Home › Forums › EA Studio › EA Studio Pro Course › EA Studio Professional Course

Tagged: - T

- This topic has 24 replies, 2 voices, and was last updated 3 years, 1 month ago by

Samuel Jackson.

-

AuthorPosts

-

-

March 22, 2022 at 10:54 #113731

Selim

ParticipantHello dear community,

We are a group of 3 German trading buddies here. We are trying to find the best and safest way to create EA systems with EA Studio.

We are all very enthusiastic about the strategy approach of Mr. Petko! But we still have some approaches we want to share with you. And questions that are still open.

Among the open questions:

- Is there anyone who has been trading this type of strategy in the LIVE market for a long time. And is also profitable. Would you please share your statistics with us?

- Our targets are 20% per month, is that realistic?

- How can you avoid that a strategy in LIVE goes directly into a loss phase.

- When the trend changes, our strategies are also adjusted. Or do we stick to a 1 month rhythm?

- How often do you add new strategies to the pool? And how do you avoid duplicate strategies in the pool itself.

New approaches:

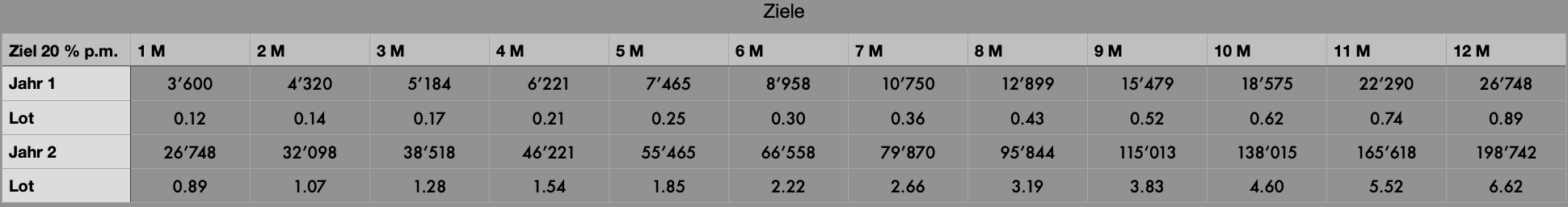

- We have chosen to reach the 20% target. we have chosen 3 strategies instead of 2. The risk is still within limits. How many strategies per time unit and asset do you use? (See table below)

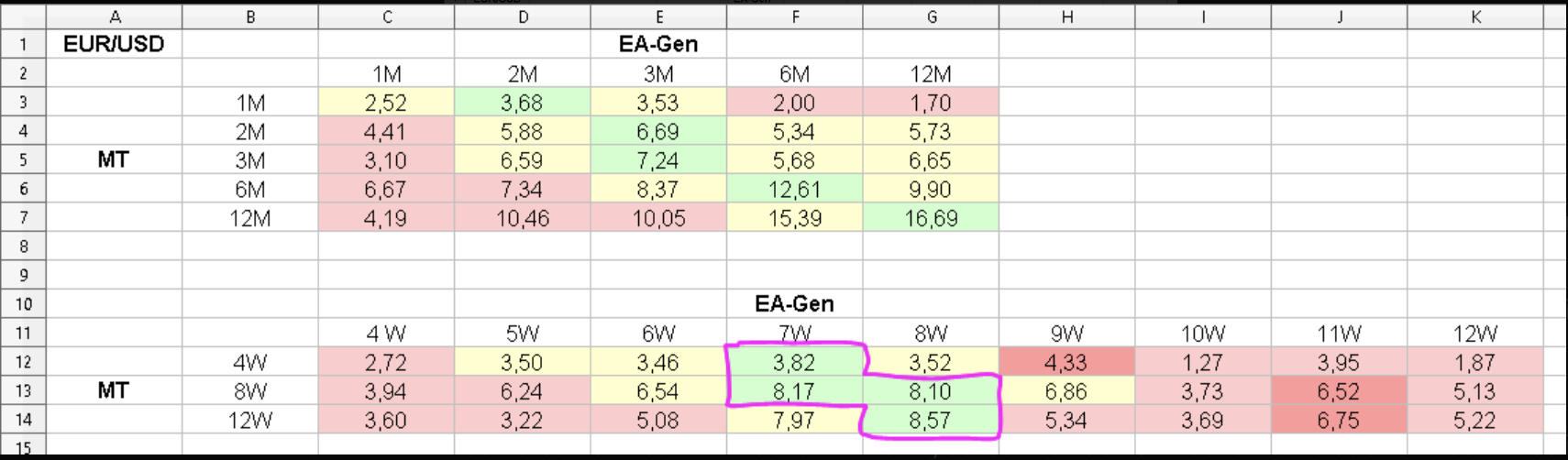

- We are currently testing with 1 strategy, with 7 weeks instead of 4 weeks, on the grounds that we think the performance is more stable if we choose a wider time period for filtering. We tested this and found that the sweet spot is somewhere between 6 – 8 weeks. What are your experiences with rebalancing the portfolio, what intervals do you have? (See table below)

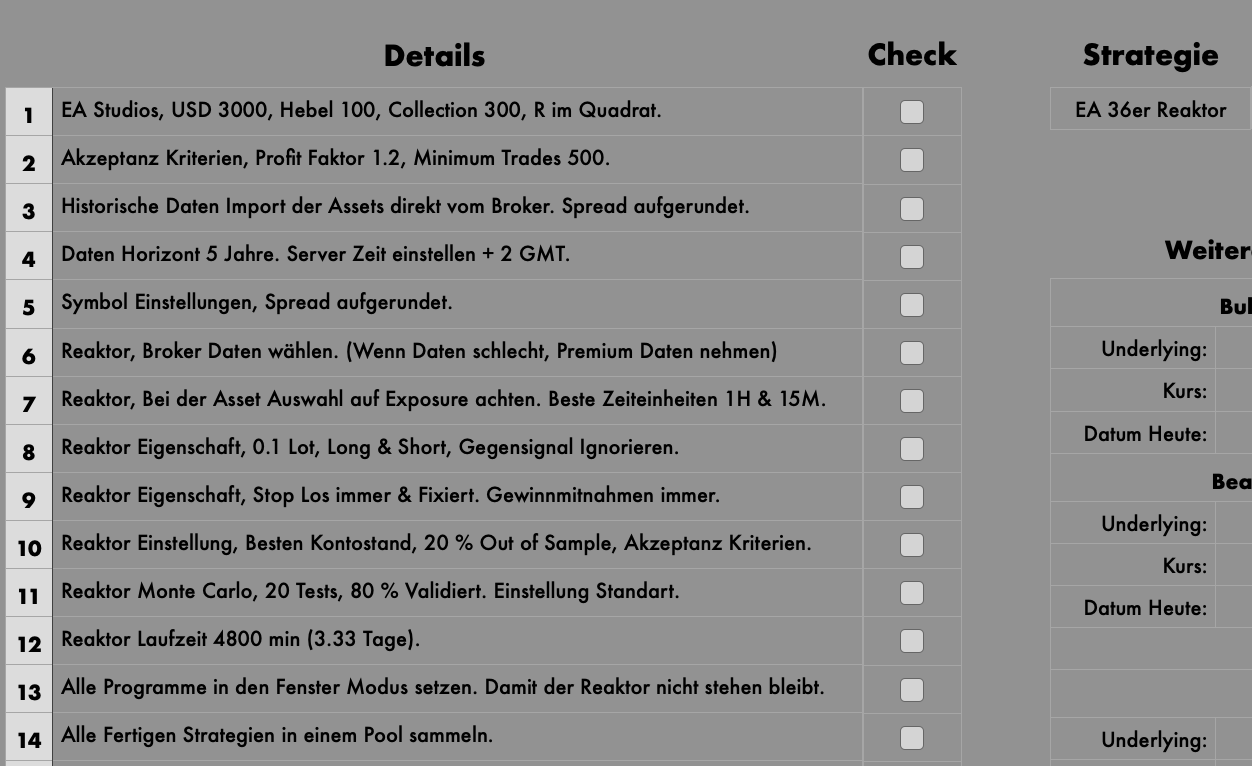

Our reactor settings with original strategy:

EA Studios, USD 3000, Leverage 100, Collection 300, R squared.

Acceptance criteria, profit factor 1.2, minimum trades 500.

Historical data Import of assets directly from broker. Spread rounded up.

Data horizon 5 years. Set server time + 2 GMT.

Symbol settings, Spread rounded up.

Reactor, select broker data. (If data is bad, use premium data).

Reactor, Pay attention to exposure when selecting assets. Best time units 1H & 15M.

Reactor property, 0.1 lot, long & short, ignore counter signal.

Reactor property, stop lot always & fixed. Profit taking always.

Reactor Setting, Best Balance, 20% Out of Sample, Acceptance Criteria.

Reactor Monte Carlo, 20 tests, 80% validated. Standard setting.

Reactor runtime 4800 min (3.33 days).

Set all programmes to window mode. So that the reactor does not stop.

Collect all finished strategies in a pool.Our validator settings with original strategy:

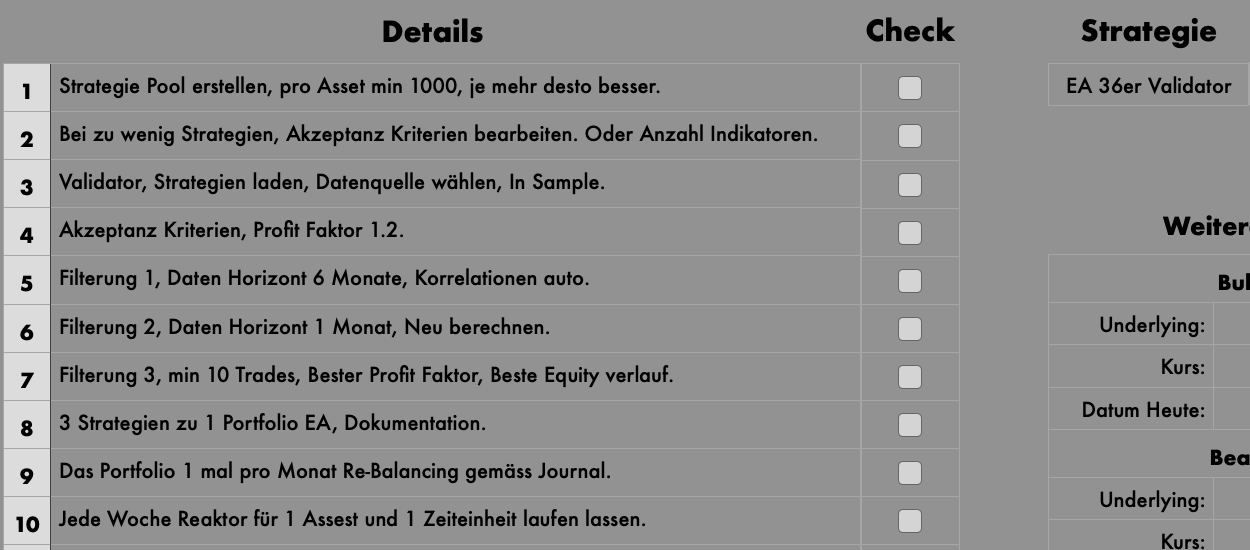

Create strategy pool, min. 1000 per asset, the more the better.

If there are too few strategies, edit acceptance criteria. Or number of indicators.

Validator, load strategies, select data source, in sample.

Acceptance criteria, profit factor 1.2.

Filtering 1, data horizon 6 months, correlations auto.

Filtering 2, data horizon 1 month, recalculate.

Filtering 3, min 10 trades, Best profit factor, Best equity run.

3 strategies to 1 portfolio EA, documentation.

Re-balancing the portfolio 1 time per month according to the journal.

Run reactor every week for 1 assest and 1 time unit.Our risk calculation with NOT original strategy:

Our test with 7 weeks with NOT original strategy:

Our 20% target scaled to 2 years:

FxBlue Account Original Strategy:

https://www.fxblue.com/users/s117

FxBlue Account Original Strategy:

https://www.fxblue.com/users/marcusfenix

FxBlue Account 7 Weeks Strategy:

https://www.fxblue.com/users/704750

We are open for further inputs, we are happy to share our further approach here on this forum. So that others can learn from it.

We are also looking for new trading buddies who are interested in forming a learning group.

We wish you all a good trading week.

Translated with http://www.DeepL.com/Translator (free version)

-

March 23, 2022 at 10:46 #113870

Samuel Jackson

ModeratorHi Selim,

About your 20% monthly target. I think it is a good target. For reference, on my first month of demo after taking the professional course I increases a 3000 account to 4500, so a 50% increase. I used Petkos pool and just followed his instructions as closely as possible. Easy to then rush into live trading due to impatience but consistency is everything!

A good rule of thumb is make sure you are happy with your profits and consistency over a 3 month period before moving to live.

The great thing about EAs (Or one of the many great things) is that emotion should be removed. So more than manual trading it should be manageable to remain consistent if you follow your system with no interference. Even so if that first month of live the first week starts with a drawdown emotions can be tough to handle when its real money so build your confidence and understanding in demo. If you have three months of profit in demo then you would have been profitable in live also with the same broker if you did the same thing (The results wont be identical but they will be very similar).

Also, why don’t each of you three get on here as a separate voice? You could each post your individual results and discuss with each other and Petko and the community can join in? I think you would each learn more that way and get more benefit from the forum.

You could also each try a slightly different approach inline with your overall philosophy too and see what works best over a couple of months (For example one of you could run the system using Petkos pool, one with your own pool and one with say M30 and M5 from either Petkos pool or your own) OR even just all generating your own different pool with identical settings and identical approach OR each using the same pool (either Petkos or you own) but using different brokers. Can be a definite BIG benefit to a team of 3, use it to its full potential :-)

I can see three separate fxblue account links but not much is happening on them? Its not very clear to me what is being shown here? Is the intention to each run the system separately and share results in this way?

I’d personally love to see this topic progress on the forum and hope you’s stick with it. I like the organization and planning even if I don’t fully understand 100% of it, its definitely a big key to success in this so off to a good start.

-

March 23, 2022 at 12:48 #113876

Samuel Jackson

ModeratorHi guys,

Well done on your selection of software and community btw. It took me a while to find EA studio and this community and I strongly feel it is the best software out there and the best place to learn it.

So in a nutshell you are using a modified method of Petkos Professional Course using a a self generated pool of EAs?

I’ll give my thoughts on some of your questions and definitely look forward to hearing from Petko also. There is actually so much information in your above post it almost opens up too many questions. I’ll take a look tomorrow and add a few extra points but for now I’ll just stick to answering a few below.

3 – How can you avoid that a strategy in LIVE goes directly into a loss phase.

There is always going to be a risk of this happening. However its significance depends on your trading rhythm (as you put it). For example, say you are trading an EA for one month that typically has shown in backtesting to have waves lasting about a week but generally trending up. If you are trading this EA for a month then starting on a loss is not so much of a problem, however if for example you EA has shown to have waves lasting a month or more then that could be a problem.

You are going to be trading 36 EAs so make sure as a final check to have a look at the typical cycles in the last 6 months and favor ones that have shorter stagnations and drawdown periods to lower the risk. You can take other measures such as taking a look at what factors might typically lead to the reversal of a drawdown but I’d say starting on drawdown or not can just come down to luck sometimes but it is not how the month starts that is important or skillful but how it finishes.

4 -When the trend changes, our strategies are also adjusted. Or do we stick to a 1 month rhythm?

Don’t interfere with your EA’s based on emotion. You should decide on a rhythm and a plan and stick to that. Backtesting a system based on a 1 month cycle of changing EA’s is a good timeframe and once you have decided on a good system you need to stick to the plan and keep emotion out of it. Always on demo of course until you are consistently profitable.

5 – How often do you add new strategies to the pool? And how do you avoid duplicate strategies in the pool itself.

Don’t worry about duplicate strategies in the pool as when you run the validator they will be filtered out. This can be reduced by decreasing the correlation coefficient though.

New approaches:

1 We have chosen to reach the 20% target. we have chosen 3 strategies instead of 2. The risk is still within limits. How many strategies per time unit and asset do you use? (See table below)

This sounds fine and is only a small tweak to the system in my opinion. Just lower the lot size traded as you increase the number of strategies. Is your calculated risk simply a sum of the drawdowns given by EA Studio? Over what period was this risk and profit shown in the table calculated (OOS, IS, COMPLETE?). For any of these taking these values seems very optimistic to me and looks like you have simply taken an average for the drawdown risk? For example if EA studio has calculated the OOS max drawdowns to be 2% for 10 EAs on different pairs then I would be expecting a risk of at least half of those experiencing a drawdown at the same time which would be 10% but it looks like you are just taking an average and assuming a risk of 2% for the portfolio of 10 EAs?

2 We are currently testing with 1 strategy, with 7 weeks instead of 4 weeks, on the grounds that we think the performance is more stable if we choose a wider time period for filtering. We tested this and found that the sweet spot is somewhere between 6 – 8 weeks. What are your experiences with rebalancing the portfolio, what intervals do you have? (See table below)

This seems a little bit narrow in terms of testing and I think you need to increase your sample size significantly before deciding that this is the sweet spot, its simply the sweet spot for this particular strategy over the trading period you have chosen. its highly likely if you repeat the exercise for a few different strategies a different sweet spot will appear.

One last thing is a big apology if I seem over critical in my thoughts and super to the point. I actually think you’s are getting off to a GREAT start and am very interested in seeing how you guys progress :-). Its just late here and I am tired but I wanted to reply. (Also I know Petko is very busy as the site is going through some big updates at the moment and so I expect he wont be as quick to respond as normal right now).

Keep us posted with your progress :-)

-

March 24, 2022 at 17:46 #114051

Selim

ParticipantHey Samuel,

Thirst of all thank you for you’re respond to our topic, and those long answers.

Good to here im not too crazy with my 20 % target :D

i was before 3 weeks in profit. I restartet because my friends joined. We will share our results with the fxblue accounts, 2 are now startet a bit lately because of no time to setting up. And we will stick to demo for 3 Month and wait for consistency thank for you’re advise!

Two of us will go with the standard plan. The other will do his slightly configured plan. I already tell him to join here also as a voice in this forum and tell us more about his other configured plan. He is on the way. My other friend is a compleet beginner. So of course he will also join here and tell us his sight also from the plan too.

Answers to youre second Post:

3 – How can you avoid that a strategy in LIVE goes directly into a loss phase.

Absolute right it is the overall performace which is important. Yes i already got a bit finer with the Filer 1 & 2 Prozess. Now are a profit factor of 1.3. Before was 1.2 Also we searching for the lowest drawdown always.

4 -When the trend changes, our strategies are also adjusted. Or do we stick to a 1 month rhythm?

Okey no changes till next month, got it!

5 – How often do you add new strategies to the pool? And how do you avoid duplicate strategies in the pool itself.

With the Checkbox, resolver corelations in the collection. Thank you.

New approaches:

1 We have chosen to reach the 20% target. we have chosen 3 strategies instead of 2. The risk is still within limits. How many strategies per time unit and asset do you use? (See table below)

In the table the risk is calculated via Absolut Drawdown amount in the last month. Then i got also the average. Because most system hast other drawdown times. I use for a 3600 Account 0.01 Lot for each system. Total of 36 system the maximum amount of possible lot size is 0.36 Lot. In this EA’s constellation the maximum drawdown should be around 5 %.

2 We are currently testing with 1 strategy, with 7 weeks instead of 4 weeks, on the grounds that we think the performance is more stable if we choose a wider time period for filtering. We tested this and found that the sweet spot is somewhere between 6 – 8 weeks. What are your experiences with rebalancing the portfolio, what intervals do you have? (See table below)

This will the us my friend.

Updates will follow soon!

-

March 26, 2022 at 12:06 #114110

Samuel Jackson

ModeratorSounds good,

I still think the calculated risk is a little low, you are essentially expecting a Return/Drawdown of 8 (Nothing wrong with being optimistic though!). But your time in demo trading will give you more of a feel for what to expect (which is one of the reasons its so important).

I would definitely recommend you keep close track and record these important parameters in your demo trading to build a ‘feel’ for things (which really only comes with time and practice). Don’t be too surprised or disappointed if your drawdowns are more than expected and you can adjust for the next month with new insight (continually :-).

Also you say you are always searching for lowest drawdown, just make sure this doesn’t mean lowest profits also! The return/drawdown may be more appropriate I think.

Happy trading, looking forward to seeing upcoming results and discussion!

-

March 27, 2022 at 11:22 #113866

Samuel Jackson

ModeratorHi Guys,

First of all I like what you are doing in collaborating and learning together as a group of 3!

In a nutshell what is seems you are doing is the following:

1. Using Petkos approach presented in the Professional Course but with some modifications

2. Rather than using Petkos pool you are looking to generate your own pool and apply the approach to that

This sounds like a sensible enough starting point to me.

I am guessing that you have formed a collective in order to both share costs such as software, hardware and trading capital etc as well as knowledge and effort?

I’ll try to answer a few of your questions below but first off I would like to ask what type of timeline and progress path do you intend to take towards trading with live funds and what checkpoints along the way seem sensible?

These are my thoughts on some of your questions, will be interesting to hear from Petko also for sure (The website is going through some work and he is no doubt swamped so I expect he will be a little later to respond than usual due to that btw)

3.How can you avoid that a strategy in LIVE goes directly into a loss phase.

You cant 100% avoid this this only becomes a big problem depending on the profit window you are aiming at. For example if you have a strategy that has ups and downs tending to last about a week but is generally going up over the course of a month say, then if you start it during a drawdown but keep it on for a month then likely all is well. Of course if you are changing robots weekly then you may just get the drawdown for a week and then remove the EA and never get the profits that were coming. It sounds like you are aiming to change robots monthly which is sensible so take a look at how long the drawdowns tend to last I suppose and wether it starts in a drawdown or profit is partly down to luck but be more concerned with not how it starts but how it finishes if you give it appropriate time.

So simply put if a strategy looks good but it has had long stagnations lately or drawdowns lasting more than a month then I would try to pick a strategy that has shorter stagnations and drawdowns lately, that way at least if you do hit a drawdown initially it is less likely to last long. Also at this point of refinement I’d personally always favor a small sample of most recent data only (i.e. the most recent couple of months)

4.When the trend changes, our strategies are also adjusted. Or do we stick to a 1 month rhythm?

Create a plan and stick with it. A month is a sensible rhythm if you interfere and try to adapt too much then this is gonna get harder and harder to backtest.

5How often do you add new strategies to the pool? And how do you avoid duplicate strategies in the pool itself.

You can add strategies to the pool as much as you want. Duplicates are not a problem in the pool as when you pass them through the validator any duplicates will be removed. If the pool seems to be getting too large then you can easily put them through the validator with to strip some out. For example lets say you grow your pool to 3000 over 6 months or so but you would rather trim that back to 500 you could just load half of your collections to the validator and rerun with your preferred settings and then save the new collection and repeat for the other half. That way you can get the top 300 according to what you prefer (profit factor, nett profit, R/D for example).

If there are a lot of strategies being discarded purely because excessive strategies are passing the criteria but the collection only holds 300 then you can rerun the validator with an either an increased criteria (say increase pf>1.2 to pf>1.4 for example), or a stricter robustness test such as increase monte carlo for 80% to 90% or reduce the correlation coefficient from 0.98 to 0.95 for example to give less correlated strategies.

There is a lot to learn and it take time, so get lots of practice using demo accounts until you are ready for live. You can also of course try several different systems on several separate demo accounts to save time in learning. Make sure to keep track in a spreadsheet you can can learn from what you have already done

Keep us posted on progress, I’m sure others will chime in soon :-)

-

March 27, 2022 at 11:22 #114115

Dirk Diggie

ParticipantI want to say hello. I’m one of three. :)

-

April 2, 2022 at 7:43 #114234

Burak Kay

ParticipantVery kind, I greet you many thanks for your effort.

-

April 2, 2022 at 7:55 #114473

Petko Aleksandrov

KeymasterHey Guys,

Great topic and discussion here!

I am happy to see you are discussing the plan in such detail. Asking for help and opinion is never a shame! Good job!

I stand 100% behind the words of Samuel, thanks mate, for answering with extended writing.

I can add that you should not focus that much on the ”20% Monthly”.

With a lot of crypto trading in the last two years, I realized that the profits we make depend so much on the market itself.

If I make 50%, I am happy with it. If I make 5%, I am still satisfied. I am happier if I make 2000% (which I did with some coins).

It is the same with Forex and the Stocks. It depends a lot on the market (more than what I thought initially).

So you guys, focus on perfection in your strategy/system and leave it on the market to bring you the profits.

Always try to improve the system to test new things and experiment, which will make you successful.

-

April 2, 2022 at 9:46 #114482

Samuel Jackson

ModeratorHi Dirk and Burak,

Good to see you have joined the forum, looking forward to seeing how your results go!

Happy to help how I can Petko :-), and couldn’t agree more about continually trying to improve with testing and experimenting!

-

April 3, 2022 at 17:20 #114554

Petko Aleksandrov

KeymasterHello everyone,

I have spent the Sunday filtering and analyze all collections in the Pool (from EA Studio Professional Course)

All of the strategies have:

Profit factor >1.2

Min Count of Trades 300

R-squared > 50As you can guess, there are fewer strategies now but more effective ones. Robust ones!

-

April 5, 2022 at 18:13 #114671

Selim

Participantgood day dear teachers,

thank you for your support in our quest to become the best students here with you in the trading academy community.

@petko thank you very much for the revised pool. I see in the course some things have changed, I assume you are working on it at the moment because I can’t see it at the moment.Also regarding the 20% target I am aware that this is rather unrealistic. I myself have unfortunately only been able to make losses with my demo account. The market has definitely not become easier the last time. But that will certainly be better in the future.

Our trading group is always open for further tips and suggestions.

One question I have how is your trading with this stratgie the last month run?

thank you very much for your very detailed words. We have raised the profit factor to 1.3. Monte carlo we still leave on standard values. The correlation too. We will certainly publish updates here as soon as we have more data.

-

April 6, 2022 at 9:38 #114703

Samuel Jackson

ModeratorHi Selim,

Sounds good and looking forward to results.

Regarding your question. I personally didn’t trade this strategy last month so I can’t answer but I would like to suggest how you can get a sense of how trading this system would have performed so that you can actually answer your own question :-)

1. Open up a spreadsheet and a copy of EA studio.

2. Upload your broker data to EA studio using the export from MT4 script. (I am assuming that you are using a raw spread account so this will give the broker swaps and you can set the spread and commission appropriately)

2. For your each pair and period run your validations on whatever collections you are using but do this not to trade from this point forward but a month in the past. (I.e. Check your 6 months and 1 month performance but offset these dates a month in the past)

3. Then instead of downloading the EAs and trading them on demo for a month you can simple check how they would have performed last month and record all the net profit values in the spreadsheet and then sum the totals. Then you will know if you would have been profitable or not if you had traded this way last month.

Of course this will take a bit of work but you will learn much more in my opinion running tests and checks like these ongoingly.

The spread on demo is variable so results will be a bit different but if you have set up EA studio to match your broker data well then generally you should get an accurate indication of how you would have performed.

Also when you say you are currently making losses on your demo how long has your demo been running? Remember these could easily be reasonable drawdowns that are going to occur so make sure you allow the demo to run according to your plan (i.e a month) before deciding how your strategy performed.

Also don’t be disheartened by the initial losses (even if it is for the whole month). It is very reasonable to make losses starting out on demo, but with the mindset of wanting to be the best at this and the willingness to put in the time and effort to achieve this you will ultimately be successful in time :-). You will get out what you put into learning and testing and persevering!

-

April 8, 2022 at 10:23 #114813

Petko Aleksandrov

KeymasterHey Selim,

Can you make it more transparent what you mean by “I can’t see it at the moment”? Do you not see the course or?

Thanks, Samuel, for taking the time to answer in detail.

-

April 8, 2022 at 16:14 #114877

Selim

ParticipantHello Petko,

Sorry my fail, it was hidden behind the show more button. I had to click twice in this area to get the on more special thing. :D i will test it now with the new pool thank you very much!

-

April 19, 2022 at 12:28 #115517

Selim

Participanthello all,

Now the 1 month is over, and I draw a conclusion of -3.71%, which is considering what happened last month so perfectly in order.

I let the tests now continue to run. and hope that the market gives us many positive days.

Yesterday, 12 new EA’s were created with the specifications of Mr. Petko. It is again a better feeling when the strategy come from their own pool.

Regarding my buddies, most likely none of them will continue : ( because of time reasons or because there are already strategies that perfrom better.

I am open to everything that can make money so I will continue to update this, also because it gives me a lot of fun.

I wish you all a nice trading week.

-

May 6, 2022 at 12:20 #116123

Samuel Jackson

ModeratorHi Selim,

3.71% loss is pretty measured, and yes it was a tough month.

That’s a shame that your buddies are most likely not gonna continue. Good to see you are though.

You seem to enjoy this method of trading – As do I :-). My opinion is this is probably the most important factor in eventual success. Profits aren’t gonna jump into anyone’s pocket, I have been doing this a while now and although my results aren’t quite where I ideally want them to be (yet) there has been very significant continual improvement ongoingly with occasional leaps. The harder I work and the longer I persist and deepen my knowledge the better my results get (Funny that!).

An enjoyment of the tools and trading style is a such a major key in persisting and improving so we are both very fortunate to have found that! I’m honestly obsessive at times, constantly having ideas to try popping into my head – it keeps me very busy and I love it haha

Keep doing what you are doing and sharing your results and I’m sure we will get some good discussion points that will be to all our benefit :-), tracking things as you are doing is very important so off to a great start.

Are you running any other systems alongside the 12 EA’s?

Happy trading week also! This recent week has been pretty poor for me personally but the two before it were great, cant win all the time ;-)

-

May 8, 2022 at 10:39 #116186

Kalin

ParticipantHello everyone,

I am running EA Studio in 10 tabs using the reactor in each tab. I have found that over the same period of time the tabs are generating very different volumes of strategies calculated. After two hours on tab has 45K calculated while others have only several hundred.

Is this normal? Do I have too many tabs generating at the same time?

When using portfolio EAs is there an ideal number of EAs to be included in the portfolio? Is it possible to have too many EAs in one portfolio EA?

Thanks!

-

May 8, 2022 at 10:49 #116236

Samuel Jackson

ModeratorHi Kalin,

Okay so it sounds to me like you have each EA studio in a seperate tab on the same browser rather than on seperate browsers? If so then that is the problem. The several hundred will just have been generated in the brief moment that the tab was active. Can you confirm if this is the case or not?

As for the portfolio, stick to 100 at most I would say personally. Do you have any great need for anymore than this? If so can you give a little more detail on your system?

100 per portfolio will be absolutely fine (optimal is possibly dependent on how many positions open at the same time but I would need to test this, however don’t feel its really necessary).

-

May 10, 2022 at 21:06 #116328

Kalin

ParticipantHello everyone,

I want to start using a VPS. Is there a section in any of the courses that covers how to set up and use a VPS? Are people using the service that is integrated with MT4 or something else like AWS?

Thank you!

-

May 10, 2022 at 21:28 #116331

Samuel Jackson

ModeratorHi Kalin,

Did you resolve your original issue with the multiple EA tabs? Was it that you were running EA on separate tabs rather than separate browsers as I expected? It’s good to clarify for anyone else who may come on the forum looking for an answer to a similar problem :-)

Setting up a vps is pretty straight forward. It is essentially just a remote computer close to the brokers server which will run your MT4 terminals 24/7 and reduce latency (your order signals will be faster).

It is definitely worthwhile. There are many forex specific vps options (will find on google easily) with free trials. Just sign up for a couple and see what one you like best, it’s more about the cost per resources you want (number of cores, ram and hard drive space) which is dependent on how many MT4 terminals you intend to run. Also when choosing an operating system use windows 2012, it uses less resources and is better for this purpose in my experience.

-

May 10, 2022 at 21:40 #116335

Kalin

ParticipantHi Samuel,

Thank you for your reply.

Yes, I have all the tabs open in Brave browser. It does appear that only the tab that is visible is the one that is generating strategies. Is there not a good way to have multiple reactors running at the same time? Multiple browsers?

The reason I asked about the portfolio EA strategy upper limit is that I have an idea for managing my demo EA’s using portfolio EAs.

I’m thinking that I can make portfolio EAs from the Pool of strategies to test on my demo account. If I make one portfolio EA per asset/time frame then I can easily test all of the strategies on my demo account and track the results on FX Blue. I wouldn’t be trading the portfolio EAs live. I would only be using them to add many strategies to the Demo account without having to add each strategy individually on their own chart.

Then I can pick the best performing strategies from FX Blue to move to my live account.

I realize that this idea is similar to what Petko demonstrates using the Validator. I think what I like about this idea is that many strategies will be tested against live data rather than historical data.

Is this making sense? I’m just getting started so I am very open to feedback or suggestions.

Thank you.

-

May 11, 2022 at 0:28 #116344

Samuel Jackson

ModeratorHi Kalin,

First point is well done on coming to this portfolio idea independently but Petko does this in most of his courses also (well since portfolio EA became a feature in EA studio) :-). What course have you taken so far? You are getting off to a good start but it may be worth taking a look at one of the newer courses where petko is using portfolio EAs in this way?

So this is a good way to use the portfolio EAs, and I’d say stick to 100 strategies per portfolio personally and you won’t go wrong.

And yes I thought that might be the problem regarding the tabs. Yes the solution is just to use multiple browser windows rather that multiple tabs.

Is there any particular reason that you have chosen to use Brave? EA studio will work on most browsers but chrome is recommended as the fastest and it is considerably faster than Firefox for example when I tested this.

Brave is a good lightweight browser so I expect your think it may have been faster?? Chrome is the way to go :-)

-

May 17, 2022 at 13:38 #116763

Marin Stoyanov

KeymasterHello,

I had the same issue with browser tabs. It’s a “by design” feature of every browsers to minimize the processor activity when the tab is not visible, and they always try to improve this. I tried Edge, Firefox, Brave, Opera, Chrome and less known browsers but all had exactly the same behavior :-(

There are tutos to change some advance configuration to disable this but I never found any that really works.

The only way (I’ve found) is to separate the tabs and keep them all visible.

Another way that I use now, is to create some virtual machines, and on each machine I run one browser, and I’m very happy with that system, because my settings stays the same on each machine when I restart the browser, as EA studio saves last configuration when the browser is closed.

And with all the tests that’s I’ve made, I got better results with chrome… -

May 18, 2022 at 0:28 #116795

Samuel Jackson

ModeratorYour conclusions match my own David. I started out in a very similar way, trying to run as many browsers as I could and always wanting more computer power. These days I’d be pretty happy with just a single mid range computer with a 6-8 core processor that can run 6 reactors at the same time comfortably overnight :-)

In a nutshell:

1. Use Chrome

2. Run EA studio on seperate browsers not seperate tabs (Again this is shown in Petkos courses)

3. Keep the Tabs visible

Kalin can I ask how many EA studio instances you are wanting run at a time? Also what is your computer processor and ram are you running (Nothing extravagant needed for EA studio in my personal opinion, just checking you are running an optimal number of EA studio instances for your hardware).

-

-

AuthorPosts

- You must be logged in to reply to this topic.

FxBlue Account Original Strategy:

FxBlue Account Original Strategy: