Home › Forums › Ready-to-use Robots › Waka Waka Robot › Waka Waka EA performance this month?

Tagged: Wakawaka broker

- This topic has 16 replies, 2 voices, and was last updated 11 months ago by

msmahi.

-

AuthorPosts

-

-

June 7, 2023 at 13:21 #174983

David Hanlon

ParticipantHello, Given the very turbulent market conditions this month could someone who has been running the Waka Waka EA please let us know how things have been going? Has it been in profit or does it get stopped out? Thanks in advance for any info.

-

June 7, 2023 at 16:08 #175030

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey David,

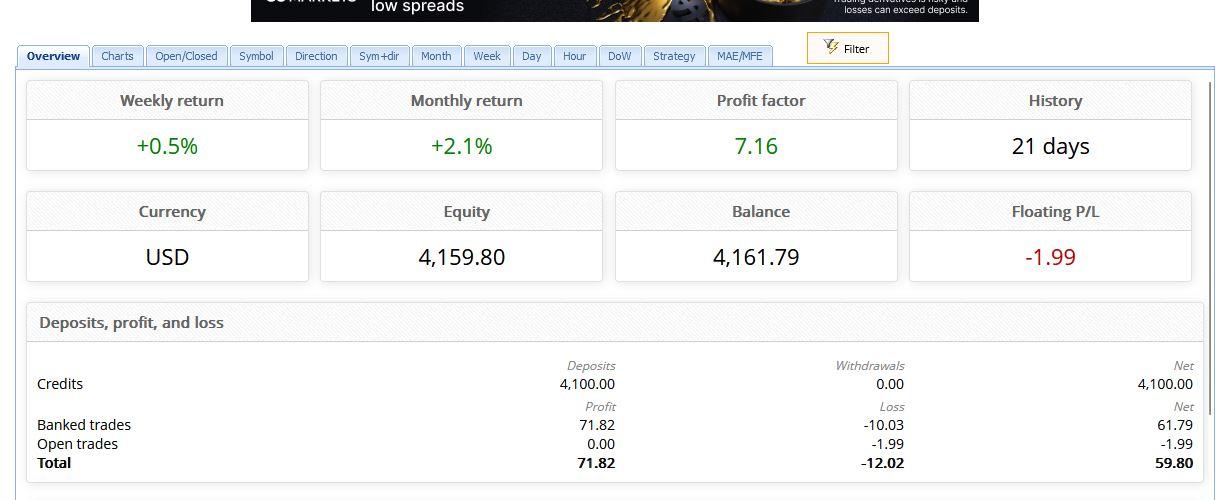

Glad to hear from you. I can share how it performed on the FTMO-funded account. Please, see the screenshot below:

However, I use it with very low-risk settings to stay within the 5% drawdown.

Now, I am placing it in $1500 live account and I will update you with the results.

-

June 7, 2023 at 23:43 #175086

David Hanlon

ParticipantThanks Petko. That’s great and very interesting info. It looks like it did very well overall except for that massive drawdown episode. But the fact that low risk setting can balance that risk is important. I will be very interested in future results on a live account. That’s always the acid test. Thanks again.

-

June 8, 2023 at 0:15 #175088

Alan Northam

ParticipantAccording to the Waka Waka stats it had averaged 7.18% profit per month and has a maximum drawdown of 26.7%. It also touts every month for the last five years had been profitable. Since the average profit per month is 7.18% it stands to reason that some months produce less than 7.18% per month and some months more than 7.18%. Also it stands to reason, since every month has been a winning month, some months could produce a profit below 1% but greater than 0% with a risk every month of having a 26.7% drawdown. To adjust the risk so that the maximum drawdown is less than 5% so as not to fail the FTMO drawdown requirement and close the account also means to have a smaller monthly profit to well below 7.18%. So by reducing the risk therefore would indicate that the monthly profit would be too low to pass the price target to complete the Challenge or the Verification phase. As a result I don’t see how this EA can be used to pass the Challenge or the Verification phase. I do see how it can be used in a very low risk / low profit funded FTMO account. If the funded account performance Petko has shown above is for one month then it represents a monthly profit of about 0.7%.

-

June 8, 2023 at 9:57 #175133

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterYes, Alan is right. I explained that in one of my videos for the Waka Waka on Funded account.

The chances of passing a Challenge with Waka Waka are less than 30% because you will have to increase the risk, which might lead to more significant drawdown that will break the rules of 5% daily.

However, a funded or live account is quite suitable.

-

June 14, 2023 at 11:48 #176034

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterAnd here is the video I published yesterday about the Waka Waka performance:

-

August 21, 2023 at 5:06 #192640

Kadoski

ParticipantHi

Is this with the lowest risk setting available for the Waka Waka or mid risk?

I have just bought the EA and looking to open it on a $4000 AUD live account.

With this account, I was considering using mid risk settings and allowing for a 30% drawdown. Meaning I would set it up so that it would close trades if they reached 30%. Any thoughts?

And I’m undecided yet whether to use a 1:300 or 1:500 leverage.

Thanks

-

August 30, 2023 at 2:14 #194708

netbizint

ParticipantHi,

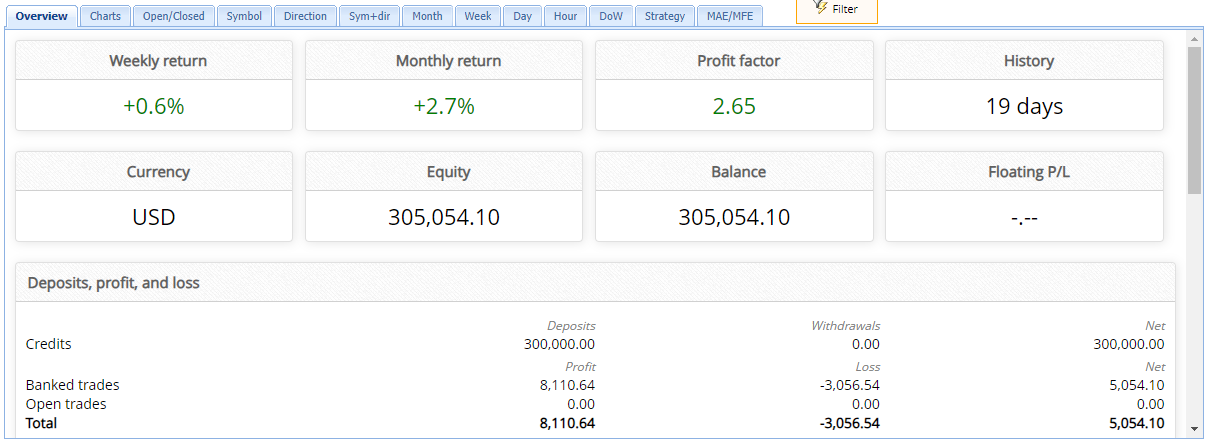

I started at Pepperstone with USD $4100 with a LIVE account. Was then advised by WakaWaka users from their Telegram chats to not use Pepperstone. I switched to BlackBull markets start of August 2023. Leverage is 1:500.

I watched one of Perko YouTube videos on the EA after setthings this up. I changed the settings to mid risk set 40% annual. So far performance for me is

Hope this helps.

-

August 30, 2023 at 2:19 #194716

Alan Northam

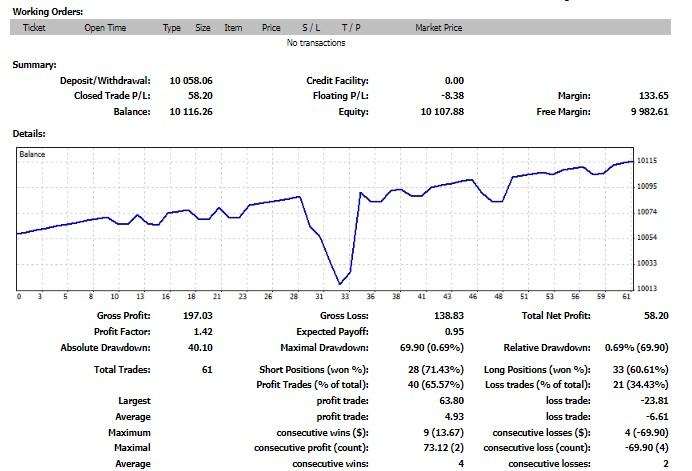

ParticipantJust for comparison between using Waka Waka and EAs created by EA Studio here is my results over this last month:

-

-

-

-

September 29, 2023 at 18:00 #202167

Rick van Rosmalen

ParticipantHi guys! Which brokers do you recommend for wakawaka on a live account? Unfortunately icmarkets is not working for me, because then don’t allow Dutch people..

thanks 🙏

-

December 3, 2023 at 15:47 #218731

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI think any regulated broker with low spreads and fees should work.

Try with any of the brokers we have listed here.

-

-

November 10, 2023 at 11:33 #211274

sovereignalgotrader

ParticipantIn reply to 192640. If you are an Australian resident you are restricted under australian law to a maximum of 1:30 leverage. Period. No exceptions unless you qualify as a sophisticated investor which clearly you do not. Running waka waka on a small leveraged account of 1:30 with on 4000aud is almost pointless. You would be trading micro lots, and waka waka will be chasing 3 to 10 pip wins. You will be lucky to make 5$ per day.

-

December 3, 2023 at 15:49 #218732

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterOn my FTMO Funded account I also use the Waka Waka with leverage 1;30: https://www.myfxbook.com/members/PetkoA/waka-waka-10-funded-ftmo/10549404

And it works fine. Never hit the DD until now.

-

December 6, 2023 at 23:34 #219418

Jeffrey Farrell

ParticipantHey everyone, I’m new here, I just started, but I do have the Waka Waka. I’m just curious if I have a 200,000 account with Next Step Funded, and they have a max drawdown of 5%, how would I set this up? I see the drawdown places in the Waka Waka inputs, but I don’t know which one to put it in. And will Waka Waka recognize that this is a 200,000 account and increase lot size accordingly? Any good videos or places I should go to brush up on this info? Thank you all in advance! Happy trading!

Jeff

-

March 25, 2024 at 20:18 #244224

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Jeffrey,

Sorry, I didn’t see the post earlier…

The best thing usually is to ask on their website for the right set file according to your challenge rules.

-

March 25, 2024 at 20:30 #244228

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello traders,

We aim to save time and minimize risk for our traders, so we have implemented several EAs on live accounts and published the results (with track records) on our website:

We have deployed Waka Waka on a live account with Eightcap. Please note that this is a grid system and requires more capital. We utilize low-risk settings in the account.

-

August 5, 2024 at 10:09 #274040

msmahi

MemberI’m curious about the Waka Waka EA’s performance as well, especially in these volatile market conditions. If anyone has experience or data, it would be great to hear how it’s holding up. Thanks!

-

-

AuthorPosts

- You must be logged in to reply to this topic.