Home › Forums › Trading Strategies › Forex strategy, Forex ea or cryptocurrency ea – share with everyone

Tagged: cryptocurrency ea, forex ea, Forex strategy

- This topic has 142 replies, 2 voices, and was last updated 8 months, 1 week ago by

Abhi Ram.

-

AuthorPosts

-

-

April 2, 2017 at 20:56 #1353

Petko Aleksandrov

KeymasterHello dear traders,

in the new Forum i would like to ask everybody who has already FSB or EA studio to share at least 1 profitable good Forex strategy. In this this way everyone can have benefit, we will save a lot of time, and everyone will learn more and more ways of creating strategies. -

April 4, 2017 at 1:02 #1369

Petko Aleksandrov

KeymasterHello Petko,

that is really great idea for the new forum and i will go first, i hope the others will join me.

The Forex strategy is really simple but i have made more then 200 pips the last 2 weeks. I will attach picture with the inputs and the profit line.

I will try to fit that Forex strategy to the other pairs as well but i created it originally for GBPJPY

Hope it will be profitable to all traders:

-

April 5, 2017 at 18:53 #1401

Petko Aleksandrov

KeymasterGreat job! the Forex strategy is simple and easy – that is what we are targeting!

Keep up the good work. -

April 20, 2017 at 13:02 #1418

Jade Brown

ParticipantPetko,

i wish to share more strategies with everyone, do you mind if i do? And also if you don’t mind i would like to know your opinion about them and see how can improve them.

For example i wonder if it is the right thing to use one and the same indicator for trend following strategies as filter. What i mean is that i am using the MACD indicator mostly as filter on H1 with the strategies that i have created in Forex Strategy Builder Pro and i am using different entry rules to enter on M1, M5 and M15. I do that because of my experience as a manual trader before – i used to look always on the MACD on H1. Of course now with the great back test that we have with Forex Strategy Builder and EA Studio i see that my strategies did well and are still doing good as automated.

So please tell me if i can improve them in anyway.

Thank you indeed Petko Aleksandrov -

April 27, 2017 at 17:16 #1422

Jade Brown

Participanthello, i wish to share also a Forex strategy that is simple and makes me a lot of money recently

as far as i understood from the second course,its best for everyone to optimize the Forex strategy for the historycal data they use, so i am not showing any of the inputs of the parameters, but only the conditions for enter and for exit from the Forex strategy

here it is: -

April 27, 2017 at 21:12 #1424

Petko Aleksandrov

KeymasterHello Ilkin, please send me your EAs on prive so i can have a look at them and give you a feedback.

-

May 11, 2017 at 16:45 #1481

Jade Brown

ParticipantI am glad to see this topic in the forum, i think it will be very useful for all, because we will have good strategies from each other. I am still a beginner but as soon as i make a good Forex trading strategy i will share it immediately.

-

June 13, 2017 at 21:23 #1604

Petko Aleksandrov

KeymasterCome guys, don’t be scared or shy to share ideas and EAs…its like you give money to the poor man on the street – every good you do will be back on you :)))

-

July 6, 2017 at 16:11 #1888

Zack Georgiev

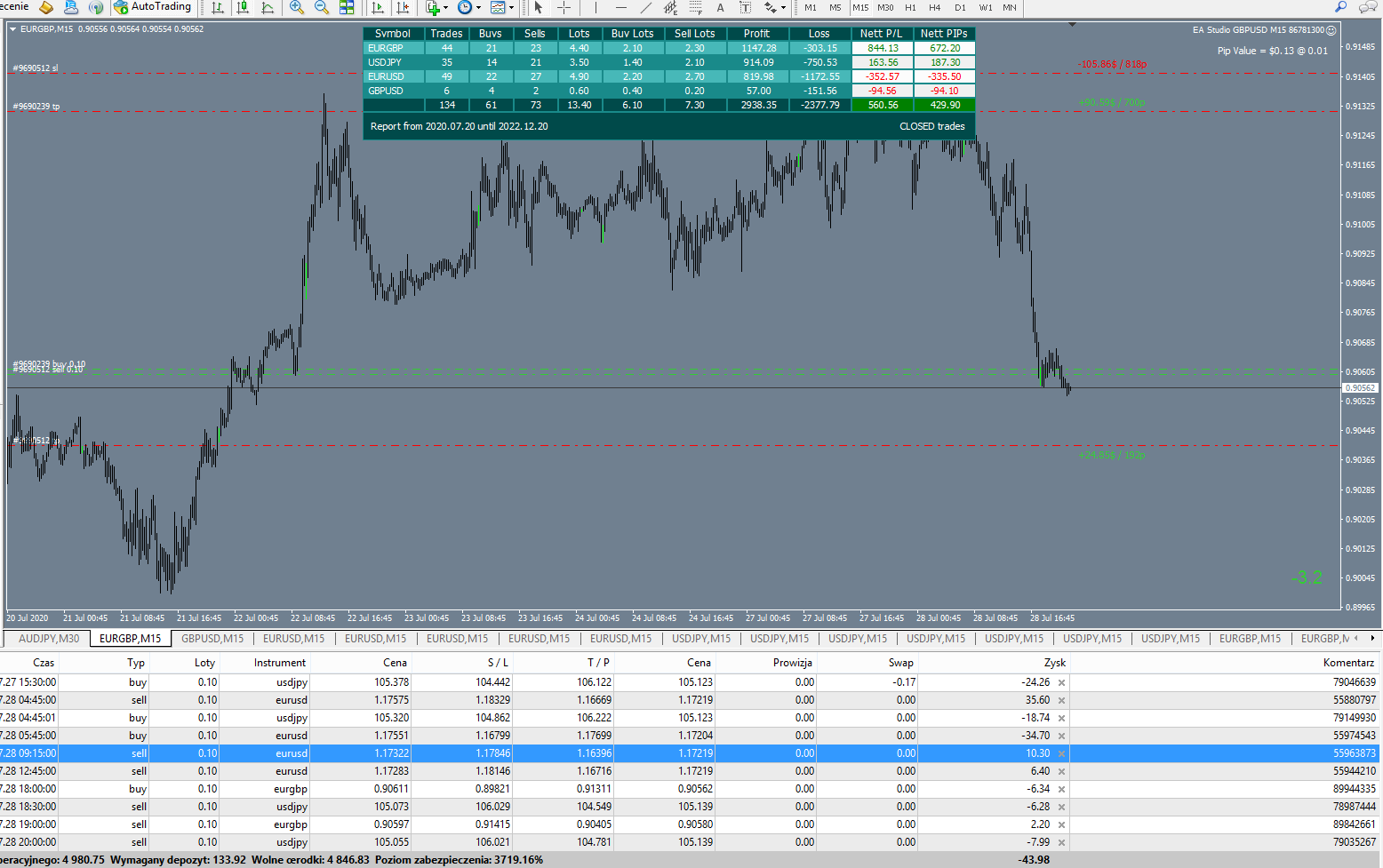

ParticipantHey guys, just now i joined the forum. i am glad to see that topic and straight away i will share my top performing Forex strategy from last month. Its on GBPUSD on M15 and showed pretty stable results. I am attaching the pic and here are the inputs:

RVI 40

ADX 35

Stochastic Signal 16;1;3 -

July 7, 2017 at 12:19 #1899

Zack Georgiev

Participantthe profit line of this Forex strategy looks so nice…i hope it will keep it up. Did you use the Reactor to have this strategy. And after that did you actually change anything on it? I mean did you add any entry condition? Or changed the sl or tp?

-

July 7, 2017 at 12:28 #1900

Zack Georgiev

Participanti just rounded the parameters to the 0.0010 and that is all. it was all done with the reactor. Really nice tool EA Studio…i just run it and at the end i have good Forex Strategy

-

August 6, 2017 at 11:36 #1941

George Steel

ParticipantHello all!

I would like to know if it is possible to create Forex Strategy that is very very active. For example to open 10 trades every hour. I have been testing the FSB for a week and I think to buy it but I would like to know if there is such an option there. It was ordered to me from a broker in Malaysia, but ucfortunately so far I can not create such an EA.

Thanks for the help -

August 6, 2017 at 11:58 #1944

George Steel

ParticipantDear George, I think you will need to use less entry conditions, like 1 or 2 in order to create such a Forex Strategy. Also try to use a small Sl and Tp so the trades will be closing quickly and new once will open.

-

August 6, 2017 at 18:35 #1949

Petko Aleksandrov

KeymasterGeorge, the Pope is pretty much correct with that. I have just created such a Strategy and actually it has a pretty nice results. I will see if I can improve it a bit more and I will come back to you and share. Have in mind that such a Forex Strategy will cost you a lot of spread so you need to trade it in a very low spread broker.

-

October 31, 2017 at 11:20 #2552

Petko Aleksandrov

KeymasterMates,

I wish to sahre one forex ea that I have created and it shows really good results. Ops sorry actuappy it is cryptocurrency ea :)

It is on the Bitcoin and it is on M15 chart. Pretty stable results there with Monte Carlo and also on Demo. Soon I will test it on live account as well.

Please see the picture below:Expert Adviser – click to download the EA

Make sure you optimize it with your broker, if you wish to use it.

cheers! -

October 31, 2017 at 11:24 #2553

Petko Aleksandrov

KeymasterDear Andi,

great for sharing it with us. As a mentor, I can tell you that it is really nice strategy from the first view and it is simple which makes it easier and faster.

Also, keep in mind to stay with a low lot size on a live in the beginning :)

Great for sharing this cryptocurrency ea in the forex ea section.

If you think of sharing more, we will be glad if you open a topic for cryptocurrency ea sharing in the forum.

You are welcome to do so!

Cheers -

October 31, 2017 at 11:40 #2555

Petko Aleksandrov

KeymasterGuys you will be surprised to see that when you are using forex ea and cryptocurrencies ea, the little difference there is just the history data behind and the optimization process.

What I mean is that if you have already few forex ea you, you can easily modify them to cryptocurrency ea.

What you need to do:

1. Upload the forex ea that you have in the EA Studio.

2. After that import history data for the cryptocurency ea that you wish to create (the cryptocurrency history data – Bitcoin for example)

3. See the performance of the new cryptocurrency ea – probably you will find it horrible. This is normal because this was a forex ea and you see it now as a crytpocurrency ea.

4. Optimize the EA for the new cryptocurrency data.

5. Be careful to avoid over optimization by using round steps in the optimizer

6. And just repeat it for all forex ea that you have, in order to find a profitable cryptocurrency ea.

7. If you can not find any, simply run the reactor over the cryptocurrency data, and you will have manyHope this helps and I think I will add to this topic cryptocurrency ea, because everybody is asking us for that.

Feel free to share cryptocurrency ea here, as well as forex ea.

Cheers guys! -

October 31, 2017 at 17:08 #2557

Petko Aleksandrov

KeymasterHey Petko,

thank you for sharing this information.

I hope this cryptocurrency ea will be use ful to other as well. -

November 2, 2017 at 1:17 #2576

Petko Aleksandrov

KeymasterAndi thank you for sharing this cryptocurrency with us. I am just enjoying Petko’s course but I will find a time and a way to practice and test your strategy for the Bitcoin. Glad there are such users in the forum

-

November 9, 2017 at 20:03 #2583

Damian Roger

ParticipantHey guys, very glad to see this topic. I just register today after having all courses from EA Forex Academy and I do not know why I missed the forum….I am just buying the softwares and I will share as soon as I have some nice cryptocurrency EA because this is my passion.

-

November 10, 2017 at 14:31 #2587

Damian Roger

ParticipantGreat topic Petko! I just took the Optimal Pack and I will share. Cryptocurrency ea or forex ea once I learn how to create robust strategies. Also I have downloaded the shared cryptocurrency ea and I will test it. Thanks

-

November 14, 2017 at 18:22 #2673

Petko Aleksandrov

KeymasterKeep up the good work guys and keep sharing cryptocurrency ea or forex ea with everybody.

What I have found to enjoy the most is sharing my knowledge as Forex strategy or system, because this way I develop it faster and I get feedback much quicker than doing it by myself. The best thing is I have the blessing to communicate with great people all over the world! -

December 4, 2017 at 15:55 #2831

Iohan Dive

ParticipantHello everyone,

thank you very much that share with us your forex strategy.

Petko great idea about create this topic for Forex strategy, I will really save a lot of time, and I hope that soon I can share with you forex strategy, which will be advantage to all of you.Cheers,

Iohan Dive -

December 9, 2017 at 20:20 #2848

Thapelo

Participantgreat job done here guys! I have taken the Mega Pack and now I have so much to learn and practise for creating robust crptocurrency ea and forex ea and also I want to create some stocks ea. I will share as soon as I have some good results. I think I will start with a cryptocurrency ea creation

-

December 31, 2017 at 17:43 #3014

Petko Aleksandrov

KeymasterGUys, I do not know if you have tested the cryptocurrency ea I shared not long tima ago, but keeps great results :)

-

January 9, 2018 at 0:36 #3126

Petko Aleksandrov

KeymasterDear Andi,when any cryptocurrency ea or forex ea is working, there is an old saying:

“When something is working, do not touch it” :) -

June 13, 2018 at 14:18 #4503

Petko Aleksandrov

KeymasterHello all,

I am very new to trading and I came on this forum and I find it very useful.

Can someone please, share a Forex strategy that is suitable for a beginner trader so I can practice with it.

Thanks a lot -

June 14, 2018 at 10:06 #4534

Petko Aleksandrov

Keymaster -

June 16, 2018 at 13:49 #4580

Petko Aleksandrov

KeymasterHello Rose,

thank you so much for sharing your strategy with me. I will immediately place on EA Studio and export as Forex ea.

I think it will be useful to me also, to practice it manually and see how exactly it is working.

Thanks so much again! God bless.

Cheers -

June 20, 2018 at 11:43 #4790

Petko Aleksandrov

KeymasterHey Ian,

the thing you can do is to optimize the strategy for your broker before exporting it as forex ea.

This is important because anyway you might not achieve same results as Rose does.

Kind regards, -

July 1, 2018 at 8:49 #5243

Petko Aleksandrov

KeymasterHello all,

Just register and glad to see that there are shared strategies. How can import this strategies into EA Studio, I do not see attached the ex4 files?

Sorry if the question is stupid, I just want to start trading with Forex strategy that is profitable and not to lose money from the beginning :)

Thanks -

July 27, 2018 at 9:03 #5564

Petko Aleksandrov

KeymasterHello Bob,

what you see are pictures of the entry and exit conditions for the Forex strategy. All you need to do is to import that conditions into the EA Studio, and export from there the Forex ea.

Cheers -

August 11, 2018 at 8:53 #5704

Petko Aleksandrov

KeymasterDoes someone has a nice strategy for EURJPY, I am straggling to Generate strategies with EA Studio for this pair.

Thanks indeed -

August 12, 2018 at 9:38 #5712

Petko Aleksandrov

KeymasterDear Haliffa,

You are enrolled to our Automated Forex trading course + 99 Expert Advisors.

There I include 33 EAs every month for EURJPY. I am sure you will find more than one nice strategy among.

Also, if you are straggling to find strategies with EA Studio, there could be the following reasons:

1. Your historical data is too small – give it a try with the Meta Trader – Demo, which is by default. If you succeed, than the problem is with your Historical data.

2. You place too strict acceptance criterias for your Forex strategy

3. You use too strict robustness tools for your Forex EA.Kind regards,

-

September 5, 2018 at 15:12 #6096

Petko Aleksandrov

KeymasterHello Petko,

Do you know from where come the default EA Studio Meta Trader Demo server? Can we use it as reliable Historical data?

-

September 9, 2018 at 21:43 #6141

Petko Aleksandrov

KeymasterHey Thapelo,

yes, comes from the JFD Demo server. It is not a bad data. The best thing you can do is to import the data from your broker. This way you will be able to generate strategies for your broker, where you will be trading. Here is a free video, how you can do that:

Cheers

-

October 27, 2018 at 10:59 #6695

Petko Aleksandrov

KeymasterThat video is what I was looking for. The FSB Pro is bit harder for me but I prefer to use it more than EA Studio. I took the Pack last month and every day I spend like 2-3 hour but for sure it will take me longer to master it all.

Nice content in you videos Petko! -

November 29, 2018 at 16:13 #7170

Petko Aleksandrov

KeymasterCheers thetrader! Glad to hear that!

-

November 30, 2018 at 12:32 #7191

Petko Aleksandrov

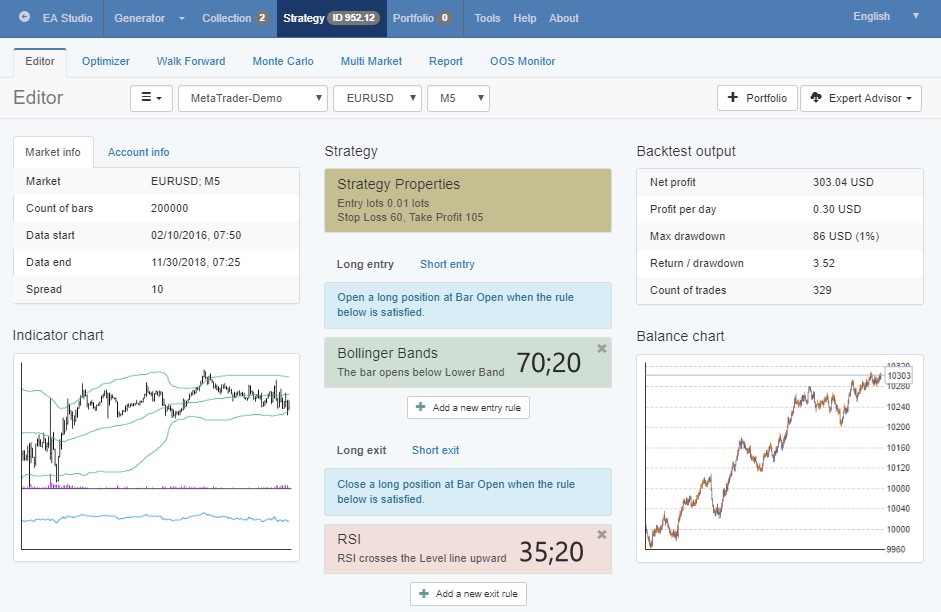

KeymasterHey guys,

since this topic was opened with a very nice idea of Petko, to share strategies and Expert Advisors, I decided to share one strategy

So here is a strategy that I used the last month and got very nice results:

-

December 3, 2018 at 13:34 #7334

Petko Aleksandrov

KeymasterThank you so much Haliffa! You are helping a lot on someone like me, a beginner.

I am just starting my trading with EA Studio and I will be glad to share some strategies too, hope to find them quicker!

I have exported your as EA and placed it on Demo! Thanks indeed

-

December 3, 2018 at 15:43 #7337

Petko Aleksandrov

KeymasterDear all,

this is really great topic where every one can benefit. In order to motivate you all share you strategies, I have decided to share one of my own:

Also, here are the Expert Advisors:

-

December 4, 2018 at 10:06 #7383

Petko Aleksandrov

KeymasterThank you, Petko! The balance chart of this strategy looks like really great! So far I did not succeed to make such a strategy with such equity. The EA is on the Meta Trader already. Also, I exported the one from Halifa.

It is really awesome to be part of this forum, the Academy, it is so much to learn every day!

-

December 5, 2018 at 19:13 #7436

Petko Aleksandrov

KeymasterGlad to hear you learn new things Stephan, and I am sure there will be much more to learn.

I highly appreciate everyone who joins the forums and share experience. This is the best way for everyone to learn.

-

December 14, 2018 at 10:57 #7687

Petko Aleksandrov

KeymasterI tried to share one of my strategies but failed to upload the picture. I saw on another topic opened by Jacpin that we will have soon this option easier :)

-

December 15, 2018 at 9:44 #7712

Petko Aleksandrov

KeymasterHi Andi,

it will be ready on Monday!

Have a nice weekend!

-

December 25, 2018 at 18:36 #7914

Petko Aleksandrov

KeymasterPetko, you share so many strategies in your courses, so many EAs, that I think everyone is satisfied with them :)

-

December 26, 2018 at 13:32 #7933

Petko Aleksandrov

KeymasterHey John, thank you for the kind words!

The possibilities that come with EA Studio and FSB Pro are huge, and I am sure many traders can share different methods that they have tested and found profitable.

Anyway, I know it takes time to come up with profitable EAs, and many do not want to share their EAs. That is just fine :)

-

December 29, 2018 at 14:12 #8044

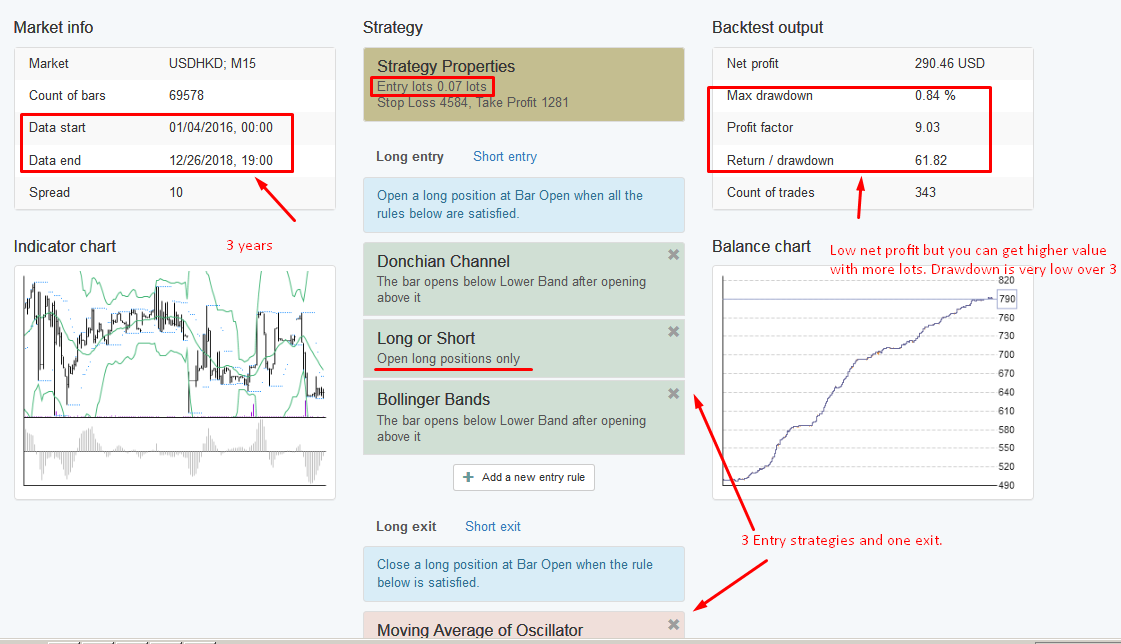

dommech

Participant -

December 29, 2018 at 17:06 #8048

Roman

ParticipantDommech,

Interesting you posted this, I was going to try and see if I could find better strategies by running long/short only entries. Have you been demo testing this yet?

-

December 29, 2018 at 18:52 #8051

Petko Aleksandrov

KeymasterHi Dommech,

Glad to see you posted a strategy.

Did you get this equity line from the Reactor or you used optimizer?

-

December 30, 2018 at 11:40 #8065

Petko Aleksandrov

KeymasterHey, I did not know there was such an indicator to add in the strategies in EA Studio!

Petko, that would be easier to add in your Expert Advisor for the Bitcoin and Ethereum never losing formula?

This way we do not need to change from the inputs of the Expert, right?

-

January 4, 2019 at 9:39 #8152

Petko Aleksandrov

KeymasterHey Bob, you are right but this way we will need 2 Expert Advisors – one for long market and one for short market :)

So instead of switching it, you will need to replace Expert Advisor, which is a bit more work.

-

January 11, 2019 at 9:43 #8366

-

January 11, 2019 at 13:54 #8369

Petko Aleksandrov

KeymasterHello Dommech,

It is available as indicator that you can add to any strategy. I think what Bob wanted to say is that we can add it to the Ethereum robot for the never losing formula, so we can trade it with the trend direction.

-

January 11, 2019 at 23:03 #8386

Petko Aleksandrov

KeymasterHey Petko,

yest I got your point. Anyway when I have the EA Studio licence I can get 2 Robot easy :)

-

January 12, 2019 at 22:58 #8409

Otis

ParticipantI am interested if forum members would be willing to share what acceptance criteria they are using to generate/filter collections in EA Studio? My approach is to try and find about 20 or so strategies with low drawdown (<20%), decent RDD (>4), low stagnation (<25%), and enough trades. I am not interested in the number of strategies but rather the quality of the strategies. In my experience finding the correct balance of not being to loose or restrictive in the acceptance criteria can save you a lot of time by generating a decent number (20-30) and that are also viable for my trading style. My approach to EA development is to focus on risk first and profits second. Like most traders I have a strong preference for smooth equity curves. The following acceptance criteria has worked well for me over the last month and typically give me a handful of solid strategies for further testing. I have noticed since the EA Studio updates I am getting fewer strategies in the generator and am in search of ways to generate more high quality strategies.

Any help is appreciated!

-

January 12, 2019 at 23:16 #8410

Petko Aleksandrov

KeymasterHello John,

Welcome to the Forum!

There is a Topic about the Acceptance criteria: What Acceptance Criteria do you guys use?

Please, copy your question there, and you will get more answers from the other student. I will remove the question from here once you copy it there.

-

January 13, 2019 at 23:40 #8439

Roman

Participant@Otis- Our searches are very similar, though I’ve added minimum win rates to help keep me sane. I am currently trading live with an EA Petko supplied in September with a 40% win rate to help stretch my tolerance levels. Going good so far after giving it 20 demo trades before the live account. 29 trades since September Net profit of $398, 13 W’s 16 L’s.

-

January 14, 2019 at 13:56 #8455

Petko Aleksandrov

KeymasterHey Roman, glad to hear that you found so profitable EA from those I share!

Now, I know we always “miss” these trades on Demo account, and not on the live, but we need to test the EAs. Anyway you wouldn’t know which one between all will work best for you.

-

January 16, 2019 at 9:14 #8500

Petko Aleksandrov

KeymasterHey Roman,

it will be great if you share which is this EA from Petko. This is the topic here :)

Thanks!

-

January 17, 2019 at 9:51 #8534

Petko Aleksandrov

KeymasterI remember I had one cryptocurrency EA before from Petko that was trading for month so so well, than it went in range – losing and profiting.

Now I am back in trading, and I will look for the next profitable EAs.

-

January 18, 2019 at 0:30 #8559

Petko Aleksandrov

KeymasterHey George,

it is all about testing and trading, tasting and trading, tasting and trading…

Sometimes we get these EAs that work with months, but not that often. :)

-

January 20, 2019 at 9:02 #8644

Petko Aleksandrov

KeymasterHi Petko,

yes I know its all about testing, but what to do…

The good thing is that by having EA Studio, when one EA stops working we can replace it quickly with another.

But that is why we need to test to make sure we have what to replace with.

-

January 21, 2019 at 23:41 #8689

Petko Aleksandrov

KeymasterYes, it is all about testing, OR you can use the method shown in Ethereum 99 EAs course where I demonstrate how to avoid the Demo testing.

This way with EA studio very quickly you can have strategies for live trading accounts.

-

January 23, 2019 at 23:03 #8731

Petko Aleksandrov

KeymasterSomeone to share a good strategy for EURGBP? :) It is hard for me to generate any…

-

January 24, 2019 at 8:15 #8740

Petko Aleksandrov

KeymasterHey Desita,

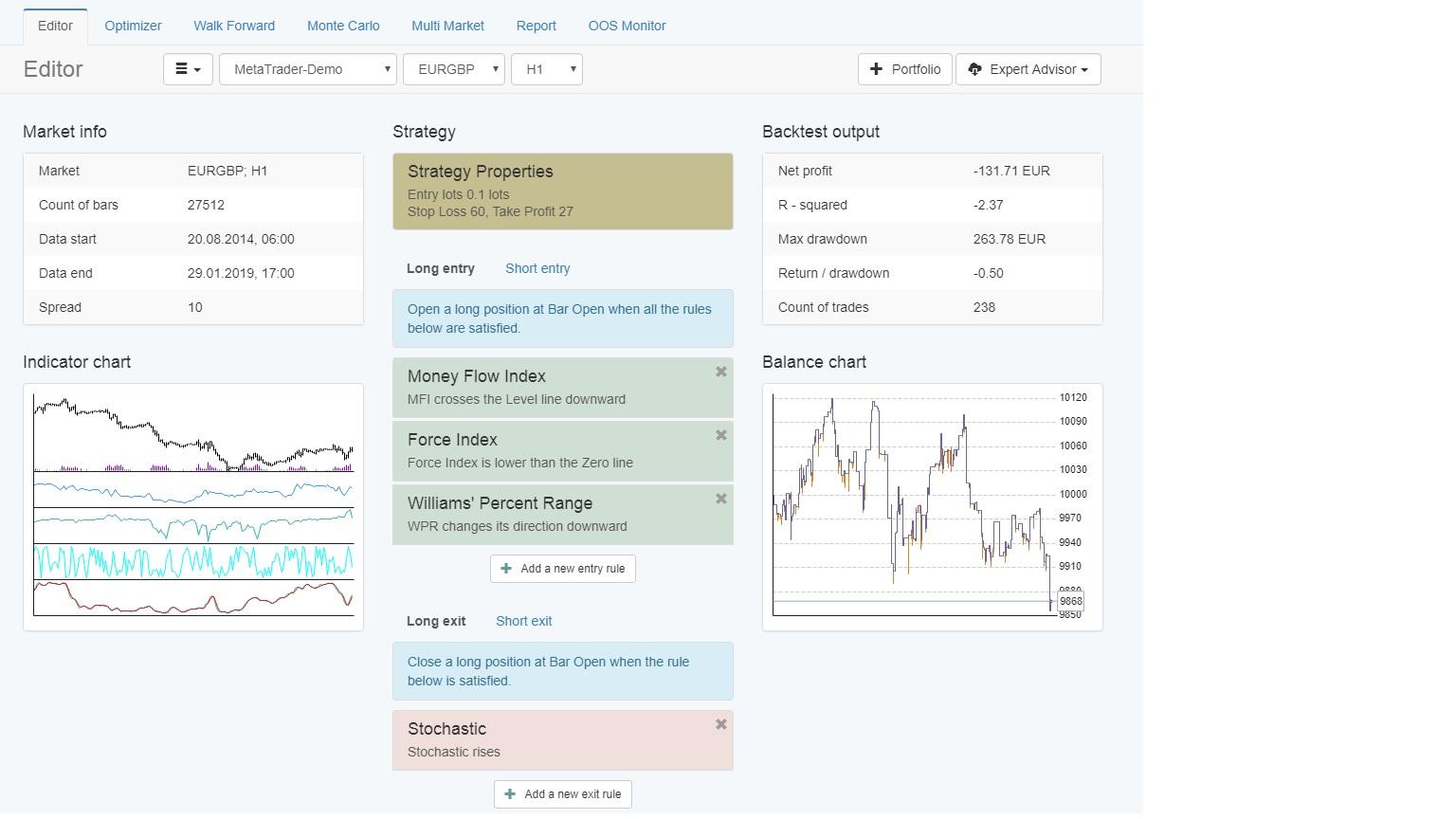

last night I saw the update from Petko about the r-squared and gave it a try with couple of generators. Surprised in the morning with the results!

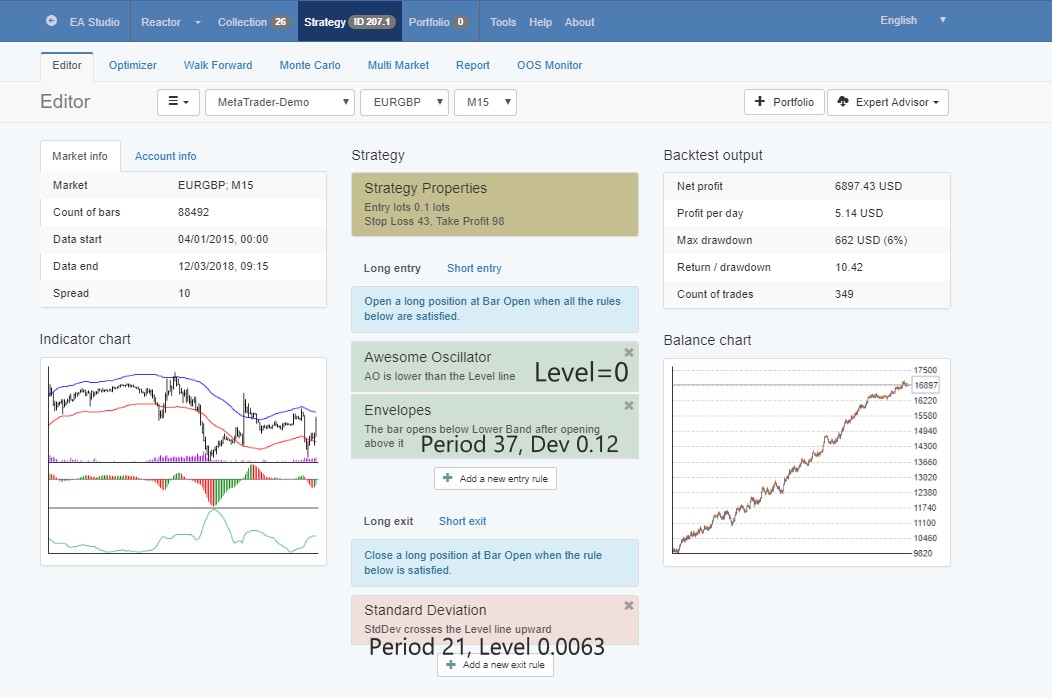

The equity lines looked great, and here is a strategy for EURGBP exactly that I have selected from about 15 generated totally:

I have written on the side the parameters, so you can place them in EA Studio and export is as EA if you want to try it of course :)

-

January 24, 2019 at 21:56 #8757

Petko Aleksandrov

KeymasterGreat you share strategy Andi! Glad to see that you included the R – squared, look at your equity line! It is great!

-

January 24, 2019 at 21:59 #8758

Petko Aleksandrov

KeymasterSo kind of you, Andi!

Thank you so much!

I have exported the strategy and placed on a Demo. The equity line is really nice. I will try generating EAs again for EURGBP, but if this one works, I will use it for sure.

Thanks again!

-

January 26, 2019 at 12:52 #8787

Petko Aleksandrov

KeymasterHello Desita,

if you can not generate EAs for some reason for any currency pair or asset, you need to find the reason for that.

What you need to do first is to remove the acceptance criteria, and run the generator. If you do not see still strategies, it means that their is an issue with your Historical data that you have imported.

If you see strategies, start setting up the acceptance criteria, but slowly. With every new criteria added, run the generator. This way you will see what is the reason for not getting strategies.

-

January 26, 2019 at 23:03 #8804

Petko Aleksandrov

KeymasterI have the EA Studio licence now, so I will export all strategies shared in the Forum, and I will see which ones will show good results with my broker.

I hope soon to be good enough to share my own Forex strategy, that others can benefit :)

-

January 27, 2019 at 10:28 #8811

Petko Aleksandrov

KeymasterInteresting Forex strategy, the becktesting with me is even better ;)

-

January 27, 2019 at 22:32 #8835

Petko Aleksandrov

KeymasterI am surprised to see such a topic in the Forum – people sharing EAs…never seen that in other forums! You guys are awesome!

-

January 28, 2019 at 14:47 #8847

Petko Aleksandrov

KeymasterHey Kiro,

Yes, it is great to share strategies. I share 100s of strategies every month in my courses, and that makes me feel great.

Glad to see that there are already users in the forum that share their strategies too.

-

January 28, 2019 at 23:00 #8866

Thomas Hainzl

ParticipantHi,

I have reconstruct Andi’s EA but I my Balance Chart went to south (meaning it was not profitable). What did I wrong?

Have inputed all parameters and indicators according to the picture.

I’m new here so maybe I made a basic error ….

Thomas

-

January 29, 2019 at 0:11 #8870

Petko Aleksandrov

KeymasterHey Thomas,

please, recheck the parameters, the time frame and the currency pair. When you are sure all is the same, switch to Meta Trader – Demo as source for your Historical data. If you see the results that Andi shares, and you do not see similar results with your broker, it means it is from the Historical data of your broker.

Check the spread also, may be is high? If all is good and just the results are different, than it is from the data. You can try to optimize the EA, and run Monte Carlo, to make sure it is not over-optimized.

Cheers,

-

January 29, 2019 at 0:17 #8871

Petko Aleksandrov

KeymasterHi Thomas,

I had to change some of the parameters to make the equity line better for my broker. When you make optimization, you should use round numbers. This trick I know from Petko, but it keeps the strategy away from over-optimization.

-

January 29, 2019 at 23:42 #8890

Thomas Hainzl

ParticipantHi Petko, hi Desita,

I have cheched the parameters but found no error. I have changed the broker to MetaTrader-Demo but the profit line is quite bad.

I think it makes no sense to optimize. So I have no clue why this is that different.

-

January 30, 2019 at 0:11 #8891

Petko Aleksandrov

KeymasterHello Thomas,

quite interesting to see such a difference with one and the same Forex strategy. There is something missing for sure.

Can you please capture the Tools – Settings that you have?

-

January 30, 2019 at 9:48 #8921

Petko Aleksandrov

KeymasterVery strange why the results is different, I tried the strategy and it was just fine.

-

January 30, 2019 at 23:25 #8937

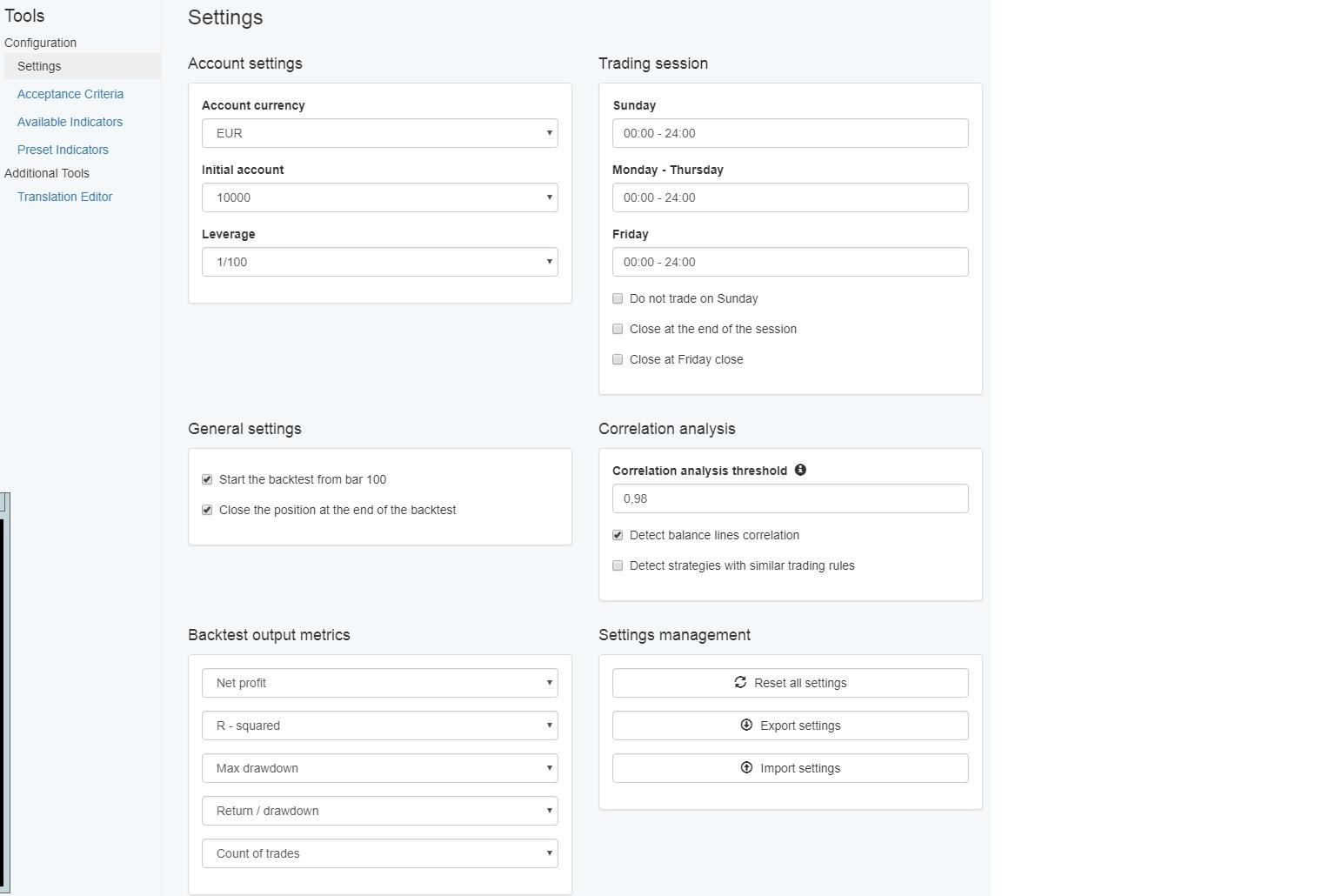

Thomas Hainzl

ParticipantHello Petko,

Here are the Tools-Settings.

And on common acceptance criteria – Complete backtest – I have minimum count of trades of 80.

Cheers

-

January 31, 2019 at 9:28 #8942

Petko Aleksandrov

KeymasterHello Thomas,

Glad to hear from you. The settings look just fine to me.

Only Do not trade on Sunday I would check. I am not sure if on the above strategy it was used or not.

-

February 1, 2019 at 16:41 #8970

Petko Aleksandrov

KeymasterHey guys,

anyone trading AUDNZD dollar? I would be happy if someone shares a strategy about the asset! :)

-

February 2, 2019 at 10:34 #8997

Petko Aleksandrov

KeymasterHey John,

let me know if you have issues generating strategies for any asset. There is always a reason for that. There could be an issue with the Historical data, but normally if you have one Forex strategy, and you look at the equity chart, and the report, you will know if the Historical data is fine.

-

February 15, 2019 at 0:11 #9648

Petko Aleksandrov

KeymasterHello All,

I would love to share a Forex strategy that I tested for some time now performs great until the moment:

You should optimize it for your broker

Here are the statistics, very stable so far:

-

February 15, 2019 at 9:28 #9657

Petko Aleksandrov

KeymasterHi Desita,

great to see you shared your Forex strategy. I like the profit and loss in currency by weekdays stats.

I am going to build it with my broker and optimize. See if it will pass the Monte Carlo and Multi Markets.

-

February 17, 2019 at 10:07 #9716

Petko Aleksandrov

KeymasterHello Desita,

I like the way you shared the Forex strategy, without the parameters. This way, everyone will know that it is important to find the parameters that work fine with the selected Forex broker.

Good job! The stats look just fine.

-

March 11, 2019 at 20:17 #10471

Deniza

ParticipantHello, I have built the strategy, and the equity line is even a bit better. Thanks for sharing!

-

March 12, 2019 at 16:57 #10493

Petko Aleksandrov

KeymasterI wish more traders share their trading strategies. It is a great way for others to test your strategy and share their experience. This way you will receive feedback for the strategy, improvements, and ideas.

-

March 13, 2019 at 8:13 #10520

Petko Aleksandrov

KeymasterYou are absolutely correct, Petko! I was thinking many times to share my strategies here, but I am afraid that they are not good enough and I might mislead someone…

-

March 14, 2019 at 9:11 #10542

Petko Aleksandrov

KeymasterEveryone understands that it is own risk to trade the EAs. Same when I share EAs in my courses, it is a personal risk for everyone to trade with them.

The idea is that when you share the strategy, more people will test it for you, and at the same time they will see a different perspective for a trading strategy.

-

April 9, 2019 at 12:35 #11114

vmazur

ParticipantHello, Petko!

I tried ea studies and it seems that service works with errors. I set one strategy, that has somei indicators for the formation of signals (in the specific case: MACD Signal, RSI). After adding a strategy to the collection, the strategy contains completely different indicators (Stochastic, Volume). How to correct the mistake?

B.R.

Vlad -

April 10, 2019 at 7:54 #11119

Petko Aleksandrov

KeymasterHello Vlad,

Do you mean that you preset some indicators? And what do you mean you added the strategy to the collection after that?

I am using EA Studio for over a year now and I never had any errors or mistakes.

-

April 10, 2019 at 8:04 #11121

Petko Aleksandrov

KeymasterVlad, I can bet you that there are no errors in the program :) You have missed something.

-

April 14, 2019 at 10:18 #11247

Petko Aleksandrov

KeymasterHey Vlad,

are you using the Preset indicators? There are no errors in EA Studio, all was fixed at the beginning. Give us more information about what you are trying to do so we can assist you.

-

June 6, 2019 at 0:08 #13063

Petko Aleksandrov

KeymasterHere is one strategy for Gold which I started to use recently and it shows fantastic results:

These are the rules:

-

June 11, 2019 at 10:34 #13378

Petko Aleksandrov

KeymasterHey Andi, the strategy looks great indeed! I see that the SL and the TP are within $100 which I really like for the Gold. Good job!

-

July 1, 2019 at 23:30 #14991

magaskuszob

ParticipantHi guys!

I have a several question about this kind of trading:

First:

What is the best method for create/learn new strategies? With a laptop (i5 3317u 2c/4th, not so fast, and hot also), or a better PC (1240 v2 xeon 4c/8th, more ram, much faster) or with a VPN server (1-4 cores. The 4 core is 4 times more money)? Now two 5000 minute “learning” is on my laptop. CPU peaks at 100%.

Second:

It the time (longer) means better strategies? Eg: Is a 2 month old strategy better than a 2 week?

Third:

Is there any required/recommended criteria? Now Im using only pin bar for long and short opening. Seems much better than a normal without any options of course.My time is kinda limited for doing it manual trading, cuz I have a lot of meeting, hand-on training as an Continuous integration engineer. So I want to create a few strategies, that has around 10%/month yield. Of course, I can manage them at the weekends and at two aftermoon in a week.

Thanks for the help, and also sorry for my english and the stupid questions.

Regards

Adam -

July 2, 2019 at 10:32 #15039

Petko Aleksandrov

KeymasterHello Adam,

no stupid questions, even I asked many at the beginning :)

There is not really a recommendation for a computer or laptop, mine is similar to yours and with EA Studio it works very fast. Simply, it works on the browser. So it does not really require a lot of resources from the computer. FSB Pro is heavier and might run slower, but just give it a try…

Regarding the strategies, it is all about generating new ones, testing them and placing the best EAs on a live account. Petko shows that in nearly all the courses. I have some EAs running profitably from 5-6 months now…but every day I run the Reactor and leave it. Put on Demo the ones I like, and then I follow results. I palce on the live the ones that perform the best. Simple as that :) Of course to get used with that it was not easy at all.

-

July 5, 2019 at 8:48 #15374

Petko Aleksandrov

KeymasterHello Adam,

Welcome to the forum. What I would suggest you is to start simple. All you need is two Meta Trader platforms which will run without an issue. In one test the strategies as a Demo account, the other for a live account where you can place the top performers from the Demo.

Of course, if you are beginner instead of live account, use another Demo(as it was your live).

Cheers,

-

July 19, 2019 at 10:45 #16319

magaskuszob

ParticipantDear Petko and all!

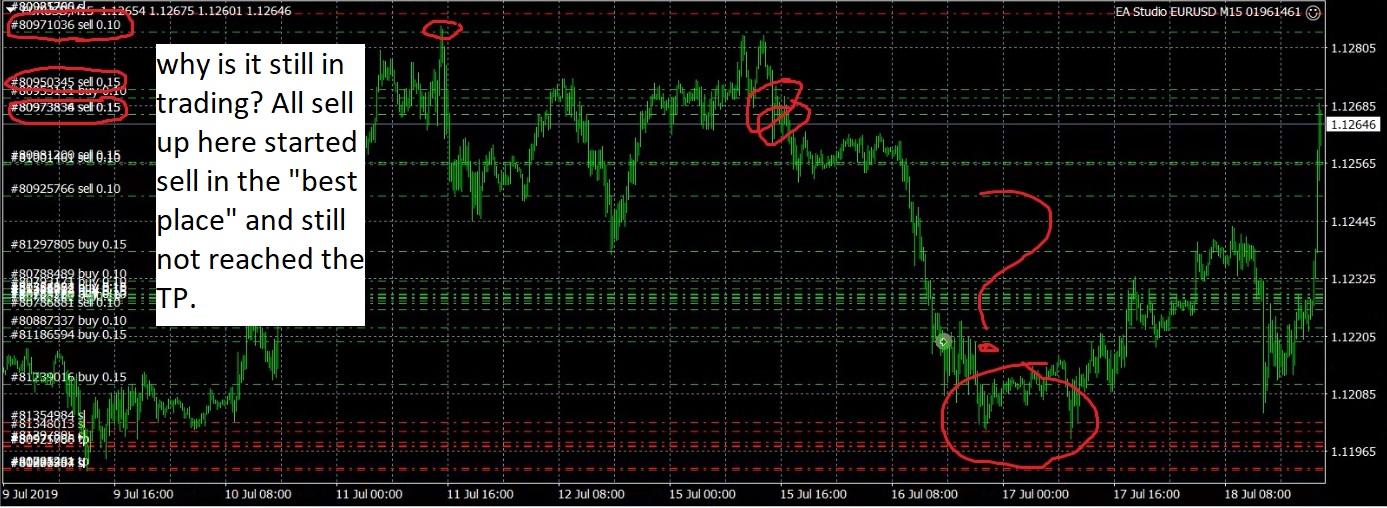

I have round 100 EA for EURUSD 15M, and 10 of them is pretty useful and works good. But… they are placing SL and TP so randomly, and always too high, or the SL much higher than the TP. There is one example:

So as you can see, the randomly generated Stop Loss and the Take Profit is so inconsistent. (by the way, this EA got around 6k profit from 300 dollars in 4 years).

So, there could be two solution:

1: Let the EA works, how it should be, and using trailing for every market and EA. There is one example, why it can be useful:

An of course, after its almost got the TP, turned around and started to go up. Zero profit from the SELLs.

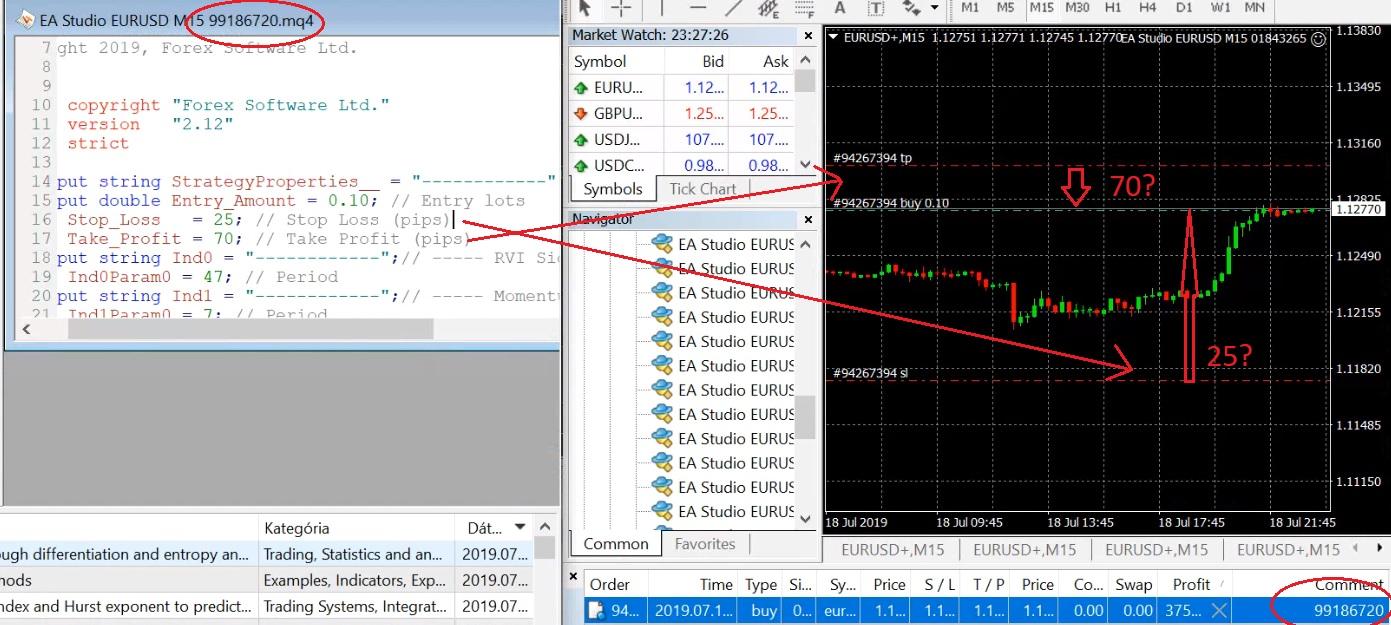

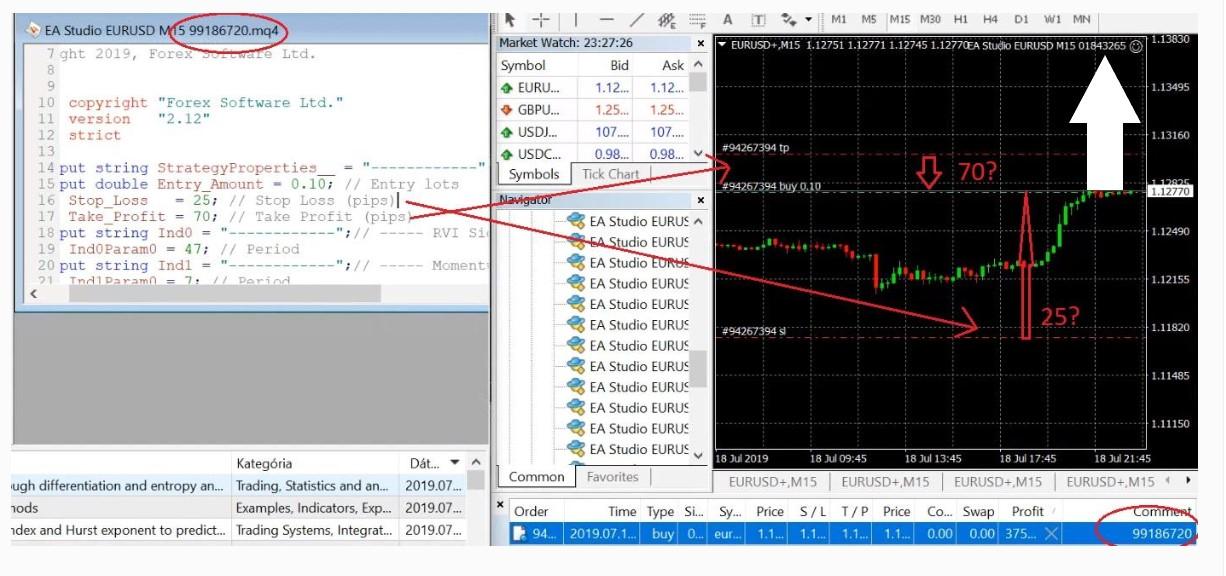

2: Manuall interraction:

I started to change every EA and SL-TP manually. Changed every SL and TP for the same amount of pip. 20-60, 25-70.

After a new minutes, its started working a little bit strange, as you can see in the picture. _

EA number same, TP and SL same, but the SL got the 70 pip, and the TP got the 25, not as I wanted.So I have 2 question about this issues:

How can we turn on the trailing manually, and how can we change the SL-TP numbers and use it in the correct way, and not like mine?For everyone:

After 1 and 2 weeks, dont say EA is bad and not works and so on. Its depends on you. Your time and the maintenance. Just take a few minutes in every week and strat to investigate, why is it not works in proper way.

On my first week, i had -1%, now I have 3-5%. Just with the manual interraction. But after this problem fixed, hopefully, It will not take hours in every day and week, just minutes, for check them.Sorry for the missspells and so on. Im in hurry and after 4 hours of sleep :D

Regards

Adam -

July 19, 2019 at 14:29 #16333

Petko Aleksandrov

KeymasterHello Adam,

thank you for writing in the Forum. Appreciate you have attached pictures which makes it easier for me and the others to see.

Now, first of all, keep in mind that this software is coded for many years now and thousands of users are using it. All bugs and mistakes were fixed long ago. Of course, its a code, there could be something always.

Now here is what you are missing:

1. The SL and TP are generated according to the Historical data you have and the acceptance criteria you have selected to use. From my experience, I saw that it does not really have to be an SL smaller then TP. I know the “old trading” rule for having Sl 3 times smaller than the TP, and many people realize it was quite wrong when using the EA Studio backtester. Of course, you can find some strategies with such SL and TP but not too many.

Now, what I see on your picture is normal. It will always happen that the price will go towards the TP and turn the other way around. But the SL and the TP are set based on many trades(not only one situation that you have in your case).

Regarding the trailing SL, you can set it when generating the strategies:

If you select to use it, all the EAs will be with a trailing SL.

2. In the second picture, you are looking at two different EAs.

On the right up corner, you have the number of the EA that is attached to the chart. In this case, it is 01843265, not 99186720.

So for me, I do not see anything wrong in the pictures you shared. Make sure you look at the right EAs.

Regards,

-

July 21, 2019 at 22:10 #16595

magaskuszob

ParticipantDear Petko and Andi!

Finally I1m here again, so I can answer.

Firstly Petko:

Trailing: I want to use it in my every EA, and coding into the EA manually. So the question is, what is the code? Or where can I turn it on?

I find this code, okay, now its false, so not works. I have to change it to “true”, then give pips, digits and so on for being useful.

Is there any “magic numbers” for this? eg. after every 20 pip, follow the current price, and so on.Anothe one: The picture.

Yes. Im watching every EA in one window, but nonsense where. It showes every currently workin’ EA. So, it nonsense what is in the corner. If u check the comment/number, it showes the exact trading.Andi: Cuz a few of them are so dumb. 130 on SL and 80 on tp, and every trade is on SL after 2 weeks.

I only checked the best profit instead of robostusness and RR. For me, three trade with profit and one with closed sl is much better, than that one, which trade 3 sl and 2 tp. Maybe the 2 TP givesm ore money, but I cannot trust on them. There is a lot of good open, but not good levels. As you can see my 2nd pcture from the previous comment, at least 4 sell did great, but never closed. Cut too damn high TP lvl. Same for the SL. around 20-35 pip is good for SL, but I just want to test them for a few weeks. Same for the TP. Fistly, I will use 60, then more, or less, but the 80/120, like a few, is not good.

“I see you are putting some manual trading emotions in your EA Trading.”

Yes, as I mentioned, a lot of good lvl, good opening, but not goot tp and sl. I had to change. But yes, my goal is get a few working as well. but I fix them for myself.Adam

-

-

July 19, 2019 at 14:37 #16336

Petko Aleksandrov

KeymasterHi Adam,

why do you want to change the SL and TP manually? There is no sense in this. if you want to use exact SL and TP for your EAs you can set them in the strategy and optimize the other parameters with the Optimizer. But if you have a generated strategy and after that, you change the SL and the TP do you get better results with EA Studio backtest? I doubt it…

I see you are putting some manual trading emotions in your EA Trading. i guess everyone does that at the beginning. If the price reaches towards the TP, you should not hurry to close the trade or to get angry if the price gets the other way. That is exactly what causes manual traders to lose.

Leave the EAs do their work, and just monitor them on Demo and live account. if you see which ones are profitable(as you have some already) you can place them on a live.

Have a nice weekend!

-

July 22, 2019 at 8:24 #16617

Petko Aleksandrov

KeymasterHello Adam,

When you generate the EAs you can set up the range for the SL and the TP. r you can choose exact values to use.

Look at the first picture from Petko, you can see min and max in pips. The EA Studio does not give you 80/120 alone, you have set it this way in the first place(maybe you did a huge range and it found the best parameters). For me, these are not bad levels by the way. You make conclusions too quick just from a couple of weeks.

Once again, if you want to use precise levels in SL and TP, you can set it there, and all generated EAs will use those levels.

-

July 22, 2019 at 8:53 #16622

magaskuszob

ParticipantGood morning!

Yes, I see. But can I retrain my all existing EA? I had to start a new training session, same setup as before, but now all of them with trailing, and not as optional.

When you generate the EAs you can set up the range for the SL and the TP. r you can choose exact values to use.

Yes, I have 2 selection. One with “bad” SL-TP and net profit (as I mentioned, 120-80, or even worse, 120 for sl, and 80 for tp, just as an example. Net profit not above 5500 dollar from 300 dollar.)

Another selection SP and TP range is: 10-30 and 70-120 (the lowest had 6k from 300, the highest one 10066 from 300, 0.15 lot). And now, I want to turn on the trailing for these. But probably, If I get only one with these parameters, I can change my all EA on code lvl. I have the original selection, so its not matter.Adam

-

-

July 22, 2019 at 9:00 #16623

magaskuszob

ParticipantAnd I forgot to metion, my 14 day long test is expired. I bought 2 udemy courses, but I cannot make an another one.

-

July 22, 2019 at 14:56 #16636

Petko Aleksandrov

KeymasterHello Adam,

For me is hard to understand what you want to do or at least I do not see your logic. You want to change the EAs you have already with Trailing SL, am I right? If you do, this will totally change your strategy backtest. As Andi said you can not make a conclusion from a couple of trades opened if it will be better with trailing or not.

What do you mean you have “bad” SL-TP?

-

July 22, 2019 at 15:27 #16637

magaskuszob

ParticipantDear Travis

So i write it down without any information:

I have around 100 EA, half of them with 30-100 SL – TP ratio, another half with 80-120. (around)

I don’t have trailing, but I want to hardcode into everz EA by myself. I want that code part.

I want optimalise every AE for myself at deep code lvl, change the SL-TP and trailing.At the morning, I found a few trailing EA that can work on every another EA, and thats all. I can train them also for myself and change it by my hands. So I have a solution for this problem.

And now, my problem is in my first picture, as I rememben.

The sale and the TP numbers swapped, and everything works inverse. But why? Noone answered this question, only noticed another not valid problem.Adam

-

July 23, 2019 at 5:40 #16673

Petko Aleksandrov

KeymasterHello Adam,

yes, there are such EAs and scripts for trailing the SL that you can apply to any Expert Advisor. This will be the easiest way for you if you want to put different SL and TP. Keep in mind that as Travis said, it will change your backtest which means that you will not have the same performance from what you saw in EA Studio when generating the strategies.

Regarding the first picture, again I say you are looking at different EAs.

Look at the right up corner where is the smiley face and the magic number of the EA( I place a big white arrow). It is a different number from what you see in the code. Simply you look at different EAs with different SL and TP.

The function of the SL and TP works just fine, all bugs and mistakes were fixed long ago.

However, if you still can not see it properly, let me know and I can have a quick skype look at your screen and make it clearer for you.

Kind regards,

Petko A

-

July 23, 2019 at 8:37 #16684

magaskuszob

ParticipantDear Petko!

I changed the sl-tp, and only change in one code is not enough, Its needed 2 times in a code and one times in the MT4. So This is not a issue anymore. Thats why it worked not as it had to be.

I have a trailing EA, but its doing nothing right now, probably the setup is not goot, but I will look for an another one tomorrow.

Or is it possible to trun the trailing on in every trading? Cuz the built-in works properly and following as it sould be. -

July 23, 2019 at 21:44 #16732

Andi

MemberHi Adam,

the trailing SL in EA Studio for the EAs works great. I would not really bother the code( I know some basic MQL but not enough to mess it).

So what I would if I were you is to generate EAs with trailing SL in the generator settings. This way you will assure you do not have problems, no need for additional EAs.

-

August 4, 2019 at 20:40 #17403

Petko Aleksandrov

KeymasterI would suggest you do the same as Andi. Generate EAs with trailing SL and you will not have issues.

Or just build your ones with Trailing.

Cheers,

-

November 22, 2019 at 15:39 #27754

champagnelennie44

ParticipantGood advice, thanks.

-

December 30, 2019 at 9:25 #32946

Meryjonestexas

ParticipantI think it would be awesome to renew this topic and share some EAs with each other. I am currently in generating very nice set up in EA Studio, very strict acceptance criteria and I will share a complete collection in here, so the new traders can choose which EAs to use.

-

January 2, 2020 at 12:33 #33329

Petko Aleksandrov

KeymasterI am looking for that, Mery! I will support you as well with some Forex EAs to share in here

And Happy New Year!!!

-

January 5, 2020 at 1:23 #33668

gianlucaforextrading

Participant<p style=”text-align: left;”><span style=”vertical-align: inherit;”><span style=”vertical-align: inherit;”>Ciao Petko, ciao commercianti. </span><span style=”vertical-align: inherit;”>C’è un EA che non ho. </span><span style=”vertical-align: inherit;”>O meglio: nel mio FX blu c’è un EA che sta aprendo operazioni e facendo soldi. </span><span style=”vertical-align: inherit;”>Il numero magico è 68844071. Ma guardo nei miei EA, nei miei grafici e non ho questo numero magico. </span><span style=”vertical-align: inherit;”>Certo, sto parlando del mio account sui corsi Petko. </span><span style=”vertical-align: inherit;”>Petko, puoi aiutarmi? </span><span style=”vertical-align: inherit;”>Grazie</span></span></p>

-

January 6, 2020 at 4:43 #33729

gianlucaforextrading

ParticipantHi Petko. Sorry for that post, it was the automatic translation. i was talking about an EA, very profitable, with magic number 68844071. The problem is that it is gaining a lot of money, but i don’t know who it is. Better: in my fx blue, i see the EA with this magic number gaining money, but in my mt4, i haven’t EAs with this magic number. The problem could be that in the mql4 code, there is this magic number, but in the inputs another one. Can you help to know this EA? Thanks

-

January 22, 2020 at 21:28 #35582

adc

MemberHi Petko, hello guys, I’m new here, I’m Petko student with Bitcoin, Ethereum, Walk forward, Dow Jones, Gold and the never loosing formula.

I saw many of your posts, the sharing is great! I was thinking… since there are many of us taking the courses and building and testing EA’s, could it be a good idea to make a super portfolio all together and keep it updated in a monthly basis? we could share the work load and make the most of our resources (VPS for demos, analysis time, etc.) we could do it in this forum for bitcoin and Ethereum for instance and use another forum for gold, dow jones, etc. or in this same forum if Petko approves,

What do you guys think?

If you like the idea we could start by discussing a homologous acceptation criterion for the EAs, my suggestion would be: to keep the ones that prove to be consistent profitable (have weekly net gains) every week (more than 4 weeks and then keep being profitable every week) and sort them by profit factor.

-

January 27, 2020 at 10:32 #36127

Andi

MemberHello, Adc,

Glad to hear that someone wants to share. I was sharing a lot before, but I did not see an honest response from the others to share as well.

Anyway, your idea is awesome and we can think about it. But it is not that simple to create such a super portfolio.

The first issue is that everyone uses a different broker. That is why we can not have a portfolio of many EAs that will perform equally in the backtest for everyone.

Second, the most reliable test would be if we place all these EAs trading in one account, which is nearly impossible.

Third, I do not think Petko will mind having such a basket of EAs, but we will have to ask his team to create some kind of app or a page on the website where everyone can place his best EAs that fit any acceptance criteria. Anyway, if we write in the forum and attach them in here, people will have to look in previous pages. They won’t know from where to start and so on…

Not a bad idea, but again its a lot of thing to think about.

-

January 27, 2020 at 18:35 #36167

adc

MemberHello Andi,

Thanks for your asnwer, as you said, we should think this over, I have some thoughts on your ideas:

“The first issue is that everyone uses a different broker. That is why we can not have a portfolio of many EAs that will perform equally in the backtest for everyone.”

You are right, but I think we can find a solution, here’s one idea: we could discuss which broker to use to formulate the super portfolio and this discussion could be based under the merit of broker features and trustworthiness. In order to keep it short we can decide to dedicate a week or so to this topic, come up with a decision and ask everyone who wants to get involved to get a demo account with this broker. As an alternative we can just work with the broker that EA Forex Academy works to backtest the super-portfolio so nobody has stings attached and understand that there will be differences based on the broker each one uses (or chose to work with this specific broker) What do you guys think?

“Second, the most reliable test would be if we place all these EAs trading in one account, which is nearly impossible.”

Agree, but for this we can just define a maximum amount of robots to use so they wont exceede the max 99 that are allow in mt4, as an alternative we can just wrapp them up in a single portfolio per month using Expert Avdisor Studio. Alternatively we can start just with bitcoin. what do you guys think?

“Third, I do not think Petko will mind having such a basket of EAs, but we will have to ask his team to create some kind of app or a page on the website where everyone can place his best EAs that fit any acceptance criteria. Anyway, if we write in the forum and attach them in here, people will have to look in previous pages. They won’t know from where to start and so on…”

Great idea, what do you think Petko, could it be possible to have such a space in your web? or should we just add a new forum under the tilte “montly super portfolio” and post every month outcome there?

What do you think guys is it worth it to give it a try? in Mexico we have a say “La unión hace la fuerza” that would translate as “strength through unity” do you think we could apply it to this and make the most of our time and resources?

-

January 29, 2020 at 10:11 #36264

Thapelo

ParticipantThis is a fantastic idea!

I think this will be useful to everyone, and it will save so much time…

Cheers,

-

January 30, 2020 at 19:51 #36346

Petko Aleksandrov

KeymasterHey guys!

That is a great idea that we have been actually discussing with Mr Popov from Forex Software.

Andi is correct, it is not that simple but hopefully, we will have such a pool where we can have top EAs from the users of EA Studio and FSB Pro.

Actually it will be much more, to show statistics of the strategies, reports and actual trading results

I do not want to give a lot of details because it is still in developing, but hopefully it will be ready soon.

Cheers,

-

February 6, 2020 at 0:02 #36790

adc

MemberHello Petko,

That’s great news, will it be available also for your students? I havent buy ea-studio, im only using the ea’s you share with us.

Arturo

-

February 7, 2020 at 9:38 #36902

Meryjonestexas

ParticipantThis is really nice to hear. I will be looking forward to it.

-

February 7, 2020 at 10:14 #36907

Meryjonestexas

ParticipantHello Arturo,

Glad to hear from you. I can not say just because I do not know yet :) It is still in the to-do list so many things might change.

Anyway, I always do my best to get something more for our students, discount or anything else. So yeah, you will have something more for sure…

-

February 13, 2020 at 10:46 #37843

mohamin9974

Memberhi can help me to modify that ea for exite aoutomatic

-

February 13, 2020 at 14:05 #37851

Petko Aleksandrov

KeymasterHello Mohamin,

Which EA are you talking about? Can you give some more information?

-

July 15, 2020 at 1:20 #54104

Kamil

MemberHello Everyone,

Am new into this forum and i greatly believe in the EA trading but considering the fact that am from Africa; Nigeria to be precise. the exchange rate here is crazy. i will be glad if you guys can share your winning EA strategies (links) pending the time i develop mine & subscribe.

GBPUSD

EURUSD

GBPJPY etc

Many thanks

-

July 19, 2020 at 12:15 #54321

Petko Aleksandrov

KeymasterHello Kamil,

Glad to hear that you are interested to trade.

This is one of the first topics we had in the Forum, but it turned out that the traders do not really want to share their trading strategies. And that is understandable. This is why I include many EAs in the courses so the beginner traders can test and trade them.

Also, you can have a look at the free course for EA Studio:

https://eatradingacademy.com/courses/algorithmic-trading/online-trading-course-ea-studio-start-up/

You can test the EA Studio to generate EAs for 15 days, and you can use these EAs lifetime.

-

July 24, 2020 at 9:35 #55095

jospjn

MemberDear Petko,

I was using Expert Advisor like on your tutorial (Trading Portfolio Expert Advisors+100Eur/USD Strategies) I used the Reactor for the Metatrader-demo M15 however unlike your tutorial I got 2 that passed the generator and 0 that passed the Montecarlo. Using the same criterias you got 363 that passed the generator and 114 that passed the Montecarlo am I doing something wrong?

-

July 25, 2020 at 18:24 #55283

Petko Aleksandrov

KeymasterHello Jospjn,

Most probably this is because of the Historical data that you used.

Which is the broker you have selected to use and how many bars you had? And on which time frames?

Send me some screenshots from your generator so I can see better.

Cheers,

-

July 27, 2020 at 11:27 #55385

jospjn

MemberHi Petko,

Thanks for your reply well, these days I discovered that the historical data must match the broker both in Time and specifications for the particular currency pair.

I am reloading the data for 4 brokers at the moment which are IC Markets, JFD, Dukascopy and Blueberry Markets I want to test them all to see what outputs they will give me. Do you think this is a good idea?

I had two question about the times in GMT which I posted in another topic,

-Do we need to constantly update this data periodically (Say every 6 months or so)?

-Do we need to update the data for the broker when winter time comes due to the daylight savings?

Thanks again

Jos

-

July 28, 2020 at 22:31 #55452

fxtadeusz

MemberMaybe I didn’t add it here

Nobody puts the results here,

maybe I’ll start.

8 days without optimizer.

good result for me. -

July 29, 2020 at 17:09 #55484

jospjn

MemberHi Petko,

Thanks for your reply well, these days I discovered that the historical data must match the broker both in Time and specifications for the particular currency pair.

I am reloading the data for 4 brokers at the moment which are IC Markets, JFD, Dukascopy and Blueberry Markets I want to test them all to see what outputs they will give me. Do you think this is a good idea?

I had two question about the times in GMT which I posted in another topic,

-Do we need to constantly update this data periodically (Say every 6 months or so)?

-Do we need to update the data for the broker when winter time comes due to the daylight savings?

Thanks again

Jos

-

July 30, 2020 at 8:43 #55549

Petko Aleksandrov

KeymasterHello Fxtdeusz !

It is great if you share results. I asked at the beginning many times the students to start sharing results because this way it is useful for everyone.

Everyone can see how others are doing, and I can see how the EAs that I provide are doing on different brokers. Because I can not really test on many different brokers, just a few.

So do not hesitate to share results no matter good or bad! It is always useful!

Cheers,

-

July 30, 2020 at 8:46 #55550

Petko Aleksandrov

KeymasterHello Jospjn,

It is a fantastic idea to test a few different brokers. And as well I would appreciate it if you share with us which broker showed the best results.

Of course, if you want to compare them you need to generate EAs using each brokers’ data but test them on all brokers.

This is something we prepare to show in the upcoming course.

Cheers,

-

February 28, 2022 at 18:22 #110391

Petko Aleksandrov

KeymasterGuys, wake up here! Share your strategies and EAs :)

-

March 30, 2022 at 10:23 #110509

Samuel Jackson

ModeratorI’ll add one, see if I can get the ball rolling ;-)

Its a SUPER simple one, I created it manually (i.e. no generator) and each indicator setting has default settings. Optimization didn’t result in huge improvement so I left it unoptimized.

I ran a monte carlo with 40 tests on changing indicator parameters only and they all passed (Repeated this 3x), I also checked that it performed well on several uploaded data from different brokers over the period above which it did.

I created it using the end date of about 6 months ago (Doing the steps described above) and then tested it on the most recent 6 months that I had kept up my sleeve and again it performed well on all the brokers data (5 other brokers data including Premium and Metatrader data).

Its definitely not making loads of trades but I think since its been checked on several different brokers data that can consider the trade count in term of how many trades it performed well on, considerably higher then the 108 over the 5 years as shown?

For the premium data shown spread is 10, commission is 7 and swap is -5 and -2.

I’ll aim to add something more exciting soon, just thought I’d try and kick things off. Looking forward to seeing some strategies others have created :-)

-

March 30, 2022 at 10:25 #114320

Petko Aleksandrov

KeymasterHey Samuel,

Great strategy! It’s nice you did it manually, without the generator. This means you know the indicators and the logic behind them.

I like also that you used a big SL so you give chance to the trades.

Let me know how it goes when you are trading the strategy.

-

April 5, 2022 at 3:13 #114656

Samuel Jackson

ModeratorHi Petko,

I traded the strategy on a dukascopy demo account for a month along with many other strategies (Dukascopy demos expire after 2 weeks but I requested one that doesn’t expire, when I opened a live account with them :-).

It only made a single trade for a small profit but that was to be expected from the numbers shown in my previous post (Average trade of 483/108 = 4.47). Reading this into EA studio also confirms that this profit was made with very little drawdown as shown below (No doubt there was a bit of intrabar drawdown but EA studio shows zero drawdown which is good).

Yeah gave it a large stop loss level as you say. I just wanted to give the indicators room to do their job and from looking at the journal really there were very little trades closing via stop loss or take profit but rather just from the indicator signals which was the intention (and also what happened with the trade on demo).

I’m no expert on all the indicators but I do like to have a very quick scan to make sure there are no super obvious red flags in the strategy, like buying long when it looks to me like the entry rules would better suit a short position for example (for ranging strategies). EA studio of course generates sensible strategies but sometimes I like to just target ranging strategies so like to remove anything that obviously looks like a trending strategy and vice versa, also if a strategy is too complicated or doesn’t make sense to me at a reasonably quick glance I’d rather avoid it even if it probably is fine.

As I said this one was a super simple un-exciting strategy created manually. But this week I will add one that is showing a much more impressive equity curve and has been generated and tested though the reactor that can hopefully result in a few more trades and a larger profit.

Of course there are never any guarantees especially with a signal strategy as it could be a great strategy but just going though a losing phase for a few weeks, that’s why trading lots of strategies is so important.

-

April 8, 2022 at 9:43 #114808

Samuel Jackson

ModeratorHi, as promised this strategy is a bit more exciting :-). It traded last month making 7 profitable trades and no losers which is a great result (although may mean that it could be due a less good month up coming but I’m gonna leave it running).

I created it using the reactor with all the principles learned from Petkos courses applied.

It has a higher stop loss than take profit which I like (As I find the same thing as Petko in that this often results in a better strategy closing more profitable trades than the reverse), the trading logic is reasonable to me, it has a nice equity line both in IS and OOS (10%) and has made lots of trades with an excellent return/drawdown ratio.

I also like that it is a simple strategy with 2 entries and a single exit condition. Last month 2 of the trades hit the take profit and 5 used the exit condition to exit the trade for a profit so also has sensible take profit level :-)

As to the parameters:

– The CCI entry period is 48 and level is 195 (Apply to Typical)

– Envelopes Period is 28 and deviation is 0.56 (Apply to Close and use simple MA method)

– Awesome Oscillator level = 0.00

Good luck to anyone who wants to trade it, let me know how it goes (On demo first of course!)

Hopefully this thread picks up and we can all get some good strategies shared around and see and discuss what’s working well for each other.

-

April 8, 2022 at 9:46 #114810

Samuel Jackson

ModeratorI’ll let you’s know how this one trades in a months time and share another strategy if this thread is getting some interest :-)

-

November 5, 2024 at 11:02 #375362

Abhi Ram

ParticipantChoosing between a Forex strategy, a Forex EA (Expert Advisor), or a cryptocurrency EA depends on your trading goals, experience, and time commitment. A manual Forex strategy gives you control and flexibility, letting you adapt to market changes in real-time, but it requires market knowledge and consistent monitoring. A Forex EA, on the other hand, is automated, executing trades based on pre-set parameters and reducing the time spent on manual analysis. Similarly, a cryptocurrency EA can help navigate the often-volatile crypto markets without constant oversight. Ultimately, each option has its pros and cons, so it’s best to test and see which approach aligns with your trading style and goals.

-

-

AuthorPosts

- You must be logged in to reply to this topic.