Home › Forums › General Discussion › Roadmap – Working routine

Tagged: Procedure, process, roadmap, routine, working routine

- This topic has 12 replies, 1 voice, and was last updated 4 years, 8 months ago by

Petko Aleksandrov.

Petko Aleksandrov.

-

AuthorPosts

-

-

October 9, 2020 at 20:39 #62845

Asser

ParticipantHi guys,

As a newbie – though oldie but good-looking nevertheless (just kidding) …

(Jokes aside) I wish some of you, fellow traders, would guide/inspire me by briefly describing your steps towards using EA Studio (Pro) from creating robots to replacing them routinely.Here’s my problem: I went through 4-5 Forex algo courses and understood pretty much everything but still need a “push” (a final touch to my roadmap). Can’t see the forest for the trees! Confusion is part of getting old – sorry!

The following steps are meant as an example:

– How do you create your strategies/EAs?

– What’s your daily, weekly or monthly routine?

– What historical data did you use first time?

– What historical data you’re using routinely to update your EAs?

– How far you’d go back historically (first time and on each update)?

– How do you clean up your old historical data?

– How do you test/update your EAs?Maybe we could vote for the best working procedure.

Looking forward to your participation but only if you’re up to it. No rush, no pressure!

Thanks.

-

October 10, 2020 at 16:13 #63051

Asser

ParticipantNo need!

Was a little confused, but I finally got it (Phew).

I also found a thread in this forum with somewhat the same topic.

Anyway, let me know if my request could do some good or am I a newbie demanding too much and wasting your time.

If so, I apologize! -

October 11, 2020 at 11:30 #63064

yigityilmaz

MemberHello, can you share the link to the topic which you’ve found?

-

October 11, 2020 at 11:57 #63065

Asser

ParticipantSure! Here it is:

How many assets and/or EAs are you trading with?It’s a long thread but covers many of my questions.

Anyway, I’m creating my very own plan as we speak.

I’ve decided to stop doing what others do (including Petko) and find my own way. Learning from others’ methods rather than “copying” them is the best way to go. Please let me know what you think or whether you agree.One more thing yigitilmaz:

If you want to search this forum in a more efficient way than by using the search option provided, here’s (in my humble opinion) a better way:

Go to Google and type (in Google’s search box) exactly:

site:eaforexacademy.com/forums/

… followed by “space” and your keyword(s)

Hope I’m not breaking any rules! Otherwise, please delete my post. Thanks. -

October 11, 2020 at 13:04 #63067

yigityilmaz

MemberThank you so much for the information especially for the searching one :)

I am also a beginner on automated EA trading. Need more practice and figure out the system on the demo accounts.

Last week, I have selected 15-20 created EAs by me and 15-20 from Petko’s have started with 3000 $ demo account,

0.01 lot volume / per ea but really less trading per ea account because they are generally for H1.

I’ve changed my broker cause of the high spread ratio than the preferred broker at EAforexacademy. But with the new symbol settings for the broker, the amount of created EAs / per time is decreased dramatically.

My new act of plan as below in detail :

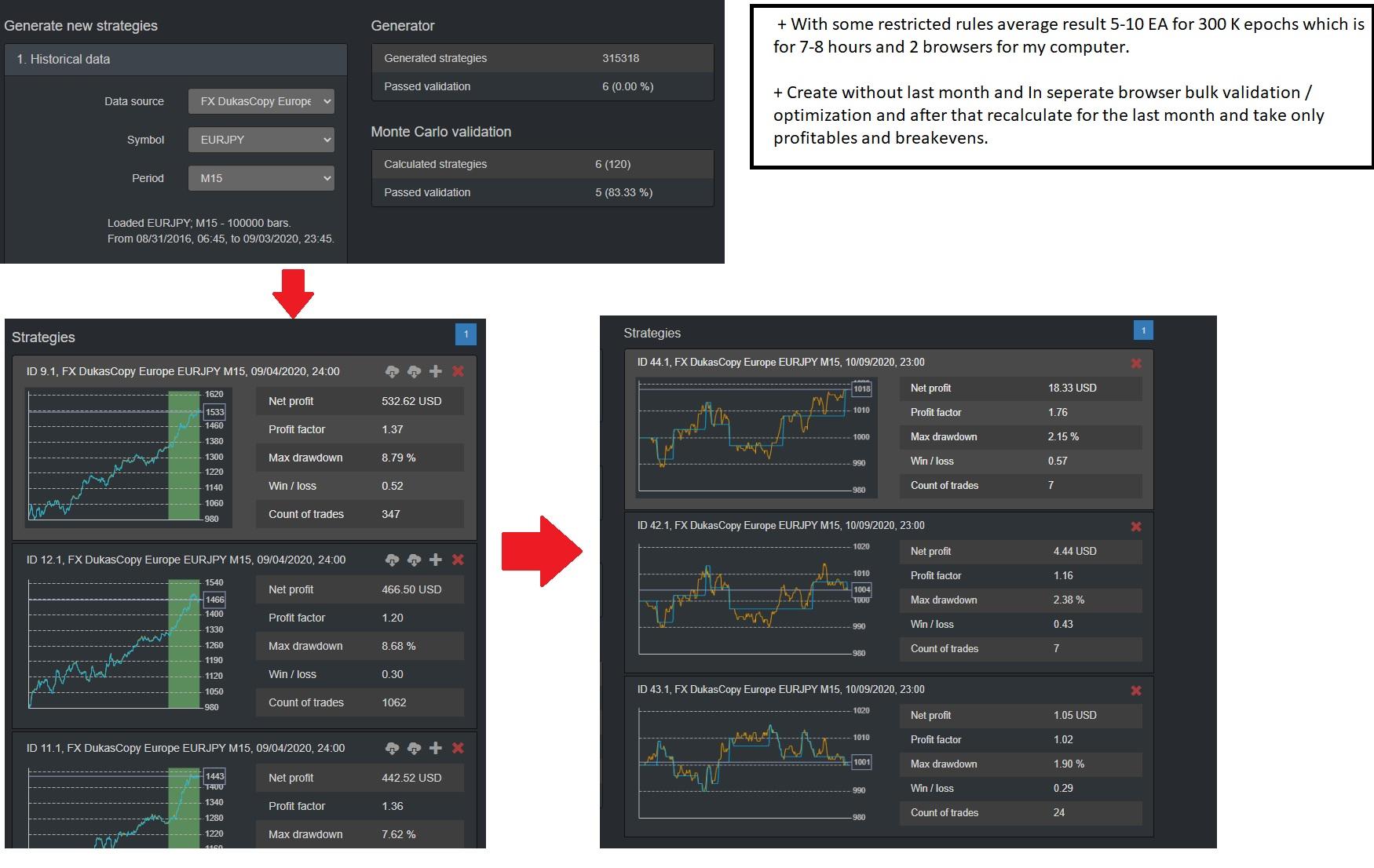

means that I am able to average 5-6 validated EAs / per day.

And as the first start (again in the demo because I am inexperienced on automated EA trading)

for the start 2 accounts ;

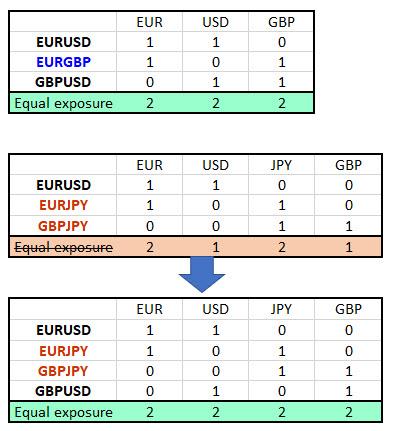

- 1000 $ one for long term portfolio H1, cross pairs like EURUSD / EURGBP / GBPUSD or EURUSD / EURJPY / GBPJPY and create each month new EA’s replace with losers. 1 demo / 1 live tracking (0.01 lot) .

- 3000 $ one for short time – more active account M15 / M30 time frame high amount of EA’s 1 demo / 1 live tracking (0.01 lot).

- If these are profitable maybe in future coin or gold account may I thing.

H1 EAs are easier to create with restricted criteria 40-50 validated EAs/month.

M15 – M30 EAs are harder to create with restricted criteria 20-25 validated EAs/month.

I have also notice that if you have created EA for small-time frames like M5 – M1 which are really hard to get suitable for all brokers they are really effective in getting sufficient results on forward-tests but they are much harder to create.

I have given detail to learn effectively. I have watched so many lectures of Petrov’s but sharing a live experience more effective, your one-sentence may create 1-month effect on my process at least.

Regards..

-

October 11, 2020 at 13:47 #63068

Asser

ParticipantSharing our experience is good, true!

One small remark, if I may:

The other set of currency pairs (EURUSD / EURJPY / GBPJPY) doesn’t have equal exposure. I’d add GBPUSD to it.

Let me explain:

Thank you for sharing yigityilmaz. -

October 11, 2020 at 14:32 #63069

yigityilmaz

MemberHm clear, great. Thank you so much, if I’ll realize a stable way to grow up my capital, I’m going to share :)

-

October 11, 2020 at 15:04 #63104

Asser

ParticipantHi Petko & yigityilmaz and everybody,

Here’s my plan and hopefully my roadmap:

Balance:

I have about $3000 to invest. Money from a family member, so I’d better do it right!Broker:

I tried to reveal my broker but some security device prevented me from doing so. So I’ll skip this step.Living in Europe, where CFD and high leverage trading are not welcome, and in order to avoid ESMA rules, I chose 2 Australian regulated brokers.

-

October 11, 2020 at 15:11 #63113

Asser

ParticipantAssets:

Focusing (for now) on: EURUSD, GBPUSD, EURGBP and XAUUSD. -

October 11, 2020 at 15:21 #63115

Asser

ParticipantHi MARIN – HELLO MODERATOR:

I’m having a problem submitting my post. Obviously there’s a security plugin in Forex Academy that prevents me from submitting my post. Probably a word or a combination of words. Could you please get in touch with me (You have my email) so I can show you what I’m writing?

-

October 11, 2020 at 15:48 #63134

Asser

Participanttest

-

October 11, 2020 at 15:59 #63135

Asser

ParticipantHi Petko & yigityilmaz and everybody,

Here’s my plan and hopefully my roadmap:

Balance:

I have about $3000 to invest. Money from a family member, so I’d better do it right!Broker:

Living in Europe, where CFD and high leverage trading are not welcome, and in order to avoid ESMA rules, I chose 2 Australian regulated brokers.Assets:

Focusing (for now) on: EURUSD, GBPUSD, EURGBP and XAUUSD.Historical data:

I’m convinced that approx. 5 years of historical data is adequate and gives us robust strategies. BUT I’m not sure that’s the way for me for two reasons:1) I don’t have good historical data accumulated from my broker and it would take me years to accumulate 5 years of data.

2) Therefore, instead of using Dukascopy’s historical data and adjust them to my broker(s), I’m testing whether using the “EA Studio Data Export Script” combined with weekly update (to start with), gives me enough data from my broker. LOGICALLY fresh historical data (of a year or so), DIRECTLY from my own broker, should (theoretically & in my mind) be more suitable than 5-year-old data adjusted to conform with my broker. So, I’d like to see that with my own eyes.

As a beginner, I really miss a roadmap to START trading, not to CONTINUE trading. Many (if not all) of Petko’s lessons focus on how you continue trading – although he says different (no offense Petko – and sorry if I’m wrong).

What drew my attention (very much) is the fact that there’s a way to test the strategies you create without the need of demo trading. That’s by using the “OUT OF SAMPLE” method or (alternatively) by limiting your historical data using the “Data Horizon” when back-testing strategies.

I know that Petko doesn’t recommend trading live without demo trading first, but I’m getting old and running out of time & money. Furthermore, I see no harm in trading live with one or two EAs of 0.01 lot each per asset. THAT’S my plan.

Please comment.Thank you.

-

October 14, 2020 at 9:28 #63290

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Asser and guys,

Interesting topic here.

It is very important to have a plan. And I can not tell you, guys, what plan exactly to follow. Everyone is different, everyone sees the market with different eyes. That is not mathematics whit one solution for the problem.

Asser, in most of my courses I show from scratch to start trading with the EAs. Obviously, I do not like to do very basics staff that are available on YouTube. So I do not agree that my courses are to “continue trading” as most of our students were complete beginners. And of course, it is different for everyone – how long it will take you to start, what amount you have for trading, and so on.

I wouldn’t suggest you rush with the time because that is a factor that might drive your losses.

Anyway, your plan looks fine to me. BUT I would suggest you test it for a few months on a couple of Demo accounts.

And last, I have always refused to trade with someone else money. Many friends asked me to do it, students and traders, but I always say no… Because the pressure is bigger and you might break a good relationship.

-

-

AuthorPosts

- You must be logged in to reply to this topic.