- This topic has 60 replies, 1 voice, and was last updated 1 year, 11 months ago by

Petko Aleksandrov.

-

AuthorPosts

-

-

September 16, 2021 at 17:50 #97830

Stefanos Ioannou

ParticipantI have been using the EA Studio for some time now and I can’t say I had success. I was having hard time understanding a technique that I could follow. I signed up to two of the courses of Petko Aleksandrov and I am glad that he explains a way to go. I know I might be ahead of myself but I have tried several things in forex with no success and I want to ask earlier and know that this is something that would have a degree of success.

So, I follow Petko’s instructions on both courses, waiting for the EAs to make some trades and will take the necessary actions of moving them to a live account. I am wondering though how good this technique is? Are there any past stats out? Not that they guarantee future results but it is a kind of assurance. I just don’t want 2+ months to pass and be at square one again.

Also any other techniques/suggestions I can use the EA studio that others had success with? Right now I am looking for a 5% average profit per month and from what I’ve seen in the webinar and courses it is very probable.

-

September 16, 2021 at 17:56 #97935

Cone D

ParticipantHey Stefanos, put yourself higher targets. I target 20% monthly.

It took me about 6 months to figure it out, but I am glad I did not give up. EA Studio is a great tool, but in the end, it depends on you how to manage the EAs.

-

September 18, 2021 at 18:27 #98025

Stefanos Ioannou

ParticipantThanks Cone.

Well I am trying to find EAs that are in their profitable phase and move them to live after gathering the statistics on demo. I was happily surprised on Friday as it was the first day I could move some good EAs to live and i got really great results. I mean 4 ea’s generated 5 winning trades. I don’t want to get ahead of myself again but I really hope this approach works. It is so easy. And if it does work a 20% sounds possible!

On another note, I have EA’s that do a huge profit factor. For example right now I have 22 EAs on live account with a profit factor above 3. Isn’t this amazing? I mean some EAs have profit factor of 10, 15, 20 (!). Was I just lucky this time or are such statistics normal?

-

September 29, 2021 at 9:36 #98345

Petko Aleksandrov

KeymasterHey Stefanos,

Glad to hear that you already have some good results. Just take it easy and increase the number of the EAs slowly, so it will be manageable.

According to my experience Profit Factor of 10,15,20 is not just amazing, but super amazing :)

When you trade longer you will see that the average is lower but as long as you are with a Profit Factor above 1, than it means you have more profits than losses :)

-

February 28, 2022 at 12:29 #109747

Marin Stoyanov

KeymasterHello Guys. I am trading only for a few weeks with robots. Especially when I saw the first course from Ilan. Then I had 99 EA course and GOLD course. all is OK but…. I am struggling with profits…and I am struggling a lot. My losses are far bigger than wins. I do trade TOP5 robots from 99EA course monthly updated by Petko…..but I don’t know. Maybe I am doing some mistake or should I put there in live account more than 5 EA’s I have 6 Demo account running about 250 robots on test. But I still don’t know what to do with them. DO I have some fear to put them over there? DO I something wrong with management or…really don’t know…And I saw the courses several times

-

February 28, 2022 at 13:08 #110343

Samuel Jackson

ModeratorJaroslav, it definitely sounds like you are not ready to be moving anything to live yet. Use a second demo as a mock live account to move your EAs till, then once you have build confidence in what you are doing you will feel much more comfortable moving to live.

-

February 28, 2022 at 17:21 #110375

Petko Aleksandrov

KeymasterHey Jaroslav,

Let me know the results if you compare the demo and the live trading, do the trade match?

-

March 2, 2022 at 17:59 #110550

Marin Stoyanov

KeymasterHello Guys. I did not looked on the performance exactly of every EA. As Mr. Jackson writes I already have shot down the Live account because this was apparently useless.

We had some important events at work so I was not able to do the analyze precisely. I am doing it now. I will let them trade on SHADOW (DEMO as LIVE) and will learn there the process until it really works and makes profit. as thiw bloody war started the markets are going crazy but I saw my 99 EA demos they together made over 3000 EUR profit so this is obviously my and only my mistake. I really feel like an “idiot” because there are lot of great data obtainde from FXblue….I work as internal financial auditor so my kind of organization is really precise but how is that possible I am not able to manage some EA’s to be profitable ? don’t know

Petko: As I stopped to trade those EA I cannot give sou the performance because I went crazy as I wrote this so I just closed the laptop and stopped for several days. the history is there also my losers….I will analyze this and try as Mr. Jackson said on Demo account until this management will really not be profitable on regular basis,……

Thank you.

-

March 2, 2022 at 19:50 #110571

Petko Aleksandrov

KeymasterHey Jaroslav,

Sometimes taking a break is the smart thing to do. :) It happened to me so many times when the trading does not meet my expectations.

One thing to test…try to lower the time on a Demo…because the longer you keep a profitable EA on a Demo, the more you increase your chances of getting closer to the losing trades.

-

March 4, 2022 at 21:25 #110726

Matthew Roberts

ParticipantPetko: I am also struggling very much to make profits. I have lost over $10,000 dollars with EA Studio robots.

What is the recommended time to lower the time to on a Demo? I did 2 weeks and over 10 trades to put it on for another 2 weeks or until 10 trades has proven to have a lower than 1.2 profit factor.

I’ve tried everything from putting trades on for a whole month using your no demo method.

I’ve tried top 2 robots moderate risk, top 10 robots lower risk, top 50 robots very low risk.

In none of these methods have I been able to produce profits on even a demo account.

Demo account and live accounts have been making the same trades.

-

March 4, 2022 at 22:26 #110734

Samuel Jackson

ModeratorHi Matthew,

Profits do not come easy and Petko’s advice has always been to learn and practice using demos before using live. I made the same mistake early on but to a much smaller degree than 10k fortunately.

You must practice on demos until you are profitable.

Regardless of how skillfully a collection of robots has been put together if you just throw them on a live account you will very likely lose money.

As to the recommended time etc, have you run your own tests?

Countless ways to do this but you need to get creative, for example. IC markets allows up to 20 demo accounts, you could open 1 to put on all the robots you have then come up with 10 or so variations of moving robots and keep track of the results in a spreadsheet and see what is performing best as a filter criteria maybe?

For example

10 trades with pf>1.2, 5 trades with pf>1.2 and win/loss > 0.6 and so on.

Play around and learn, but definitely don’t go live until ready or you will lose money for sure regardless of the quality of the robots you start with!

-

March 9, 2022 at 0:23 #111371

Matthew Roberts

ParticipantCurrently, I’m working on trying to pass the FTMO challenge.

I can’t continue to finance losing strategies for sure.I have moved back to demo only.

My tests have been at 1.2 or great profit factor and 10 trades put it on live. Usually, I check every week on the demos and filter the strategies are over 10 trades and over 1.2 profit factor then I put them on a separate demo account. They have all failed for sure. If you don’t mind sharing, what do you personally do?

-

-

March 5, 2022 at 21:59 #110798

Samuel Jackson

ModeratorHey Matthew,

Just to add to my previous post. Either by using demo or non demo filter methods, principally we are trying to do two things I think:

1 – Trade only the Strategies that are staying true to their generated acceptance criteria

2 – Catch these strategies in their profitable phase

So with your tests you definitely want to play around a bit but also keep this in mind to avoid being too random in your approach of course.

What broker are you using and have you uploaded their data to ea studio? What longer term filter are you using and is this definitely fully past the date range used to generate the strategies you are using(including OOS)?

Also you say you have put on Top 5 etc with poor results, presumably this is top 5 according to net profit. Perhaps may get better results if put on top 5 according to R/D or max drawdown?

-

March 9, 2022 at 0:34 #111373

Matthew Roberts

ParticipantThanks for a second reply!!

1. Staying true after how many trades?

2. There are no guarantees in trading and I know this, but I feel as I’m missing something here. There are always some strategies that I run that are profitable, but the majority of the ones I run are unprofitable and it far out ways the wins. I’m struggling running those strategies in their profitable stage.

I’ve taken a more specific approach rather than random.

I’ll typically Generate strategies in sample.

Then I Normalize 30% out of sample.

Then I monte Carlo 90% at 20 runs.

Acceptance criteria whole strategy:

300 minimum count of trades.

1.2 minimum profit factor.

Acceptance criteria in sample

1.2 profit factor minimum

Acceptance criteria out of sample

1.2 profit factor minimum

I’ll usually then put the top 50 strategies in an account and wait for a week to see what happens and then start throwing them on the demos.

To be clear this has never worked.

I’ve tried KOT4X and I’ve tried FTMO demo accounts.

FTMO performs better due to very low spreads and low commissions.

However, they all seem to slowly drain the account balance.

I’ve mainly tried USTECH (also known as NASDAQ or NAS100) & BTCUSD.

-

-

March 9, 2022 at 10:46 #111609

Samuel Jackson

ModeratorHi Matthew,

It will be interesting when Petko responds which I am sure he will soon but here are some of my thoughts and suggestions.

First sticking with FTMO free trials is smart because you can do them as many times as you want with good metrix information but also just regular demos are obviously great too.

1. Why have you chosen to generate using the complete sample and then normalize only on the 30%, that is not logical to me (It’s not a huge deal but is there a reason?)

2. Your acceptance criteria looks fine to me although the complete pf>1.2 is redundant since you have it in both the IS and OOS but 1.2 for both is a good target in my opinion.

I totally understand the problem of the losing ones killing the overall portfolio, this is where running some tests will be really useful.

I don’t think there are any hard and fast rules as to how many trades etc, strategies generated are random in nature and so each sample of say 300 reactor results with same settings is gonna be a bit different.

Therefore, 1.2 for 10 trades may work great sometimes but not others. To counter this I would suggest holding a Month of data or so back when you run the reactor, then using once you have a collection of 300 test this filter criteria to see if it would have worked.

What will be easier than a count of trades to test will be a time period, so if for example you used the validator to see what would have happened if you traded only strategies that had a pf>1.2 for both a week and a month prior to your reactor end date then how would your results have been if you traded on the month of data that you held back?

<p style=”text-align: left;”>I hope this makes sense, your approach is close from what I can see. You are creating and robustness testing strategies to target a pf>1.2 and then only accepting ones that also stay true to this profit factor in the OOS, but then you are kind of randomly just selecting a filter criteria whereas I believe if you run some reasonably quick tests then you could give much more confidence to your filter criteria of over what periods you want to see a strategy stay true to this profit factor before you move it to live(or mock live demo in this case :-)</p>-

March 9, 2022 at 19:04 #111677

Matthew Roberts

ParticipantThanks Again for your reply, Samuel.

I’m very interested in Petko’s response as well.

1. I have chosen to generate using the complete sample of 1.2 because I want good quality strategies to start with. The 30% OOS normalization allows me to optimize the strategy.

2. the 1.2 in sample filter and out of sample filter ensures that I have only strategies that are performing similarly during the optimization period and after the optimization period. I have chosen to do this to prevent over-optimized strategies and to hopefully get consistent future profits. (no success yet sadly. However, I’m not giving up.)

I have tried this method of holding back a month of data and filtering PF>1.2 Minimum count of trades >10. Then tested those bots and found that when they are all combined that they were not profitable as well.

I’d really like to try your suggested method to forward test strategies for a week and then pick only those for the remainder of the month of data.

I had thought of this but was limited due to my strategies are all generated based on the H1 time frame. I’m having an issue doing this as the Minimum data bars are floored at 300 under the data horizon tab. 300 / 24 = 12.5 trading days. NASDAQ only trades on Monday through Friday, so I have to use 2 weeks and 3 days in a forward test. BTCUSD is always open, I only have to wait 13 calendar days. In both cases that is longer than the 1 week.

Is there a way that I don’t know about to lower the floor in data horizon on minimum data bars to 120(5 days x 24 bars) for NASDAQ and 168(7 days x 24 bars) for BTCUSD?

-

-

March 9, 2022 at 10:57 #111622

Samuel Jackson

ModeratorIt sounds like you are doing well to me btw, like you say theres perhaps just a few subtleties missing I think.

Plenty to chew threw from last post but small additional point is check what your acceptance is in the Monte Carlo, I am taking a complete guess that you are running indicators and backtesting date tests and that your acceptance criteria for the Monte Carlo is set to profit factor > 1??

If this is the case for example, I expect you might get a similar amount of strategies passing if you reduce the 90% to 80% and increase the profit factor to 1.1 or even 1.2 which may be worth a try, just a side suggestion/food for thought comment though :-)

Also my approach is generally similar and I have mixed results so I don’t claim to have everything figured out at all (but the harder I work the more things improve). I have been at it a while though and certainly tried and pondered lots for sure though so hopefully some of what I have said helps give you some ideas to move forward :-)

-

March 9, 2022 at 19:12 #111679

Matthew Roberts

ParticipantYes My monte Carlo boxes checked are “Randomize indicator parameters” and “Randomize backtest starting bar” Validition is Minimum profit is >= 0 or in other words profit factor >= 1.00 and 90% is considered acceptable.

I’ll try the minimum profit factor 1.1 at the 80% method and see what that does for me.

Thanks for the suggestion.

-

-

March 9, 2022 at 11:04 #111624

Samuel Jackson

ModeratorOne last point also, is that we are discussing obviously just one pair and timeframe and it could just be a bad month for that pair, so definitely a good idea to do some backtesting tests on the spare months day for say three well balanced pairs and them sum the results of the combined portfolio. Say EURGBP, EURJPY and GBPJPY for example.

-

March 9, 2022 at 19:17 #111681

Matthew Roberts

ParticipantThanks for the suggestion to diversify the risk! I started testing forex pairs at the beginning of my use with ea studio and had horrible results. Maybe I should go back and try again now that I’ve been using ea studio more.

-

-

March 9, 2022 at 11:14 #111629

Samuel Jackson

ModeratorONE last thing Matthew (Things keep popping into my head haha). Have a good read of some of the other forum threads even if they are a bit old, there’s lots of great information especially coming from Petko (It’s all here it just takes a bit of time and practice to assimilate)

‘what acceptance criteria do you use’ is a really good one for example.

-

March 9, 2022 at 11:33 #111638

Samuel Jackson

ModeratorAh hold on it IS a big deal that you are generating IS, definitely change that to be 30% OOS. You have changed the strategies by normalizing them but it definitely still takes away from the value of the OOS check considerably.

-

March 9, 2022 at 19:30 #111683

Matthew Roberts

ParticipantOkay, I will test this method of 30% OOS for the generator as well!

Another thought I had is sharing my normalization parameters and strategy properties settings to see if you or Petko or any other experienced user might have some suggestions on if I’m doing something wrong.

I’m using strategy properties of always using SL and TP on NASDAQ and BTCUSD.

My NASDAQ settings are at 10,000 min and 50,000 max for both SL and TP.

BTCUSD I’ve tested 300,000 min to 600,000 max for both SL and TP (here I find it easy to find strategies, however, the system gets high into profit and then doesn’t close the trades once they get into profit because the TP is so far away and the market just reverses)

BTCUSD I’d like to test 150,000 min to 300,000 max for both SL and TP. The problem here is I find it difficult to find strategies. The 14-period average true range of the D1 chart is around 250,000 ish right now. So that means that on an average day I’ll see about 250,000 pips of movement in a single direction and the hope is the strategy catches somewhere at the beginning of that 250,000 and continues for the remainder of the day and into the next day to close at the TP. So trades would be open for usually a max of 2 days unless it’s a fluctuating market.

Optimization settings:

Remove Take Profit is unchecked everything else is checked.

Out of Sample 30% OOS.

Numeric Value steps 20 steps for NASDAQ and 40 steps for BTCUSD

Search best Net Balance

Thanks again for any suggestions you might have for me to try.

-

-

March 9, 2022 at 21:51 #111695

Samuel Jackson

ModeratorHi Matthew,

The optimization settings seem fine to me, of course you can try experimenting with changing search search best Net balance to perhaps R/D or Maximum drawdown for example to help for the rules of FTMO challenge but for now if stick with what you have rather than changing too much at once.

Ah yeah, I have the same issue so yeah can’t check 1 week but can do 2 weeks as I mostly favour H1 timeframe also currently.

Additional detail with this is that EA Studio won’t make any trades in the first 100 bars of data, so if you want to check 2 weeks which is 240 bars for H1 then set the bars to 340 bars, you can check this is the journal and also will see the setting in the tools page. So if you put 300 bars in for H1 you are actually checking about 12 days.

One other suggestion is dont change everything at once but rather make a change and try to get a feel with some tests of how that single change has affected the results. Obviously more time consuming to start but in the long run I think you will win faster.

Hopefully your results start improving soon, let us know :-)

-

March 9, 2022 at 21:57 #111697

Samuel Jackson

ModeratorYeah my original thought re generating for complete but then normalizing for 30% was as you say, optimization has changed the strategy and then you check it’s still okay OOS.

But if you want more bars for generation then I think just set the bars higher, but keeping the OOS completely reserved for a final check so that it hasn’t been used at any point in the strategy development is the way to get the most out of this robustness check.

-

March 10, 2022 at 16:18 #111938

Matthew Roberts

ParticipantI’d like to hear how many months of data Petko recommends. I’ve always heard having more time for more trades is more robust, however, having too much of a time period reduces potential profits. That’s why I stuck with 13 months and 300 trades.

My new game plan for testing is going 15 months backwards to 2 months backwards.

300 count trades.

PF >= 1.2 in sample and out of sample.

normalize 30% OOS (all boxes checked except for remove take profit.)

Monte Carlo 80% 1.1 profit factor last 2 boxes checked.

I’ll generate a pool of about 1000 strategies to run through the validator from 2 months to 1 month ago.

All the strategies that had PF >=1.2 will be downloaded into a new collection. (This will be my last step before a mock demo)

Then I’ll run the new collection through the validator from 1 month ago to half a month ago.

all the strategies that had PF >=1.2 will be downloaded into a new collection.

At this point, if it was real-time I’d consider the strategy acceptable to go on a demo account (it’s going to be a “live” demo account.)

I’ll run it through the validator one last time to see if it was profitable from half a month ago to today. (This would be the point if it was a real account that I’d repeat the process and swap out the bots for new ones)

I’d like to find a way to make consistent profits every month with this and I’m gonna get there!

All please let me know if you have any suggestions for me and I’ll let you know how this testing goes.

-

-

March 10, 2022 at 22:05 #111972

Samuel Jackson

ModeratorThat sounds like a pretty good plan forward Matthew. I’d say increase the number of bars to around 35000 for the H1 timeframe though which is about 5 years. Maybe try the same for the M30 or M15 timeframe also for 4-5 years.

15 months is too short for H1 period.

Also do this using several pairs as discussed. This is also going to be important in limiting your account drawdown.

Keeping track of everything in a spreadsheet is a really good idea also, not just a quick sheet but something that you will maintain for months.

“I’d like to find a way to make consistent profits every month with this and I’m gonna get there!” With this attitude you WILL get there!! Keep pushing, every time you try something and if it doesn’t work you will learn something and develop deeper insight and this will lead to success over time. Fall 7 times get up 8 as they say – I’ve fallen a hell of a lot more times than 7 but I never stop getting up;-).

Enjoy the challenge :-) Looking forward to hearing how you get on.

-

March 15, 2022 at 14:39 #112955

Petko Aleksandrov

KeymasterHey Matthew,

Your plan looks really promising. Please, keep us updated.

Regarding the data, it depends on a few things. First, if you use a too big number of bars, the program will get slower. At the same time, if you use a small range of data, you will get to over-optimized strategies. But if you use a min count of trades that will eliminate the issue.

Something in the middle works best.

-

March 27, 2022 at 11:23 #110593

Marin Stoyanov

KeymasterOK…NO I have a question. Should I do the analyze every day? Or Every second day? Probably the weekly is not that what is needed to be successful.

I did it yesterday evening. From 99 EA’s I have already nic data. Monthly performance I was able to choose 10 EA’s with over 10 trades with over 100 EUR net profit and profit factor over 2.00 which is really good. For weekly performace there were EA’s with over 3 trades Profit factor over 1.4 and net profitover 50EUR….well as top 5 there were 4 EA’s as EUR/USD which I lowered to 2 best of them that makes top 3 of 99 EA’s The top 3 right now #87543211 / #87513216 / #86879152

From Ilans EA’sthe conditions are little bit lower because there a lot of H1 EA’sBut still monthly I have over 100EUR net profit over 2.00 Profit factor and over 5 trades.

Weekle at least 3 Trades and PF over 1.4 but here I will take in consideration all EA’s with any profit. Finally I took out 3 of them #48095358 / #51327790 / #48162246

From your Gold EA’s there was no EA with over 1.4 Profit factor so I could not take them considering the fact that also with 0.01 lot thery have still huge SL level which could lower my account down by over 30% per trade if the SL were hit so this will have to wait for far mo data as I have this GOLD demo running for only 2 weeks

FInally I woke up this morning and I found on SHADOW demo closed profit with 5EUR …As I set this accout to my starting 500EUR account this made over night 1%……WHY?

Why on demo is all working great and makes profit…I had this same system on live account and made over 35% losses……

Currently I am learning far mor strategies also for manual trading….also scalping……I set another demo account for this…..so now I am running 7 demo accounts in one computer.

One is 99 EA’s from you….another is weekle EA’s from Ilan…third one is GOLD EA’s from you. Another is my Shadow with top EA’s another is for Manual swing trading and scalping Another 2 I have for my own EA’s created manually from my own strategies in ETASOFT FOREX GENERATOR……

As you can see I really want to make trading my job because I see here a far more financial possibilities and freedom as at my Work where I am too busy to make this in that scale I would like to. Tharefore I am heading to automatic “ROBOT” trading which can trade in time when I am asleep or at work. There are days when I am simply too tired from work to make any trading at evening. So hopefully I will be able to manage this somehow so that I could finally do trading as full time business.

So guys if you read my notes an management don’t hesitate to tell me If I am doing something wrong and what I could make better. You are free to tell me everything because critical notes are those which make us better.

Thank you

-

March 27, 2022 at 12:54 #114200

Samuel Jackson

ModeratorHey Jaroslav,

Great to hear form you :-)

It definitely sounds like things are improving a lot which is great!

Your first question is around the timings. I personally think the more the better if you have time to update the EAs so if you can make it a quick and easy daily task to do then why not. Its important to tweak your system around your current schedule and make it manageable. BUT how often is necessary is dependent on the timeframe and frequency of how often the EAs trade. For example if your EA’s are H1 and M30 and typically opening trades 1-2x a week then changing a couple of times a week is likely to work well, but if you have M15 and M5 that are trading say 3 or more times a week typically then I would probably favor updating every day or two.

What broker are you using? Demo and live should be very similar so to check this for yourself why don’t you try the following:

1 – Upload the live data and demo data to your EA studio account and then see how the results compare when you switch from using the live to demo data. Also you can check with Mt4 back tester.

2 – If you want to convince yourself of how live and demo compare then why not pick a few single EA’s each for a different pair and trade them each with the smallest lot size on both the demo and live account to compare the results. Of course this could cost you a small amount if they lose but it really shouldn’t be a costly lesson (You could even cheapen the lesson by reducing the stop loss and profit taking from typical max=100 to 50 when generating EA)

Definitely a smart move to run more than one demo at once, just make sure to track everything properly so you learn from all the things you are trying but will hugely speed up the learning.

Keep doing what you are doing. I really think you are going in the right direction, just keep doing what you are doing and learning from the results.

I can understand wanting to get onto live as soon as possible but once you have sufficiently consistent demo results then this will translate to good live results. Whenever you go live, to start you could also put the same EA’s on a demo initially to further build your confidence in this “live ~= demo” equation.

-

April 2, 2022 at 7:42 #114470

Petko Aleksandrov

KeymasterGood point!

I would also suggest you keep it simple. In the past, I used to have dozens of Demo and Live accounts which I was using to test 1000s of EAs. And the daily check was obviously taking me a few hours. So I started checking the account 3 times a week, after that, just 1-2 times during the weekend was wrong.

As Samuel says, it is better to check daily but quickly (so you won’t lose a lot of time with that).

More, it depends on what time frame you are trading. If you use M1 and you have many trades daily, then you need to check often. But if you trade on H1, H4, or D1, you won’t have a lot to check.

So finding the golden middle would be best.

-

April 3, 2022 at 4:18 #114511

Samuel Jackson

ModeratorThat’s been my learning too Petko.

Aiming to keep things simple is always best and if what ever you are trying starts to feel too complex then take a big step back and do some thinking!

Also fallen victim to trying to manage far too many demo accounts. Finding the golden middle ground as you say with regards to simple systems and the amount of tests you are running at once is really important otherwise it can all get too messy and its easy to end up learning nothing because the lessons are all to jumbled. Less haste is more speed as they say :-)

-

April 3, 2022 at 17:22 #114556

Petko Aleksandrov

KeymasterAbsolutely!

And everyone should be enjoying it, and not struggling with it.

Plus, the IDEA of algo trading is not spend a lot of time on the PC :)

-

June 22, 2022 at 0:53 #118358

Matthew Roberts

ParticipantI’d like to update you.

It’s been 3 months since I shared my strategy that I was going to test on a demo.

Here’s an update with the profits and losses of the demo.

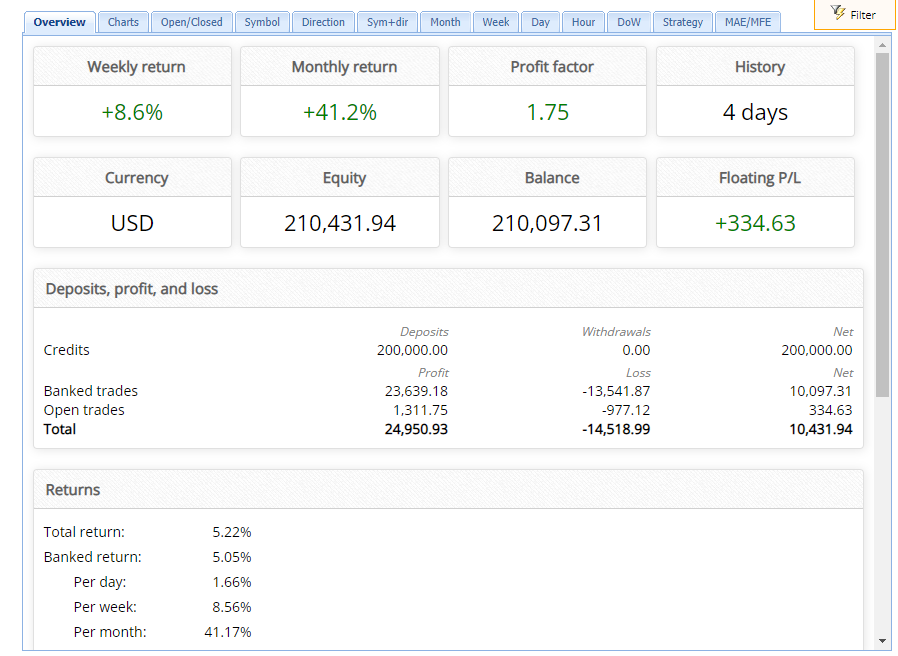

Starting Balance

$ 10,000.003/24/2022 – 4/7/2022

$ 6,582.10

4/7/2022 – 4/21/2022

$ (2,037.61)

Month 1 Total

$ 4,544.494/21/2022 – 5/5/2022

$ (1,160.98)

5/5/2022 – 5/19/2022

$ 4,132.21

Month 2 Total

$ 2,971.235/19/2022 – 6/2/2022

$ (3,325.80)

6/2/2022 – 6/21/2022

$ 83.52

Month 3 Total

$ (3,242.28)Ending Balance

$ 14,273.44The contract size is 10 on my broker. I started with .10 lots.

At the end of every 2-week period, for every 2000 I gained or lost, I increased or decreased my lot size by 0.11.

I’m not happy enough with my results to trade live as month 3 was a total bust.

Any suggestions?

My demo is still in profit which is great! -

June 22, 2022 at 12:29 #118422

Petko Aleksandrov

KeymasterHey Matthew,

Glad to see you shared your results.

Can you make it clearer how you decide to increase or decrease your lots? And why would you do that?

Also, did you make any changes to the parameters or just the trading amount?

Petko A

-

June 23, 2022 at 7:34 #118460

Matthew Roberts

ParticipantHi Petko,

I am making no changes to the strategies. No manual entries, exits or modifications are being performed.

As for why I change my lots it’s in attempt to compound my account with the profits. For example a person with $100,000 could trade larger lots than a person with $10,000.

See below for how I am scaling it.

Every time I run a new batch of bots I’ll input the below formula to decide which lots all of the robots in the portfolio will trade at for the 2 week period I run them.

I am essentially adding extra lots as my account size scales up or down.

The exact formula

initial lots = (Beginning Balance / 1000)/100

new lots used = initial lots + ((Current account balance – Beginning Balance)/2000)

So my beginning balance was $10,000 so the first 2 week period I ran .10 lots on the portfolio and gained $6500.

After that I made new bots and plugged in the new lots used formula.

.10+{[($16,582.10-$10,000)/2000]/100} =.1329105

I always round down so I used .13 lots on the second round and so on until I posted here.

Any other suggestions as to what might be causing some of these periods to not be profitable?

-

-

June 26, 2022 at 3:48 #118605

Samuel Jackson

ModeratorHi Mathew.

This seems like a big success really. Especially as you were just getting pure losses hen you entered this thread right?

Balance drawdowns are pretty inevitable. Have you been keeping an eye on your equity drawdown?

Also am I right in that you are moving EAs from demo to your mock live account monthly and still working with the same EAs on the original demo?

I would recommend keep doing what you are doing for another month or two but also maybe run a second system side by side using the EXACT same process.

It could be that this is just a natural drawdown and you may get another profitable overall three months OR perhaps the life cycle of your system starts to deteriorate after 2-3 months?

4+ grand profit on a 10k account over three months is a great result as far as I am concerned.

-

June 30, 2022 at 23:16 #118812

Matthew Roberts

ParticipantMy equity drawdown is fine.

In fact, my equity was so high at one point I would have passed a $100,000 proprietary trading firm challenge phase 1. But phase 2 I would have failed.

I do a brand new system every 2 weeks and get rid of the old bots not caring how they would have performed.

I read in other forums that Petko aims for about a 50% return every month.

I’m curious for any suggestions on how I might change it up to gain results similar to that.

Currently, I’m doing the same method I was using, however, I’m adding more assets to see how that works.

I’m interested in adding XAUUSD.

Any suggestions on SL and TP limits and how much backtest data should I be using to get to a minimum of 300 trades without getting the what I like to call “can’t generate enough strategies” message.

-

-

July 1, 2022 at 9:47 #118847

Samuel Jackson

Moderatoryeah but your balance drawdown recently was ~18 % which as you say would fail a prop challenge. Likely your equity drawdown was greater but would be good to know what it’s been throughout the life of your account.

for example if it hit 20% and you knew that then reducing your lots size by just over half would have kept you in the challenge right?

Of course it reduces the profit you will get so that needs to be balanced.

Seems like you are going pretty good though, I’d keep doing what you are doing and if you wan to try anything different then do so on a separate account.

Okay so by brand new system you mean you just go straight to live without any demo. Seems to be working well, would be definitely interesting to see how doing same thing for a few more months. If overall it works well again for three months then that would certainly give much confidence I’d say

-

July 15, 2022 at 2:50 #119432

Matthew Roberts

ParticipantHey Samuel, I should have been more clear. I was using risk settings meant for a 100,000 FTMO account. The max draw down I had for a day in the system was 4125.00 which passes the FTMO max draw down of 5% per day requirements. And the max draw down overall was never even close to the 10% allowed at FTMO.

I’m finding that my system seems stable enough to not lose money, but it’s not making enough money to pass a prop firm challenge.

I’m looking for that extra boost in profits. I’ve seen that Petko aims for 50% per month using eastudio… that’s absolutely amazing. I’d love to reach a point where I can gain even 15% consistently. This way I can be sure to beat a prop firm challenge and get going full time in my forex career freeing me up to pursue my music dreams.

Petko, any suggestions?

-

-

July 16, 2022 at 12:59 #119534

Samuel Jackson

ModeratorHey Matt,

Well that’s definitely looking great then. The prop challenges are definitely tricky to get through but it sounds like you are getting close with your stable results.

It’s definitely the daily drawdown that is the trickiest to pass while making profit target as you are finding.

How many EAs are you trading? Diversifying further could help you achieve a better reward to risk ratio.

-

July 21, 2022 at 20:43 #119767

Matthew Roberts

ParticipantHey Samuel, I tried diversifying and made a small amount of profit on month 4.

I added BTCUSD, GBPJPY, and NAS100. Using the top 10 strategies.

gbpjpy I found I had to increase the amount of time to years to generate enough strategies with 300 count trades 30% out of sample.

that’s said, all else equal it was my highest winning pair in fact the demo account made about 7500 in a month in just that pair alone.

BTCUSD has been the big loser this month almost losing all of that 7500 and nas100 was barely a winner. With that said, maybe I should venture into more forex pairs.

I like to follow the rule atleast 10 to 15 trades per month for a strategy and I couldn’t get eurusd to generate enough strategies at 300 count trades at 24 months, then I tried 30 months and still couldn’t. Anything past 30 months is less than 10 strategies per month and I’m really not interested in that pair any more.

Any thoughts on what forex pairs might be able to generate enough strategies with 300 count of trades in 24 months?

I think I’ve mentioned this before but just in case:

Profit factor required for acceptance is 1.2 in and out is sample 30%.

minimum count trades 300

-

July 21, 2022 at 22:18 #119776

Samuel Jackson

ModeratorHey Matthew, yeah now would not be a good time for EAs on crypto in my opinion. I tend to prefer to trade indexes differently and only in the long direction.

I mostly stick to diversifying within forex though.

What timeframes are you using? 300 trades in 24 months is quite a lot so I can understand why it’s hard to get lots of strategies passing this with a good profit factor.

Also btw your stop loss and take profit ranges can make it harder to find strategies if too tight so you could try increasing that. What are you currently using, if 10-100 then I suggest the following.

Open as many reactors as you can on your computer (my rule of thumb is a reactor for each processor core) each with the same settings on a different pair using your preferred timeframe (I am assuming M15?), make sure stop loss and take profit limit is set to 20-200. Run for 24hrs and then see what pairs have more strategies that meets your acceptance criteria.

You could do this several times with a few different batches of symbols and you can take note of the pairs that are working best for you.

-

July 21, 2022 at 23:14 #119779

Matthew Roberts

ParticipantI’m doing H1 time frame.

10 to 100 TP and SL.

That’s a good idea to see which pairs will create more strategies.

Could you further explain why 20 – 200?

-

-

July 22, 2022 at 6:00 #119799

Samuel Jackson

ModeratorHey Alan,

Its will just give more range for EA studio to work with and find strategies. If you are getting plenty strategies for certain symbols then you could reduce the range a bit for those symbols and vice versa for the ones not getting many strategies.

Start with some general settings and tweak a few things for each pair. You could for example increase these ranges as suggested if not getting many strategies and if still at 200 and getting no strategies you can then start reducing the strictness of your acceptance criteria in stages, for example reducing your 300 trade requirement OOS to 200 trades and see the effect.

Take note of what works well for each symbol so you don’t have to repeat the process as it may take a week or two.

-

July 28, 2022 at 18:51 #120144

Matthew Roberts

ParticipantSamuel,

Just wanted to pop in and say thanks for the suggestions. Going 20-200 helped me find more strategies and I played around with each pair a bit.

I first tried 24 months data, 30% OOS, H1 strategies, 300 trades, minimum PF 1.2, normalizer 30% OOS, Monte Carlo 1.1 PF 80% valid.

if I found enough strategies, great I ran with it.

Most didn’t, so I moved on to 30 months and if I found enough strategies I ran with it!

If not, then I switched the time frame from H1 to others and found that most that didn’t work on H1 worked on M15.

If after that I still could not find enough strategies, I gave up on the pair.

I found 7 of the 8 I tested to generate enough strategies. NZDUSD was not a success. Any ideas on that pair?

Anyways, I’ve been generating 1 pair per night. I put 5 pairs on an account so far. The account is up $7600.00 as I am typing this.

The max drawdown so far is $5600.00.

If this continues like this, I’ll be trading for a proprietary trading firm very soon.

Thank you Petko for making this forum available to us and thanks Samuel for the help :)

-

-

July 29, 2022 at 5:13 #120171

Samuel Jackson

ModeratorHey Matthew, you are welcome re my suggestions. Glad they helped :-)

Requiring 300 trades over 2 years data will definitely be much easier to pass for M15 than H1 so that makes sense. If you want to get strategies for H1 also then I would be increasing the number of bars used in backtesting to be closer to what worked well on M15.

Not sure re NZDUSD, maybe try initially relaxing the acceptance criteria to get 100 or so eas into the collection and then investigate in the collection what seems to be the criteria that it is struggling the most to pass and make a decision about how best to proceed from there.

Well done on the great results so far. Good to see :-)

-

July 29, 2022 at 23:06 #120203

Matthew Roberts

ParticipantActually, I had 5 of them generate enough on H1. So I stuck with those 5 only.

I have decided I’d still like to do more testing on M15 pairs before placing them on my FTMO trial.

Anyways here are the results of the last 4 days doing only H1 pairs.

I still have 11 more pairs to test out on H1 to see if I can generate enough.

The way things are looking though, I’m very happy with the results I see below.

If this does end up being consistent, the saying goes “If it ain’t broke, don’t fix it.”I can always do more testing, but I want to focus the majority of my efforts on what is working.

-

August 3, 2022 at 12:11 #120688

Samuel Jackson

ModeratorHey Matthew,

You are definitely working things out and seem well on your way to that ftmo prize :-).

Its great to the the good results and I definitely agree. If it ain’t broke don’t fix it, sticking with a system is a major key to success. I got lost a while back jumping around and trying too many things too often.

keep it simple and if it ain’t broke don’t fix it are two excellent rules to live by in trading.

will be interesting to see your results when you get more pairs involved for sure!

-

September 11, 2022 at 11:21 #122476

Alex C

ParticipantHi,

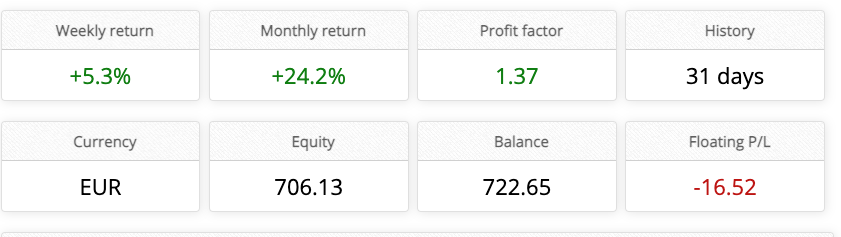

I’m new here and started taking Petko’s courses. I ran the strategies created in the courses and tested them for more than a month managing them as shown in the videos on a weekly/monthly basis. I’m very happy with the past month:

I have a couple of questions:

- What settings should I use to generate strategies for OIL/BRENT & DAX? How can I determine the SL/TP range, I saw some people talking about it but I don’t understand how they come up with those numbers

- Is there a way to generate EA’s taking 50% profit and let the rest run with a ATR trailing stop? Or adding an external EA that could manage this? Or is this not a good Idea?

- Do you close positions on Friday on your live accounts or not?

-

September 11, 2022 at 11:30 #123089

Samuel Jackson

ModeratorHi Alex,

Great initial results! What symbols are you focused on?

Currently an ATR based stop (trailing or otherwise) has not been implemented in EA studio. I do know that it is on Popov’s but it could be up to a year until its implemented in EA studio and FSB pro from chatting with him. You can set a trailing stop though of course, there is no problem adding external modifications to EAs other than you will lose ability to manage any strategies with modification in EA studio which would definitely be a big disadvantage.

I’ve had success both closing my positions on Friday and not. I am a bit undecided what is best but for trend following strategies I wouldn’t want to close on a Friday.

I focus on forex so cant really comment on those assets. I’m sure Petko will respond soon.

-

September 12, 2022 at 19:17 #123132

Alex C

ParticipantHi Samuel,

I took the Gold, Dow, EURUSD, GBPUSD, Crypto course, and the portfolio course I run them on demo and go through the steps like showed in the course… I run them on 3 different brokers. After posting it only went down, no positive weeks anymore… still in profit but I’m confused …

Can you also help determine what the minimum balance should be on a 1:30 leveraged account per trading pair/EA?

And what about Gold & Dow, how much should I add for each running EA? I have trouble understanding how you can determine that based on leverage etc….

-

September 19, 2022 at 15:31 #124421

Alan Northam

ParticipantHi Alex C,

I wanted to comment on your confusion as posted above “After posting it only went down, no positive weeks anymore… still in profit but I’m confused …” If I am off base I hope Samuel or Petko will correct me.

When we create a strategy the balance line does not go straight up and will have periods of drawdowns. So it makes sense to me that the strategy will have periods of draw downs in the future. For example my portfolio of 10 strategies from 02/19/2022 through 08/19/2022 has a drawdown of 1.65%. When I move my strategy forward from 03/19/2022 through 09/19/2022, which includes the most recent price action of the market, it has a current drawdown of 2.47%. The current draw down is a little less than 1% greater (2.47% – 1.65%). I attribute the current draw down I am experiencing at due to the current increased volatility in the market as due to recent economic conditions which is worse than the previous six months. It is my belief that as we go through the months ahead there will be periods when my portfolio’s balance line will continue to move higher along with future periods of draw down. So, while it may be frustrating to watch my portfolio go through the current drawdown I am not giving up. I believe that my portfolio will continue to increase in value as I go through the months ahead. So, in my opinion, I don’t think I would be confused yet. I would give it more time.

-

-

September 18, 2022 at 14:30 #123886

Petko Aleksandrov

KeymasterHey Alex,

That depends on the brokers you use.

When you have a trade opened with an EA, check the margin in the terminal, and you will see exactly how much your broker blocked from your account for that particuar trade.

For example, with this picture shows how much is blocked from my account:

Do it with 0.1 so you can easily make the calculations for yourself.

-

September 19, 2022 at 2:06 #124206

Samuel Jackson

ModeratorHey Alex, to add to what Petko has said.

How much you trade depends on your risk tolerance you want to make sure that first you are at no risk of a margin call so should calculate what your max margin would be if you had an open trade on all your EAs and adjust accordingly (use half your margin at most).

Also you should have rough idea of what your range of profit/drawdown would be per month or so, best to make sure that also this limits your drawdown to your risk tolerance. 5% a month works for my sanity

-

September 19, 2022 at 9:44 #124293

Alex C

ParticipantThanks for your answers…

With a 1:30 leveraged account and using 0.01 lotsize how much should I have on my account, because using the process you describe it is never a fixed amount of EA’s.

Also US30 has a minium lotsize of 0.10 on my broker, Gold and indexes tend to skew my results because of their pip value which is bigger…

Do you use an EA to manage risk, like closing all positions when the 5% is reached? Do you then wait for a month to put new EA’s in the market? IF you use an EA could you please share it? Do you also apply a max risk per EA?

-

September 20, 2022 at 0:31 #124754

Samuel Jackson

ModeratorHey Alan,

Your thoughts are correct as far as I am concerned. Drawdowns are inevitable no matter how good the account. If the principles however are solid and you have faith in your system along with setting sensible levels of risk then riding them out is needed when they occur.

It takes time and practice to develop this faith and experience and therefore scaling up slowly from demo, to small live to incremental increases in trading capital is a sensible path.

I also wouldn’t be confused with drawdowns occurring. All portfolios have stagnation periods.

Its up to you to decide wether it is a stagnation period or a poor system which comes with practice and time (experience)

-

September 23, 2022 at 10:48 #125207

Alex C

ParticipantI understand that an Equityline can’t go straight up. What I saw over the last weeks is that the active portfolio seems to make profits big profits on Monday and if it doensn’t the rest of the week is catastrophic (10%-20%). Also Friday’s seem to be profitable 80% of the time, do you consider eg. only putting EA’s on specific days when you see that other days aren’t profitable?

I also read about drawdowns of strategies and timing to put them in the market, running strategies on demo accounts and putting them up live when they have a drawdown on demo because you expect a recovery. Does anyone take this into practice or not?

Can someone tell help me determine how much robots I can best put on my 500$ account with 1:30 leverage and how I can calculate this for myself? I see that indexes and gold have a lot of impact on my strategy performance as the minimum lotsize is 0,10 for indices and gold tend to move more. What can I do about that on a small account?

-

September 24, 2022 at 9:50 #125270

Samuel Jackson

ModeratorOn this size of account I’d stick to forex and only open 0.01 lots size positions.

The easiest way is gonna be to just open a demo account with 10k balance and the same 30 leverage. Then open enough 0.2 lot size position manually until you hit about a 1/3 of your margin.

Since 10k/0.2 lot is the same as 0.5k/0.01 lot that will be the number of EAs you should trade on your 500 dollar account.

This should take 5 minutes to open a new account and 5 minutes to do you calc :-)

-

October 1, 2022 at 13:20 #126508

ARRR

ParticipantThanks everyone for sharing your valuable experience.

-

July 27, 2023 at 12:08 #186171

Petko Aleksandrov

KeymasterCheck out a new video from SIC Trader! It will help you understand how EA Studio works:

-

-

AuthorPosts

- You must be logged in to reply to this topic.