Home › Forums › Ready-to-use Robots › Prop Firm Robots › Prop Firm Robots: Errors and Solutions › Reply To: Prop Firm Robots: Errors and Solutions

Marin Stoyanov

Marin StoyanovHey Richard, the EAs from the Prop Firm Robots App/Top 10 Robots App/EA Studio all trade at the opening of the bar so for the backtest you should use the “Open Prices Only” model like it’s shown below. You can adopt your leverage and account size as per your needs but for the purpose of this post, I used the below settings which are the default in my accounts. Also I ran the backtest for the last 5 years because this is the maximum period that we can see in the apps so this will make the comparison more reliable.

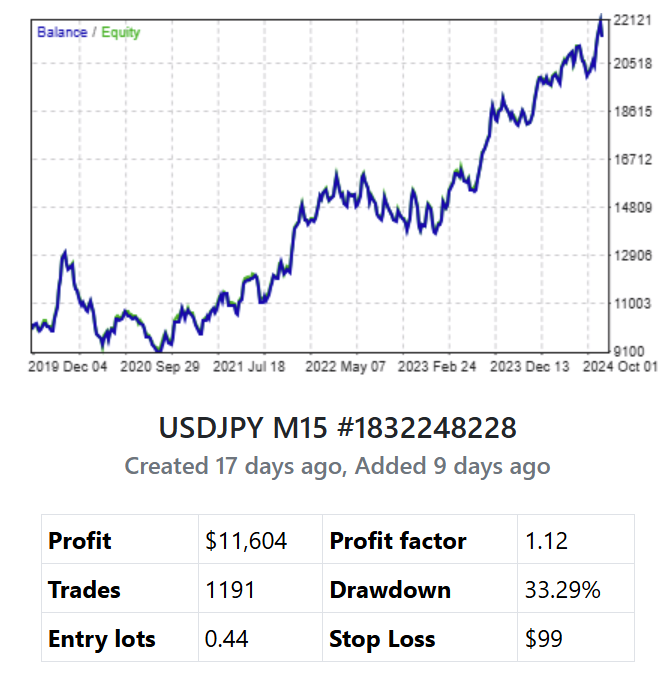

So I performed several tests to show the results of a random strategy from one of the apps. For the tests I picked the below strategy from the Prop app, and I downloaded it for a $10,000 account size.

<span style=”text-decoration: underline;”>Prop Firm Robots app 5Y stats</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (EightCap)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (BlackBull)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (Darwinex)</span>

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on EightCap</span> (beacuase of the wider image the balance chart looks more flawless but you can obviously see the drawdown at the beginning similar to what you see in EA Studio’s backtests)

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on BlackBull</span>

As you can see from all backtests, with the proper settings, the strategies show very similar performance. The difference comes from the count of trades that is different with different brokers because they use different liquidity providers and have different quotes and commissions and spreads.

Thanks to Alan and Sandor for sharing their strategies and systems. It’s always nice to see how different users are using the robots from the apps as the way we use them is our own system but it doesn’t mean that this is the only way to manage the robots.

The system we follow with the robots from the apps is shown in every video and on the challenges or live accounts pages, but I’ll write it here once again to have more context for future readers of this thread. We start by picking 3 to 5 EAs and trading them on our accounts. We keep an eye on how well these EAs are performing both in the app and in our trading accounts by tracking their magic numbers. If we notice that one of our EAs is no longer among the top 3 performers in the app, we swap it out for a new top performer to keep our trading strategy effective. This way, we always use the best-performing EAs. We check the EAs performance daily and the highest success we had by picking the top performing EAs from the monthly or yearly charts. We see ups and downs in the accounts and this is quite expected as market is not a straight line and the strategies also show losing trades in the backtests and on the apps charts as well. It’s normal to have such periods in trading.

There is also one other thing which can have impact on the actual performance compared to the backtest and this is valid for absolutely every EA out there. To understand the differences between backtest results in the app and actual performance, it’s important to consider the role of order flow in live trading. Backtests use historical data to simulate market conditions, but they don’t account for real-time factors like order flow and market liquidity, which impact actual trade execution. In a live trading environment, other traders’ orders affect price movements and can lead to slippage (difference between expected and actual trade prices). These factors often cause discrepancies between backtests and live trading results, especially in fast-moving markets or with larger positions. So, while backtests are a useful tool for evaluating a strategy, actual performance will inevitably differ due to these dynamic market influences. You can expect a similar performance but it won’t be the same as the backtest (that’s applicable to the MetaTrader strategy tester as well).

Still, until we find a better system to manage the EAs for ourselves, we will keep using the system that works well for us at the moment and we have plenty of live accounts and passed challenges so far that prove for us that the system it’s working. I know a lot of users who have success with our robots because they write to us via email but when we ask them to share this publicly in the forum, many refuse because they prefer to have some privacy. You all know that many people use VPNs, fake/hidden emails, proton emails and etc. to hide themselves, and I can assure you from my experience in the Academy, that in trading the number of such people is very high.

Kudos to Alan and Sandor who shared their success, I know other users who passed challenges and have great performance with our robots. Recently we launched a reward program for the Prop Firm Robots App users to reward their performance and stimulate them to share their experience and by the end of the year we will do a similar thing for the users of the Top 10 Robots app as well.