Home › Forums › Trading Courses › Automated Forex trading course + 99 Expert Advisors › My result after 5 week of Automated trading

- This topic has 64 replies, 1 voice, and was last updated 5 years, 10 months ago by

forexmaniac.

-

AuthorPosts

-

-

October 27, 2018 at 17:22 #6700

JordyTr971Participant

JordyTr971ParticipantHi,

I want to share with you my results after 5 week of trading applying what I’ve learned in the courses “Automated Forex trading + 99 Expert Advisors every month”

I keep trading the TOP 10 EA’s

The EA has been generated on EURUSD, EURJPY, USDJPY – M15 OnlyNow I want to have more diversification on the timeframe, I will do M15, M30 and H1

And stll keep trading the top 10EA’sLet us know how do you manage you’re EA and Please don’t hesitate to share with us you’re results

-

October 27, 2018 at 23:15 #6702

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Jordy, you nearly doubled your account mate!!!!

That is awesome. I enrolled to the course but left if for a bit later. I took the Pack with the courses and the strategy builders so I will focus on learning EA Studio and FSB Pro first.

But seeing your results will force me look into the course and start testing the EAs. Once I H we results for sure I will place them over here. You have opened great topic!

-

October 27, 2018 at 23:35 #6704

JordyTr971Participant

JordyTr971ParticipantThank you!

Yes, dont waste more time automated trading with EA Studio and FSB is really a good thing !

I have wasted more than 2 year trying different thing (Manual trading, holy grail indicator, buying expensive EA ..) Without any sucess ..

now with EA Studio and the big help of Petko Aleksandrov I have finally my first profitable month in 2 year !!!I just bought the courses “Algorithmic trading course: London, New York & Tokyo system”

I will try it and let you know in few weeks !

-

October 28, 2018 at 8:51 #6706

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Jordy,

Unfortunately this is the path that most people find algorithmic trading. I had a similar start in trading.

And years back the algo trading was much harder, because I needed to hire developers to code the strategies…a lot of money and time.

Now with the EA Studio and FSB Pro is really easier, and I guess only the people who know the algo trading before that can really appreciate it.

Glad to see that you share your results.

-

November 30, 2018 at 16:50 #7198

jacpin2002

ParticipantHi Jordy! I didn’t see that you had already posted as I also posted a similar question about other people are using EAs to trade. I see that your focus is on three Forex pairs and are just using the top ten strategies for each of those pairs on M15 only. Now, I see you are going to expand to M30 and H1 charts. That’s gonna be 90 EAs trading on three pairs! You have great results.

I am building strategies on 24 different pairs with two time frames, but they are not just Forex. I’m also including indicies, cryptocurrency, metals, and energy. If things don’t work for me in this way, I may switch my logic and focus on maybe three pairs like you and then trade on multiple time frames. I currently have three Fprex pairs trading live right now. Thanks for sharing.

-

November 30, 2018 at 21:52 #7227

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThis is so nice to see such results with other traders. I am pretty new to EA Studio. Well, actually I tested it nearly year ago, but was a bit skeptical. After losing some money on live account trying to trade manually and predict the future in the market, i went back to Petko’s courses. I did realize that I need the EA Studio, and to work harder on it.

Now I have taken 2 more of his courses, the lifetime license for EA Studio, and when I saw this topic it gave me some more enthusiasm, but for sure I will take it easy with the lice trading. The loss still hurts :) Thank you all for sharing! Impressive!

-

December 2, 2018 at 13:00 #7272

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Viktor,

glad to hear you have your enthusiasm in trading back. Try to ignore the trading results you had before. I can share with you that most of the students joining the Academy is after having losses. Nearly everyone starts trading without any kind of education.

And actually the enthusiasm should be used in hard work with EA Studio and the Expert Advisors and not in trading. Emotions should not be there in trading! Trading automated EA Forex is one of the key points to ignore the emotions.

-

December 3, 2018 at 4:05 #7299

jacpin2002

Participant@Viktor-I know exactly how you feel. Petko is right. I started with hardly no education, loss some money in live accounts and found the Academy with EA Studio. I’m very glad I found this software.

I also agree with Petko about keeping emotions out of trading, which I also had a hard time with when doing manual trading. With the EAs, I don’t even look at charts anymore. The only thing I do is check to see what my account balance is and to see how my demo EAs are performing. Most of my time is spent creating the EAs with EA studio, loading them on MT to use for automated trading, analyzing results, and replacing if need be. I love this about EA Studio.

Glad to have you back on board. Feel free to reach out. I’m starting to get more involved in the forums and have no issues with sharing my experience.

-

December 3, 2018 at 13:33 #7333

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey guys,

thank you so much for giving me some power to step on my feet with trading. I will do my best to follow your advises! Petko you are the man in educating people! I wish I have found you earler.

Jacpin, you are so kind too! It is great for me to see other;s success. This way I believe that I can do it too.

Now I will focus on testing the EAs from the courses, and creating my own. I do not have the capability to open live account again, because I do not want to trade with anything less than 10k. So I am planning to spend my time creating and testing EAs as you say.

Yes, i know it is great to avoid the emotions and not to look over the chart every 2 min, watching how the price goes against you. I realize how better is trading with Expert Advisors.

Jacpin, may I ask you how long time are you testing the EAs on Demo before placing them on live account?

-

December 3, 2018 at 16:58 #7350

jacpin2002

Participant@Viktor-I took some advice from Petko and then formulated my own rules for demo. I put a lot of effort on the generation of EAs…meaning my acceptance criteria is very strict. Once this is done, I demo test with this criteria before going live:

Min 2 week trading time period

Min 10 open and closed trades

Min 70% winning percentageI have 4 live EAs in my account right now and I am demo testing 96 EAs. The 4 EAs that I have live, I keep them in demo as well just to maintain performance history.

-

December 4, 2018 at 10:18 #7384

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Jacpin,

thank you so much for the replay! This gives me some good starting point. I like that you have exact rules. Petko says that this is important in algorithmic trading.

How do you calculate the winning percentage? Do you transform somehow the Profit factor?

-

December 4, 2018 at 13:13 #7391

JordyTr971Participant

JordyTr971ParticipantHey, Sorry guys to not keep you updated !

Right now i’m trading 3 pairs on TF M15, M30 and H1

I have 30EA on each timeframe, 90EA on each pairs So 270 EA totally running on a demo account

I want to trade only top 10 EA !I want to always have top 10 EA trading on my live account so I’m working on a ways to automate that (Yes i’m a lazy guys haha) that’s why I not share any result here

-

December 4, 2018 at 15:59 #7393

jacpin2002

Participant@Viktor-No problem. I am enjoying this trading so much, I have no issue with sharing my experience. I keep the calculation very simple..7 out of 10 trades equals my 70% winning percentage. Even if a trade has a 70% winning percentage and then has a small negative profit, I will still use it. I just analyze each of the 10 trades to see if I can manipulate the stop loss and/or take profit to result in a better net profit. This is also when I use the optimizer in EA Studio to see if it comes up with similar results.

I maintain this process even after I go live. Once an EA loses more than 3 times out of 10 trades, I immediately pull it and replace it with a new one. I don’t want to take the chance that it will continue to lose and then perform better later. If it does, that’s nice and if I ever have to replace another EA for the same time frame and currency pair, then I can revisit it again. I’m very conservative in my trading, so risk management is very important to me. :)

-

December 4, 2018 at 16:01 #7394

jacpin2002

Participant@Jordy-Thanks for letting us know! Seems like there is a consensus to just trade three pairs but on multiple timeframes and with the top 10 EAs on each. I may have to start demoing things in this way to see if it works out better for me. I might try to start the new year.

-

December 4, 2018 at 18:04 #7399

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Jordy,

Glad to hear from you again. The whole process will be automated one day with certainty. We had couple of meetings with Forex Software discussing how the process could be automated effectively. Of course it will take time…I do not know when and exactly how it will be, but I know that if it happens we will be the first ones to use it :)

Anyway, years ago there was no even generator, and the only way was to hire developers.

Jordy, your diversification is good…

-

December 4, 2018 at 21:28 #7400

JordyTr971Participant

JordyTr971Participant2019 Will be a great year for us i’m sure :)

Thank you, Diversification is very very important in automated trading, I’ve learn that from you’re courses and this is really true !

For me good money management is nothing without diversification

-

December 5, 2018 at 9:59 #7419

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterYou are right, Jordy! What Petko teaches in his classes is just precious. I often blame him that he gives the courses so cheap :) :) :)

-

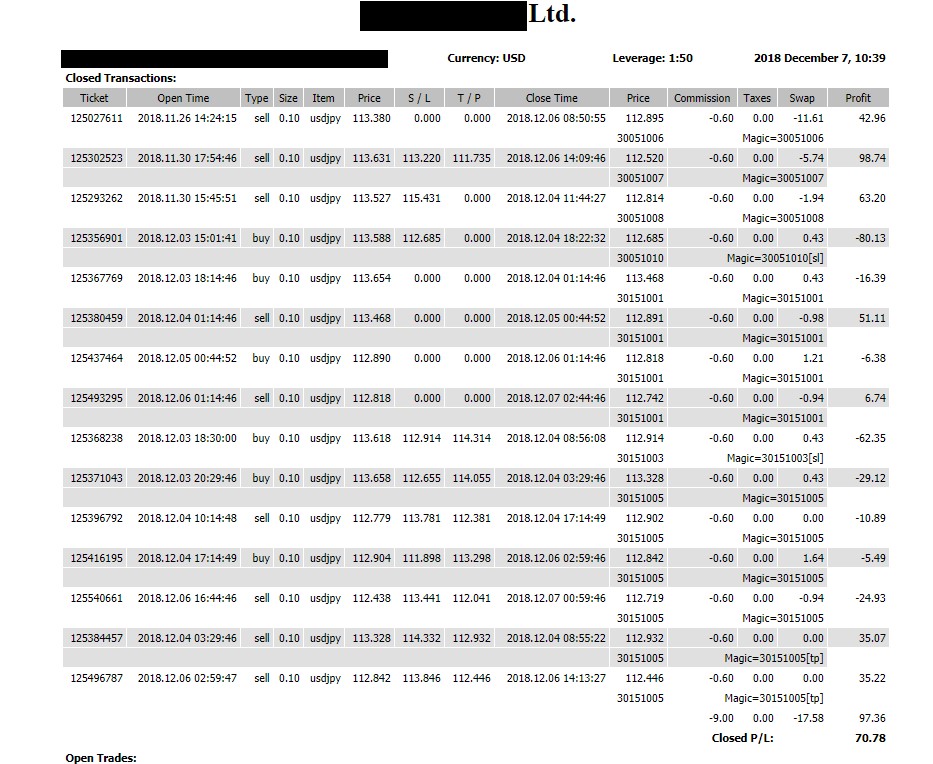

December 7, 2018 at 10:43 #7477

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Petko,

I was a bit out of the country. When I got back I saw your recent course the Top 10 USDJPY EAs, placed them imidiatelly on Demo, and I am happy with the results from the first week man!

How do they perform with you from the beginning?

-

December 7, 2018 at 21:27 #7503

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Al_kuwait,

Glad to see you are doing good while testing the EAs.

These 10 turned out to be showing great results since I launched the course…last week I wanted to update them, but It was hard to find any need for change.

I just touched a bit 3 of the EAs, the rest are doing just fine. They do not make any impressive profit so far, but seems to me more stable equity of the whole portfolio.

Kind regards,

-

December 8, 2018 at 10:02 #7528

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterWow! Great results with these EAs. I Was away but I took the recent courses you have launched, and I am placing them today on small live account. You know I prefer to test with 0.01 on live instead of Demo.

I am in the mid of the USJPY course, great work!

-

December 9, 2018 at 12:08 #7546

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI missed this course somehow. I will be pretty happy if I receive mails when new courses are launched by EA Forex Academy.

The statement looks nice, even for such short period of time.

-

December 10, 2018 at 14:36 #7564

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Sisi,

we do send notification e-mails when new courses are launched. However, I am not really a fan of sending too many e-mails…probably I will open a new topic in the Forum where I will let everyone know about the new courses.

Cheers

-

December 15, 2018 at 19:49 #7733

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Petko, such a topic will be great. This way we can follow along with the new courses and all of the automated trading you do.

-

December 16, 2018 at 13:51 #7743

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHi Andi,

yes I am going to do it after the new year.

Cheers

-

January 1, 2019 at 19:19 #8102

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHappy new Year all!

Al_kuwait, glad you shared your results. I am just starting the Top 10 USDJPY course, and I will share my results soon!

Wish everyone great trading year ahead!

-

January 5, 2019 at 14:48 #8220

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterGreat trading year to you too, John!

-

January 15, 2019 at 11:40 #8476

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Petko,

what do you think about some kind of platform/app or any thing on the website where people can actually share trading results. I think it willb e very motivation. May be competition?

-

January 15, 2019 at 23:34 #8488

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Haliffa,

Well….the forum is a great place to share trading result. I mean, for sharing results we really do not need a lot(anything with functions).

You can upload trading History, statement, pictures, just as Jacpin, and some other trader shared in the Forum.

Now, competition is something I have been thing for quite a long time…and we have just been discussing it with the team, how to organize it, how to manage it, and what should be the price. Probably we will do it by the end of this year.

-

February 28, 2019 at 0:00 #10109

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Petko,

I missed this topic because I was out of town again.

I am looking forward to the competition.

That would be really great!

-

March 1, 2019 at 8:22 #10126

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey George,

it is still in the “to-do” list, but once it is live, I will let you know.

Cheers,

-

March 10, 2019 at 10:22 #10435

Deniza

ParticipantHello Al_kuwait.

I am quite new to the forum, just took the EA studio lifetime license and some of Petko’s courses.

Where are these 10 USDJPY EAs? In which course? I want to have them too.

-

March 11, 2019 at 9:05 #10456

AndiMember

AndiMemberHello Deniza,

the 10 USDJPY EAs are from the course Top 10 USDJPY Expert Advisors: Algorithmic day trading.

-

March 15, 2019 at 11:24 #10568

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI have been using two of the EAs since you launched the course. I really like their performance. :)

-

March 16, 2019 at 14:55 #10601

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterGlad to hear that Bob! Keep up the good work!

-

March 24, 2019 at 7:33 #10727

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterSo back to the question here…how long time everyone tests the EAs on Demo before moving to live account? I still can not figure it… :(

-

March 26, 2019 at 10:56 #10820

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Shamasa,

I talked a bit more about that in the last course that I launched yesterday with the Top 10 USDCAD EAs. Really there is no precise answer to this question.

If you test the EAs too long on a Demo account, you will see the profits in the Demo account. Every strategy has its profitable periods and losing periods (you see that in the equity line of every strategy). So if you test it too long, you are in this profitable period for the strategy, and when you decide to move on live, you might hit that losing period.

Basically the more you test on the Demo, the closer you are getting to that losing period.

-

March 30, 2019 at 9:00 #10930

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterPetko, recently I use only the method you showed in the Top 10 AUDUSD course to avoid the Demo trading. I use the OOS.

After that, on the live account, I use a profit factor of 1.2 If the EA falls below that factor, I remove it from the live account.

It works great so far.

-

March 30, 2019 at 22:09 #10944

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI am just watching the AUDUSD course, and I will implement the OOS. I see that many people wrote in the forum they are using it after the course and the update videos from Petko.

-

April 3, 2019 at 12:42 #10998

DesitaParticipant

DesitaParticipantI use the OOS now all the time. I went a few times over this lecture and really liked the method. It saves time for Demo testing. Unfortunately I am not brave enough to skip Demo, so I test still there.

-

April 7, 2019 at 8:01 #11076

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey guys,

Glad that the OOS helped. I use it more and more as well. I implemented it in some of the updates for the courses, so the new EAs that I launch every month should be better.

Desita, you really should not be brave in trading :) You should be confident with the time.

Bob, glad to hear that you figured what rules to follow to work fine for you.

-

April 8, 2019 at 21:31 #11102

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHi Petko! The OOS improvement in the acceptance criteria is a game changer!

-

April 11, 2019 at 22:12 #11134

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey, Rose! It is really. I use it more and more and I think I will include in more in my courses because the EAs are getting better.

-

April 18, 2019 at 10:53 #11335

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterI have missed that it is important to have acceptance criteria in the In Sample and the Out of Samle parts. Just now I realized that when the complete backtest is set, it is for all the period, but I saw now that is not…ahh..thanks Petko!

-

April 20, 2019 at 8:12 #11383

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Haliffa,

Actually the complete backtest is indeed for the whole backtested period. I will give you an example:

Let’s have a profit factor of 1.2 for the complete backtest. This does not mean that the profit factor in the In Sample or the Out of Sample will be above 1.2. Could be less, could be more. When you place for both and the whole period, then you will have your equity line smoother and at the same time, the Profit Factor will be above 1.2 for all.

-

April 21, 2019 at 6:05 #11395

donaldmoore

ParticipantPetko: I noticed in the list of indicators that the Donchian Channel was not part of my default indicators. I initialized the Donchian indicator and ran the USDCAD 15 minute reactor. The top three results used the Donchian Channel “bar opens below the lower band after closing below it”. The best result had a r squared of 97.52 and a profit factor of 1.4. The three best results just used different closing indicators. My questions are do you use Donchian Channels in your reactor runs? And if not what are your reasons? You have mentioned in your webinars that you do not pay much attention to which indicators are used in the list generated by the reactor. But when the top three all use the same indicator to enter a trade would this affect your decision?

-

April 21, 2019 at 17:04 #11404

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Donald,

Very good question here! I am still testing the results with this indicator. I noticed that it comes as a favorite in the Reactor results.

I always like to test a lot before including any EAs into the courses or my trading portfolio.

I would appreciate if you share some results with it.

Enjoy the rest of the Sunday!

-

May 21, 2019 at 22:51 #12527

Deniza

ParticipantThis indicator works better on FSB pro with me because the position can open on the channel. In EA Studio opens the trades on bar open, which means it will be over/below the line. Which might be a lot further from the lines.. In FSB Pro it can open exactly on the lines.

-

May 23, 2019 at 8:08 #12546

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Bob,

Glad to hear you gave a good answer. What you say is correct but keep in mind that the bar opening is for every indicator with lines. Even for the MA Indicators. If there is a cross the position will open at the first bar opening. This way the cross is confirmed.

-

May 27, 2019 at 8:23 #12596

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

I think that the bar opening is the only way to prove that there was a confirmed cross of any MA or another indicator.

Let’s say we have a Moving Average and the price is below, going up. In order to avoid the fake signals, we always need to see a new candle opening above the line/indicator. I am glad that EA Studio Experts work this way.

-

May 29, 2019 at 8:18 #12627

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Bart,

yes, this way face breakouts are eliminated. Of course, it might happen that the bar will open above and the price will go back down. The thing is to follow always one and the same rule/condition to have a precise backtest.

-

June 2, 2019 at 7:39 #12907

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterSorry for the silly question but what means exactly “bar opening” for EA Studio? I just want to understand better how it works.

-

June 3, 2019 at 7:58 #12943

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

this means that the Expert Advisor checks for the entry conditions right after the bar is opened. If they are true (if they allow the trade) the Expert Advisor will execute the trade. Now, many strategies (old fashioned) are based on the close of the bar/candle. The traders use it as a confirmation for the break of the line. In Forex bar closing of one mar and bar opening of the next one are very similar prices(most of the time few ticks difference).

Hope that makes it clearer.

-

June 10, 2019 at 9:48 #13344

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHi Petko, great you made this clear. I never really got into it, how it works. Now I know :)

-

June 11, 2019 at 9:17 #13374

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterIt is important just if you want to apply some strategies that are used in manual trading. For example, if you are looking for entries that happen in the middle of the bar, crossing a line, you better use FSB Pro.

-

June 12, 2019 at 7:23 #13409

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThanks, Petko, this makes much sense. This way I will have a better idea which strategies to trade on Demo and which on Live.

-

June 14, 2019 at 10:43 #13505

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Sisi, here we talk more about the methods of how EA Studio and FSB Pro open the trades. Not so much is it on Demo or Live, that is not connected to it.

-

July 5, 2019 at 8:50 #15375

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterBasically, the EA Studio uses bar open, which means the trades can be opened only at the beginning of the bar. With FSB Pro the trades could be opened in the middle of the candle, or at the end. Hope that makes it clearer.

-

July 7, 2019 at 11:37 #15524

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Petko! This makes it much clearer to me. I never noticed actually that the trades are opened after the bar opens. :)

Normally in manual trading, the strategies use bar closing. For example, one EMA is considered to be crossed if the bar closes above/below. Why it is different here?

-

July 11, 2019 at 11:40 #15856

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterMery, do not bother with manual trading. Do not even try to make anything manually…worthless for me.

-

July 16, 2019 at 17:45 #16156

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHaliffa, people are different. Some prefer to trade manually some algorithmically.

As I explain in nearly all of my courses the algorithmic trading helps the traders to avoid emotions, but at the same time, there are some really good manual trading strategies.

This is why in EA Forex Academy we give the choice for manual and algorithmic trading.

At the same time the results trading automated EA Forex and easier to be tracked and analyzed.

-

July 16, 2019 at 17:45 #16159

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHaliffa, people are different. Some prefer to trade manually some algorithmically.

As I explain in nearly all of my courses the algorithmic trading helps the traders to avoid emotions, but at the same time, there are some really good manual trading strategies.

This is why in EA Forex Academy we give the choice for manual and algorithmic trading.

At the same time the results trading automated EA Forex and easier to be tracked and analyzed.

-

September 7, 2019 at 8:16 #20693

AndiMember

AndiMemberPetko, I do not see a single reason why some should be trading manually. Seriously. We are in the 21st century, we have the MetaTrader, the Strategy builders and unstoppable internet. :)

Trying to trade manually when there are the Expert Advisors is like riding the car of Flintstone when there are regular cars.

-

September 13, 2019 at 17:20 #21373

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Andi, I like your example a lot :)

But here is the kicker you do not see:

Imagine everyone drives the Flintstone’s car and they do not know there are regular cars…can you imagine that?

This is the truth in Automated EA trading. People do not know about it. More than 95% of the people trade manually. Worst is they do it from their phone clicking on the buy and sell buttons without an idea what they do. Broker become millionaires…

So I believe that the more courses and content I do, the more you guys in the forum share your results trading Automated EA Forex or Crypto or anything else, the more people will find out about not just the cars, but the electrical ones :)

-

October 18, 2019 at 15:01 #24056

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Andi,

Can you share more of your experience with Expert Advisors, and why do you prefer them than manual trading?

Also, if you share result Trading autoamted EA Forex will be great.

Thank you indeed.

-

October 25, 2019 at 13:40 #24741

forexmaniac

ParticipantHi Andi. What you say is only true. I used to trade manually until I learned about automated EA trading. One thing I still don’t understand though, is there any difference between FSB Pro and EA Studio? Also, does FX Blue serve the same purpose as the two?

-

-

AuthorPosts

- You must be logged in to reply to this topic.