Home › Forums › EA Studio › Trading Robots from EA Studio › How to Select EA’s to Use?

- This topic has 43 replies, 1 voice, and was last updated 2 years, 12 months ago by

Alan Northam.

-

AuthorPosts

-

-

January 24, 2018 at 12:56 #118718

Alan Northam

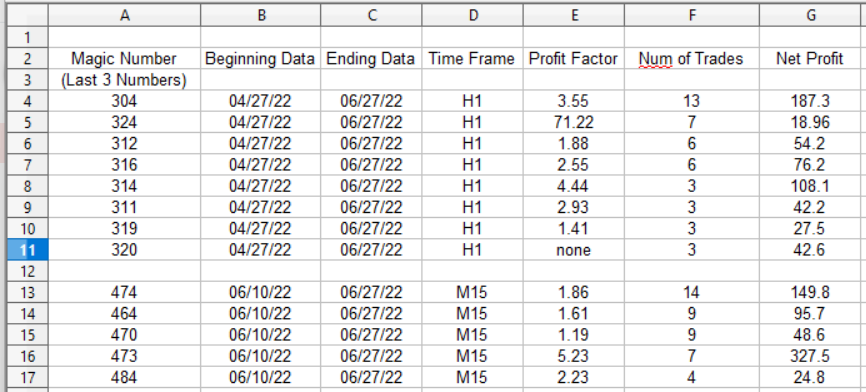

ParticipantI have taken all 50 EA’s and ran the strategy tester on them in my MT4 demo account. The attached spreadsheet shows the results. I need to trim this list down to 10 EA’s. The question I have is should I use the ones with the greater Profit Factor, number of trades or net profit?

I am setting up 10 live accounts with my Oanda broker and will fund each account with $200.00. I may need to adjust Lot size based upon margin requirements. At the end of each month I plan on reviewing the results. Each account will contain one EURUSD EA to avoid the FIFO rule in the United States. I will then create a Portfolio in FXBlue to combine these 10 live accounts together so I can analyze them all as one account.

-

January 24, 2018 at 12:56 #3185

Petko Aleksandrov

KeymasterHello Petko,

I have a quick question here about the best forex robot that you are explaining in the Top 10 EURUSD Forex strategies course. Is the idea to find among the ten, the best forex robot and to keep trading it at all times? If so, how can I actually understand which one it is? I mean when I placed the EAs on Demo and connected with the FX blues, I see that the one on the top is changing all the time.

What I was thinking to do, so I can fin the best forex robot, is to keep a statistic, which one stayed the longest on the top. So for example, if robot A goes up and stays there for 5 days, than B stays there for 2 days, than A stays another 4 days, and so on? Do you think that is correct or not? If so, then for how long time should I do that, to make it sure I selected the best forex robot among the 10.

Anyway, I will really appreciate your opinion about it, because I have been struggling for a while to fine my best forex robot.

Thanks for all that you share in your courses!

Sincerely yours,

Thapelo -

January 24, 2018 at 13:01 #3186

Petko Aleksandrov

KeymasterDear Thapelo,

Glad to hear from you. Actually the idea of trading the best forex robot is different.After you place the EAs on a Demo account and connect it with the FXBLue website, you need to open another Demo account(which after that will be the live account). What you need to do is to move to the second account the best forex robot with the first statistics you have ready. After that when any other takes its place, you need to replace the one that you have out in the second account. Just remove it.

This way, you will always keep the best forex robot into the second account. So it is not about having one permanent best forex robot to trade, but to KEEP the best one always into the second account.

Also, you can do the very same thing for the Top 3, Top 5.it is your choice.

Hope it is clear

Regards,

-

January 24, 2018 at 13:02 #3187

Petko Aleksandrov

KeymasterThank you so much Petko. This makes more sense to me! I will try to do that and come abck with any questions.

-

February 14, 2018 at 14:37 #3249

Iohan Dive

ParticipantHello Petko,

I am new in the forum of the academy and I see many topics and questions here from your students and you explain everything in details. I am new also to the trading and I want to ask you which course should I would start with? I want to trade with Expert Advisors, but how to find the best Expert Advisor? i will exprect your answer!

Best Regrads!

-

February 15, 2018 at 0:51 #3250

Petko Aleksandrov

KeymasterDear Van,

Glad to hear from you, and welcome to the forum and the Academy.

We have many courses, it depends on what will fit you. Tomorrow we will launch the first basic course. So far we have only advanced courses, but since many students asked us for a basic course, we decided to do it. It is called Basic cryptocurrency trading course – A to Z. It this course, I go from the basics to the advanced algorithmic trading. As well there you will find the answer about the best Forex Expert Advisor, and how to look for it.

Anyway, we have some more algorithmic trading courses. You can have a look at the Top 5 Forex Strategies, where each strategy is automated as a Forex Expert Advisor.

Also, in Top 10 EURUSD Forex strategies course, you can look for the best Forex expert Advisor, by trading the 10 EAs in one account and select the best performer.

We have as well two great courses for Bitcoin and Ethereum, where I have decided to put 99 Expert Advisors, and more, I update every month with new 99 EAs. There you will have much bigger chance to find the best Expert Advisor for you.

Regards -

February 18, 2018 at 23:46 #3300

Petko Aleksandrov

KeymasterNo warries Thapelo. Let me know if you have any qestions or hard time finding your best forex robot.

-

May 22, 2018 at 18:40 #4197

Petko Aleksandrov

KeymasterI have taken advantage of your summer sale, and took the courses. Thanks for the explanations and the support you do, it is very helpful all!

-

May 22, 2018 at 18:48 #4201

Petko Aleksandrov

KeymasterAnyone has traded the gold with EAs? I tried to generate strategies and look for the best strategy, but it seems that Forex is easier. I think it will be hard for me to find the best forex robot there, just because it is not FOrex, but gold :)

-

June 15, 2018 at 19:42 #4555

Petko Aleksandrov

KeymasterGlad to hear from you Stephen! Let us know if you have questions about the course or any Forex Expert Advisor

-

June 15, 2018 at 19:45 #4556

Petko Aleksandrov

KeymasterDear Lim,

Glad to hear from you. Yes we have tried during th years many things but we stick to the Forex, and recently to the cryptocurrencies.

Much easier to findd the best Forex robot because it is ok to trade even 99 EAs(as I show in one of the courses) in one trading account.

We follow the performance on Demo account and after that we place the best Forex robot on a live, and by the best, I mean the one that is currently making profits. -

February 15, 2019 at 9:37 #9660

Petko Aleksandrov

KeymasterBest Expert Advisors in time? This morning I was wondering this question.

Should we focus on the best Expert Advisors that we find during the current month, put a higher lot and use them for short period of time, or should we focus on the best Expert Advisors that we find in the longer term, even not making such great profits?

Everyone looks for the best Expert Advisors that will run a long time in the account and will trade with profits, but so far I found only a couple that went profitable over 4-5 months. Of course with the time I will find more and will have a stable portfolio I am looking for.

The point is that when we are changing monthly the EAs, we use the best Expert Advisors at the moment, as Petko teaches, and that brings me personally more pips.

Would be happy to know what others think about this.

-

February 16, 2019 at 5:00 #9675

jacpin2002

Participant@Andi-I I think that this is a great question. Personally, I like to stick with EAs that work for a longer period of time. As long as it stays profitable and maintains my criteria of acceptable performance, I keep it until it starts to do bad. I kind of rearranged my trading portfolio, so I had to recreate a bunch of EAs for my assets and different timeframes. With this, I am only running EA Studio to produce enough EAs for me to trade live and then have some backups running in demo. I honestly don’t want to keep running the software every single day unless I have to. I haven’t really used the EAs that Petko gives us except for the ones in cryptocurrency and that is because I am having a hard time generating them myself with the criteria that I deem acceptable. I’m thinking that I need to start pulling some of Petko’s EAs into my portfolio…

-

February 16, 2019 at 15:22 #9687

Petko Aleksandrov

KeymasterHey Andi,

this is a question that every algorithmic trader starts to ask himself at one time, especially after some experience is there. You are there now :)

The best is to combine the two. It is good if you have EAs that perform well for a longer time, and at the same time, you need the EAs that might bring you quick profits in the short term.

As Jacpin says, as far as it is within your rules, keep trading with it. And during this time look for the EAs that you create or you take from me. You do not know which one of those will remain profitable for a long time, so this is the only way to find those best Expert Advisors.

-

June 16, 2020 at 12:39 #51210

suraj.bhawan

MemberI’ve taken the following courses:

1. Forward Walk Optimiztion

2. Forex Strategy Course: 12 EA’s

3. Forex Trading Strategies from a Professional Trader: 5 EA’s

4. Automated Forex Trading Course: 99 EA’s

I was considering running the EA’s we receive from above in the validator with my brokers data, under acceptance criteria out of sample (20% OSS) minimum profit factor of 1.1

Using the out of sample profit factor would act like it was a strategy run on demo.

For robutsness I would select Monte Carlo, count tests 20-30 with validated tests at 80%.

Thoughts on above?

-

June 16, 2020 at 22:53 #51254

Petko Aleksandrov

KeymasterNot a bad idea. I would only remove the OOS because these are ready strategies. You just want to see how they performed with your broker right? So you would like to see especially in recent months.

If you are generating EAs, then yes, OOS is awesome.

-

June 17, 2020 at 5:23 #51262

suraj.bhawan

Member<p style=”text-align: left;”>Yes, ideally I want to see how the strategies would perform in recent times. The ones that perform well I’d take to my live account.

The idea here was to initially try this method of application on a small account, if the method proves successful eventually apply in on a proper account.</p>

Another thought that came to mind was that, once a week, use forward walk to optimise the strategies in action, more replicating the idea of continuous forward walk optimisation. Although I know you prefer not to touch what’s working well. -

June 17, 2020 at 5:25 #51263

suraj.bhawan

MemberThe intervals of optimisation could be done once a week.

-

June 17, 2020 at 15:31 #51278

Petko Aleksandrov

KeymasterHey Suraj,

What Andi says is right. If you use my EAs on your broker’s data, just check if they do well. After that place them on a Demo and see which are the top performers. The OOS is useful when we generate new EAs.

Walk forward is a fantastic robustness tool but again when generating the EAs.

Simply, when you have ready EAs, all you need to do is to test them and decide which ones to place on a live account.

-

June 18, 2020 at 11:22 #51311

suraj.bhawan

MemberI was looking at the EAs on EA Studio and noticed that there is a vast difference in performance from the MT4 Demo data and my broker data

Stategies that are profitable over a period are actually loss making on the same period with broker.

Wouldn’t optimisation using broker data make those strategies a better fit. I understand that OSS and Forward Walk are best used when generating own EA’s.

-

June 18, 2020 at 13:59 #51315

Petko Aleksandrov

KeymasterHey Suraj,

yes, it could be a difference with the broker’s data. That is why there is the option in EA Studio to import your own data because the brokers offer a way to different quotes, which results in different Historical data.

I would suggest you generate EAs with your own data, instead of optimizing the EAs.

Also, you can use the Historical data from the Free App which we have on the website, and there is a video in there where I explain how to fit that data for your broker.

Cheers,

-

July 1, 2020 at 16:37 #52551

suraj.bhawan

MemberHi,

I just had an idea that I wanted to run by you. Since I am using the EA’s generated by you, would it be a good idea to keep changing the portfolio based on the best performing EA in the previous week. For example, all th EA’s are first taken to the demo. Every Saturday, the best performing EA’s are taken to the live account, the same process is repeated in the following week. If 1 week is a short period the same concept could be applied either every two weeks or monthly.

-

July 2, 2020 at 12:09 #52566

Petko Aleksandrov

KeymasterHey Suraj,

I think one week would be great to use.

Just test it is first on two demo accounts simulating one is a real account.

Do not hurry risking on a live account before you found the right period and method of testing.

-

August 1, 2020 at 4:47 #55625

John

ParticipantHi Everyone,

I currently trade 5 EAs in my live account and I replace the losers with good performing ones from my demo account. The problem is nearly all of them either start losing at the same time or the one that I replaced starts winning in the demo account but whatever I moved to my live account starts losing. I’m only trading with USD/CHF but my EAs use different timeframes and were generated with different acceptance criteria. If I’m only trading one currency, how many EAs would you all recommend to have on my live account so that I have a good amount of diversity?

Thanks,

John

-

August 4, 2020 at 17:38 #55962

Petko Aleksandrov

KeymasterHey John,

Welcome to the Forum. I would suggest you trade at least 3 currency pairs. And why USDCHF exactly?

What is your rule to move the EAs from Demo to Live and from Live back to Demo?

Most importantly did you check if you have the same results on Demo and Live? When you place one EA in the live account, do you keep trading it in the Demo, and do you see the same results? Do the trades match?

Let me know so I can give you some tips.

-

August 5, 2020 at 1:03 #56001

mgunton2

MemberPetko,

I’m using Dukascopy and I’m not seeing a 100% match with the trades in the demo and live account.

The demo account is now unlimited as they’ve set that up for me.

I had quite stringent parameters and I’m still not seeing the results correlating…..too such an extent that either the markets are completely bonkers at the moment or more likely …. there’s something not quite right here…

I’d be grateful for some assistance here as the way this is going…even trading 0.01 lots…even trading gbp/usd, eur/usd & gold….I’ve only had 1 winning day and losing days since I started last week….

I just don’t see the point in spending ages testing on demo, get comfortable and then the moment real money is used it doesn’t match and you lose money!

Casing point….I have the same EA running on demo and live….it’s got a buy trade open in the demo (in profit) and a sell trade open in the live account (typically in loss!)….how can this happen if they are supposed to be identical???

Please help!

-

August 5, 2020 at 15:16 #56058

Petko Aleksandrov

KeymasterHello there!

Most probably the difference comes because you have placed the EAs at a different time.

I guess what you did is to place the EAs on a Demo to test and then you placed the winners on live?

Now, when you place EA in the Demo it starts opening trades. When you put it on a Live, it starts scanning for new signals. But during this time you might have a trade opening in the Demo. And in the live it will open a different trade. It could be with a different direction.

It depends on the strategy but sometimes it might take more than a week or the Demo and the Live to match the trades.

Cheers.

-

August 19, 2020 at 9:03 #57526

John

ParticipantHi Petko,

Sorry for the late reply, I have been really busy. Eventually I want to trade more currencies but I wanted to start generating a lot of strategies for one pair first. I chose USDCHF because I’ve manually traded it in the past and I’m a little more familiar with the pair.

Between my demo and live account, the results are close but not exact. It might be different because I have the demo account on a separate VPS which I’ve had about a month longer than my live account.

The way I have my accounts set up is I have a few identical portfolio EAs on both accounts. The EAs on the live account have all the exit and entry signals commented out except for the top 5 performing ones. I keep track of the accounts using FX Blue and when a strategy goes below 1.5 profit factor with at least 5 trades, I usually disable it on the live account and enable another one based on what is doing well on my demo account.

I’d be really grateful for any tips that can help me improve my routine. Also, what other currencies would you recommend to start trading with? I’ve had luck with EURUSD before the pandemic but sometime around March, all my EURUSD EAs quickly became unprofitable and I haven’t really tried trading that pair since then.

Thank you,

John

-

August 19, 2020 at 14:08 #57532

Petko Aleksandrov

KeymasterHey John,

I think you already have a good routine.

I wouldn’t focus on one currency pair because it brings a higher risk. For example, you can EURGBP. This way you will have 4 different currencies – USD, CHF, EUR, GBP.

It is important to keep equal exposure. So if you trade USDCHF, EURUSD, and GBPUSD, you will have a higher exposure on USD.

Now, if you want you can stick to USDCHF, but then I would suggest you look for risk diversification in different time frames. Try to create EAs for all time frames. Test them and see which time frame would work best for you.

Cheers,

-

August 20, 2020 at 3:55 #57654

John

ParticipantHey Petko,

Thanks so much for the reply. I’ll make sure to pick up some more currency pairs and try to balance my exposure a bit.

Regards,

John

-

July 10, 2021 at 21:43 #93208

autobetting

ParticipantHi,

i somewhere read that there are packages with EA’s , Petko does use and change every Time its needed. Can you let me know which courses these are. I cant find them. Are there some for Forex and some for Crypto ?

-

July 15, 2021 at 17:46 #93657

Petko Aleksandrov

KeymasterHey mate,

In the top menu, when you click on Packages, the last one is Trading Robots:

Kind regards,

-

February 28, 2022 at 12:29 #97832

Stefanos Ioannou

ParticipantPetko, in summary what is the procedure with these EA’s?

Do we put them up and running on demo and select the best ones after some trades or just put them all up and get an average profit? or? Thanks

-

February 28, 2022 at 17:22 #110377

Petko Aleksandrov

KeymasterHey Stefanos,

I always trade the EAs first on a Demo and this way I select the ones for my live account. But this is how I do it, and I showed it in most of the courses in the Academy.

You can test and play around to see which way you will feel comfortable.

-

June 29, 2022 at 5:10 #118727

Samuel Jackson

ModeratorHi Alan,

Where did the original 50 EAs come from and why have you used the mt4 tester rather than just use EA studio?

Soumds sensible what you are doing to get round the FIFA rule.

How long have you been demo trading? It sounds like you are going straight to live? If so I would strongly recommend doing what you are doing with demo for at least a month or two first.

Of the three options you have given I would say profit factor but definately trade them for at least a bit on a demo account to make sure you are happy with their performance.

-

June 29, 2022 at 11:49 #118734

Alan Northam

ParticipantThe 50 EA’s I used came from the ” Top 10 EURUSD Expert Advisors: Top EA Forex Trading ” course. The 50 EA’s were selected as a result of testing strategies in EA Studio. I then took those 50 EA’s and tested them in the invironment they will be used using MT4 strategy tester. See attached spreadsheet which shows my results.

I have been demo trading for the last two months using EA’s from the ” Top 5 Forex Strategies from a Pro Trader + 5 Forex Robots ” course and have had good results with the EURUSD EA from that course which has given me confidence in going live.

-

June 29, 2022 at 11:56 #118741

Samuel Jackson

ModeratorHi Alan,

It would be logical to continue using that EA that you have faith in and had some good success with in demo for two months and it’s good your not going too fast. Might be an idea to test your new plan using demo also though, but scaling up with small money to start is also fine really (as long as can tolerate any drawdowns and losses with real money).

Remember that in using the EA from top 5 course that it was selected for you. Picking 10 from this selection means you are picking yourself so there is a difference.

I’d suggest also trying to pick less correlated EAs to combine also rather than just top 10 profit factor for example

-

June 29, 2022 at 14:11 #118744

Alan Northam

ParticipantYes I am using the EA from the top 5 course. From the top 10 I need to pick myself I have only added two of them to two live accounts and I am monitoring them closely. I have also reduced lot size to 0.05. As these go into profit I will be adding additional EA’s to live accounts. It will take some time to get all 10 live accounts fully up and running. Once I have sufficient closed trades I will then add them to FXBlue. As for using less correlated EA’s, I don’t have a group of less correlated EA’s to chose from. As this portfolio of EA’s makes money I plan on using some of the profits to add courses so I will have access to other currency pairs to chose from.

Currently, I am undecided about using EA Studio. From the messages in the Forum it seems like it could take quite some time to learn how to use it properly so that I can get reliable EA’s from it. Therefore, at this time I think it would be less time consuming to just add courses to select EA’s from and let you guys deal with EA Studio. I think my time would be better served using your EA’s and putting together a good performing portfolio of EA’s. I could change my mind at a later date but for now this is my plan.

-

June 29, 2022 at 23:42 #118755

Samuel Jackson

ModeratorSounds like a good plan to start out Alan.

I’m sure you will adjust as you go of course.

I just meant with the correlation that you can open the EAs you have it EA studio (all for the same pair and timeframe) and make sure that they are not correlated using its tools but if you are not using it then that’s not an option.

Will be interesting to see how you go. Keep us posted on your results :-)

-

June 30, 2022 at 22:15 #118810

Alan Northam

ParticipantI will update on July 9th…

-

July 11, 2022 at 11:33 #119200

Alan Northam

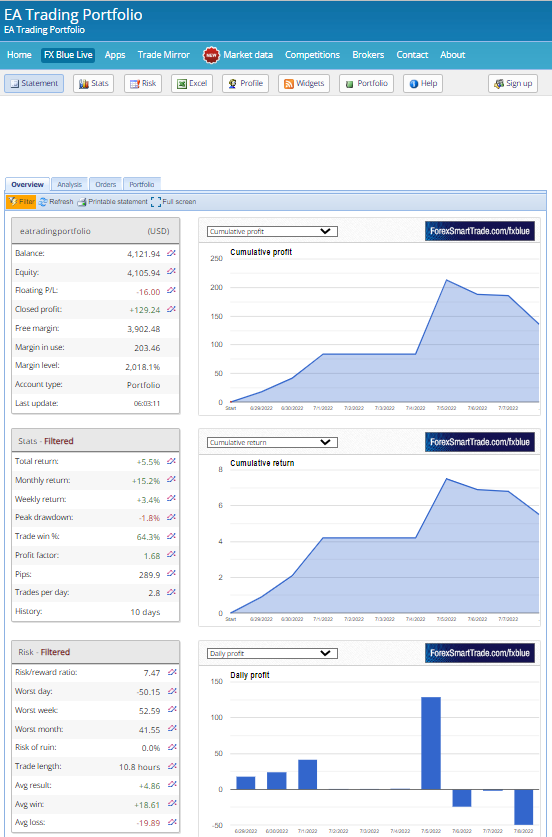

ParticipantAs promised I am now updating my portfolio of 10 EA’s comprising of EURUSD. I started this portfolio of EA’s 10 days ago. To put together this portfolio I opened 10 MT4 accounts. Five accounts with Oanda.com and five accounts with Forex.com in the United States. I funded each account with $400 and set the lot size to 0.05 lots. I selected the EA’s to use as discussed in a previous post shown above this post. The results show that I had a total profit of 5.5% over this 10 day period as shown in the attached picture. The picture also shows that over the last 3 days the portfolio had losses. I attribute these losses to the Non-Farm-Payroll report that came out Friday with the markets starting to brace for this report from Wednesday onward. The first 7 days of the existence of the portfolio showed profits with the flat period occurring because of the weekend. In reality, I don’t expect this portfolio to just make profits day after day. What I expect is for some days to be profitable and some with losses but overall I expect the trend to point in an upward direction. It will be interesting to see how this portfolio of EA’s does over the balance of July.

Some may be wondering how I am managing this portfolio. So far I have not made any changes to the EA’s. Each day I have been running the MT4 Strategy Tester on each of the accounts and looking at the resulting graphs to examine the trends. Two of the accounts have not yet had any buy or sell triggers. Two of the accounts are moving sideways. The remaining accounts have been fairly active. Overall the portfolio has exhibited an average of 2.8 trades per day. I have not yet received my 50 EA’s for July. However, once I receive them I will examine each by running them through the MT4 Strategy Tester and catalog the results as I have shown for the June EA’s in a previous post above. I may at that time make a few changes to the portfolio. However, the EA’s from my June selection I will continue to leave in the portfolio for another month as long as they continue to perform well. As for the lot size, once I feel completely confident in the performance of this portfolio I may increase lot size slowing in 0.1 lot increments. My overall goal would be a portfolio that increases by 1% per day. Over the last 10 days this portfolio has increased by 0.54% per day. Not bad for starters.

I will update again next weekend…

-

July 17, 2022 at 14:56 #119586

Alan Northam

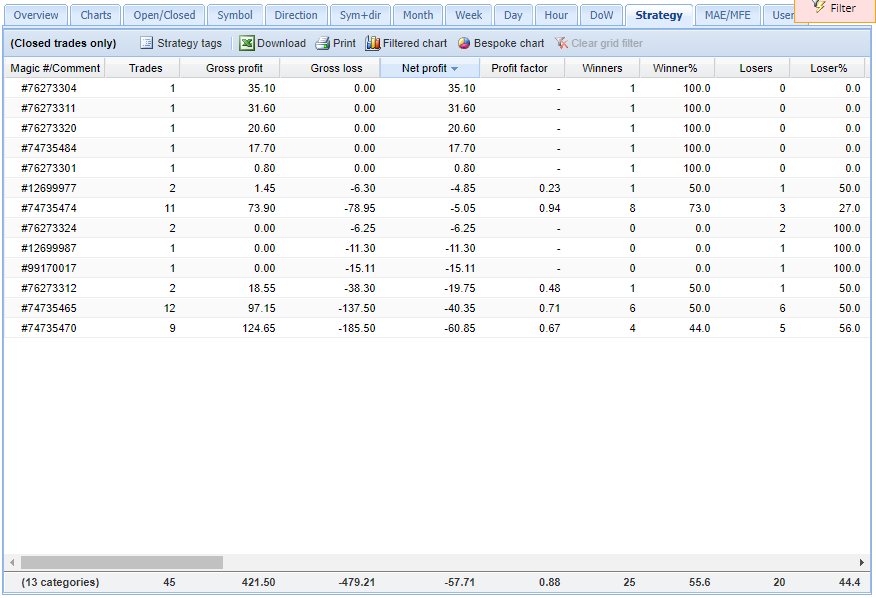

ParticipantAs promised I am updating the results of my EA Portfolio. This portfolio consists of 10 EA’s with each EA in a separate MT4 terminal. This portfolio is now 19 days old. This week the portfolio resulted in a small loss of $57.71 or -0.8% of portfolio balance. Up until this past week the portfolio had generated a nice 5.5% profit. I contribute the losses this past week due to the bad economic reports from CPI and PPI. I believe the results of this portfolio of EA’s will improve with time as more trades take place.

This past week I also update the portfolio with the July EA’s. Two of the MT4 accounts still had open trades in progress so I did not update these two accounts until these trades were closed.

The attached PNG file shows the status of the portfolio to date. This month I decided to show the Strategy table sorted by the profit column. One note about the totals of each column is the profit factor of 0.88 is not really accurate as several strategies don’t have any losses and therefore the profit factors cannot be calculated.

I will update this portfolio again at the end of July…

-

July 17, 2022 at 14:59 #119592

Petko Aleksandrov

KeymasterHey Alan,

The CPI that came out is crucial as it is higher than expectations. And it comes at a time when the FED is increasing rates.

So we can not really do a lot in such situations.

Sometimes such news affects positively the portfolio if the opened trades are in the lucky direction! :)

-

July 17, 2022 at 19:02 #119604

Alan Northam

ParticipantPetko: Hopefully my portfolio of EA’s will do nicely between now and the next time CPI and PPI come out again in August. NFP Friday may present a nickup but I will trade through it. like you say sometimes these reports will go against the portfolio and other times go in its favor. Over the long term I would think the portfolio would come out the winner.

-

-

AuthorPosts

- You must be logged in to reply to this topic.