When you participate in the financial markets, one of the most popular ways to gain profit is buying and selling different currencies. There are several categories of currency pairs but one of them stands out – major currency pairs. They are the most actively traded combinations, forming the backbone of global currency exchanges. Understanding major currency pairs is essential for traders aiming to manage the market’s unique challenges. In this article we will explain what these pairs are and why they’re preferred. Also how they can you trade them effectively with Expert Advisors. We will offer insights valuable to both new and experienced traders.

Table of Contents:

- What are Major Currency Pairs in the Forex Market

- List of Major Currency Pairs

- Are Commodity Currencies Also Major Currency Pairs

- Why Trade Major Currency Pairs

- Algorithmic Trading with Major Currency Pairs

- How to Trade Major Currency Pairs with Expert Advisors

- What Should You Know About Trading Major Pairs

What are Major Currency Pairs in the Forex Market

Major currency pairs refer to the most commonly traded currencies globally. Each pair represents a unique combination of currencies, with the United States dollar (USD) as either the base or quote currency in most cases. They account for the majority of daily forex trading volume due to their stability, economic influence, and the frequent flow of trading between nations. Key characteristics include:

- High Liquidity: Major pairs have high market liquidity, meaning they’re traded with ease and at stable prices. This helps traders execute trades faster and at predictable prices, which can be critical for profitability.

- Lower Transaction Costs: Major pairs generally have tighter spreads compared to other pairs (e.g., minor or cross-currency pairs), reducing the cost of trading and maximizing potential profit margins.

- Market Influence: Currency pairs like EUR/USD or USD/JPY are indicators of economic trends, impacted by monetary policy, GDP data, and global trade.

A traded currency pair represents the value of one currency against another, with the first currency known as the base currency and the second as the quote currency. For instance, in the EUR/USD forex pair, the euro is the base currency, while the U.S. dollar is the quote currency.

These pairs are considered major due to their widespread acceptance and usage in global trade and finance. The presence of the U.S. dollar in most of these pairs reflects its status as the world’s primary reserve currency. This only further highlight the importance of these currency combinations. The high trading volumes associated with the seven major pairs also contribute to their classification as major. They are frequently traded in both retail and institutional markets. This liquidity ensures that traders can execute their orders with minimal slippage, making them highly desirable for forex transactions.

List of Major Currency Pairs

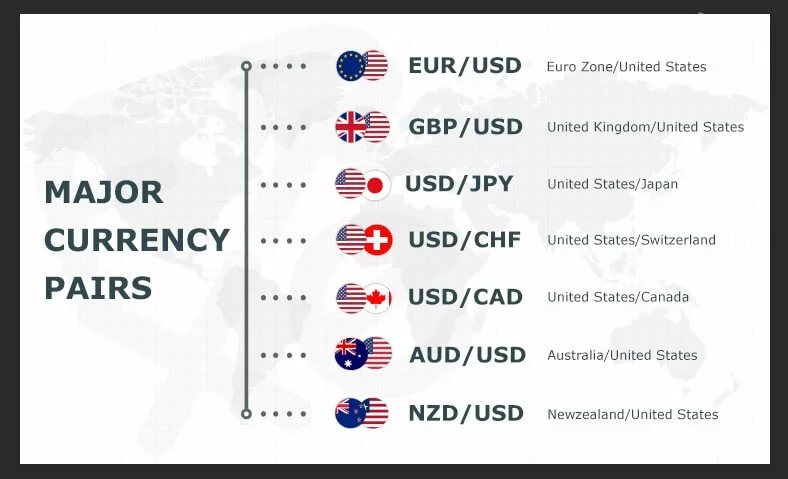

Major currency pairs are the most traded pairs in the Forex market, representing the currencies of the world’s largest economies. These pairs typically include the US Dollar (USD) and a currency from a major economy such as the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), or Swiss Franc (CHF).

There are four primary major currency pairs:

- EUR/USD (Euro/US Dollar): The most traded currency pair, representing over 20% of daily Forex transactions. Its high volume makes it cost-effective with narrow spreads.

- USD/JPY (US Dollar/Japanese Yen): Known as a “safe haven” currency, the Yen is often bought during times of global instability. This makes it a reliable pair for volatility.

- GBP/USD (British Pound/US Dollar): This pair is known for its volatility, especially following geopolitical shifts like Brexit.

- USD/CHF (US Dollar/Swiss Franc): The Swiss Franc is also seen as a safe haven. It often attracts investments in times of market uncertainty.

Want to save countless hours demo trading and but at the same time stay safe and profitable while trading ? Solution is effective automation! The Top 10 Robots App offers expertly designed robots tailored to each of the top 4 major currency pairs—EUR/USD, USD/JPY, GBP/USD, and USD/CHF. With these optimized robots, traders eliminate the lengthy process of demo trading, as each robot has been thoroughly tested and refined for immediate use. Whether you’re a beginner or an advanced trader, these robots handle the complexities of strategy execution, allowing you to focus on growing your portfolio confidently.

Check out this video to find our how to select the robots, which you can put directly on live account.

Are Commodity Currencies Also Major Currency Pairs

Commodity currencies are currencies from countries that are rich in natural resources and where the economy is significantly influenced by the export of those commodities. While often grouped with majors, commodity pairs like AUD/USD (Australian Dollar/US Dollar), NZD/USD (New Zealand Dollar/US Dollar), and USD/CAD (US Dollar/Canadian Dollar) are slightly different. These economies rely heavily on commodity exports (such as oil, gold, and agricultural products). This makes them more sensitive to global commodity price changes. For instance, a rise in oil prices typically strengthens the Canadian dollar because Canada is one of the largest oil exporters. Similarly, an increase in gold prices can bolster the Australian dollar. Although not part of the “Top 4,” they are popular choices due to their volatility and unique trading characteristics. Traders must consider the impact of commodity price movements on these currencies when trading major pairs that include commodity currencies.

Why Trade Major Currency Pairs

Trading major currency pairs offers numerous advantages for forex traders. The primary reason for trading these pairs is the liquidity they provide, which allows for quick entry and exit from trades without substantial price fluctuations. Additionally, well-known economic indicators often influence major pairs. This makes it easier for traders to anticipate price movements based on economic news releases. Their popularity also leads to a wealth of available resources, including analysis, trading strategies, and educational materials that support traders in their endeavors. Moreover, major pairs often serve as a benchmark for assessing the performance of other currency pairs, making them essential for any comprehensive forex trading strategy.

Benefits of Trading Major Currency Pairs

- High Liquidity and Narrow Spreads: Major currency pairs offer high liquidity, which allows for fast trade execution with reduced price fluctuations. This liquidity also means that the difference between the bid and ask prices—known as the spread—is typically narrower, minimizing trading costs.

- Lower Transaction Costs: For high-frequency traders and beginners, lower spreads mean lower fees, making trades more affordable and profit margins potentially higher. This aspect is especially beneficial for traders who place multiple orders daily, to keep costs to a minimum.

- Market Predictability and Stability: Due to the economic strength behind each currency in the major pairs, their movements tend to be more predictable. For instance, changes in interest rates by central banks like the Federal Reserve often affect pairs like EUR/USD or USD/JPY in anticipated ways, making them manageable for traders.

- Accessibility to Resources and Data: With their widespread use, major currency pairs have extensive coverage from analysts and research firms. This access simplifies decision-making, allowing traders to leverage professional insights and historical data for trend analysis and strategy planning.

Trading major pairs can be highly efficient and cost-effective, especially for traders who prioritize consistent performance and access to data. This is why these pairs remain a popular choice for both new and professional Forex traders.

Algorithmic Trading with Major Currency Pairs

Algorithmic trading involves using automated systems, like Expert Advisors, to execute trades based on set criteria. Major currency pairs are well-suited for this approach due to their high liquidity and tighter spreads, supporting rapid trade execution without high transaction costs.

Benefits of Using Expert Advisors on Major Pairs

- Precision and Consistency: EAs follow predefined rules without emotional interference, ensuring consistent strategy application.

- Reduced Slippage and Transaction Costs: Major pairs have high liquidity, which minimizes slippage and reduces spreads, allowing EAs to operate more effectively.

- Market Access: EAs can monitor markets around the clock, executing trades on your behalf, ideal for active markets like the EUR/USD and USD/JPY.

How to Trade Major Currency Pairs with Expert Advisors

Using Expert Advisors (EAs) to trade major currency pairs can streamline the process and offer consistency in execution.

Step-by-step guide to getting started

Step 1: Choosing a Reliable EA Provider

Look for reputable platforms that offer high-quality EAs, such as EA Trading Academy. A trustworthy provider will offer detailed information on backtesting and performance records, so you can choose an EA suited to your strategy. Reviews and community feedback are also valuable when evaluating providers, as they reflect real-world performance.

Step 2: Pair-Specific EAs

Many EAs are designed with specific currency pairs in mind, tailored to match each pair’s typical market behavior. For example, an EA optimized for EUR/USD might focus on low volatility and steady trends, while one for GBP/USD may handle higher volatility. This customization allows you to align your EAs with the unique trading characteristics of each major currency pair.

Step 3: Backtesting for Accuracy

Backtesting is crucial to see how your EA performs over historical data before using it in a live account. Backtest each EA on historical data specific to your chosen major currency pairs to verify its accuracy and risk-adjusted returns. Look for patterns in performance during different market conditions (e.g., high and low volatility), as this gives insight into how the EA might respond to current market trends.

Step 4: Adjusting Settings for Your Risk Profile

Most EAs allow customization for individual risk preferences. Set parameters like stop-loss and take-profit levels to control risk. For major pairs, setting a tight stop-loss may be feasible due to lower volatility compared to cross-currency pairs. Leverage settings should also align with your risk tolerance; higher leverage can increase returns but also potential losses.

Step 5: Monitoring and Ongoing Optimization

While EAs operate automatically, periodic checks ensure they remain aligned with your strategy. Market conditions change over time, and factors like economic policy shifts or global events can impact even the most liquid major pairs. Regularly monitor your EAs’ performance and make adjustments as necessary, especially if spreads or volatility begin to deviate from typical levels.

Additional Tips

Utilize demo accounts to test your settings risk-free. Many brokers offer demo environments where you can run your EA and observe its behavior without real capital at stake.

Major pairs typically experience lower slippage and smaller spreads, which EAs can capitalize on. Ensure your broker offers competitive spreads for major pairs, as this can significantly impact EA performance.

The spread is the difference between the Bid and the Ask price, this is what the brokers benefit and this is what we pay when we are buying and selling currencies on the Forex market.

What Should You Know About Trading Major Pairs

Common Strategies for Trading Major Currency Pairs

When trading major currency pairs, it is essential to employ well-defined trading strategies that align with market conditions. Common strategies include trend following, where traders identify and follow the prevailing market direction, and range trading, which involves buying and selling within defined support and resistance levels. Another popular approach is the carry trade, where traders borrow in a low-interest currency to invest in a higher-interest currency, capitalizing on the interest rate differential. By employing these strategies, traders can enhance their potential for success in the volatile forex market.

Risks Involved in Trading Major Forex Pairs

Despite the advantages of trading major forex pairs, it is crucial to recognize the inherent risks involved. Market volatility can lead to substantial losses, particularly if traders do not employ proper risk management techniques. Additionally, geopolitical events and economic data releases can cause abrupt price movements, which may catch traders off guard. Therefore, understanding the risks and implementing sound risk management practices, such as setting stop-loss orders and using appropriate position sizing, is essential to mitigate potential losses in the ever-changing forex landscape.

Using Technical Analysis for Major Currency Trading

Technical analysis plays a vital role in trading major currency pairs, as it enables traders to analyze historical price movements and identify trends. Traders often utilize various technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to gauge market sentiment and make informed trading decisions. Chart patterns, such as head and shoulders or double tops, can also provide insights into potential reversals or continuations in price movements. By combining technical analysis with a sound understanding of the forex market, traders can enhance their ability to execute profitable trades in major currency pairs.

Conclusion

Major currency pairs provide a stable foundation for Forex trading with their high liquidity, narrow spreads, and strong predictability. For those seeking a more automated approach, using Expert Advisors on major pairs offers advantages in consistency, speed, and cost-efficiency. Ready to trade with EAs? Check out the Top 10 Robots at EA Trading Academy for expertly designed tools to enhance your trading experience.