Home › Forums › 21 Day Program › 21 Day Program: Experience and results › Reply To: 21 Day Program: Experience and results

Hi Maarten,

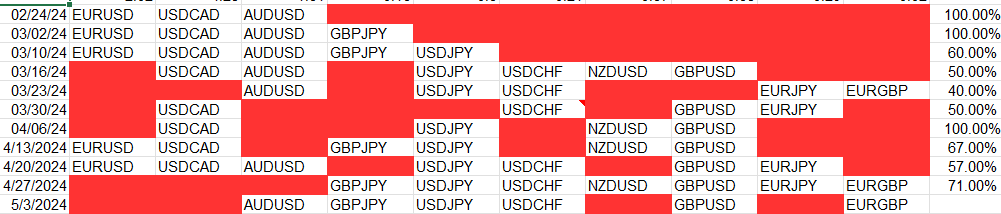

I keep track of a similar thing with my Infinity Forex Fund challenge account (see Excel screenshot below). Look at 03/23/24 line for example. Here I am trading AUDUSD, USDJPY, USDCHF, EURJPY, and EURGBP for the next week. At the end of the week the only top performing pair looking at 03/30/24 were USDCHF and EURJPY or two pairs out of the five pairs. This tells me only 40% of the pairs traded were top performers for the week. If you now understand how to read the chart you can see how each week performed. In the right most column I show the results for each week. For example, line 03/10/24 shows that 60% of the currency pairs I traded during the next week were top performers for the week. You can also see each week different pair were top performers each week. This table also shows the currency pairs that are top performers each week changes. The right most column of the table shows this weekly change in percent. Bottom line, based upon the strategies of each of my Expert Advisors, I cannot rely upon the same Expert Advisors to be the top performers at the end of each week.

So you might see similar results with your Expert Advisors. Don’t expect USDJPY to be the best pair to trade each week. When I strip out all the currency pairs except EURUSD, USDJPY, and EURtJPY from my table and read the results I get USDJPY as being the top performing pair the next week to only happen 33% of the time. However, this is based upon the strategies of my EA’s. For a more accurate analysis using the strategies of each of your EAs you would need to develop your own similar table.

Alan,