Home › Forums › General Discussion › Realistic expectations for the EAs

- This topic has 6 replies, 1 voice, and was last updated 3 years, 3 months ago by

Petko Aleksandrov.

-

AuthorPosts

-

-

February 16, 2022 at 13:31 #108977

Mario Frank

ParticipantHello Petko and community,

First of all I’d like to thank Petko for creating this project. I’ve been bouncing around the trading world since before it was cool and I can say that this is one of the most useful tools I’ve seen. Clearly I haven’t been profitable enough to quit my day job but I never give up lol.

I am a manual trader, fan of harmonic patterns but much more used to oscillators and MAs to time my entries. After spending the majority of my time on FX and XAU charts, I started to get involved with indices, mainly US30 and DAX. The main reason is that they move in daily recognizable patterns. Obviously there’s no crystal ball, but once the first daily volatility explosion fades out, usually within the first 10 minutes, you can pretty much predict if it’s going to be a “V” or “W” day, as in the patterns that are formed by price action. This movement is much more regular and therefore predictable than FX, at least IMHO. I look at my charts and indicators on M15 and H1 TF, then I drop down to M5 to get in. I usually go for 1:3 R:R and have been exploring and experimenting with partial closing and trailing stops, without great success I must say.

Having a day job and some adorable kids to play around with, unfortunately I miss quite some trading days every month and that clearly ruins my statistical advantage. So I was looking to automate my trading and my digital path led me here. I was also quite interested in the FTMO challenge, and similars, as on paper they sound like a great idea and being able to automate the trading while complying with the rules sounds like a plan worth looking into.

It’s been a couple days I’ve been playing around with the studio software and I have been totally blown away! I started by setting things up as similar as my manual trading but then allowed the generator to take things to an entirely different level. I can say that as far as I can see, indices are extremely more profitable than FX. I’ve also had good success with XAU and not surprisingly also BTC.

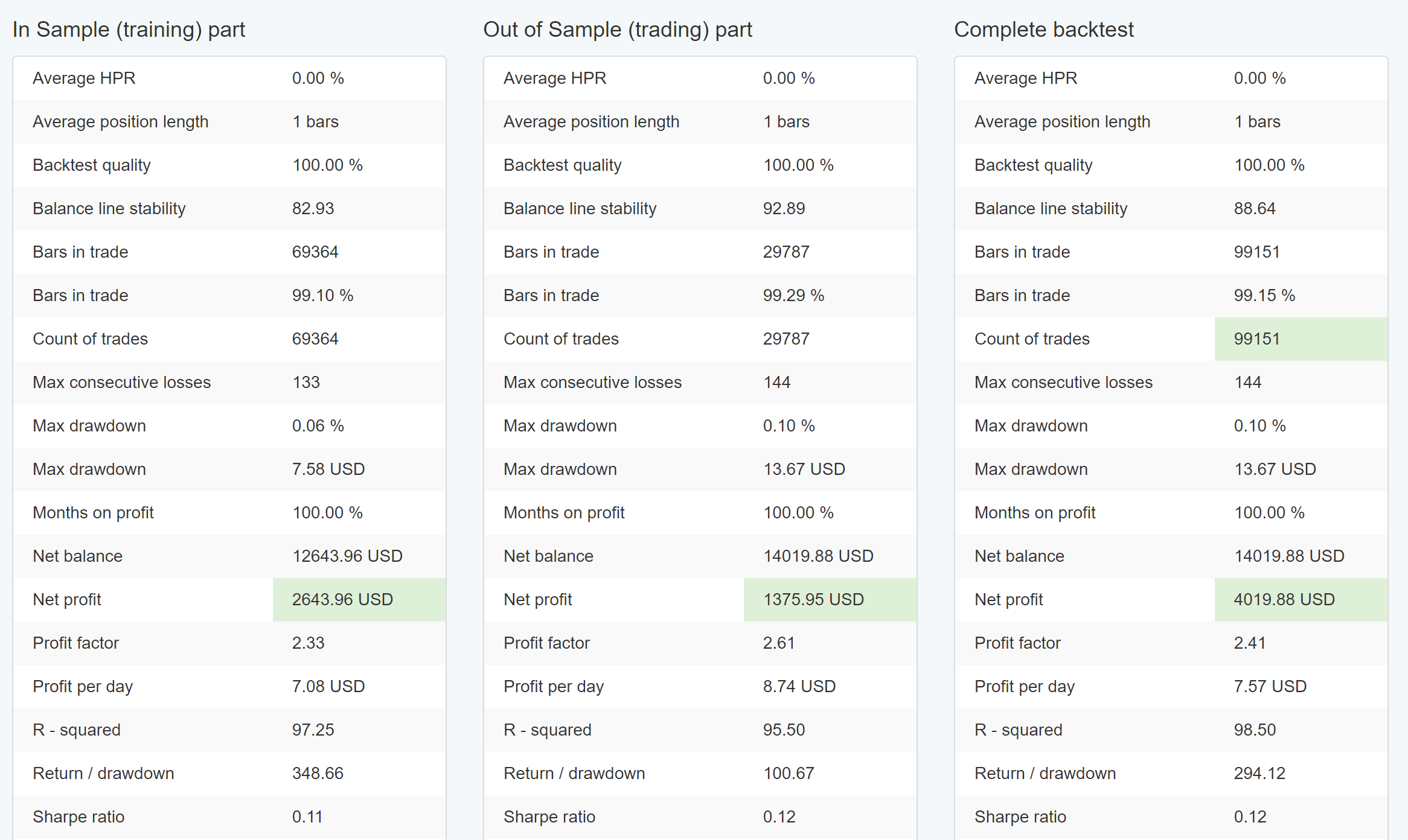

Attached you can see the statistics of all 4 strategies: US30, DAX, BTC and XAU. I had to go and play around with the settings as it would be beautiful to have 10 point spreads on these assets, but in reality MT4 brokers offer spreads closer to 25/30 points on indices and 300 points on BTC. This cuts down the profits but still the numbers are beyond astonishing. No losing months and R:R unheard of.

I will be generating the EAs and placing them on a demo account. But before even doing all that, my question for Petko is: how realistic are these results? I am very aware that past performance means close to nothing for future profit (or loss), but still, over the past two years of data the markets have gone through a range of conditions: scared by Covid, bullish for the bounce, scared by war talks and so on; the sample, due to the number of trades taken by the system, is credible. My gut tells me I’m missing something here, maybe slips and widening spreads kill the strategy. I don’t know.

I’m very much looking forward to having feedback and then trying the strategies on a demo. If it’s interesting for the community I’ll keep posting results.

Once again thanks Petko for all this!

Happy trading

-

February 16, 2022 at 13:31 #109418

Petko Aleksandrov

KeymasterHey mate,

I am glad to hear that you liked the software we integrated into the Academy.

I got your point about everything and I agree with you.

However, what is my concern with your strategy is the Average position length = 1.

Does this mean that you are trading just one bar time? And actually, it equals the number of bars. This means that your strategy traded every single bar.

How did you come up with such strategies? :)

Petko A

-

February 28, 2022 at 0:41 #110282

Samuel Jackson

ModeratorHi Mario,

You asked how realistic the strategies are:

What robustness tests have you performed? How many bars? What timeframe are you using?

As to widening spread killing the strategy two suggestions if you are concerned about this then here are a few suggestions to check this out:

1. You can simply increase the spread from 10-20 for example and see how it affects your strategy

2. Run a monte carlo on spread only

These shouldn’t show much effect as generally the strategy will simply improve if you lower the fixed spread and and vice versa if you increase it.

A check I often perform is to change the trading session time in tools from 00:00 – 24:00 to 01:00 -24:00 as I have noticed that this can be quite a volatile time for spread and so it has a measurable negative impact I personally don’t take that as a good sign.

Of course the most accurate way will be to run it on a demo and see the results when trading real-time with variable spreads.

If your strategy passes all those check then I wouldn’t be concerned about spread (In my opinion anyway), but there are many more checks required to increase the probability of your strategy being a robust one. Its as much an art as a science I reckon.

It can be quite easy to get excellent results as you have shown but you have to be careful that you have not simply allowed EA studio to curve fit results.

-

February 28, 2022 at 11:34 #110301

Samuel Jackson

ModeratorOne additional suggestion Mario, it sound like you put this together pretty quickly on what I am assuming is a recent end date of the sample?

I would suggest repeating what you did exactly but set the end date back six months or so. Then assuming you have a collection of say 50 strategies that you think look good add a sample of them (or all of them) to the portfolio and then recalculate for the most recent six months (Kind of running a second OOS manually).

That might give a quick indication on the likelihood of current your process resulting in curve fitting. Also you mention running the generator rather than the reactor which also adds to this concern.

Ordinarily I wouldn’t think spread or slippage would wreck things (provided a sensible approach is taken) but if you were trading every bar like this then I’d say spread, slippage and commission would be extremely likely to kill it.

As Petko said the major concern is the length of the trade and that you have traded every single bar of the entire set? I actually cant even comprehend how such a strategy would be created. Its really just opening a long or short trade at the start of EVERY single bar and then closing it at the end of the bar and immediately reopening another long or short position which seems pretty wild.

-

March 2, 2022 at 19:44 #110570

Petko Aleksandrov

KeymasterHey Samuel,

Thanks for sharing your knowledge. I remember when you joined the Academy, and now you sound like a Pro :) Proud of you!

Having such a strategy (if one used the generator) shows how good EA Studio is. :) But it is insane…I wouldn’t use it.

-

March 4, 2022 at 7:41 #110635

Samuel Jackson

ModeratorCheers Petko, that means a lot coming from my Teacher.

It wasn’t until I found your courses that my passion and enjoyment of trading really took off in a big way, been working hard at it ever since and loving it :-)

And yup, insane strategy that does show how powerful EA studio is, it’s fit something that looks awesome but I can’t see how it could have any predictive edge to it!

Reconsider the settings, just recently I thought I had some fantastic reactor settings going but realized that somehow they were resulting in a huge proportion of my strategies in the collection making most of their trades on Monday at 0:00 or 1:00 which is high spread period. Without going into it too much it wasn’t gonna work out well in live trading!

It really is absolutely brilliant software that does a huge amount of work for us but we still need to a good bit of thinking and run some sense checks and tests to deepen our understanding of the end result and increase the robustness of our strategies.

Practice makes perfect as they say

-

March 14, 2022 at 10:32 #112660

Petko Aleksandrov

KeymasterOne thing we have been discussing with Mr. Popov is that the better the software becomes the trickier it will be for the beginner traders.

The software uses historical data, but it is hard to catch the news, the mid-night high spreads, the over-optimized strategies (good there is Monte Carlo)

That is why the traders need to put some logic, limitations in the Reactor, and precise Demo and Live testing.

Anyway, I am glad you found your passion.

-

-

AuthorPosts

- You must be logged in to reply to this topic.