Are you considering trading with Darwinex and wondering about their 15% payout? You’re not alone; many traders have expressed their concerns about this payout structure. In this blog post, we’ll delve into the reasons behind Darwinex’s payout system and compare it with traditional hedge funds and other top prop firms.

Understanding the 15% Payout

Darwinex, like many other prop trading firms, allows traders to use their capital for trading. However, one significant difference is their 15% payout, which has grabbed traders’ attention. To grasp why this payout structure is in place, we must explore Darwinex’s business model and compare it to hedge funds.

In essence, Darwinex provides traders with the opportunity to trade using the firm’s capital, a common practice among proprietary trading firms. But what sets Darwinex apart is its 15% payout policy, which may seem lower than what traders typically encounter. To understand this policy, we need to delve into Darwinex’s unique business model and draw comparisons with hedge funds.

Darwinex and Hedge Funds

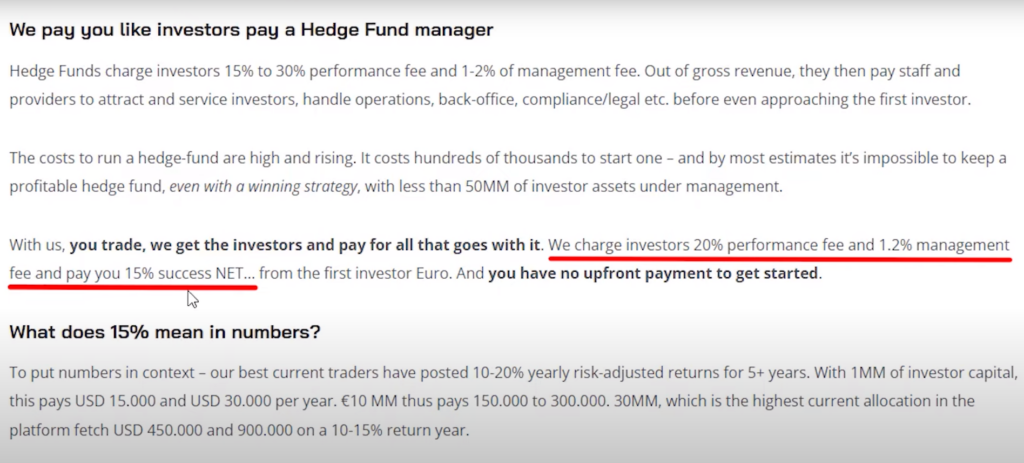

In a recent letter from the founders of Darwinex, they drew a parallel between their platform and hedge funds. Hedge funds, as you might know, typically aim to generate annual returns ranging from 10% to 20%. However, they come with hefty fees. Hedge funds charge their investors a performance fee, which is a percentage of the profits, in addition to a management fee and various other costs related to managing the fund.

Costs Behind the Scenes

Before a hedge fund can even attract its first potential investor, it incurs significant costs. These costs include attracting and servicing investors, handling day-to-day operations, back-office tasks, and ensuring compliance with regulatory requirements. All of these expenses must be covered from the fund’s returns before any profits are distributed to investors.

Darwinex’s Fee Structure

Now, let’s take a closer look at Darwinex’s fee structure. Darwinex charges investors a 20% performance fee and a 1.2% management fee. While the performance fee might seem high, it’s essential to consider the context. Darwinex takes on the responsibilities of managing operations, back-office tasks, compliance, and more, similar to what hedge funds do. These are all costs that traders typically wouldn’t have to worry about when trading with their capital.

Why the 15% Net Payout?

With the performance fee and management fee, Darwinex pays traders a net profit of 15%. Some traders might find this lower than what they expected or have seen in other prop firms. However, it’s crucial to understand that this 15% net payout takes into account all the expenses and fees associated with running a trading business.

Comparing Darwinex with Other Prop Firms

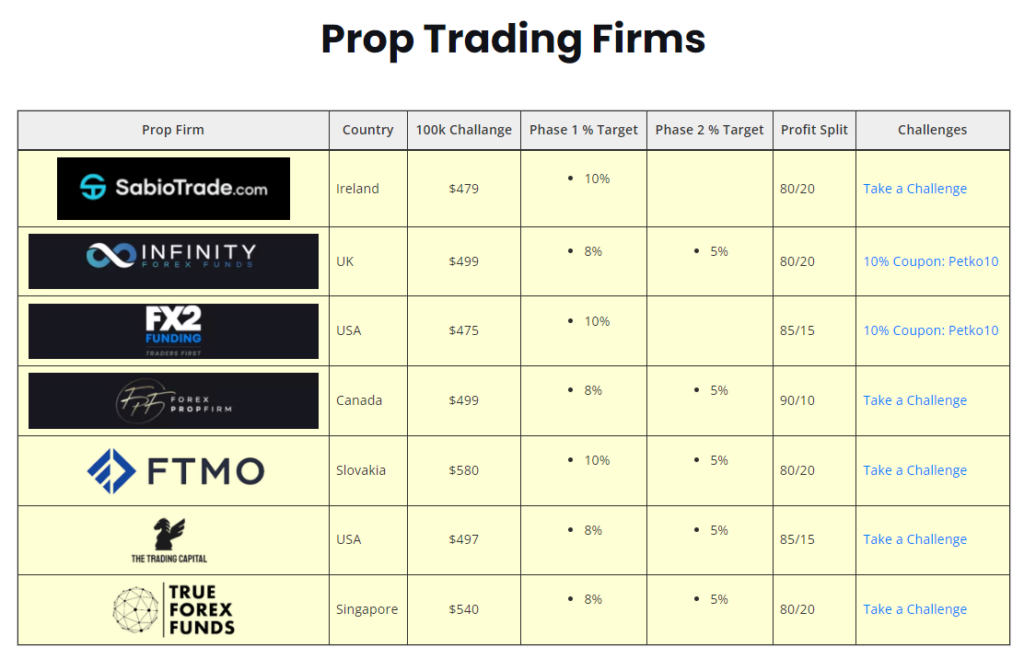

To put Darwinex’s payout in perspective, let’s compare it to other top prop trading firms. While some firms might offer higher payouts, they may also require traders to cover more of the operational costs themselves. Darwinex, on the other hand, provides a more comprehensive service, which can be seen as a trade-off for the slightly lower net payout.

Comparing Darwinex with the Best Prop Firms

Before we delve further into Darwinex’s payout structure, it’s crucial to compare it with some of the best prop trading firms available. At EA Trading Academy, we’ve compiled a list of these firms for your reference. Please note that this list is based on personal testing and should not be considered as a recommendation. We aim to provide transparency and help you make informed decisions.

MyForexFunds and Scammy Platforms

In the world of trading, scammy platforms have always been a concern, whether they are brokers, prop firms, or crypto exchanges. Unfortunately, we’ve had experiences like MyForexFunds, which highlight the importance of due diligence. We want to ensure that the firms we list are reputable and trustworthy. If you’ve had issues with any of the listed firms on our page, please let us know in the comments section, and we’ll consider removing them if they exhibit questionable practices.

FTMO vs. Darwinex: A Fee Comparison

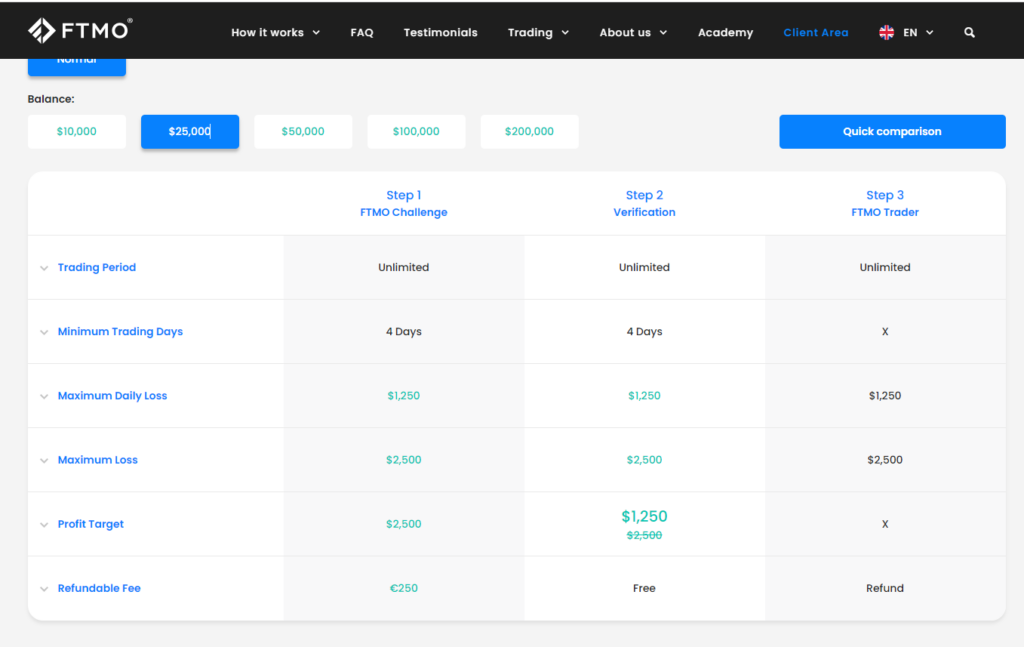

Now, let’s get back to comparing Darwinex with other prop trading firms, specifically FTMO. One significant factor to consider when choosing a prop trading firm is the fees involved.

With FTMO, if you opt for the 25k challenge, you need to pay 250 euros upfront. This amount is at risk, and if you fail the challenge, you lose this money. The reason we’ve chosen the 25k challenge for comparison is that it closely aligns with Darwinex’s capital allocation system.

Darwinex’s Capital Allocation

Darwinex offers traders a chance to access capital through their trading. To qualify for a 25,000 euro allocation, you need to demonstrate consistent performance, aiming for a 5% monthly profit with a drawdown staying below 5%. However, this allocation comes with a monthly cost of 38 euros. There’s also a 95 euro sign-up fee.

Here’s the catch: if you use the link provided in the description below, you can enjoy an additional 20 euro discount. So, after signing up and paying the 38 euros from the second month onwards, you’ll be paying a total of 113 euros per month. In exchange, you have the opportunity to receive a 25,000 euro allocation if you meet the performance and drawdown criteria.

FTMO vs. Darwinex: Understanding the Difference

Now, let’s highlight the key differences between FTMO and Darwinex:

- Cost: FTMO requires an upfront payment of 250 Euros, while Darwinex has a monthly fee of 38 Euros with a 95 Euro sign-up fee (discount available).

- Risk: With FTMO, if you fail the challenge, you lose the initial payment. Darwinex doesn’t risk your initial investment; instead, they charge a monthly fee.

- Trading Objectives: FTMO imposes trading objectives, including daily drawdown and maximum loss limits. Exceeding these limits can lead to account closure. Darwinex focuses on monthly performance and drawdown, offering more flexibility.

- Account Management: Darwinex provides traders with a 100,000 euro account that can’t be lost, even if you have drawdowns. You can recover and continue receiving allocations.

In essence, Darwinex offers traders the opportunity to access capital with lower upfront risk and more flexibility regarding drawdowns. FTMO, on the other hand, requires an upfront payment and strict adherence to trading objectives.

Regulation and Prop Firms

It’s essential to touch on another critical aspect of Darwinex – their regulatory status. Darwinex Classic is regulated by the Financial Conduct Authority (FCA) in the UK and the Comisión Nacional del Mercado de Valores (CNMV) in Europe. However, Darwinex Zero, although founded by the same team, is not regulated. While we hope that Darwinex Zero maintains the integrity of its founders, it’s a point worth considering.

In contrast, many other prop trading firms, including FTMO, operate without regulatory oversight. It’s important to keep this in mind when evaluating your options. As of now, there isn’t a fully regulated prop trading firm, but we hope that changes in the near future. Recent events, such as the MyForexFunds incident, underscore the need for stricter regulations in the prop trading industry to weed out scammers.

Funding Speed and Capital Allocation

Another factor to consider when choosing between Darwinex and other prop firms is the speed of funding. With prop firms like FTMO, you can potentially access larger allocations faster if you pass their challenge stages. In contrast, Darwinex requires consistent profitability over several months to reach higher allocations. However, they also offer the DarwinIA competition with a prize pool of 350,000 euros, providing an alternative path to funding.

Understanding the 15% Payout

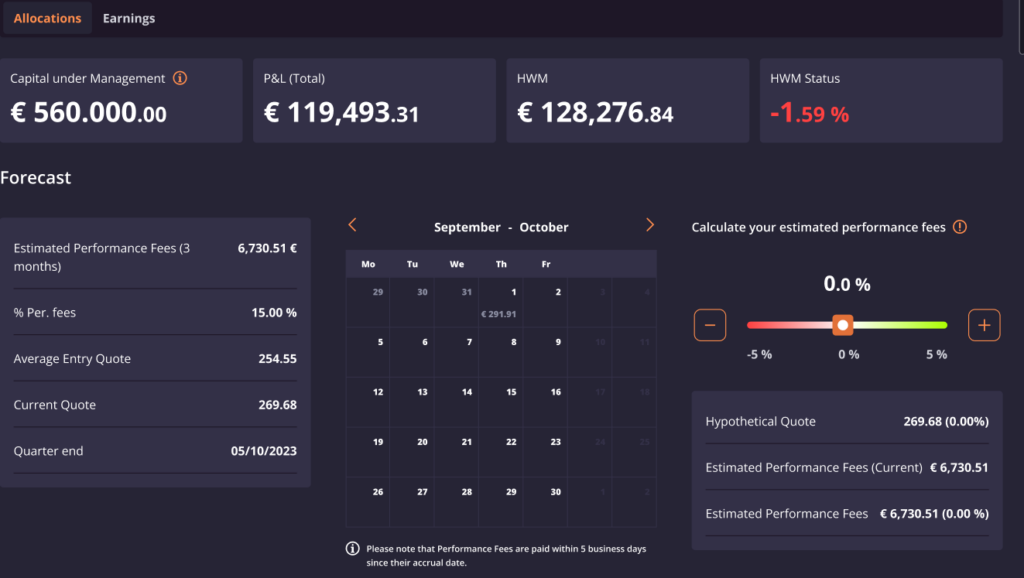

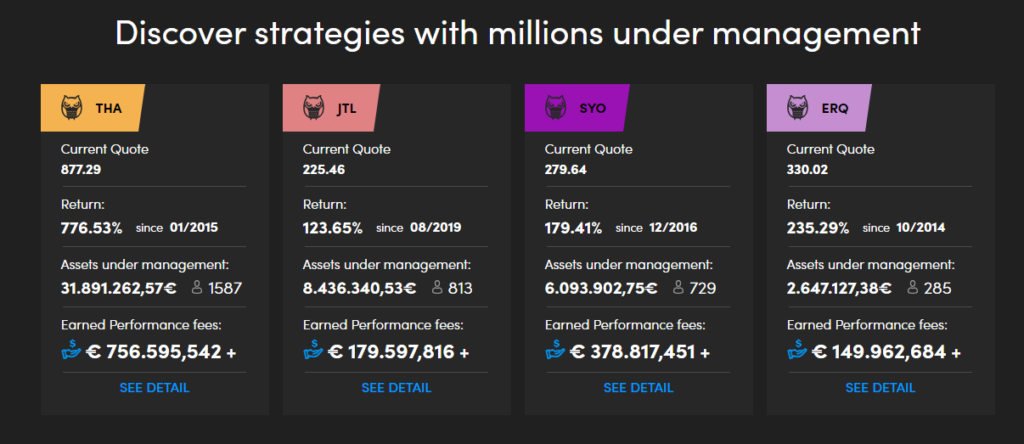

Now, let’s revisit the 15% payout that has been a point of contention among traders. Many traders express dissatisfaction with a 15% payout when some prop firms offer 85% or even 90%. To put this in perspective, let’s examine the performance of the top traders on Darwinex.

Take, for instance, the best current trader who manages over 30 million dollars in allocation. Their cumulative profit exceeds 700,000 euros. This impressive result is achieved not by chasing high monthly percentages but by maintaining steady growth, typically between one and two percent. Some months yield over 10%, while others may be in the negative.

Choosing the Right Path for You

In conclusion, the choice between Darwinex and other prop firms depends on your trading style, risk tolerance, and goals. If you have an expert advisor or trading system that consistently generates profits over time, Darwinex may be the more suitable option for long-term players who value capital preservation.

On the other hand, if you’re willing to take on more risk for quicker funding, prop firms like FTMO and others can be considered. However, keep in mind that failure to meet their trading objectives can result in the loss of your initial investment. It’s worth noting that, personally, I have had a funded account with FTMO, and they have consistently delivered on their promised payouts.

The decision ultimately rests with you, and it’s important to carefully weigh the pros and cons of each option, taking into account your trading strategy and objectives.