Home › Forums › Live Trading Results › Funded Accounts › Marin’s The5ers $5K Funded Account

- This topic has 7 replies, 3 voices, and was last updated 8 months, 1 week ago by

Marin Stoyanov.

-

AuthorPosts

-

-

August 27, 2024 at 8:30 #302878

Marin Stoyanov

KeymasterHello traders,

I open this topic to share my experience and journey with the funded account I received from The5ers. You can read my other post about the system I followed to pass the 2-step High Stakes evaluation using EAs from the Prop Firm Robots app.

TLDR: I use the robots to open trades and some trades I close manually, while other times I leave the robot to close the position. On top of this, I adopt my trading based on the market sentiment and my own common sense, and last but not least – based on my goal (more on that in the next few lines). So I would say my system is use Robots + Market Knowledge + Common Sense to get the job done.

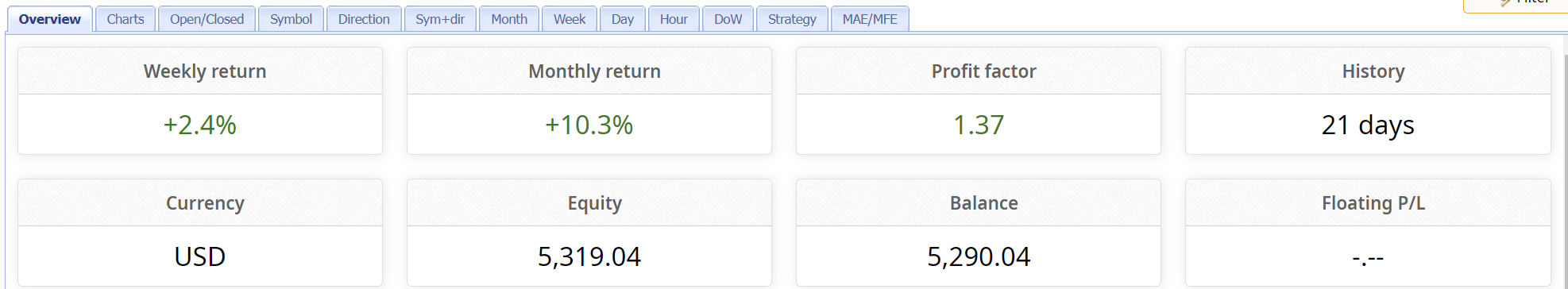

Here’s the track record from my 5k funded account. So far it goes quite well and I’m more than half way through. The profit target is 10% to be eligible for a payout.

I’m not the type of a person who sets unrealistic expectations when it comes to investing or trading as I find all those unpredictable. What I do is to set goals and look for ways to accomplish them. So my major goal was to get funded and make some passive income. I don’t have problems spending more time on this. I don’t believe in the get-rich-quick. And the most popular rich people didn’t get rich in a day or two. And why should I rush when most prop trading firms removed the time constraints to pass a challenge?

So I asked my self “what I need to do to achieve my goal”. And the answer for me is that I need to make steady profits every day, no matter if they are big or small. If I have a loosing day, I don’t rush to recover by increasing lots or etc. if in general my trading goes well. If if doesn’t, I just stop trading for a few days, but still observe the market and have EAs in my demo accounts to have a deeper insight of the market sentiment.

How do I use the robots?

The beauty of using the Prop Firm Robots is that they will open a trade when they receive confirmation from the underlying indicators. There is an actual strategy behind each robot. If I had to do this automatically, I would have to spend months to learn all the indicators, all the patterns and etc. The robots take control of this instead of me and I just need to wait for them to close positions or close them when I feel comfortable.

The EAs can close the positions automatically as well, but I found for my self that I feel better if I close some trades manually and see the profits immediately in my account. As I mentioned above – my goal is to get funded and to do so I need to make profits, and I’m not in a rush. So why not closing a trade when it was on a profit, even half way from the set TP?

Market Knowledge

As for the selection, usually I pick the top 2-3 EAs from the Prop Firm Robots app, and I avoid the crypto pairs. They are too volatile and I don’t have trust in them. Also spreads and commissions are higher in most cases. When I make the selection, I try to have a more diverse account – if the 1st and 2nd EAs are for EURJPY I might not use both of them because if market goes against my pair, I will have double loss. What I do is to pick diverse pairs and not follow strict rules. I look at the 1M charts in most cases, and I double check the strategies performance in the 1W. Also I look for strategies that were created more than a week ago and still show profits in the app – this is a good sign for a strategy if it is showing profits with real data after it was created. Also I look at the count of trades for the last 7 days and for the last 1 month to have an idea of the activity of each trading strategy.

Common Sense (or Experience)

Last but not least, as part of my system I should mention the common sense (or you can think of this as the outcome of your experience). In my case, It took me 29 days to pass the 1st step of the evaluation and 33 days to pass the 2nd step. And in the funded account the profit target is higher. So it’s quite obvious for me that I might be trading for around a month to reach the profit target. Now, here comes the math. For the $5k account the profit target is 10% which is $500. Now I divide this target by the number of days needed and it looks that I must make at least $17 per day to get funded within the realistic time frame. Again, why not closing a trade when it made $20 profit and brings me closer to the end goal?

Finally, I want to mention that I have the MT5 mobile app installed on my phone and added my challenge account so I can keep an eye on it. This helps me to close trades much quicker if I have to do it.

This is my system in brief. I’d love to hear your thoughts on how do you manage your EAs.

-

September 22, 2024 at 4:57 #311285

Camwolf18

ParticipantHi, I was wondering if you could give an update from this post :).

-

September 26, 2024 at 16:56 #312310

Ilan Vardy

KeymasterHi Camwolf18,

You can click on the link Marin provided to see the track record. There was some stagnation, but it’s getting close now.

Cheers,

Ilan

-

October 1, 2024 at 13:07 #313139

Marin Stoyanov

KeymasterHello traders, I was busy so I didn’t had time to update on this post but the track record is always active and you can check the progress.

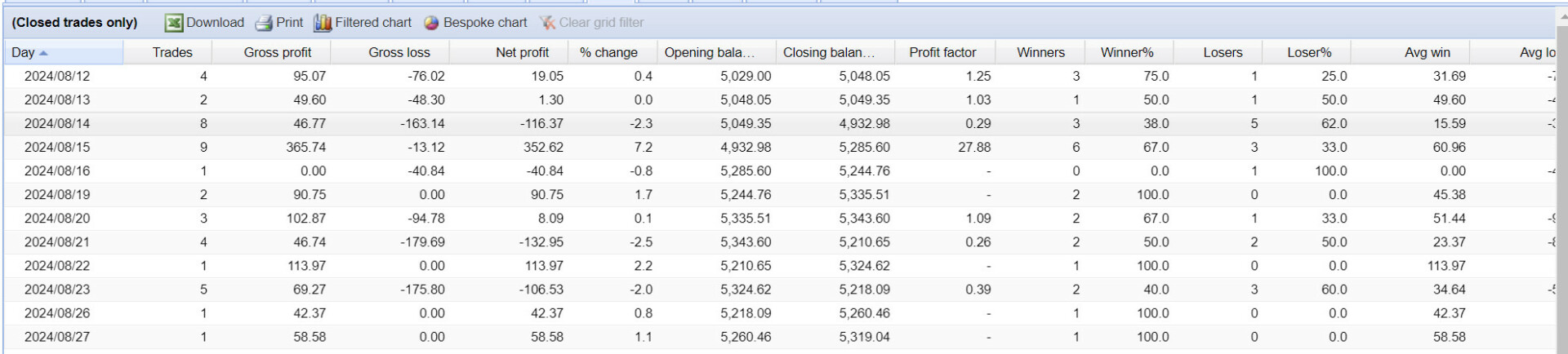

Yesteday I passed the first level of the $5k High Stakes Trader stage on my funded account. The goal was to reach 10% profit in the $5k account.

For the challenge, I used robots which I configured with the Prop Firm Robots app. My system was a hybrid of manual and algo trading. I’d say I was leaving the robots to decide when to open positions, and I was closing some trades on a profit manually during the day. You can check my track record here.

Bear in mind that certain types of EAs are prohibited by The5%ers but the EAs from the Prop Firm Robots app are fully compliant as I own the source code of the robots and I tweaked my strategies in Expert Advisor Studio so my trades are unique.

My next step is to request a payount and will let you know how it goes.

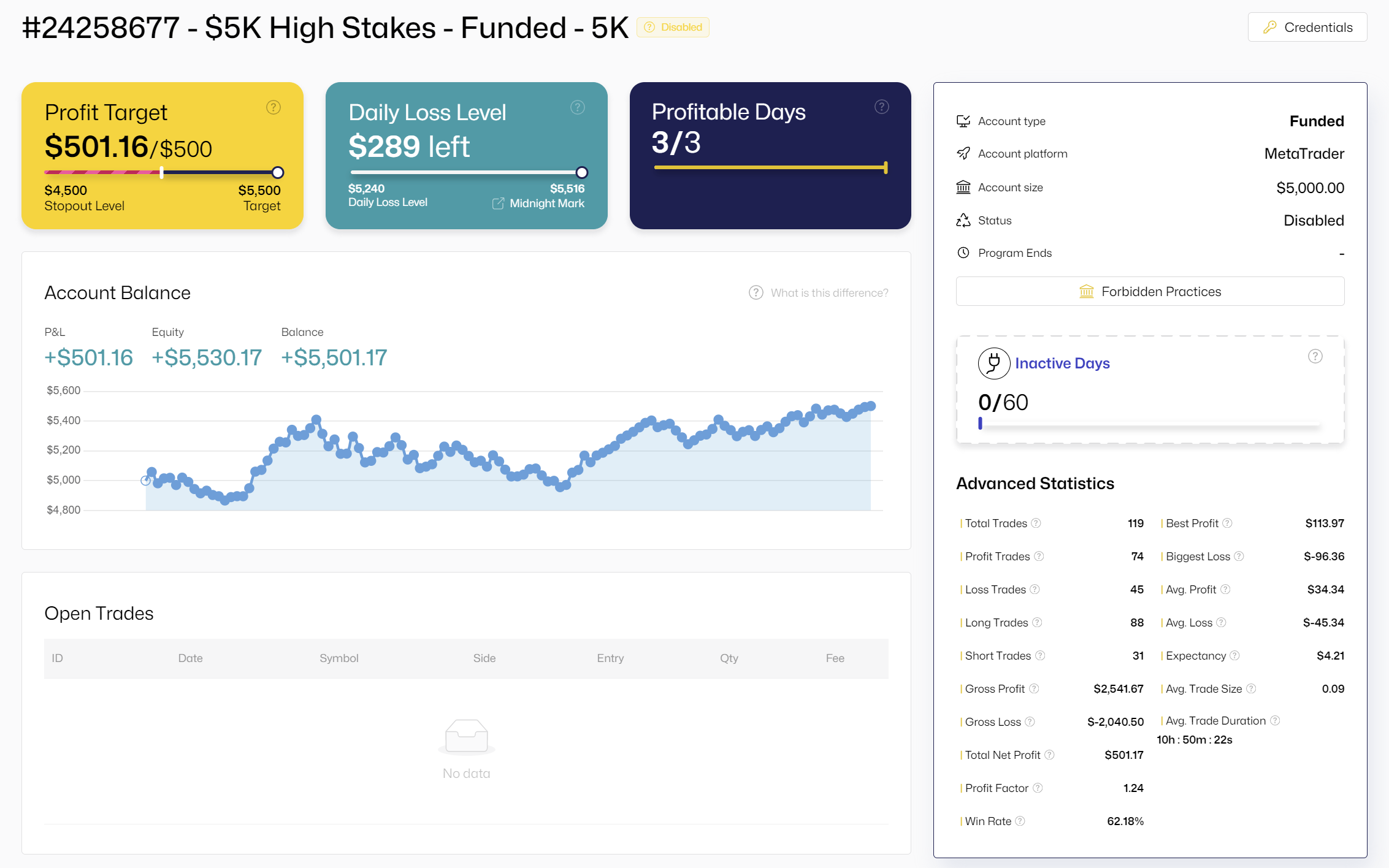

As per the High Stakes terms, for every 10% profit generated on the funded account, the account balance and profit split will be increased. Now, in the next level, they gave me a $7.5k funded account and I’ll setup it later today and create another post in the funded accounts forum section to keep things more organized.

Should you have any questions, please drop them here or in the other post, I just subscribed to the post so I will get notified.

-

October 3, 2024 at 0:13 #313474

Marin Stoyanov

KeymasterHey traders, I thought about creating a separate post about the next part of my challenge, but they I realized this is a journey, and not a challenge for me, so I’ll continue here to keep everything in one place and hopefully be of use to someone in the future.

So I setup my next stage account today. My track record for this account is public here. 5ers gave me $7.5k funded account and the goal in brief is to reach 10% profit and never fall below 5% drawdown per day. I had a very good first day and made over 1% profit. I used only robots from the Prop Firm app but those were robots that were performing well in my $5k funded account. This time, I decided to leave the EAs do their job and close positions by themselves. Starting with 2 different USDJPY EAs and one XAUUSD, the USDJPY made 2 successful trades each and the gold was on a loss but I ended up the day with over $70 as a profit, which as I mentioned is 1% from the account target.

I think it’s a good time to explain how I measure the risk with these EAs. So, i made 2 profitable trades of around $60 each and 1 trade lost around $30. The Prop Firm EAs have 2:1 risk-reward radio meaning that the absolute value of the profit is twite the absolute value of the loss.

Because of the good start (and I’m risking 0.5% per trade, probably I’ll leave the EAs to trade automatically by the end of the week and then decide whether or not to interevent future trades manually.

Also, one thing I forgot to mention is, that I went through the prop firm terms again to be sure that they will pay me, and red about the usage of EAs again. So you can use EAs if you have the source code and if your trades are unique (meaning no one is using the same EAs). But because one of the EAs I planned to use was in the top EAs of the Prop EAs app, I decided to slightly change it in EA Studio (changed lot with 0.01, changed indicators with 1-2 as far as the strategy wasn’t changed). I will continue doing the same if my challenge goes on track. Otherwise I may just use the Prop EAs until I’m on track.

I’ll try to post a few more updates from time to time, but so far, this is my system and the way I decided to trade. And for me, I consider this as a journey because it took me a few years to finally start understanding trading and by following the challenges requirements I learned a lot and there is more to come for sure.

-

October 3, 2024 at 5:47 #313496

Camwolf18

ParticipantHi Marin! Currently following your story and progress. I’d be curious to hear your overall thoughts on the prop firm robots as I’m considering purchasing them myself. Congratulations on passing the first stage and thank you for sharing your story :).

-

October 17, 2024 at 0:41 #316026

Marin Stoyanov

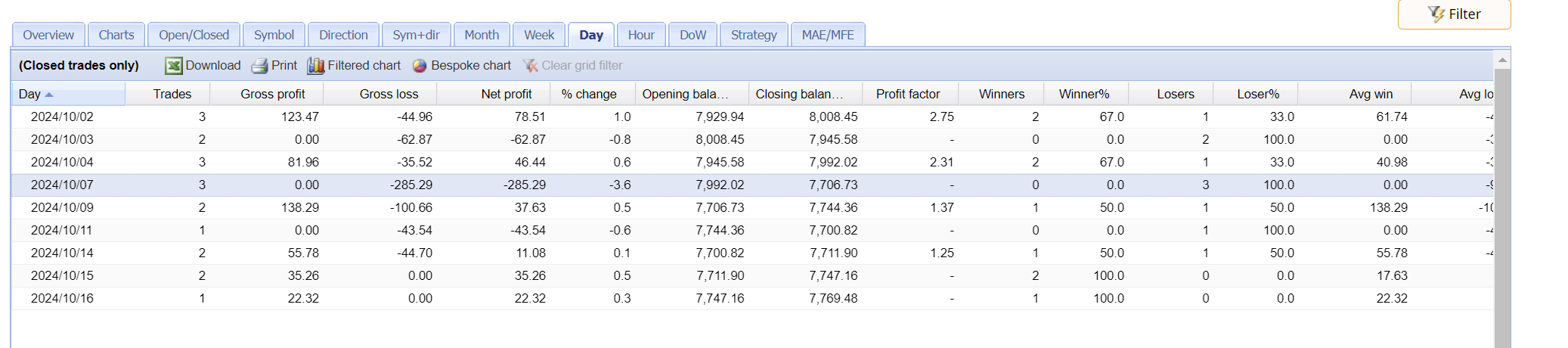

KeymasterHey @Camwolf18, I’ll share my feedback for the app and the robots so far at the end of this post. First I want to give some insights on how the funded account is going so far.

It’s been 15 days since I started trading the account. I’m telling this because in stage I had to wait for 14 days from the moment I received the funded account to be eligible for a withdrawal (that’s how 5ers works). I checked yesterday and I saw I can withdraw around $250 (which I less than I earned in total in the previous stages of the challenge – to be exact $29 from 1st stage and little over $400 from stage 2). I can’t withdraw the full amount because the funded account is not on a profit at the moment so I’ll try to reach the starting balance again and they I’ll try to withdraw to see if there are problems or not. Also, all trades must be closed before I can withdraw, otherwise the withdraw option is greyed out.

Sam, who is part of the traders team at the Academy shared his experience with other prop firm a few days ago where they said that if he withdraw its counted towards his account drawdown so I asked 5ers support if this is the same with them but they assured me that the withdraw is not counted as part of the account drawdown so I don’t have to be worried that if I withdraw I will breach the challenge. Still, I’ll try to regain the balance until I request the withdrawal.

Now for the challenge, I’d say in general it goes well. I follow the same approach as I did in the previous stages. I’m not on a profit yet but I made one big mistake which put me into this situation.

So the mistake I did was that on the 7th of October, Monday, when I placed the EAs for the new week, I unintentionally used higher risk (I was testing something during the weekend and forgot to change the risk settings) and this day the USDJPY made 3 losses which led to that huge loss. I had still some gap for losses on and on the next day I decided to keep the same risk as I had expectation that after these consecutive losses the USDJPY robot will recover. It did partially, I closed 2 trades manually before they reached the TP because I had to recover some losses. All the other days I’m trading with much lower risk and set the protections much lower than the defaults (e.g. I set them at around 1% daily loss).

So now I’m closing trades even on smaller profits just to recover the account. If I manage to do it, I’ll withdraw and continue trading the same way as long as it looks to me that I’m performing ok.

Now for the app, my opinion is that it’s a great tool and gives traders a lot of great EAs to trade with. I’m still trying to find a way to reduce the manual intervention, and in the funded account I started trading fully automatically the first few days, but when I lost 3-4% that bad day, I had to recover so I was closing on small profits manually. In general, the EAs in the app get better and better every week (with every update when new better EAs are added). I’m not a trader by nature and I don’t understand how trading indicators work, so I depend on the app for the stats, the charts, and my common sense of course. The hardest part is choosing the right robots to trade with and for how long to keep using them, but with time I tested a lot of combinations and I have more confidence now.

I wrote a few times in the above posts that I consider this as a journey and with every trading day I am becoming more and more convinced of this statement. I bought this challenge for just $29 and no matter what will be the final result, the knowledge I gained along the way is irreplaceable and I’m sure it will help me a lot in the future.

-

November 5, 2024 at 15:11 #375392

Marin Stoyanov

KeymasterHi traders, I’m posting an update on my journey.

At the end of October I decided to request a payout even I was below the $7.5k initial account balance. As I explained before, I accumulated almost $430 in the previous 3 stages but since my balance was below the starting balance for the $7.5k account, I was not able to withdraw the full amount but I decided that it’s better to withdraw some cash instead of waiting to recover the account and possibly lose it completely. So I’m happy to say that I withdrew almost $230. The initial investment for the challenge was $29 and it took me 3-4 months make my first income. I continue to trade the account and balance is still below the starting balance so I will try to recover it using my system which I explained above and at that point I plan to trade fully automatically for some time, using either a few EAs with higher risk or a lot of EAs with medium-to-low risk so I can cover more pairs and balance the exposure. I haven’t decided on this yet, but my end goal is to fully automate my trading and not bother with this account daily. Also, I’m running some tests on demo accounts where I try to find different combinations and replace the EAs weekly and I hope that I will be able to find a working formula for me. I will keep you posted on this.

-

-

AuthorPosts

- You must be logged in to reply to this topic.