Home › Forums › General Discussion › When to exit a trade

Tagged: #when to exit a trade

- This topic has 10 replies, 2 voices, and was last updated 5 years, 8 months ago by

Stephen.

-

AuthorPosts

-

-

December 14, 2018 at 20:43 #7697

Marin Stoyanov

KeymasterHi Petko,

With the JPY set of 10 monthly EA’s you release, some have limits & stops and some don’t.

Is this because they turn around and go in the opposite direction?

So we should leave them alone or cut out of the trade showing a decent profit.

Also, one of them has a 188 pip limit can we take profit over 100 pips or this defeats the purpose of algo trading?Chris.

-

December 14, 2018 at 22:10 #7701

Petko Aleksandrov

KeymasterHello Chris,

Glad to hear from you.

Yes, some of the EAs do not have SL and TP, so when to exit a trade?

They have exit conditions. These normally are indicators which give an exit signal.

Also, all of the EAs in this course are with Reverse option. This means that when there is an opposite directional signal, it will reverse the trade.

So if you have a long trade opened with some of the strategy, and the same entry conditions(same as those that opened the trade) happen for sell signal, it will close the trade, and it will open a short trade.

And yes, the idea of algorithmic trading is to leave the EAs do their job. Anyway if you decide to touch them when there are opened trades, you will put some emotions in which is exactly what we want to avoid.

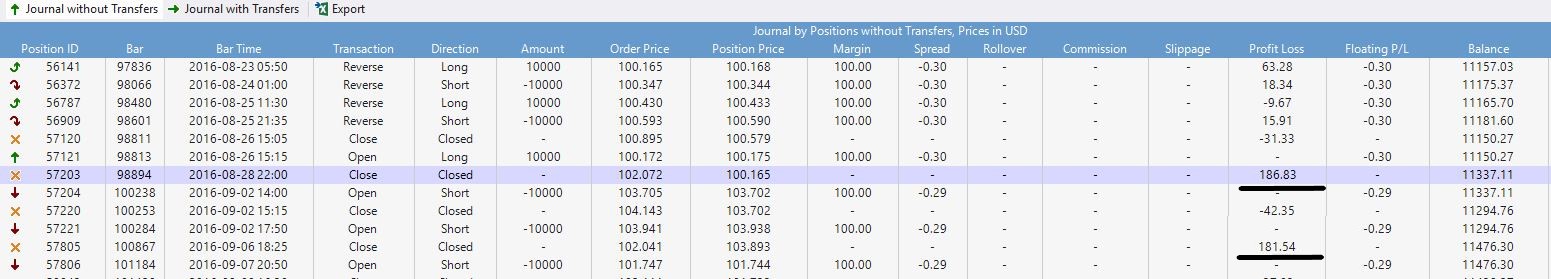

About the TP, I guess you are talking about the strategy ending on 007. Yes, this is realistic TP and if you run a back test you will see in the journal that there were times when the TP was reached:

Also, when I use such a huge TP, I combine it with Trailing Stop Limit to make sure if the price goes on profit and reverse, some profit will be taken.

In this case I used 70 pips. So if the price goes on profit of 170 and reverses, we will still have 100 pips.

So there are many options when to exit a trade and how. FSB pro gives many possibilities when creating the EAs.

-

September 30, 2019 at 5:35 #22762

thyagomendes

ParticipantHello Petko!

I noticed that currently you have always used stop loss in your courses (both in EAS and FSB). What are your main motivations for currently always using fixed stop loss or trailing stop?

Thanks

-

-

December 15, 2018 at 9:45 #7713

JIE YING FANG

ParticipantGreat reply – thank you Pekto.

-

December 15, 2018 at 15:13 #7718

Petko Aleksandrov

KeymasterCheers, Jie! It is important all to be clear! When to exit a trade is as much important as when to enter into it.

-

September 30, 2019 at 10:03 #22772

Petko Aleksandrov

KeymasterHello Thyago,

A good question here.

I still use both variations, but in the courses, I prefer to place EAs with SL and TP, because beginner traders a bit scared to trade without SL.

However, my trading shows that having an SL and TP gives us more robust strategies.

I noticed with the time that when I generate strategies without SL or without TP they are not so robust after that. Basically more over-optimized strategies are generated if there is no SL, because the generator finds better variations.

-

October 21, 2019 at 23:58 #24272

thomastrading

ParticipantHi Thyago. Do you use variations with stop loss and trailing stop?

-

October 24, 2019 at 0:47 #24532

thyagomendes

ParticipantYes, I use variations with stop loss and trailing stop. In my experience is the way to generate eas that I managed to be most profitable.

-

-

October 23, 2019 at 18:03 #24421

champagnelennie44

ParticipantWhat do you mean under – “variations with stop loss and trailing stop?”

-

October 24, 2019 at 11:03 #24617

Petko Aleksandrov

KeymasterI think what THyago wants to say is that he uses different SL and Trailing SL for his strategies and not one and the same for all strategies.

-

October 26, 2019 at 17:21 #24955

Stephen

ParticipantHi everyone. Thanks for making the clarification Petko, I also didn’t understand the concept at first. So when coming up with the SL and trailing SL to use, are there factors to consider or does one just make a wild guess and place it?

-

-

AuthorPosts

- You must be logged in to reply to this topic.