Home › Forums › Trading Courses › Crypto Algo Course + 50 EAs monthly › Cryptocurrency Algo trading with 50 EAs

- This topic has 9 replies, 3 voices, and was last updated 2 years, 9 months ago by

Ilan Vardy.

Ilan Vardy.

-

AuthorPosts

-

-

June 18, 2021 at 13:51 #91422

Robbles

ParticipantJust finished this course with Ilan. Very clear concise course with amazing value and resources. I can’t wait to put it into practice. I would add one thing though – there is no mention of using a VPS as best practice. Surely that’s quite important?

I have a few questions that you might consider addressing in this or future courses: When switching underperforming EAs with the best EAs, do you need to first check there are no open trades? If you deactivate an EA while it has an order open what happens? With no stop loss in place, this is a terrifying prospect to me!

Perhaps you could explain a bit more about why the EAs have no stop loss or take profits set?

You set lot sizes to 0.01 on all EAs, is this recommended for any account size? So the same for 1,000 / 10,000 / 100,000 accounts or do you scale them up accordingly? How does this factor in with leverage and margin requirements from brokers?

I’d really appreciate any feedback, thanks!

(Also I tried to leave a 5-star review but after trying to post it the page just reset. I seem to often have strange issues like this with your website and not on other websites so I don’t think the issue is on my end).

-

June 21, 2021 at 15:58 #91907

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Robbles,

Glad to hear from you. The post above was a scam so it was removed. Ilan will get back to you shortly.

Cheers,

-

June 22, 2021 at 7:25 #91944

Ilan VardyModerator

Ilan VardyModeratorHey Robbles,

Thanks so much for your kind words. I’m really happy to hear you enjoyed the course.

Your point about a VPS is very good. You are correct, however as this course was geared towards beginners mostly, I didn’t include it in the course, as I didn’t want to overwhelm our new traders with too much technical IT information. Having said that, I think it may be a good idea to add it when I update the course next.

To answer your questions:

I personally always close all open positions before updating the EAs, irrespective of whether they’re currently open or closed. This is because I want to use the EAs that have shown the best performance in current market conditions. If the existing EAs are open, and profitable, then great! If not, I take the loss, close the positions, and activate the new EAs.

The reason there is no SL or TP in place on the EAs, is because when I created them in EA Studio, I ran the Generator and Reactor many times, trying different settings before testing the EAs and creating the course. The best results I got, was when the indicators in the EAs decided when to open and close the trades, rather than the SL and TP. If you have a trial or full license, my suggestion is to try for yourself – play around, try different settings, and see what you prefer, or what you’re more comfortable with.

In terms of lot sizes, the 0.01 lots I use when creating and trading with the EAs, is what I am personally comfortable with, based on my account balance. This is where money management comes in too. In EA Studio, you can set your initial account balance, and again, as mentioned above, I tried different lot sizes based on my account balance, and found the results I was comfortable with, was starting at 0.01 lots. My money management system is quote simple. I increase my lot sizes proportionately to my account balance. So, let’s say my account balance increases by 10%, my lot size will increase my 10% too. Conversely, if it drops by 10%, my lot sizes decrease by 10% too. In terms of leverage, again, your risk appetite comes into play, and if you are happy taking bigger risks, then you can increase your leverage. The margin requirements depend on the broker, as they all set their own.

Thanks again for your kind words – I will ask the site manager to check the issue with the review.

Should you have any follow up questions, please feel free to ask.

Take care,

Ilan

-

June 23, 2021 at 12:52 #91971

Robbles

ParticipantHi Ilan

Thanks so much for the detailed response. That all makes sense.

I love the concept of testing multiple EAs on demo and transferring only the best to your real account. However, markets being what they are, I’m wondering if what is successful during the test phase is out of date by the time it’s implemented on the real account. If memory serves, in your course you waited 7 days before evaluating. Do you ever recommend using smaller intervals like 2-3 days or is that overdoing it?

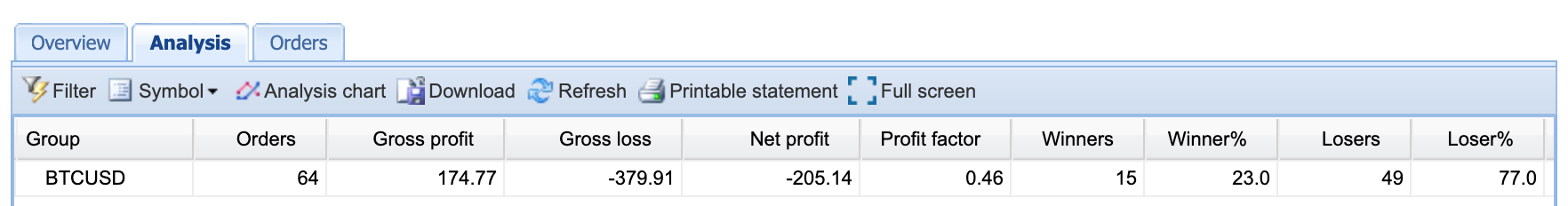

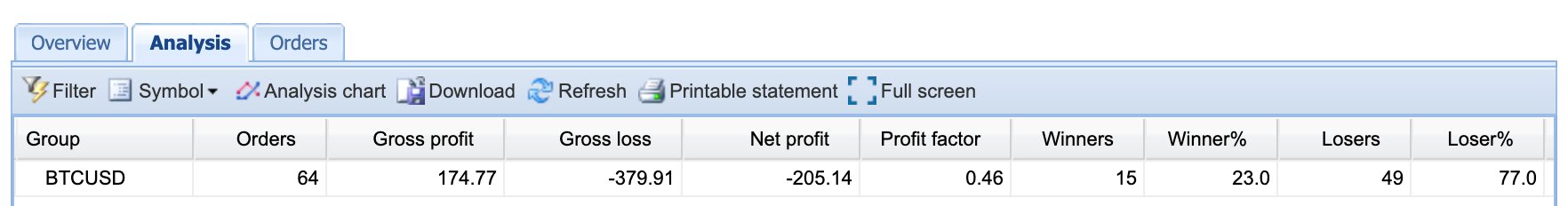

I know I’ve only been testing for 3 days and loss is always a part of trading but with 50 EAs running I was a little surprised to see that they are getting killed right now (77% losers). Even without picking only the winners, I thought that 50 EAs trading with edge was enough to see a positive profit. They seem to perform better when trading with the trend. Maybe that could be included with the strategy? They also seem to perform the worst when there is a price reversal, as seen yesterday at around 2.30 pm when BTC hit a low and bounced back. The EAs continued to open sell orders and with no SL the profits are relatively large now. As you say they will close the orders when the indicators tell them to, so it’ll be interesting to see how that plays out. I guess my question is how bad can this get, could it blow the account if the price just keeps going up and up? I apologise for my lack of understanding of how the entry/exit conditions are influenced by the associated indicators and would love any insight on how to evaluate that myself by looking at the EA properties so, in the future, I won’t need to bother you with so many questions!

As always, would appreciate your thoughts.

-

June 23, 2021 at 13:23 #91975

Robbles

ParticipantSorry the above should read: The EAs continued to open sell orders and with no SL the *negative* profits are relatively large now.

-

June 23, 2021 at 14:00 #91987

Robbles

ParticipantSorry, one more thing! I noticed that actually some but not all of the EAs do in fact have SL and TP set. So I’m guessing you also ran the generator and reactor with the same basic strategy with TP and SL added and that some of those performed well enough to be included in the June update?

Thanks for your continued help and effort here.

-

July 5, 2021 at 9:03 #92719

Ilan VardyModerator

Ilan VardyModeratorHi Robbles,

Yes, unfortunately, the market is really volatile at the moment. This is the reason we trade with so many EAs on our demo account. During times like these especially, we use many demo EAs, and then select only those that are the most profitable for our “live” account. If you are new to trading I would strongly recommend that you practice for as long as possible before risking real money. When selecting your EAs for your “live” account, even if you have only 5 – 10 that are profitable, that’s ok. This is still a good result. Keep at it, practice, and see what works best for you. The reason I wrote “live” in quotation marks, is because what I mean is, set up a separate demo account, that you can practice on as a live account, to get more comfortable. Move your profitable EAs onto this account, and see how they perform on their own.

To your second point, yes, you are quite correct. I did in fact include some small SL and TPs in the new EAs, both last month, and this month’s that I uploaded over the weekend. Due to the current volatility, I wanted to add some extra protection. Well spotted!

Thanks,

Ilan

-

July 8, 2021 at 6:27 #91974

Robbles

Participant -

July 8, 2021 at 6:27 #91970

Robbles

ParticipantHi Ilan

Thanks for the detailed response, much appreciated.

I love the concept of testing many EAs on demo and picking the best for the live account. However, a concern of mine is that what works during the test phase is outdated by the time you implement them on the real account. If I remember correctly, in the course you waited a week to get test results and rank the EAs. Do you recommend checking at more frequent intervals after that first test run? Say every 2 or 3 days or is that overthinking it and not worth the stress/effort?

I know I’ve only been testing for 3 days and I know loss is always part of trading but with 50 EAs running I thought the risk would be quite diversified and was a little surprised to see my results so far. The EAs are getting killed right: https://www.fxblue.com/users/btc50-66087799

They seem to perform better when trading with the trend so that might be worth adding to the strategy? The results are particularly bad after a bit of a reversal (22nd June 3pm BTC price hit a low and then bounced back) and without the SL/TP, the negative profits on open orders are getting relatively large now. As you say, they stay open until the indicators tell them to close, so it’ll be interesting to see how that plays out.

Love to hear your thoughts and as always really appreciate the feedback.

-

July 8, 2021 at 12:39 #93084

Ilan VardyModerator

Ilan VardyModeratorHi Robbles,

Yeah, as mentioned, the volatility on the market right now is huge. It’s really difficult to say what time frame would work best for moving EAs from one account to another. An EA can perform really well for a few days, and then suddenly stop when conditions change. In the course I do say a week, and this is generally what I use, but there is no guarantee that an EA will continue working well. As always, my advice is to try different things. For example, you could try 2 or 3 days, and if an EA performed well, say 2 or 3 successful trades, with a profit factor of 1.5 or higher, move it over to another account to test. Maybe you could then let it trade, and after 2 successful or unsuccessful trades, remove it from the chart. This is just an example of one different strategy. There are countless options.

Good luck, and let me know what you try, and how it works.

All the best,

Ilan

-

-

AuthorPosts

- You must be logged in to reply to this topic.