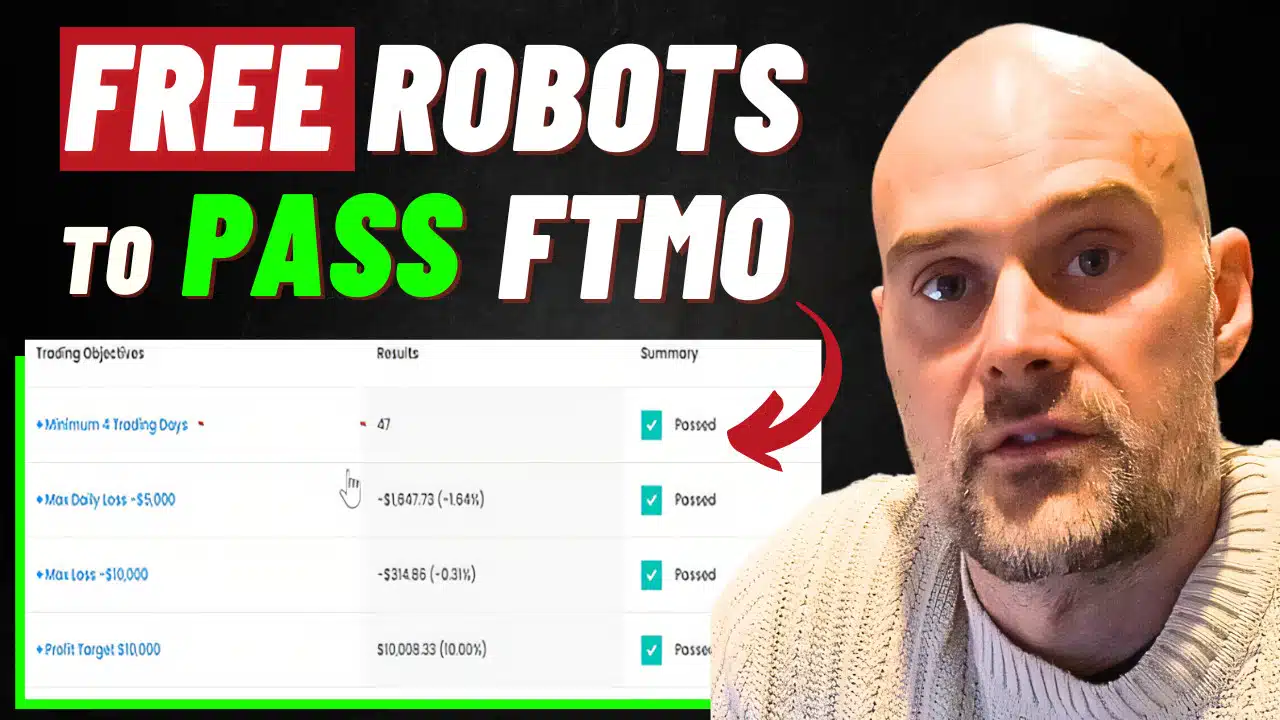

FTMO EA Free Download Pack is a set of five trading robots, all designed for the H1 timeframe and focusing on specific currency pairs. These robots were successfully utilized to pass the FTMO 100K trading challenge.

The FTMO EA Free Download Pack robots share several technical specifications, but their parameter values differ to suit their specific strategies and trading conditions. Here is a brief summary of the strategy behind each robot from the FTMO EA Free Download Pack:

- Entry Lot Size: Most robots use a consistent lot size of 0.1, reflecting a moderate-risk approach suitable for small to medium account balances. The EUR/JPY robot uses a slightly higher lot size of 0.15, which aligns with its momentum-based strategy and shorter trade durations.

- Stop Loss (SL): The stop-loss values range from 70 to 110 pips. These differences ensure the robots can accommodate varying levels of market volatility while protecting against excessive losses. For example, volatility-based robots like CAD/JPY use narrower SLs to account for rapid price reversals.

- Take Profit (TP): Take-profit levels range from 90 to 125 pips. This reflects the robots’ balance between securing profits and allowing trades to run in favorable conditions. Higher TP values are often employed in trend-following strategies to capture extended price movements.

- Indicators:

- Trend-Following Robots (AUD/USD and EUR/USD): Utilize Moving Averages for direction and RSI for momentum confirmation. To highlight dynamic support and resistance levels, the strategy is using Envelopes.

- Volatility-Based Robots (CAD/JPY and USD/JPY): Employ Bollinger Bands to identify price breakouts and ATR to measure market volatility. This ensures timely trade adjustments.

- Momentum-Based Robots (EUR/JPY): Use MACD to confirm market momentum and Stochastic Oscillator to pinpoint precise entry and exit opportunities.

For instructions, you can download our Free Expert Advisors Startup Guide before trading with the robots.

Disclaimer: The FTMO EA Free Download Pack is for educational purposes. Robots performance may vary due to market conditions, broker differences, and slippage. Always test on a demo account first.