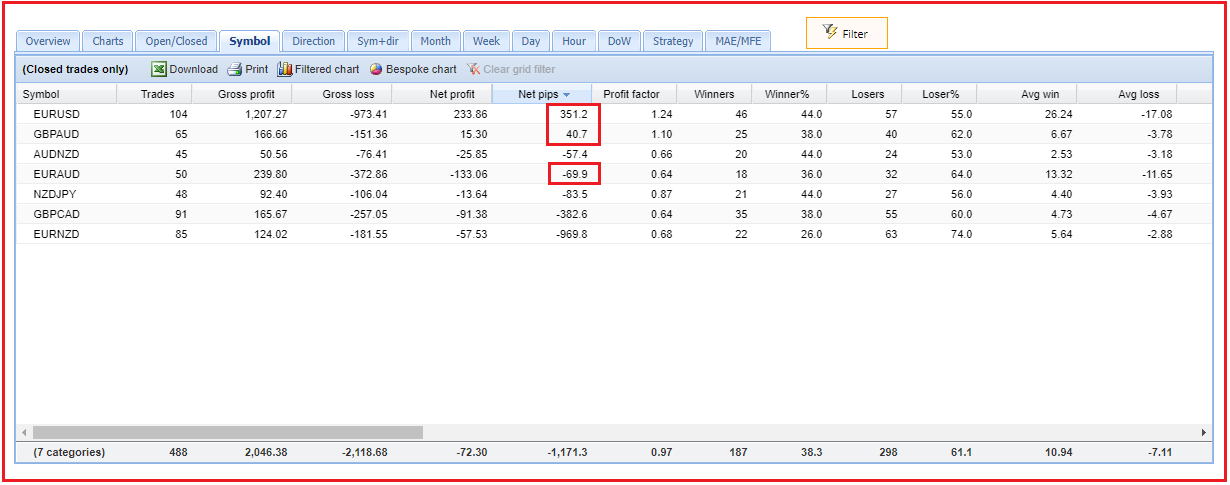

On October 26th I started an 10K FTMO Challenge using Petko’s FTMO V4.3 robots. From October 26th through mide November the lot size for all robots was 0.01 lots. In mid November I determined the 2 top performers to be EURUSD, and EURAUD. I then increased the lot size of these top performers to 0.1 lots. From the chart below you can see that from mid November the account continued to move sideways, then in early December the account drew down by -2% and has now started to rebound.

Next I looked at FXblue to check on the current top performers. I filtered the chart by Net pips. It was necessary to filter by net pips instead of net profit becuase the lot sizes are different. I noticed EURUSD was still the top performer. I also noticed EURAUD moved down to 4th place with a loss of 133 pips. I also noticed GBPAUD has moved into second place with a gain of 40.7 pips. I will not reduce the lot size of EURAUD from 0.1 lots to 0.01 lots. I will continue to keep EURUSD with 0.1 lots with all other robots at 0.01 lots. I will check this account again next weekend to see how this 10K FTMO Challenge is doing.

Alan,

-

December 18, 2023 at 13:36 #221303

Anonymous

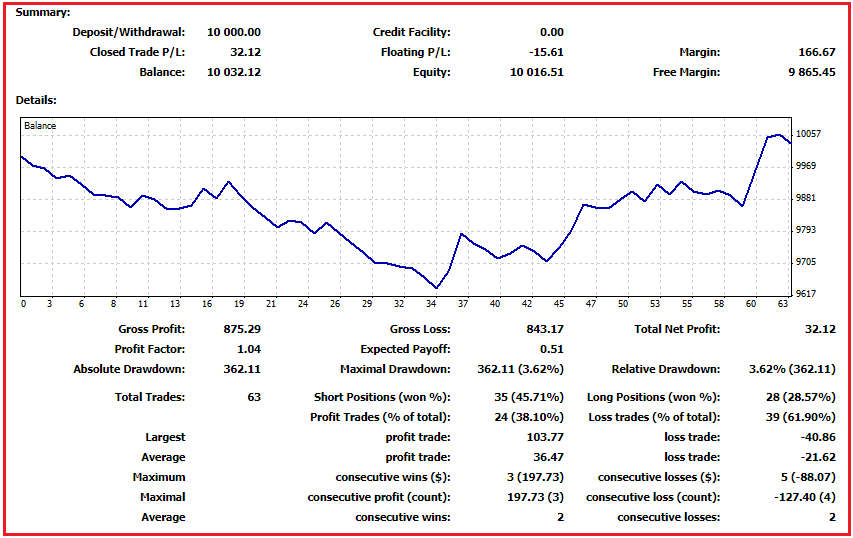

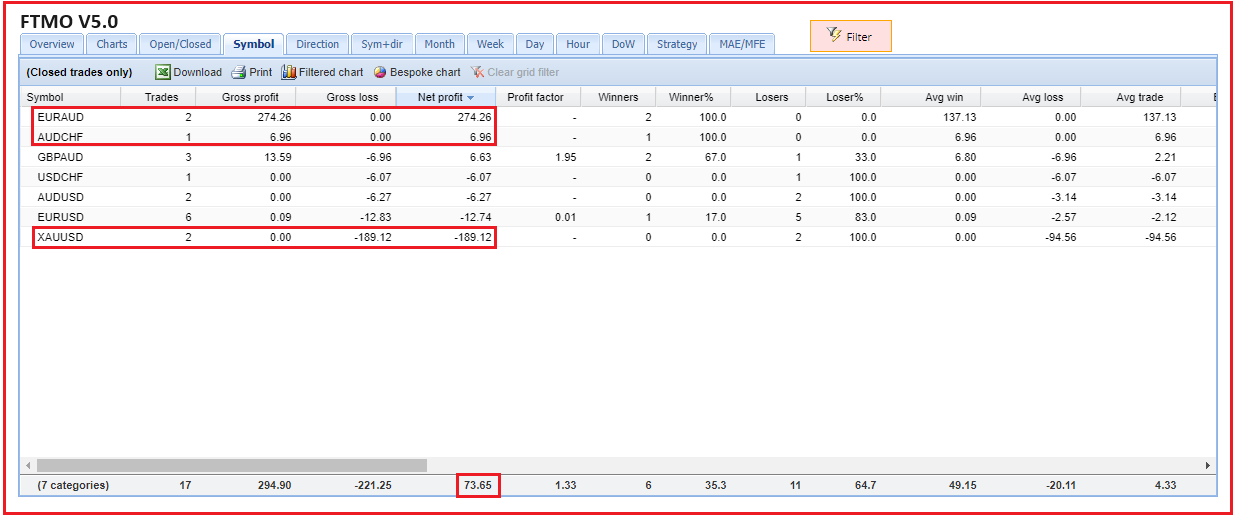

InactiveUPDATE ON MY FTMO STRATEGY V5.0

On October 30th I started a new 10K FTMO Challenge using Petko’s FTMO V5.0 robots. From November 1st until December 6th the account drew down approximately 3%. Since that time the FTMO robots reversed course and started moving upward and is now just slightly about 10K by $32USD. Basically what I have been doing over this one month period I have been testing these robots. Now that the account is starting to trend upwards, I will create an FXblue account so I can easily determine the top performing robots. So here is what I have decided to do. I will now reduce the lot size of all the V5.0 robots to 0.01. I will then create a new MT4 chart. I will install the top performer robot on the new chart, set lot size to 1% risk, and I will create a unique magic number. By doing this I will be able to filter out all the robots to monitor top performers each week, and I will be able to separately filter out the current top performers to see how it is currently performing. I know this may be a little complicated but it allows me to use the same Challenge to do two different things, to continue monitoring the top performers each week and to continue to monitor the current top performer. Hope this makes sense!

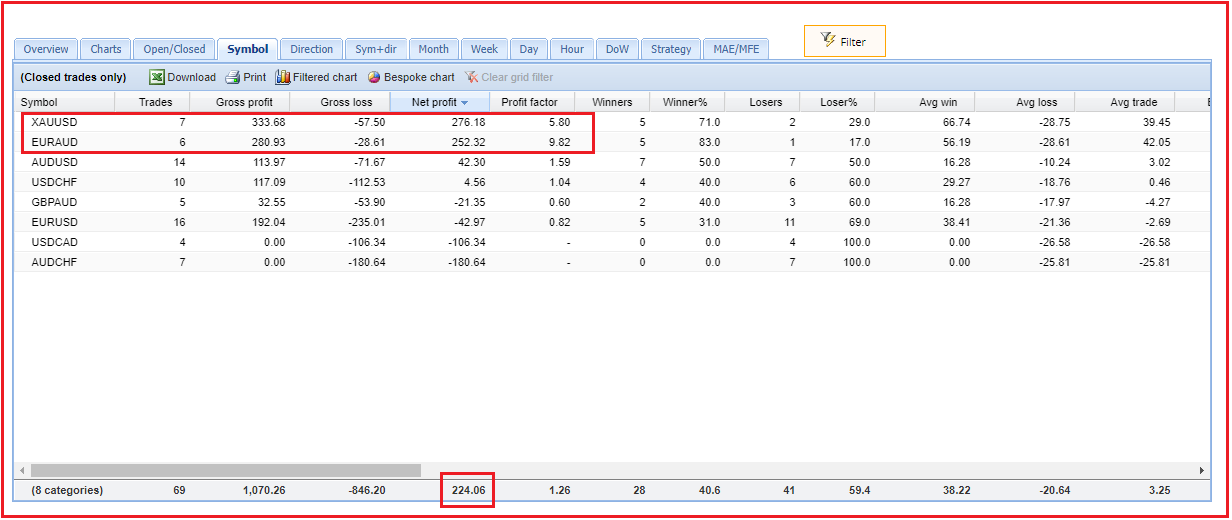

The following is an FXblue table showing the performance over the last month. As can be seen XAUUSD and EURAUD have been the top performers. I have doubled the lot size of these two robots and I have reduced all other robots to a lot size of 0.01. This will allow the top two robots to dominate the trading of this FTMO Challenge while allowing me to continue to track the performance of all robots to determine if any of the other robots move into the top performance slots in the weeks to come.

Alan,

-

December 18, 2023 at 20:31 #221369

Anonymous

InactiveThanks, please keep us updated

-

-

December 20, 2023 at 13:12 #221700

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V5.0

As of last Friday after the end of the trading week the FTMO V5.0 had a profit of $32 USD. The top 2 robots were XAUUSD and EURAUD as shown in the chart above. I then decided to double the lot size of each of these two robots from 1% of account balance each to 2%. This week is half over now so I decided to share my results so far this week. The top 2 robots remain the same and the account now has a profit of $224 USD. The following are my results:

Looking at the balance line it is still moving in an upward direction and has not started to show weakness. As a result, I expect to see this account continue to profit in the days ahead.

Alan,

-

December 21, 2023 at 11:05 #221847

Anonymous

InactiveHi Alan,

I really like this approach to your challenge. I haven’t purchased the robots yet but plan to. My only concern is let’s say you’re testing on an Oanda MT4 demo for example and get your initial results after a few weeks. You then would take your top winners and place it on your prop firm challenge. I know for a fact your results would be very different, am I wrong?

So in this case for a prop firm that does not have a demo you could place all the robots on your challenge but set the risk very low, then after each week see if you have some clear winners and increase the lot size to equal 1% risk. Is this essentially what you’re doing?

-

December 21, 2023 at 11:36 #221860

Anonymous

InactiveHi Brian,

Yes I see differences when I test on Oanda and trade the top performers on FTMO Challenge. So what I do is to place all robots in a challenge with small lot size. Then when I see top performers I increase the lot size to 1%.

Alan,

-

December 21, 2023 at 11:57 #221863

Anonymous

InactiveThis is a brilliant idea. This will be the approach I take as well. Makes the most sense because even on an FTMO demo for example I’m almost certain it will be different when you actually take a challenge. Please keep us posted!

-

December 21, 2023 at 12:20 #221871

Anonymous

InactiveI have also discovered when I trade the same EAs on Oanda demo account and the Oanda live account I get different results such that my EAs win on the Oanda demo account and lose of the Oanda live account. So even when I live trade with Oanda I demo test on the live account as well.

Currently I am demo testing the FTMO v5.1 robots on the FTMO demo account. So, once I start trading these robots on a challenge I will be able to see if there is a significant change between the demo account and the challenge account. I will not be starting a challenge until after the first of the new year.

Alan,

-

-

-

-

-

December 20, 2023 at 21:37 #221756

Anonymous

InactiveHey Alan thanks for your help. Is there any way I can create 2 mt4 demo accounts with different was to test?

I mean one for v5 and one for 5.1. I need MT5 for live account.

Thank you for your time and your massive input to this forum. I think you’re helping many people without knowing.

-

December 20, 2023 at 22:00 #221763

Anonymous

InactiveHi Robby,

Thanks for the encouragement!

FTMO only allows one FREE FTMO demo account at a time for each trader.

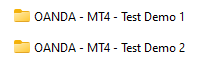

If you are using your own broker you can open two demo accounts. Then install 2 different MT4 terminals. During the installation process you can give each MT4 terminal a unique name, like Demo V5 and Demo V5.1, so you can tell them apart.

Hope I have answered your question!

Alan,

-

-

December 20, 2023 at 22:23 #221766

Anonymous

InactiveHow do i install different Terminals? You mean Like from IG Broker and Capital.com Broker?

-

December 20, 2023 at 22:30 #221767

Anonymous

InactiveNo. For example you could open 2 demo accounts with the same Broker.

Alan,

-

-

December 20, 2023 at 22:37 #221768

Anonymous

InactiveYeah but how do i install the 2 on mt? I could Open them but then there are the Same chartwindows with the Same EA‘ for Both of the Accounts.

-

December 20, 2023 at 22:57 #221773

Anonymous

InactiveOpen two demo accounts named demo acct 1 and demo acct 2. Then install two separate MT4 terminals on your pc.

Then launch one MT4 Test Demo 1 and log into demo acct 1 using login name and pw and server name you got when you created demo acct 1. Now do the same for the other demo account.

Alan,

-

-

December 24, 2023 at 16:00 #222356

Anonymous

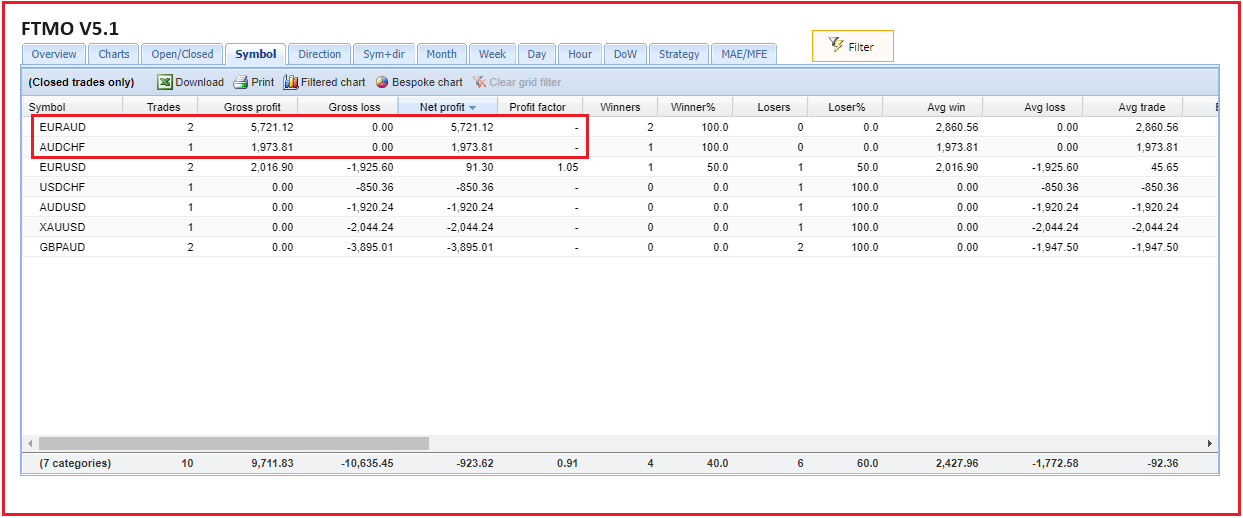

InactiveUPDATE ON MY FTMO STRATEGY V5.1

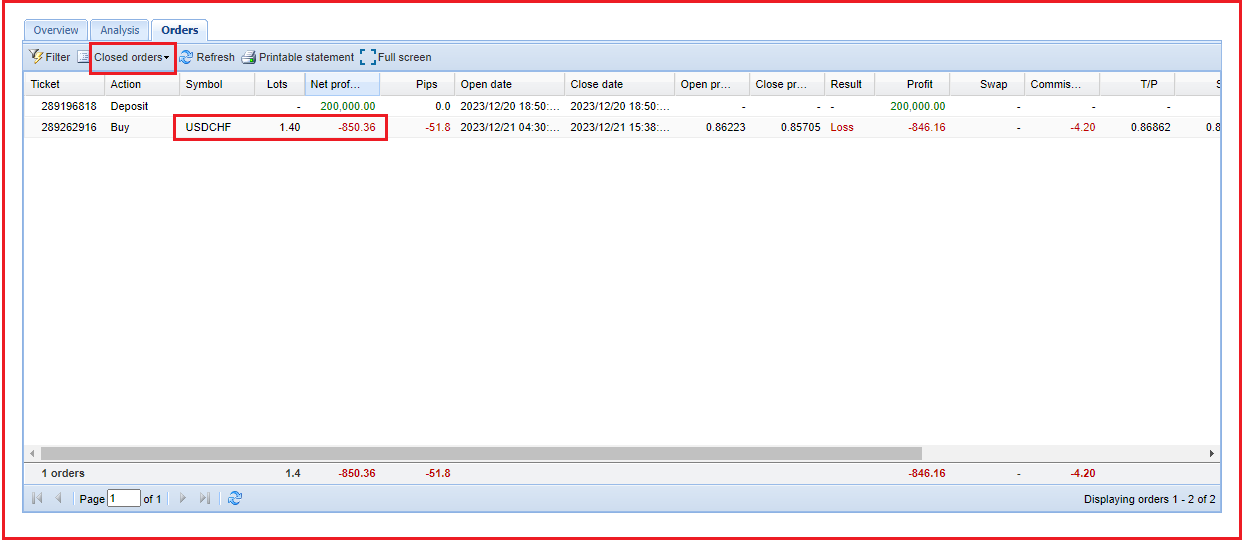

After two days of testing Petkos’ FTMO v5.1 robots on a FREE FTMO demo account the following are my results:

The top performer seems to be EURAUD but it is still an open trade. I cannot count it as the TOP EA until the trade is closed.

Please note this is an update of my strategy how I trade Petkos’ FTMO V5.1 robots.

Alan,

-

December 30, 2023 at 15:31 #223582

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V4.3

The chart below shows the FTMO 10K Challenge balance line of FTMO V4.3 robots from mid December to the end of December 2023. The chart shows a loss of 0.33% over this period. The top performer remains EURUSD. One week ago I increased the lot size from 0.1 to 0.33 lots to represent an account risk of 1%. I really didn’t expect much progress to be made over this two week Christmas holiday period. Further, there may not be much progress made over the next week which represents the New Years holiday period. Hopefully I will see some positive progress made in this Challenge during the last half of January 2024.

The question may be asked as to why am I still using FTMO V4.3 in an FTMO Challenge. What I am showing is two fold: 1. That the FTMO Challenge can be held over a long term without failing the challenge using proper risk management, 2. That the FTMO robots can be used over the long term and still be profitable.

Alan,

-

December 31, 2023 at 13:30 #223748

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V5.0

This table shows the results of the FTMO V5.0 10K Challenge from December 20th to the end of the year. Two weeks ago XAUUSD was the top performer and EURAUD was in second place. Note XAUUSD fell to last place over the last two weeks and EURAUD took the top performer place and AUDCHF jumped up to second place. I have reduced to lot size for XAUUSD to 0.01 lots and increased the lot size of AUDCHF to 0.3 lots a risk of 1% to the account. Over the last two weeks the account profited by $73.65 or 0.73%. I really wasn’t expecting much price action over the Christmas holiday season. Total account value now stands at $10301.92.

As can be seen by the balance line, over the last two weeks the account moved sideways during the Christmas Holiday period. Then on Friday the account advanced approximately $173 or 1.7% to show a profit of $73.65 for the two week period.

My strategy in trading the FTMO V5.0 robots shows this account still has quite aways to go to complete the challenge as it is up just 3% so far. The good news is that it is slowly progressing upwards. I expect I could continue to see slow progress through the first part of January until we get passed the New Year holiday period. If this account continues to move higher during the last half of January I may consider increasing the top performer lot size in February.

Alan,

-

December 31, 2023 at 14:41 #223762

Anonymous

InactiveUPDATE ON MY FTMO STRATEGY V5.1

The following is my strategy on how I plan to trade Petkos’ FTMO V5.1 robots:

I started demo trading the FTMO v5.1 robots on a FREE 200K FTMO demo account on December 21st. The following are the results so far. The table below shows EURAUD in top place and AUDCHF in second place. The problem I see in the table is EURAUD has only closed 2 trades and AUDCHF only 1 trade. This really isn’t surprising to me as the trading was done during the low volatility period of the Christmas holidays. Before I consider moving any of the 5.1 robots to an FTMO Challenge I need to see at least 3 to 5 closed trades. So I will continue to demo test these robots for another week.

Alan,

-

January 9, 2024 at 15:11 #225833

Anonymous

InactiveMY FTMO V6.0 STRATEGY

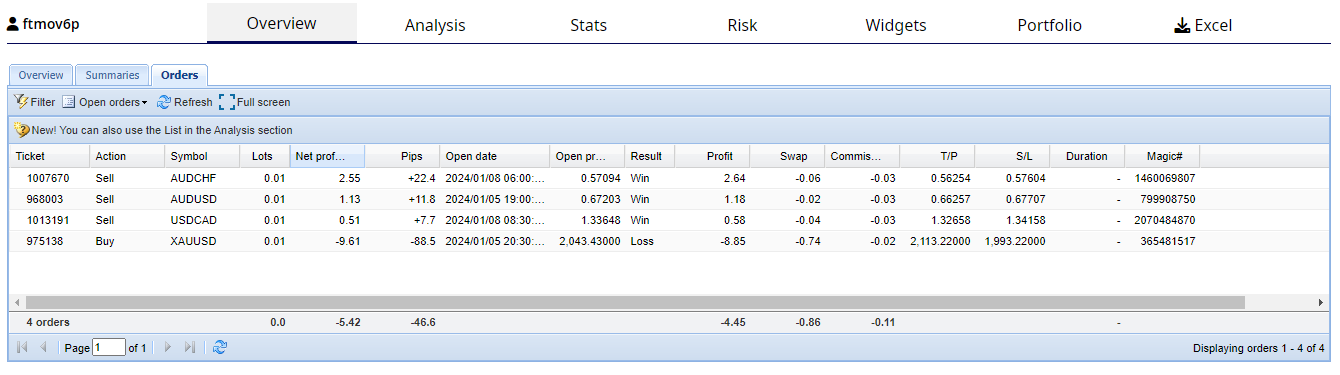

I have opened an FTMO 50K Challenge. I have placed all 8 Expert Advisors on MT4 with lot size set to 0.01. I will be testing these EAs for 5 trading days. I will then look at the top profit maker and if it has at least 3 closed trades I will then change the lot size to the recommended lot size for each downloaded EA. I started testing these EAs on Monday 01/08/2024. The following tables provided by FXblue show the results after just one day of testing. I know the results for only one day of trading is limited but I wanted to get my strategy out there so others can see how I am testing and will trade these Expert Advisors.

This table shows 2 closed trades after one day of testing. One EA was profitable EA and one EA had a loss.

This table shows 4 Open trades. The table shows 3 EAs in profit and 1 EA in a losing trade.

Alan,

-

January 10, 2024 at 11:22 #226013

Anonymous

InactiveHi Alan,

You mentioned you placed all 8 EAs but where are the other two most profitable ones (EURAUD and EURUSD)?

-

January 10, 2024 at 12:13 #226023

Anonymous

InactiveHI Puns,

I only started testing the 8 FTMO V6.0 robots on 01/08/2024 just two days ago now. As a result EURAUD and EURUSD have not yet opened a trade. I will continue to test the 8 EAs for the balance of the week. I would expect these two EAs will have opened trades by that time.

Alan,

-

-

-

-

AuthorPosts

- You must be logged in to reply to this topic.