Home › Forums › Ready-to-use Robots › Forex Gold Investor › Set Files for Forex Gold Investor EA › Reply To: Set Files for Forex Gold Investor EA

Marin Stoyanov

Marin StoyanovHey @hugco, I am not a lawyer for anyone, and I do not defend or accuse anyone (vendor or robot). I’m simply sharing another opinion and my experience with this EA.

I understand where you’re coming from and I agree to some extent. For newbies, just starting with algo trading, or with this robot, or with prop firms, I wouldn’t suggest trading with the Forex Gold Investor at the moment but this doesn’t mean that this is a bad EA. When people were “printing” money with this EA and passing almost every challenge, no one said a single word how good the EA is. Also when people were making money from stocks no one was complaining but then when the US president announced new tariffs and stocks wend down, people got scared. But now a few weeks later we can see how the stocks go up again.

Personally I don’t plan to stop using the robot completely. I still paused trading it for a few days to observe how the market would react after last Tuesday’s price gap. My personal goal is to adapt under these conditions (without taking huge risks), by doing a lot of backtesting with different settings and lowering my overall risk (and also limiting the times when the EA trades based on the volatility analysis I made).

From what I’ve observed, Forex Gold Investor is a time-based, volatility-sensitive EA. It buys gold during “deep” drops or strong momentum moves, and also trades trend pullbacks, using momentum indicators and Bollinger Bands for confirmation. And it’s very sensitive to high spreads, and especially to volatility.

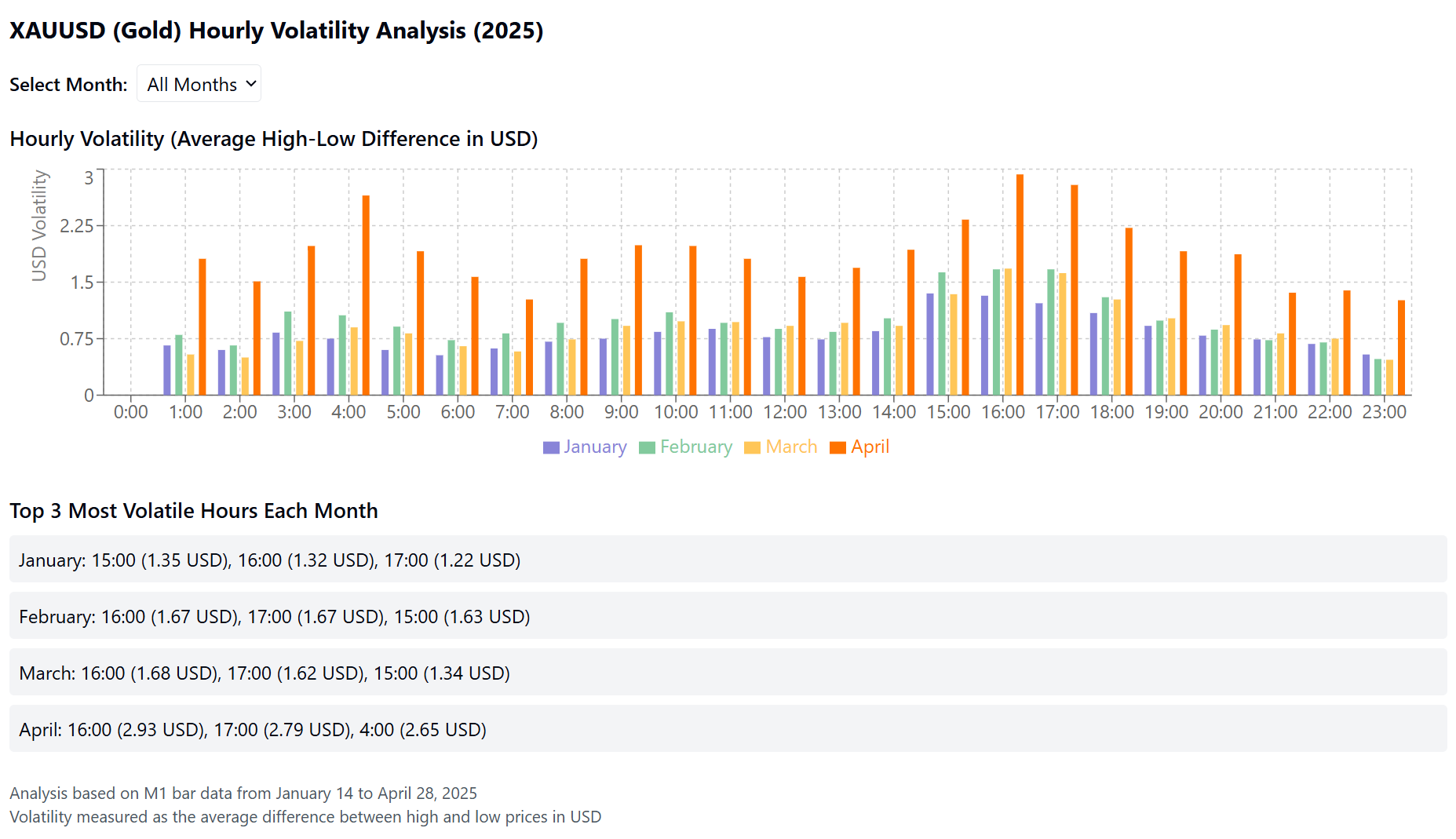

I did some analysis and sharing some of the numbers I’ve been looking at recently (data source is The5ers M1 bar data, I pulled it from one of my current challenge accounts). If you examine gold price volatility in 2025, you’ll see that we’re currently in the most volatile period since the beginning of the year. Gold even reached an all-time high in April before starting to decline again. So, the market is more volatile than usual, and personally, I believe that’s the main reason for FGI’s poor performance at the moment.

In the below graph, you can see that the gold market at The5ers closes every night at midnight. Typically, in most of my accounts FGI enters trades between 21:00 and 23:00 my local time (GMT+3), but after the midnight gap, the price often opens lower, making it nearly impossible for the EA to recover. Interestingly, the 15:00–17:00 window consistently shows the highest volatility across all months, which aligns with the overlap of the European and U.S. trading sessions. However, based on my observations, FGI rarely trades during this high-volatility afternoon period because of the built-in spread filter. So the main issue remains: the midnight gaps combined with the significant volatility that follows (as the robot already entered trade and in many cases it ends up hitting the SL).

This isn’t the first time FGI has had drawdowns – and it certainly won’t be the last. If you look at the vendor’s track record starting from August 2019, you’ll notice a significant drawdown in April last year, and several more later that same year. But since the beginning of 2025, the EA has been performing very well—until now. So I believe better times will come. The more I dig into the data and view it from different angles, the sooner I believe I’ll catch the next uptrend wave. At least, that’s what I believe in and what numbers show me.

I traded for a few days this week, for example yesterday I traded only around afternoon and then stopped, and skipped the losing period at midnight. Now I stopped because of the upcoming holidays and the limited trading hours and closed gold markets at some prop firms.

As I wrote above, my plan is to observe the market and try to adopt and learn something new for myself.

To answer the question of @boyanlow , Petko passed a few challenges with FGI earlier this year – with FundedNext and with The5ers but this was before Trump’s tariffs announcements on the 9th of April which ignited the fire of volatility. Currently the robot doesn’t perform well but I’m a believer that this time will pass and it will be a good choice again. Also for that price, Forex Gold Investor is a must-have in my opinion.