Home › Forums › Live Trading Results › Challenges › Sam’s FTMO challenge with EA Studio robots

- This topic has 9 replies, 4 voices, and was last updated 11 months, 2 weeks ago by

Samuel Jackson.

-

AuthorPosts

-

-

May 20, 2024 at 14:23 #255921

Samuel Jackson

ModeratorHi Traders,

To introduce myself, I am fulltime travelling trader who has been trading forex as a side hustle seriously using EA studio for a few years now (with a few years of manual trading of crypto and forex prior to this) but transitioned to fulltime trading about 6 months ago using mainly prop firm capital.

I just spent the last few months in Europe trading and after my next 6 weeks in Oz visiting family and friends I will be heading to Vietnam for a few months, so I will also share this experience and trading as I go by making videos and sharing the journey of travel trading as best I can along with any tips and tricks I discover along the way.

I trade primarily using strategies developed using EA studio, although I also use FSBPro and code strategies myself also.

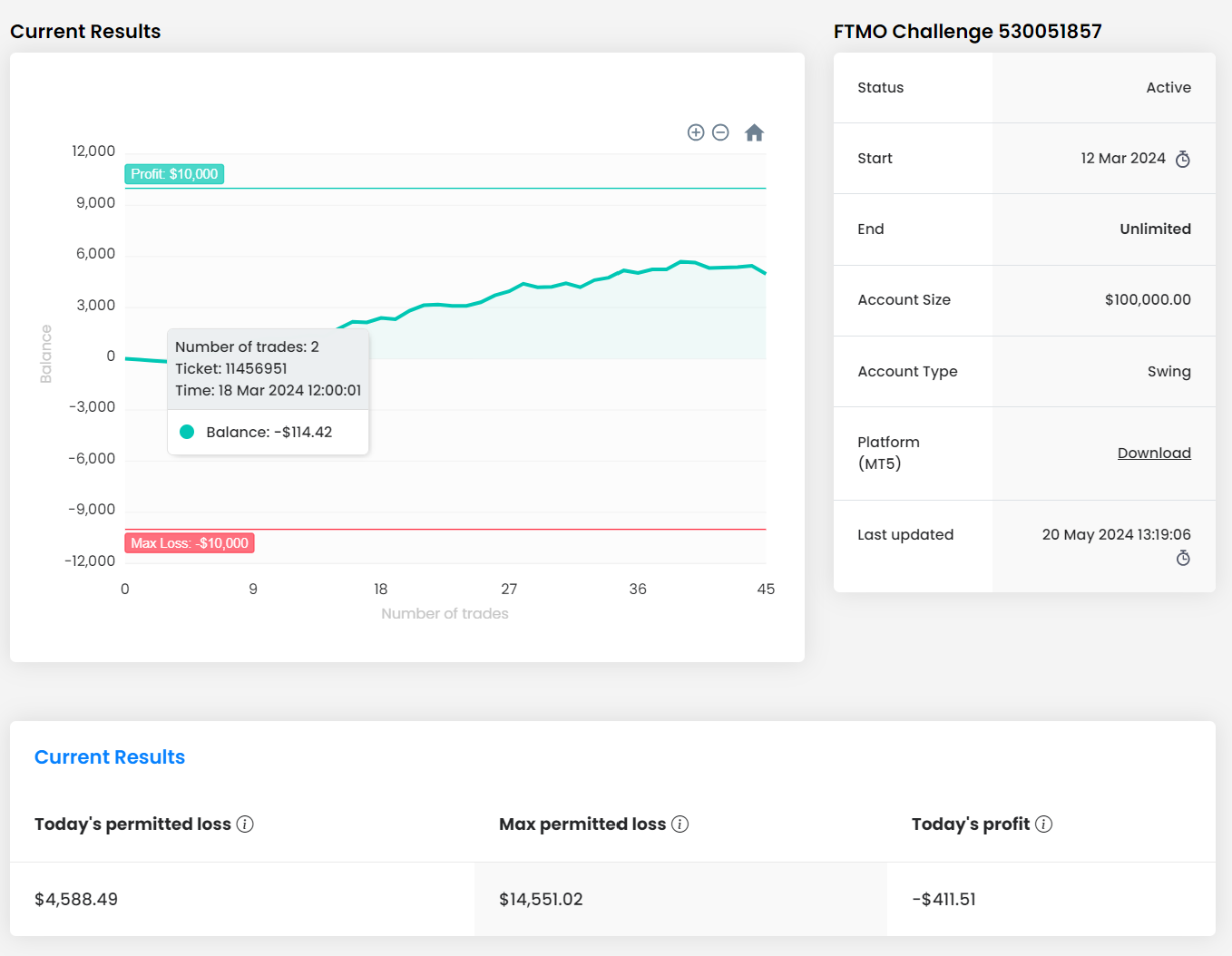

The following portfolio has been trading only strategies developed using EA studio. It has been trading well so far, I can’t control the market but I hope that it will pass in another few months or so.

Predominantly I favour H1 and a slow hands off approach so in terms of management, the same portfolio has been trading unmodified from the start of the challenge.

I am sharing my current FTMO challenge account result that has been trading since March 2024. I will aim to update the results monthly and answer any questions anyone has.

-

May 21, 2024 at 23:18 #256299

Mr Stols

ParticipantHello Sam,

In those years did you make any profits with EA Studio?

My perception is that the EA’s that are generated are of a low quality.John

-

May 25, 2024 at 4:50 #256903

Samuel Jackson

ModeratorYes John, I have been able to make consistent profits with EA Studio over time.

With any generation software there will ALWAYS be a portion of poor quality strategies as that is just the nature of the beast, however there are certainly good strategies in there. That is where effective robustness testing and experience comes in.

EA studio is just like any tool. It is only a bad workman that blames his tools (I am not calling you a bad workman btw but the saying definitely applies).

There is a learning curve and like anything the more you practice and more experience you get trading with expert advisors the better your results will become.

Will EA studio allow a complete novice to click a few buttons and trade profitably, highly unlikely. But that is a totally unrealistic expectation so that in the first place to start with.

HOWEVER EA Studio my opinion is an absolutely excellent tool at what it does (And in my experience the absolute best generator out there for both beginners and more advanced users alike). Can I and do I code my own more advanced strategies yes, but most of my portfolios are created using EA studio.

EA Studio will however massively speed up entry into the market, save an absolute tonne of time and effort and once proficient will effectively allow experienced users to create robust portfolios in the most efficient and easy way that I know of.

Trading is just like any other skill. Practice and experience are required but the right tools will help that streamline that journey to competence and EA studio in my experience is my favourite and in my opinion the best.

-

June 19, 2024 at 1:21 #261866

Stephen Schilg

ParticipantHey Sam,

Thanks for your post. I’m relatively new to EA Studio, but not necessarily algorithmic trading.

Do you have a process that is quite different to what Petko teaches in his courses for generation and testing? I’m still a bit unsure about whether to go ahead with purchasing the software as it’s a lot of money for myself.

It sounds as though you don’t rinse your EA’s as often as others might – have you found more luck on the higher TF’s with consistency? From what I understand 15M and above is best for longer term profitability.

Thanks mate.

-

August 6, 2024 at 23:53 #277884

Samuel Jackson

ModeratorHi Stephen, sorry for the late reply

I tend to leave my EAs running rather than rinse them as regularly as Petko so my process is a bit different. I will be making Youtube videos ongoingly btw so look out for those as they will be helpful.

And yes I tend to favour H1 timeframe and find its better for longer term profitability, but also do well with M15 and M30

-

August 6, 2024 at 23:57 #277887

Samuel Jackson

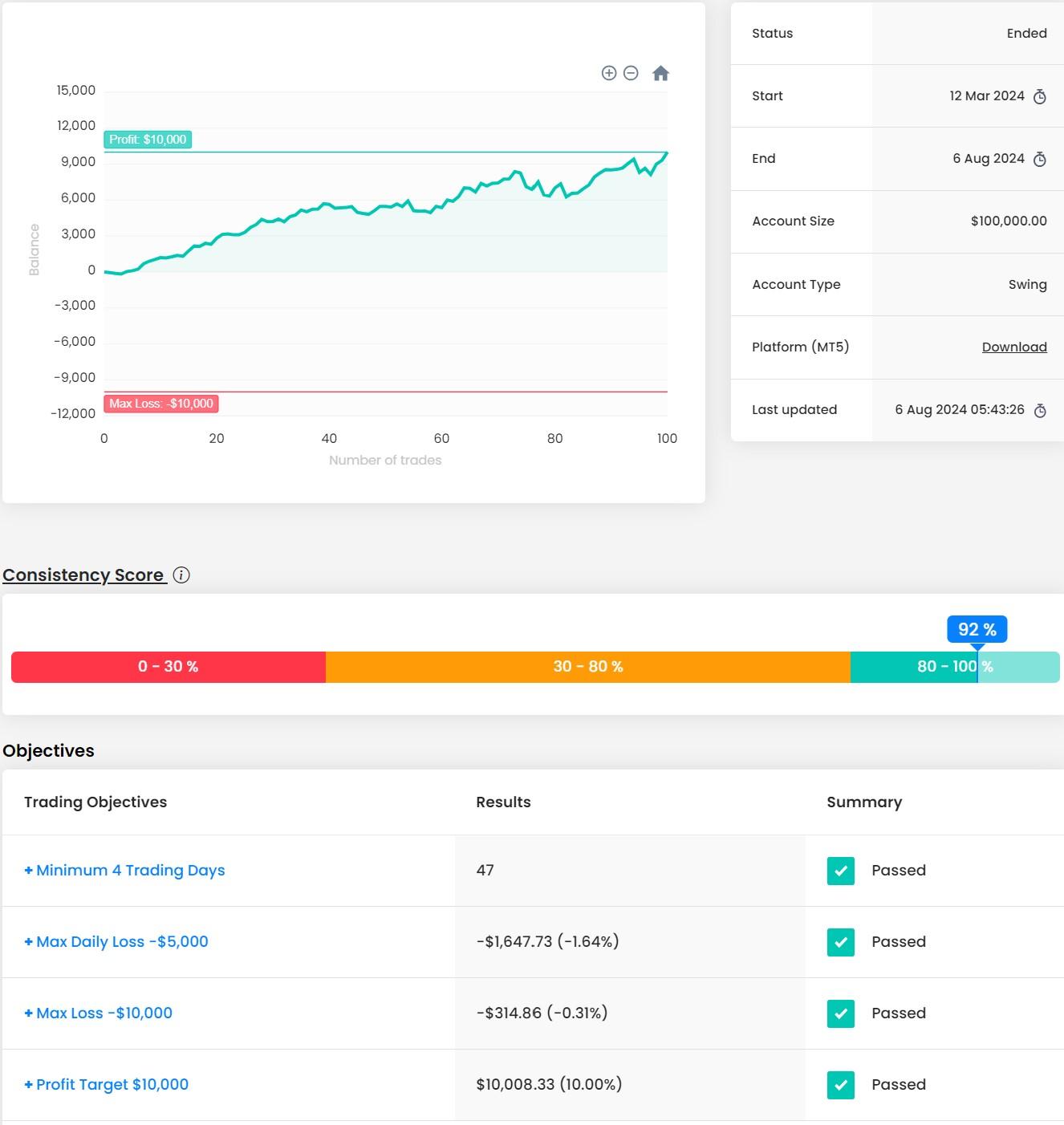

ModeratorThis account just passed the challenge btw, I used the same EAs for the entire challenge except from removing 1 around halfway through the challenge. Happy to answer any questions and discuss on here and also look out for future content videos on Petkos channel from me :-)

-

September 19, 2024 at 17:16 #310662

Rvdveer

ParticipantHi Sam thank for sharing your results. I wonder if you can share the settings we need to keep to the limits of a prop challenge like the drawdown etc?

Thanks,

Rocco

-

October 3, 2024 at 9:31 #313510

Samuel Jackson

ModeratorHi Rocco, the settings you need depends on the strategy and the portfolio. For example if have a single strategy and it has 5% drawdown on the backtest with 0.1 lot size then if your prop challenge has an allowable 10% drawdown you could trade 0.2 lots. Adding an additional factor of safety anywhere between 1.5-2.5 is sensible also depending on your risk appetite.

If you then combine this strategy with another one to create a portfolio and the portfolio has a drawdown on 2.5% then of course the lot size can be doubled for each EA.

This is how I do things anyway. Hope that makes sense.

It does depend on risk appetite though to some degree

-

October 3, 2024 at 9:31 #313511

Samuel Jackson

ModeratorHi Rocco, the settings you need depends on the strategy and the portfolio. For example if have a single strategy and it has 5% drawdown on the backtest with 0.1 lot size then if your prop challenge has an allowable 10% drawdown you could trade 0.2 lots. Adding an additional factor of safety anywhere between 1.5-2.5 is sensible also depending on your risk appetite.

If you then combine this strategy with another one to create a portfolio and the portfolio has a drawdown on 2.5% then of course the lot size can be doubled for each EA.

This is how I do things anyway. Hope that makes sense.

It does depend on risk appetite though to some degree

-

-

AuthorPosts

- You must be logged in to reply to this topic.