Home › Forums › Ready-to-use Robots › Top 10 EAs › Top 10 EAs: Results & Track Record

- This topic has 96 replies, 20 voices, and was last updated 2 weeks, 1 day ago by

Samuel Jackson.

-

AuthorPosts

-

-

January 23, 2024 at 23:23 #250744

Marin StoyanovKeymaster

Marin StoyanovKeymasterShare and discuss the performance of the Top 10 EAs. This topic is for posting historical data, live trading results, backtesting experiences, and anything related to tracking the effectiveness of these Expert Advisors.

-

January 23, 2024 at 23:23 #229187

Alex de Sojo

ParticipantIs it possible to view a solid historical results base on a platform such as myfxbook?

Thanks!

-

January 24, 2024 at 10:20 #229281

Alan Northam

ParticipantHi Alex,

When Myfxbook is attached to your MT4 or MT5 terminal it will collect all the trades from the terminal. You can then use Myfxbook to sort the results in various ways to determine which Expert Advisors are performing the best.

Alan,

-

January 24, 2024 at 11:29 #229304

Alex de Sojo

ParticipantThanks Alan, I know how myfxbook works.

My question is, in what way can I see the performance of TOP 10 EAs in the past? Is there no tracking on this? I imagine that if it is something that works well, there must be some follow up on this.-

January 24, 2024 at 12:15 #229322

Alan Northam

ParticipantHi Alex,

Sorry I misunderstood your question.

I don’t know of any publicly available tracking for the top 10. You would have to ask [email protected] if there is any available data.

Alan,

-

-

April 15, 2024 at 15:12 #248859

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello traders,

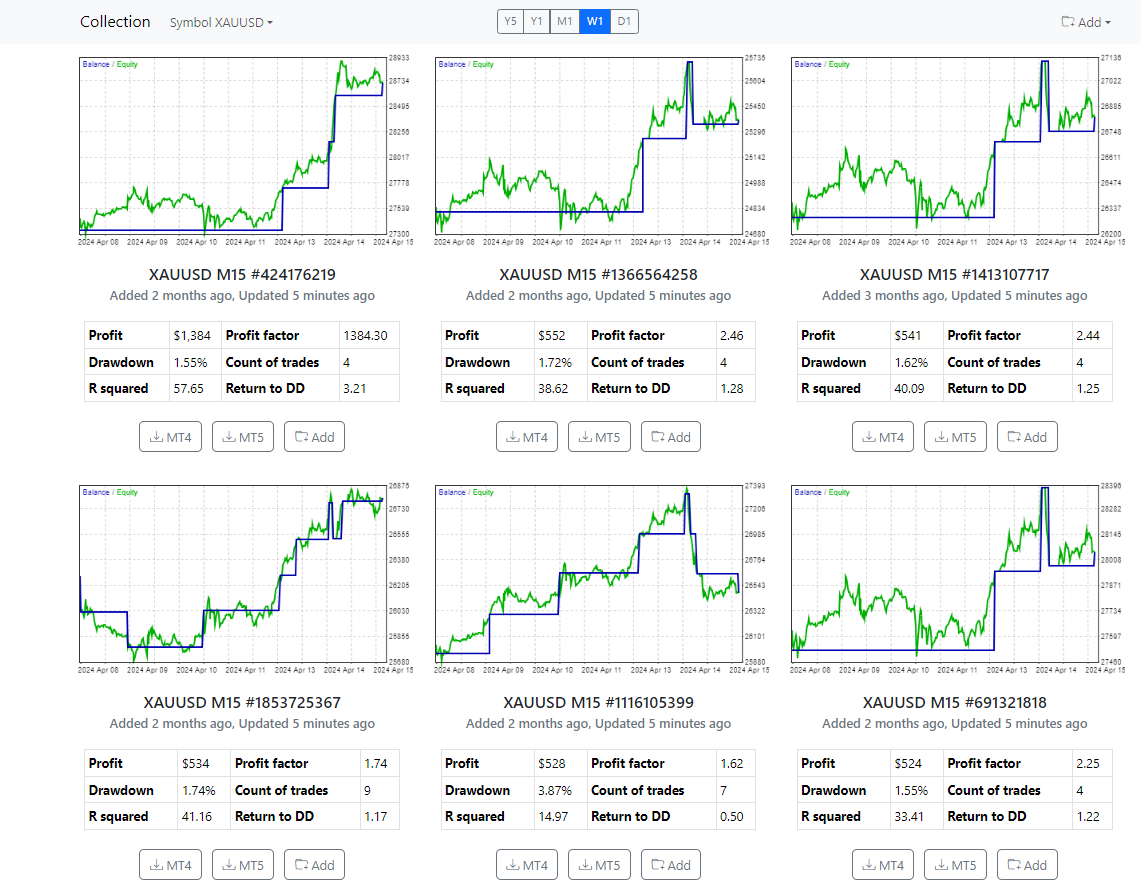

We have placed the Top 5 Gold Robots on weekly timeframe from the Top 10 Robots App on a 200$ live account!

We are choosing the top 5 robots that have the most profits and we are placing them in the account. To be able to identify the robots inside of Metatrader, we just check the magic number and we change them accordingly if another robot is more profitable inside of the Top 5 range!

To show you more on that, you can see the screenshot below:

We pick the Top 5 from there and we place them on Metatrader.

You can check how they are performing here:

If you have any questions, let me know!

Kind Regards,

Nikos -

April 16, 2024 at 14:21 #249165

Marin StoyanovKeymaster

Marin StoyanovKeymasterDear traders,

I have an update regarding the account.

We have decided to keep the robots trade with 0.01 lots as they are active and we just upgraded the account from 200 to 500$

Kind Regards,

Nikos -

April 21, 2024 at 18:45 #250330

Marin StoyanovKeymaster

Marin StoyanovKeymasterDear traders,

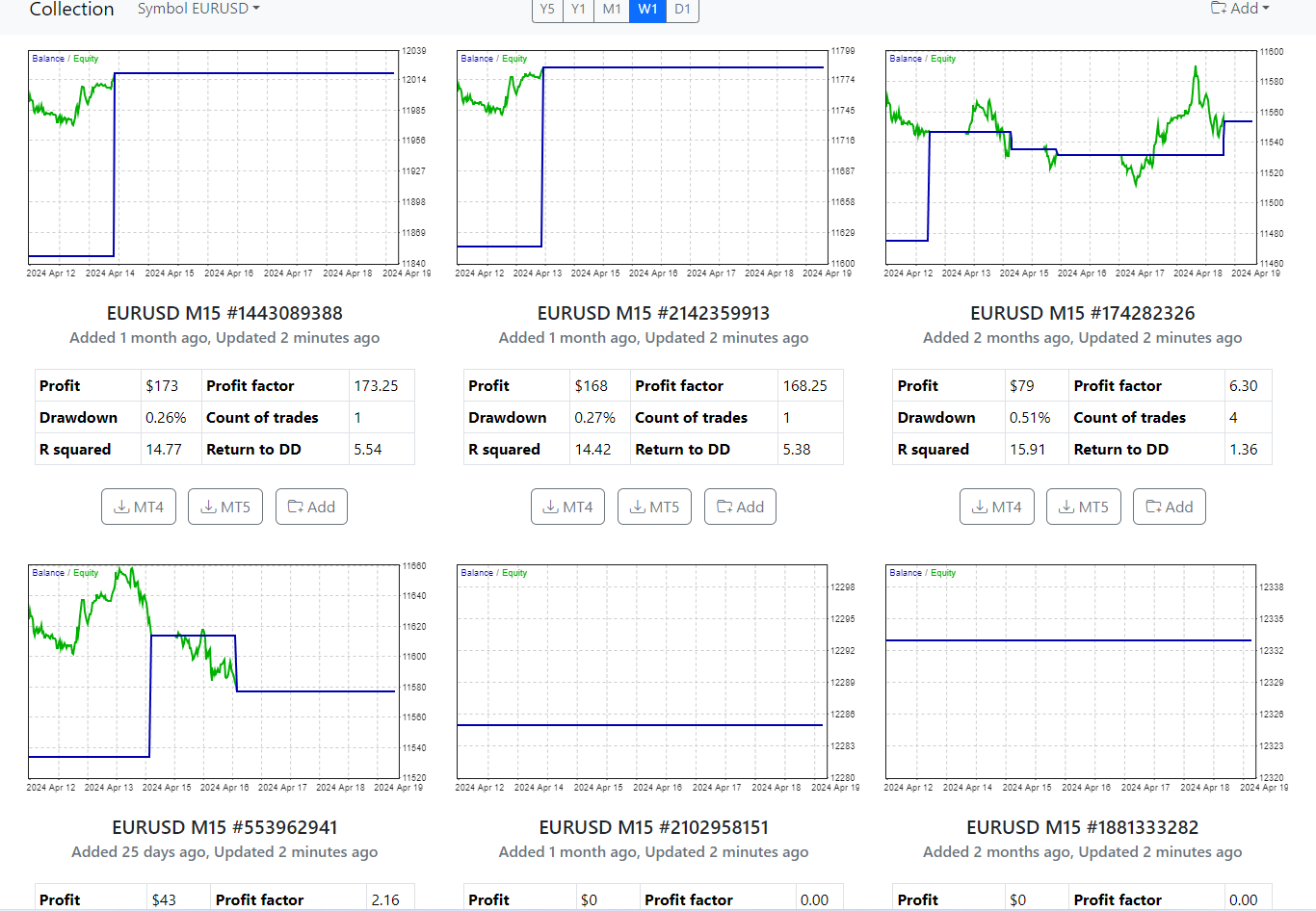

We have placed the Top 5 Forex EAs from the Top 10 Robots App on a 200$ live account.

We are choosing the 5 most profitable EURUSD robots on the Top 10 Robots App on the weekly timeframe and we are placing them in the account. We are checking everyday to see which is the most profitable one and we replace any robot that gets more profitable than the ones that are already trading in the account. To understand which robot is which, we just check the magic number that is displayed on each robot in the App.

You can see more in the screenshot below:

You can check their performance from here:

If you have any questions, let me know!

Kind Regards,

Nikos -

April 22, 2024 at 12:15 #250489

Pak

ParticipantHi team,

Can you please help and explain the timeframe selection please? What are the main differences between them? Are the EAs in Y5 gear towards long term more the others? D1 is for day trading?

What are the best practices?

Thanks and kind regards

Pak

-

April 22, 2024 at 12:25 #250490

Alan Northam

ParticipantHi Pak Ku Leung,

No, they are all the same EAs. Choosing Y1, M1, W1, D1 does two things. For example, if you choose M1 then all the EAs that have not traded over the last one year are blocked from being viewed. Secondly, it zooms in on the right hand edge of the charts so you can get a better view of how the EAs are currently trading.

Alan,

-

-

April 22, 2024 at 12:41 #250494

Pak

ParticipantHi Alan,

Thank you for the prompt reply. It is clear for me now.

Regards,

Pak

-

April 22, 2024 at 12:50 #250497

Alan Northam

ParticipantI am happy to hear that. Thanks for letting me know!

Alan,

-

-

April 26, 2024 at 12:57 #251727

stewart

ParticipantHi

The way i use top 10 EA are the followings.

Take EURUSD as example

–at least $20 profit (both in weekly and monthly)

-Profit factor > 1.2 (both in weekly and monthly)

– that EA must exist both in weekly and monthly

-monthly profit must be >= weekly profit

Using this way, run all the top 10 EA following this rules, it has more than $150 profit this week till now.

Every Sunday, i will use this way to renew all EAs.

Hope everyone can share his ideas.

Stewart

-

April 26, 2024 at 13:17 #251736

Pak

ParticipantHi Stewart,

Thank you for the tips. Are you using the portfolio experts or using the top 10 EAs individually?

I have been running the Portfolio EAs for three pairs – GBPUSD, USDEUR, EURGBP for a week now on a demo account. The profit is still negative at the moment.

I will definitely try your approach on another demo accounts for next week.

Thanks

Pak

-

April 26, 2024 at 13:36 #251740

Alan Northam

ParticipantHi Stewart,

It is great to see you have a trading strategy. Let us know how it works in the weeks ahead. It would be good for other traders to learn that developing a trading strategy and sticking to it works.

Alan,

-

-

April 26, 2024 at 13:09 #251734

stewart

ParticipantBy the way, i also include this way for Prop Firm Robots, so this week

i run total 15 portfolio including top 10 Robots and Prop Firm Robots.

Stewart

-

April 26, 2024 at 13:26 #251738

stewart

ParticipantHi Pak

I use this way,

For EURUSD

1. First in Weekly, go thru each EA one by one .

then go to monthly to check.

then In monthly , click add that EA

2. Finally, download as portfolio in Monthly.

Stewart

-

April 26, 2024 at 13:54 #251742

stewart

ParticipantHi Alan

i will report my weeky results weekly.

Stewart

-

April 27, 2024 at 5:42 #251880

stewart

ParticipantHi

Update Friday result, add USD 50 more profit for Friday with floating PL 44 now.

But I forgot if i include this rule (monthly profit >= weekly profit) or not for this week.

I will try both in next week.

-

April 27, 2024 at 13:55 #251927

Alan Northam

ParticipantHi stewart,

If I understand correctly you have floating PL of $44.00 and you decided to add an additional $50.00 to your account.

Also I suggest you write your rules down so you can follow them in the future without error.

Keep up the good work and keep us posted!

Alan,

-

-

April 27, 2024 at 15:10 #251939

stewart

ParticipantHi Alan

$50 Profit is the Friday P/L result.

So total this week P/L is around $200.

Rules is simple as the followings:

–at least $20 profit (both in weekly and monthly)

-Profit factor > 1.2 (both in weekly and monthly)

– that EA must exist both in weekly and monthly

-monthly profit must be >= weekly profit (This may be optional )

Hope it keep going well like this every week.

Stewart

-

April 29, 2024 at 19:14 #252322

Pak

ParticipantHi team,

Would you normally close a trade manually? I have some trades in the demo account that been opened for 2 weeks. Some are in profile, some are in loss?

Please advise.

Thanks

Pak

-

April 29, 2024 at 20:59 #252344

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Pak Kui,

We do not close trades manually, we let the robots do everything themselves after we have set them up with the correct settings.

Regarding the trades, it’s based on the market conditions on when they will hit a target that has been set by the robots, so it’s best to be patient on that.

Hope this helps!

Let me know if you have any more questions!

Kind Regards,

Nikos

-

-

May 23, 2024 at 10:52 #256584

jimsimons999

ParticipantToday is my 3rd day with the TOP 10 EAs app and I have been impressed by the results so far.

First day I got a bit disappointed, as I put a Portfolio of Top 3 – 5y and Top 2 – 1y in XAUUSD and it took a losing trade which is never triggered in the backtests, which was pretty weird.

Then I decided to use it another way: I got the Top 3 – 1M for GBPUSD, USDCHF, EURJPY, XAUUSD and XAGUSD, and two days after it’s near to make a 50% in a 200€ account. It’s impressive. I will keep those portfolios updated every 2-3 days or every week so I have the most performing strategies all the time. This could have been luck, so I will see if this system keeps working in the following weeks. I will keep you updated. The broker I use is Fusion Markets if anyone minds.

Good job guys,

Kind regards,

Guillermo

-

May 23, 2024 at 12:45 #256598

Alan Northam

ParticipantHi Guillermo,

I am happy to read you are developing a trading strategy. Keep testing it for at least a month so the results will include all the news events that can affect the trade results. If you are getting 50% in a couple of days I would think your lot size is too large. This could cause severe draw down when the next high impact news events occur. Be sure to use good money management to keep risk under control so you don’t blow your account. Professional traders never risk more than 2% on any one trade, and when taking multiple trades they never risk more than 6%. While you are in the process of developing a trading strategy also keep in mind to develop a good money management plan as well.

Alan,

-

November 26, 2024 at 1:48 #380379

Mark Kamrath

ParticipantI run the top 3 Gold EAs with the risks as you have set. Max loss per trade is 2%, if all trades loss I’ll have a max loss of 6% for the three open EAs. I calculate the lot size based on the EA stoploss at 2% loss. It should be noted that most often only one out of the three will lose, and often it is less than the SL as there are trailing stops. So far in November, I’ve had one 6% DD, and I’m up 17%.

-

November 26, 2024 at 1:48 #380380

Mark Kamrath

Participantoops, double posted. Apologies….

-

-

-

September 7, 2024 at 12:29 #305353

Oly

ParticipantHello Team,

I’m trying to replicate your results for the Top 10 Robots from your live trading accounts:

Top 5 EURUSD W

Top 3 EURJPY M

Top 3 USDCHF M

Top 3 XAUUSD M

Do you have high/medium news enabled or disabled?

Cheers!

Oly

-

September 9, 2024 at 6:31 #305650

Karim

ParticipantHi team

I’ve tried it on a demo account for the top 5 eurusd, now I’m opening a sell position but I’m monitoring the SL and TP, it’s really far away, do I have to hit TP or SL then close?

or follow the trend at any time, you can close it yourself.

Thank You -

September 11, 2024 at 9:25 #309028

cgw

ParticipantHi Team

The Top 10 Robots Live Trading Accounts Win for a while, then lose.

This applies both at Account Level – eg

Top 5 EURUSD W

Top 3 EURJPY M

Top 3 USDCHF M

Top 3 XAUUSD MAnd with each EA.

The EA’s we are swapping out daily, when they are out-performed by another EA.

But at Account Level, it is often too late, when you start to see performance dipping…

Do you have a method for deciding when to Pause Trading, before the Account Starts to lose?

Thank you

-

September 11, 2024 at 11:59 #309043

Oly

ParticipantI update the latest bots every morning (as Petko mentioned in one of his videos). I delete the trades with the outdated bots and replace them with the latest ones without thinking. I’ve only started on Monday, so it’s too soon to comment, but so far I’m losing…

-

September 11, 2024 at 23:29 #309204

Oly

ParticipantI’ve given up, too many losses.

-

October 26, 2024 at 13:59 #373400

Zoran Čuturilo

ParticipantHello everybody!

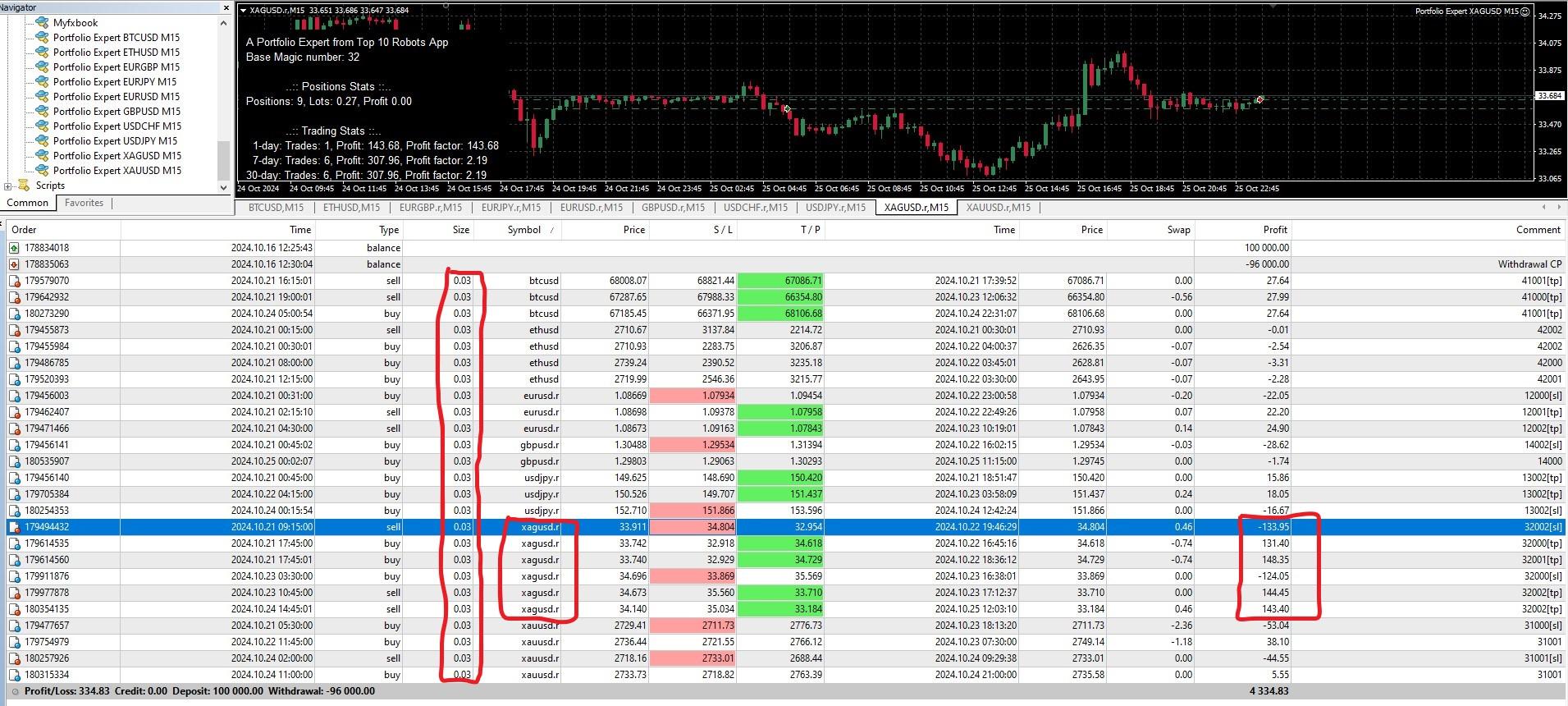

I have some questions which make me restless.

When we make portfolio EAs, original magic numbers are replaced with new, base magic number + serial numbers. How to know which original magic number is behind new number? I can not check “bad” EA in Top 10 App to see its performance …

Regarding to first question, I have issue with XAGUSDs. They made several times bigger SL/TP then other instruments. I do not know which EA make a problem and why.

And, I still waiting for answer at forum/ready-to-use-robots/top-10-eas/ Properties & Settings

All best,

Zoran

-

October 27, 2024 at 11:32 #373552

Alan Northam

ParticipantHi Zoran,

The beauty of having a portfolio of EAs’ is when a few of the EAs’ are losing the other EAs’ in the portfolio will most likely be profitable and thus compensating for the losing EAs’ to keep the overall portfolio profitable. Further, the EAs’ in the portfolio that are currently losing will most likely be profitable in the days and weeks ahead and some of the EA’s that are profitable today may be losers in the weeks ahead. Basically, the EAs’ in a portfolio will move up and down in profitability in the weeks ahead while the portfolio as a whole will remain profitable. In my opinion the only time a portfolio should be modified i.e. removing an EA from it would be if the portfolio as a whole is underperforming your expectations or is losing. Bottom line, the purpose of using a portfolio of EAs’ is not to look at the performance of the individual EAs’ within the portfolio, but look at the portfolio as a whole.

To answer your question as to how to know which EAs’ in a portfolio are losing the easiest way to do that is to keep a list of the EAs’ Symbol and magic numbers in a text file. Then in the days and weeks ahead you can look them up in the Prop Firm or Top10 apps and see how they are currently performing. Doing this you can identify which EAs’ are losing. You could then recreate your portfolio eliminating the losing EAs’ and maybe replacing them with the current top performers.

I believe the other part of your question has to do with the profit of XAGUSD being much larger than the other EA’s. This indicates XAGUSD is having a major influence in the overall profit of your account. To reduce this influence you can reduce the lot size. It looks like XAGUSDs’ profit is about three times that of the other EAs’ so you could reduce the lot size of XAGUSDs’ portfolio to 0.01 lot.

Alan,

-

-

October 27, 2024 at 20:37 #373664

Zoran Čuturilo

ParticipantThank you Alan to reach me out.

Yes, that was exactly what I was thinking about, to replace “bad” EA with new, promising one and recreate new, better portfolio where EAs rowing in same direction. Making a text file is make sense IF the order of picking them determine new magic number. First picked will have serial number 000, second 001, third 002 etc. Is that the case? Or labeling serial numbers has some other logic?

Stay sharp,

Zoran

-

October 27, 2024 at 22:14 #373677

Alan Northam

ParticipantHi Zoran,

First of all not all the EAs’ in a portfolio will always row in the same direction as they all have different strategies. Some will move in an upward direction, some may move sideways, and some may drawdown all at the same time. Theoretically, this is why you put all the EAs’ in a portfolio so the EAs’ will compensate for each other keeping the overall portfolio profitable. When putting EAs’ in a portfolio you should look at the profit and loss of the portfolio and not the individual EAs’ making up the portfolio.

Secondly, you cannot count on the first EA added to the portfolio as being serial number 000, nor can you count on the second EA added to the portfolio as being serial number 001, etc.

Alan,

-

-

October 30, 2024 at 6:09 #374120

Jojo

ParticipantHello!

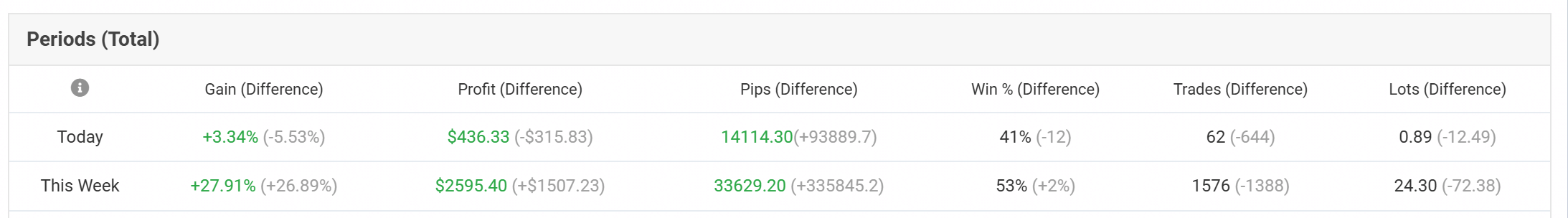

I wanted to start a thread about your thoughts on this strategy I’m currently using with the Top 10 EAs. I’ve been testing and refining it for a short period ( only two or three weeks so far).

Below are high-level bullet points – I wanted to keep this original post short and high-level.

Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

Thank you!

Strategy:

- I download all the EAs from each pair, besides Silver, into their respective Portfolio EA

- I add them into an MT account with 0.01, except ETH, which I set to 0.05

- I’ll spread this task out at different times, three or sometimes four times a day, and let them run.

My Thought Process:

- These EAs have been rigorously back-tested, Monte Carlo, and essentially forwarded tested. In the long run, over thousands of trades, they should produce more profits than losses.

- By adding more strategies that make it to the Top 10, the Overall Portfolio becomes more diverse and balanced.

- EAs that continue to stay in the Top 10 will have higher weights within my Overall Portfolio.

- Spreading out when the Portfolio EAs are added diversifies the Overall Portfolio, as even if I add the same strategy, they can potentially take different trades, as strategies can be locked out from entering new trades for up to weeks if they currently have a trade open.

Goals:

- A balanced Overall Portfolio, with a graph moving smoothly to the top right.

- As the Topic Title suggests, I want to get to 10,000 closed trades a day.

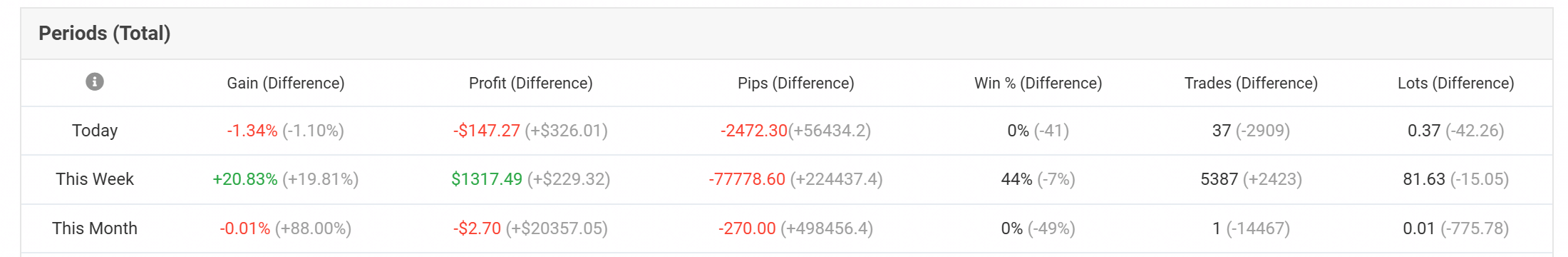

The screenshot below of my MyFXBook’s Overall Portfolio for this week is attached, which includes just over 1500 closed trades across 9 pairs, different strategies within each Portfolio EA, starting at different times. This is across 14 different MT accounts, as you can imagine adding 9 Portfolio EAs several times a day includes opening a good amount of charts daily and it can take up space, hence why I’m currently using 14 different MT accounts. It’s taken at 11:30pm NY Time – That’s a few hours over 2 FX trading days:

-

November 1, 2024 at 3:35 #374555

Jojo

ParticipantIt’s the 1st of Nov, where I’m currently (Japan), and I’m thinking of posting results periodically for this month, as I’m pretty sure I’ll hit my goal of 10,000 closed trades in a day, as yesterday I did about 4,000 closed trades.

Yesterday was relatively volatile, with my Overall Daily Portfolio as low as -$2,500. The main culprits were the JPY and GBP pairs. BTC and Gold stepped up to balance this out a bit and ended the day with roughly -$1000; even with a diverse set of trades, it won’t be in a straight line.

I’ve considered giving more weight to specific pairs to try to curtail the volatility within the Overall Portfolio, but I’m not sure if that’s possible in the long term. If someone could chime in on that, I would appreciate it.

Below are the results of over 5,000 trades from the Top 10 App, using the strategy in the Original Post. Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

-

March 4, 2025 at 1:10 #438269

bob thomson

Participantthank you for sharing your thoughts with us. Since we didn’t heard anything from you since then I wanted to ask how are things going? Your approach made much sense but since im trying to make any profits since months using this app your idea might be my last resort. I hope your approach made some good returns since then?

Im thrilled to hear from you

Greetings

-

-

November 2, 2024 at 6:28 #374765

Jojo

ParticipantI ended the week with +$1600 on just over 8,000 closed trades.

What I’ve started to notice is that even though strategies begin trades at different times and on different days, when they all close at the same time, due to having all the same exit criteria or if the market moves heavily within a pair, strategies begin to open trades at the same time.

So, rather than a single strategy opening 0.01 lots on different days and times, the same strategy will begin opening trades simultaneously across Portfolio EAs and across various accounts, effectively having many 0.01 lots opening simultaneously for a pair. This creates more significant swings than I would like. To try and smooth this back out, I will utilize the New Filter and add random times to each chart, creating windows when the specific chart can open trades.

We’ll see how next week goes. Hopefully, you don’t mind me using this thread as a personal journal… Your thoughts, comments, questions, suggestions, and concerns are all appreciated, as I’ll use these to keep refining the strategy.

-

November 4, 2024 at 15:25 #375192

Ilan VardyModerator

Ilan VardyModeratorThis is great, Jojo

-

December 11, 2024 at 18:35 #383350

Alesamo

ParticipantI am really disappointed that this forum is so “dead” here… Does anyone really have success with the FX-Robots from the Top 10 App, and if yes with what approach/strategy???

I bought it about 2 weeks ago and I am trying various options (like put all EAs in one account, add new ones regularly, track the performance, use only the best ones for another account or use the Top 5 from 1M and change it regularly or use only EAs that are Top 5 both in 1Y and 1M, etc.), but to be honest every strategy so far is negative, with way more losers than winners…

Maybe 2 weeks indeed is too short, but should there not be any improvement in performance I guess I will use the 30-days money-back-guarantee, as the promise is that these EAs are profitable…

-

December 11, 2024 at 18:58 #383354

Mark Kamrath

ParticipantYea, it would be nice to see some more participation here. I’ve been here since the end of October, and here’s my input. First, December is notably horrible for trading. My PAMM guy doesn’t trade in December and will start again on Jan 6th. So you have that. I trade just the top 3 gold EAs, updating twice a day. November gave me a 13% net gain (after the commissions are deducted), with a max drawdown of 4%. Not bad at all. December is negative so far, but I don’t expect much. And yes, 2 weeks is not enough time. Neither is 30 days IMO, especially since you are in December. You’re not getting a good taste of it. You can always get your 30-day refund, wait another month, and try again when things are more “normal”.

-

December 21, 2024 at 2:21 #384970

Jitesh Vidhani

ParticipantHi Mark, Good to see you here. You update the EAs twice a day? Are you running this on a real account or a demo account? Isnt that too much to keep closing trades if an EA is switched?

-

December 21, 2024 at 2:37 #384973

Mark Kamrath

ParticipantHi Jitesh!! Great to run into you again, small world, eh?!? Yea, they recommend daily updates, so I’m updating to top 3 gold EAs using the weekly basis. I started with a real, but moved to demo to put a little more money into my Plexy PAMM account. But on this one, I had a good November, and December is a bit negative, but I figured that. If I was live, I probably would be sitting December out. I wanted to to see what would happen through December.

And I don’t close trades on the EAs that I take off of the Top 3 list. All these EAs post both a take profit and a stop loss, just like a basic trading approach. I like that, as there are no huge DDs waiting (hoping?) for a counter-trend system reversal. Still, December had a 13 trade losing streak, for about a 14% DD (they have a trailing loss system, so you get reduced SL losses), but with the November wins, and some December wins, the total Nov/Dec account is about 8% up. Also, I watch the non-active EA trades, and will take them off if there is a decent profit, or just move the SL to break even, so at least I don’t lose money. All in all, it’s working nicely for me.

I may go live with this after I see what January does. My PAMM did over 10% just for November, with absolutely no involvement on my part. Nice! It did get to a 20% DD at one point, but that’s acceptable for me as I don’t have to manage it. He did over 100% for 2024, so better than what I have seen in all of our Nurp and Everest forums.

-

-

-

December 11, 2024 at 20:04 #383365

Zoran Čuturilo

ParticipantHi!

This post strike my nerve. In October/November I have +25% and strategy was: 3 hand picked of every pair on 1M (installed as portfolio). After 5 negative trades, I disable “bad” robot and if that repeats, I hand pick new portfolio. I was ready for live and in 2 weeks, I have -15%. My 30-days money back period is gone, so I am toying now on demo trying this and that, waiting to see some positive income. So far, just downhill. I regularly check 2 Youtube channels and live results. It would be nice to have some real weekly guidance. -

December 11, 2024 at 22:15 #383381

Alan Northam

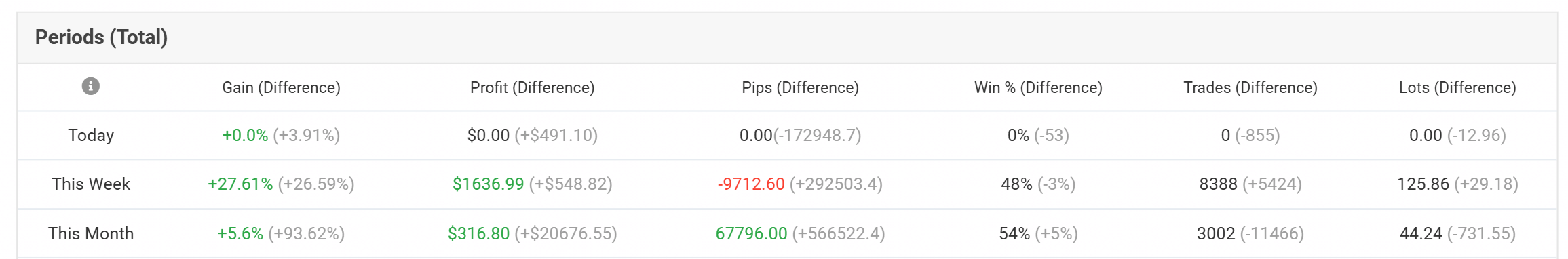

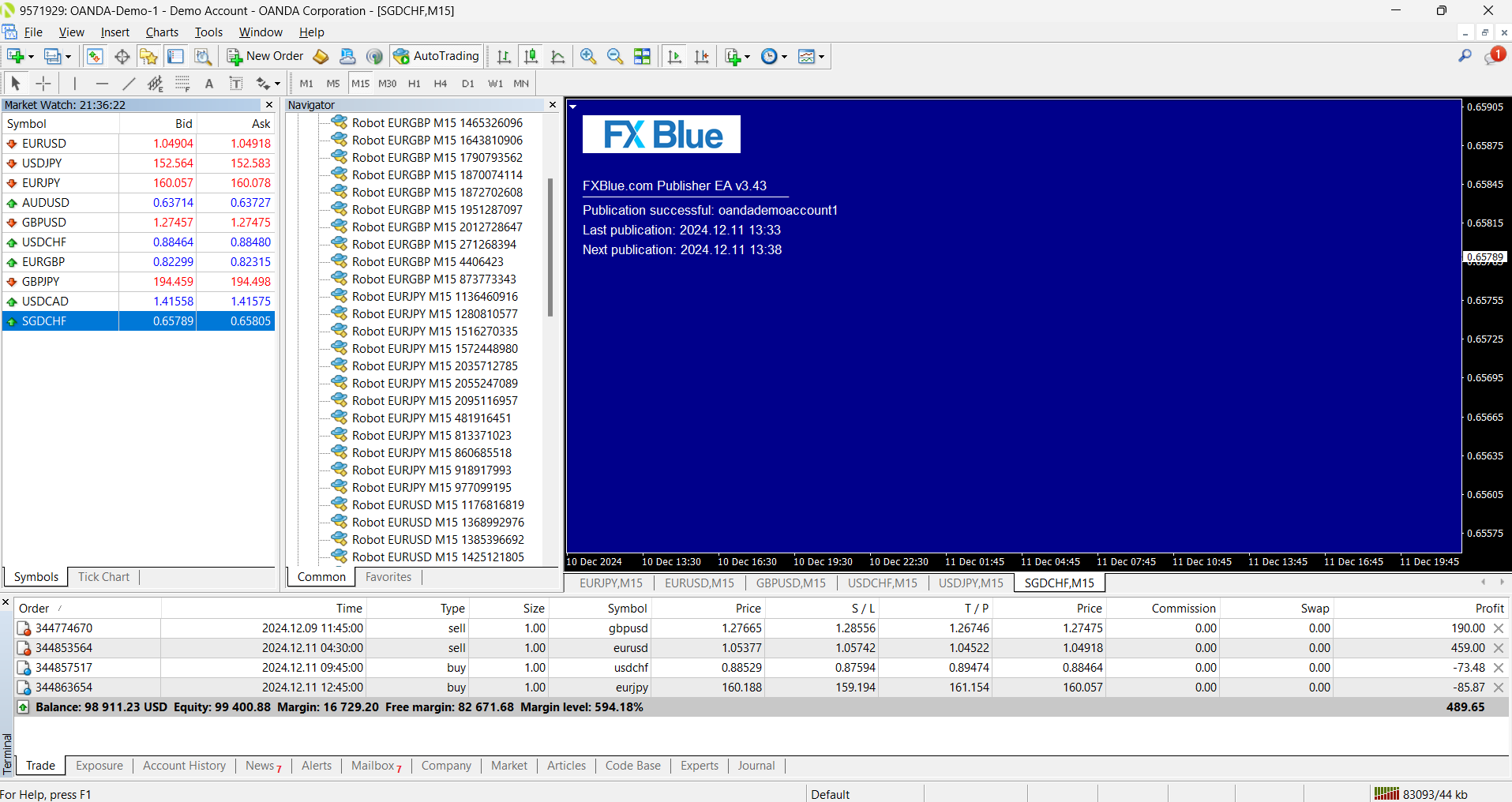

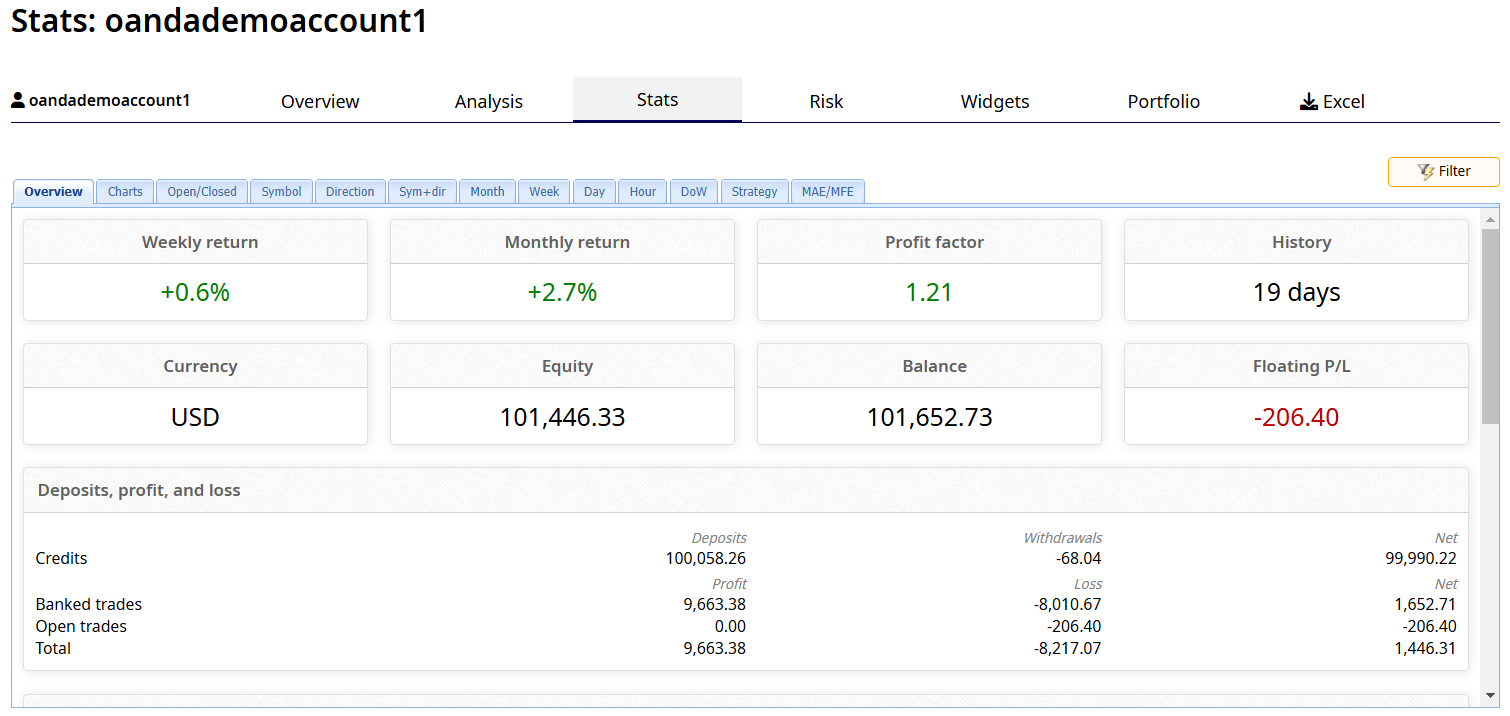

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

Ten days ago I started a new demo account with my Oanda dot com broker. The one bad thing with Oanda is you only get about two week worth of historical data. The good thing is; this will be a good test demo account. So what I did was to load all the Top 10 app robots into MT5. I then backtested all the robots using the MT5 Strategy Tester. Then selected the best performing robot from each symbol. As a result I found 5 symbols EURJPY, EURUSD, GBPUSD, USDCHF, and USDJPY. Since the account size is 100K I set the lot size to 1.0.

This first graphic shows MT5 with all the closed trades after 10 days. It also shows I have all the Top 10 robots installed. The tabs show the 5 symbols I am trading.

This next graphic shows all the closed trades filtered using FXblue. As you can see USDJPY had a nice profit of $2190 or 2.1%. The other three symbols have all closed with losses. Note USDCHF has been the biggest loser. I may decide to removed it this next weekend if I don’t see any new profitable closed trades from this symbol.

This final graphic shows the open trades. From this graphic you can see two of the four symbols are now in profit. GBPUSD currently is showing a 0.2% open profit and EURUSD about 0.4%. This is encouraging as these two symbols could potentially close with a profit. If these two close with a nice profit in the next several days I think this may be encouraging for this demo account. I will have to wait and see!

Note: The blue screen is an EA that ports all the trade results to FXblue where I do my account filtering.

Right now what I am showing is the development of a trading portfolio. Once this portfolio proves to be a good profitable trading portfolio I may decide to use it for trading. As you can see from this, my process is to first develop good trading portfolios and then use them for live trading.

Alan,

-

December 11, 2024 at 23:13 #383390

Mark Kamrath

ParticipantWhy don’t you use the backtest results from EA Academy? Their backtester is SOOO much better (more accurate) than MT4 or 5 backtesters. A search on Google will show some pretty “strongly worded” reviews of the Metatrader testers. (Although some love it, a lot don’t.) The paid backtestors, (there are several), with paid-for data will be MUCH more accurate. I have a developer/coding team that does some work for me, and they refuse to use either of the Metatrader backtesters due to their inaccuracy.

-

December 12, 2024 at 2:37 #383416

Alan Northam

ParticipantHi Mark,

Thanks for your very good questions!

EATradingAcademy uses ExpressGenerator to create the strategies and EA Studio to further filter the strategies and to download the strategies as Expert Advisors. I have these same tools and use them in a similar process to create my own Expert Advisors.

As to using the Top 10 app backtester is the historical data is from Blackbull. It is a well known fact that all forex brokers have do not use the same historical data as there is not a common place for them to all download the same historical data. As a result, Expert Advisors trade differently with the various brokers. This is easily demonstrated using EA Studio. When an EA is uploaded into EA Studio the balance line will look different when switching to the various brokers. In some cases an upward sloping balance line will actually turn into a downward sloping balance line when switching to a different broker. As a result, it is fullish to think you can take a top performing Top 10 robot and use it when any broker expecting the same or similar results. This is why I do my final testing of EAs using the broker I plan on using when live trading.

As to using the MetaTrader Strategy Tester I know it is not as accurate as using EA Studio (the worlds best backtester). I tested using EA Studio and the MetaTrader Strategy Tester with the Top 10 robots with the same brokers historical data. I found that after selecting the top 5 robots with EA Studio and the top 5 robots using the Strategy Tester, four out of the five selected robots were the same. The actual profit and number of trades do vary between using EA Studio or the Strategy tester but the actual selection of robots are almost the same.

I am using the Strategy Tester as many traders here in the EATradingAcademy Forums do not have EA Studio or any other paid backtester. What I am doing here is to use the same tools other traders have access. In using the Strategy Tester I am not looking for accuracy I am just looking for EAs that are moving in a positive direction as an initial determination as to which of the Top 10 robots to start with in a demo account. I then test these robots (EAs) in a demo account with the same broker I am planning on using for live trading.

I hope this answers your questions!

Alan,

-

-

December 12, 2024 at 2:52 #383418

Mark Kamrath

ParticipantNice, and totally agree. You know what you are doing. I’ve run into SO many people that play with the MT backtesters and then get burnt when going live. Thanks for the detailed clarifications. I’m sure anybody that sees it here will be greatly appreciative, as am I.

Still…. is the EATA process and presentation less than optimal? It seems that it is if you seen the need to go through the work you are going through!! So far, (only Nov/Dec) using the EATA portal results seems to be working nicely???

Great conversation, BTW. This would be nice to develop here.

-

December 12, 2024 at 8:52 #383442

Alan Northam

ParticipantHi Mark,

I’ve been trading since 1985. I have traded Stocks, Options, ETF’s, FX and have made all the mistakes, LOL. As for the EATA process, this is what I have determined works best for me over the years.

Alan,

-

-

December 12, 2024 at 17:33 #383515

Mark Kamrath

ParticipantHey! Me too! About the same time frame, except no Stocks, started with Commodities and the rest is the same. Worked with a few FX guys in EA development for a while, about 15 or so years ago. I’m liking EATA as well, in particular, the dynamic tracking of it as well as the fixed stop losses. Just gold though…. MK

-

December 13, 2024 at 18:28 #383736

Mark Kamrath

ParticipantHi Alan, too bad we can’t post under your initial post to keep that discussion separate. Your approach makes a lot of sense, I just don’t have the gumption to do that much work! Most of my funds are in a PAMM, and doing nicely, but I like to keep my hands in things a bit. So far, I just use the EATA app to select my top three gold EAs, updating twice a day. But on your points, I think I’ll use the MT5 strategy tester on those top 3 to confirm correlation with the EATA backtesting. If any differ significantly, I’ll test numbers 4,5,6…… until I get a positive result looking like the EATA one. Interesting approach for sure.

-

December 13, 2024 at 20:46 #383758

Alan Northam

ParticipantHi Mark,

Use the reply link to post under my original posts like I did here!

Alan,

-

-

December 13, 2024 at 18:35 #383737

Mark Kamrath

ParticipantPS: I calculate (simple excel sheet) my lot size per EA (gold only) by calculating the max loss account % using the posted stop loss. I’m limiting each EA to 2% max loss. So the larger stop-loss EAs will have lower lots (duh!). So far, this has yielded a max Drawdown (consecutive losses) of 14% over 13 consecutive losses, with per-trade losses ranging from .14 to 1.08 % of account. Which is nicely less than my max calculated loss of 2%. I like the idea of the trailing stop as it minimizes these losses.

-

December 13, 2024 at 20:47 #383759

Alan Northam

ParticipantHi Mark,

Use the trading methodology that works for you!

Alan,

-

-

December 14, 2024 at 13:22 #383852

Alan Northam

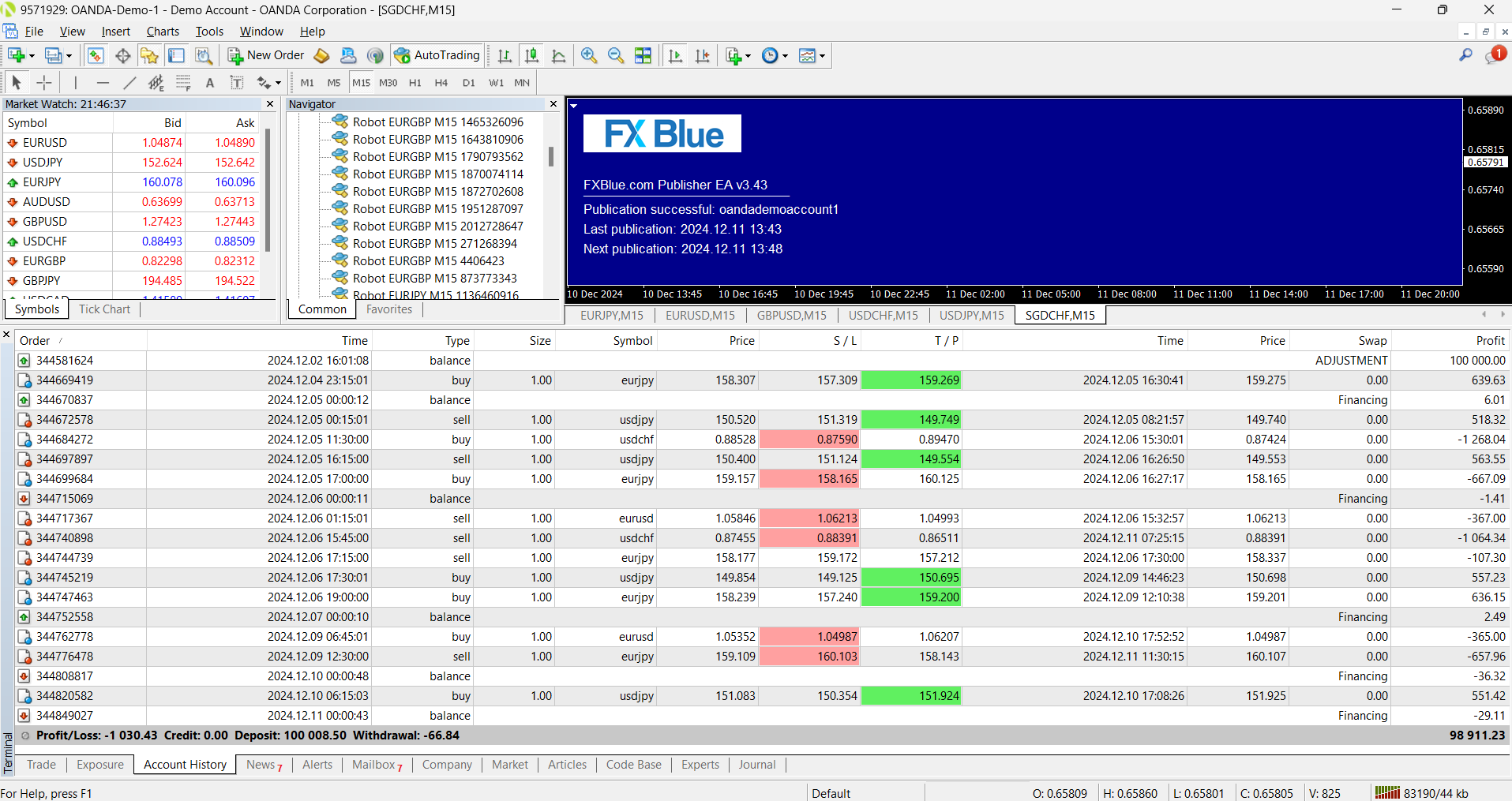

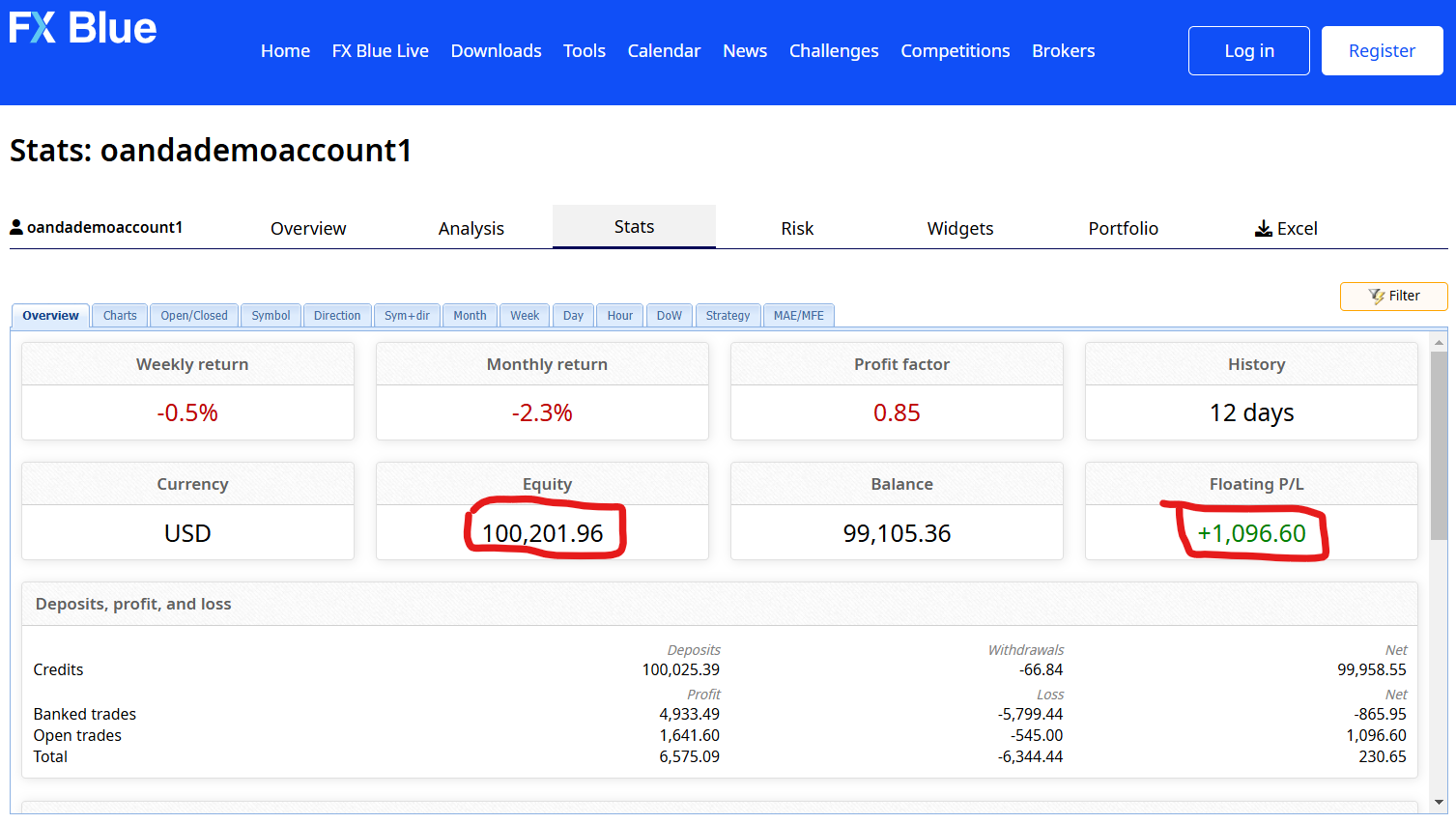

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

This weekend I am showing the results of the Top 10 APP Robots using FXblue. In this first graphic I show a nice Floating profit of $1096. Notice also the Equity is $100,201.96 which encludes the sum of the Balance and the Floating profit for a very small profit. Although the Equity shows a small profit the Weekly Return, Monthly Return, and Profit Factor are all negative. This is because of the Floating Profit. If the open trades, creating the Floating Profit, would have been closed at the end of trading yesterday (Friday) the Weekly Return would have shown a positive 0.2% return and the Monthly Return would have been 0.3%. Not very impressive but it shows the account is making progress.

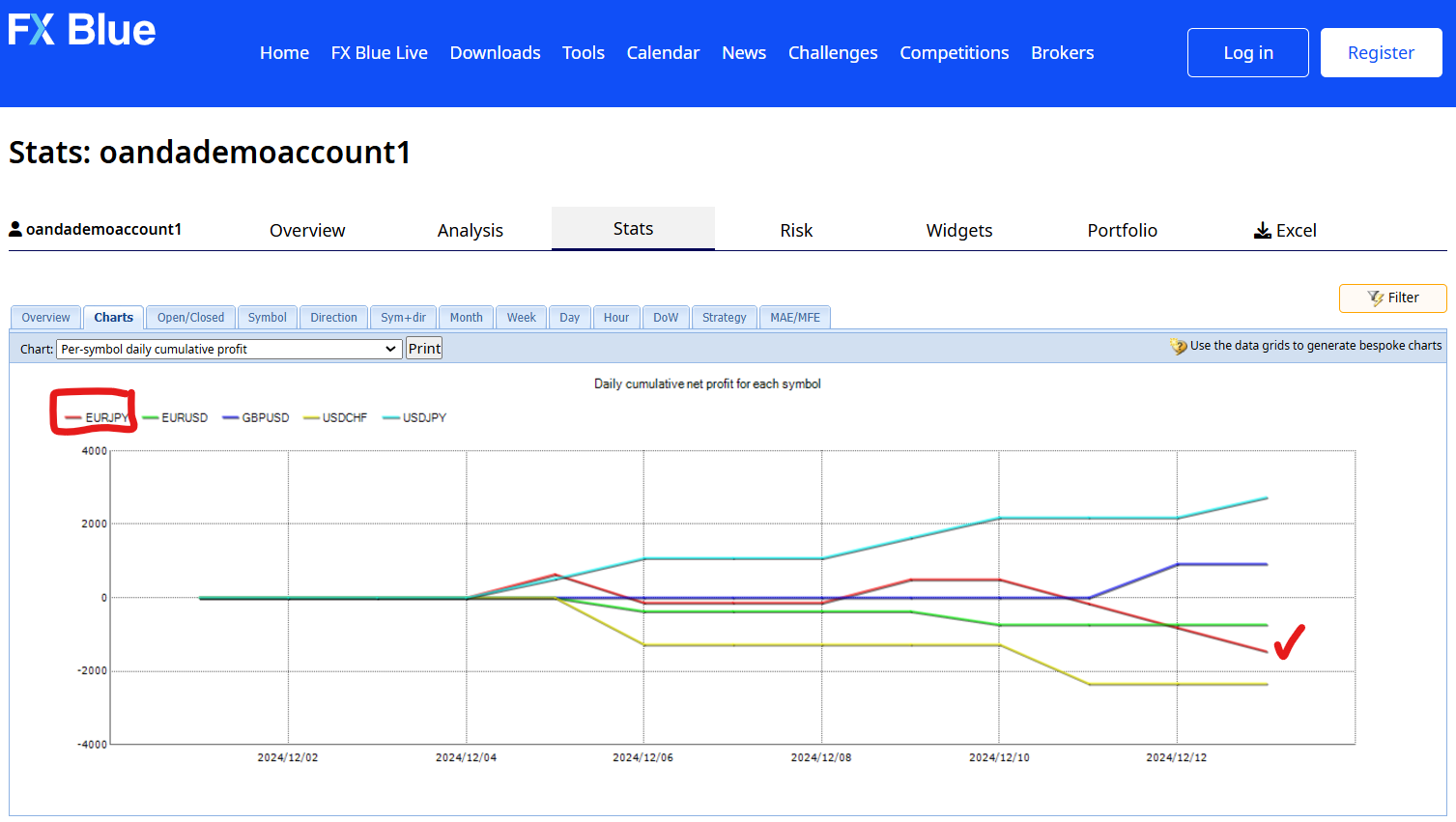

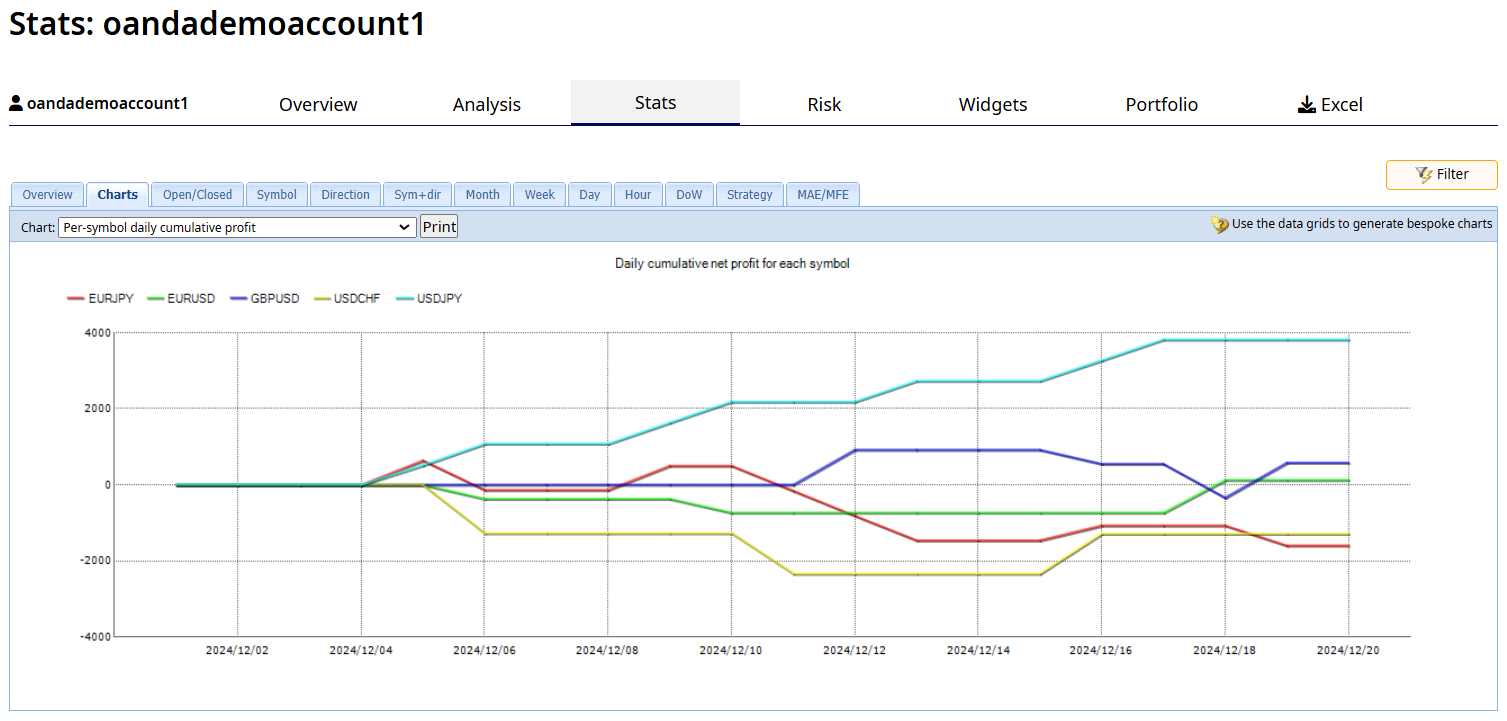

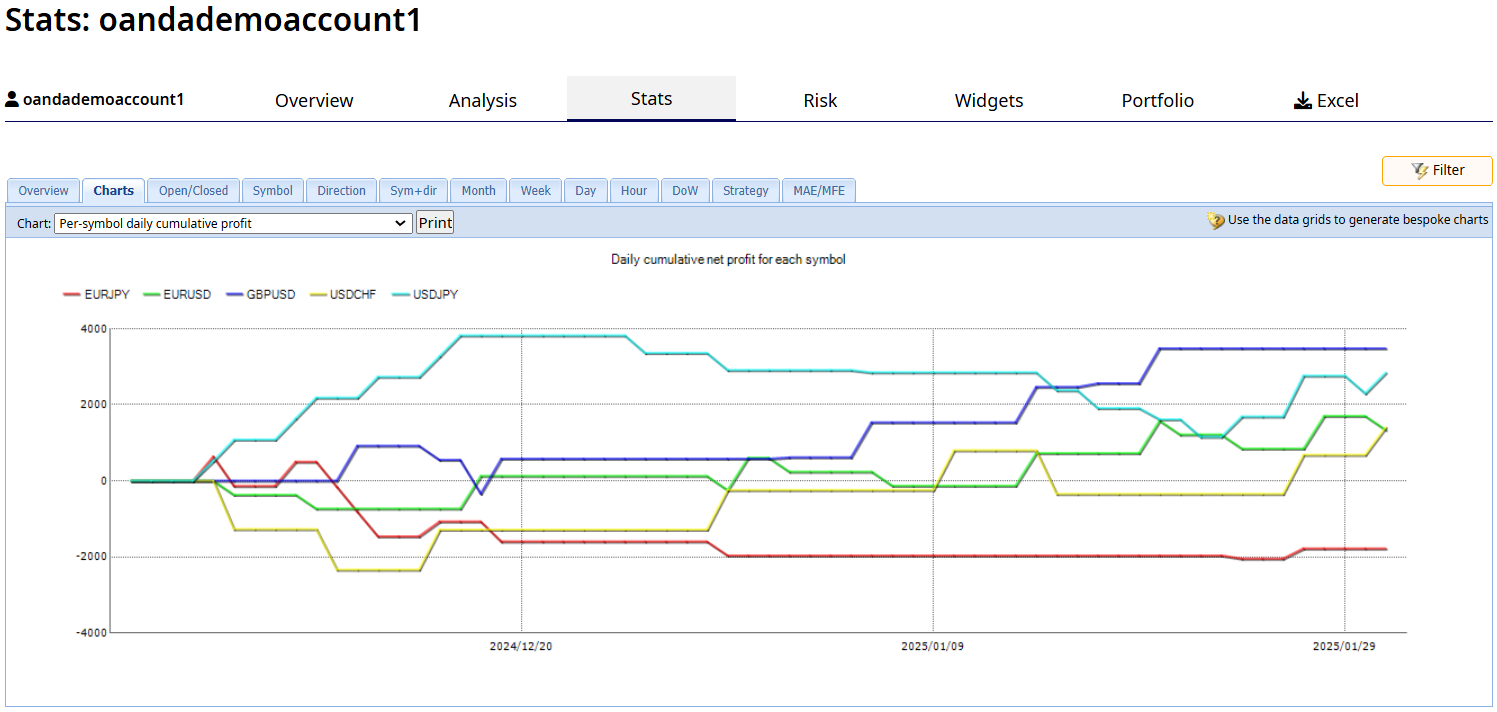

This final graphic shows the cumulative profit and loss of each of the currency pairs as a balance line. Note USDJPY shows a steady upward balance line. The red line EURJPY has been pointing in a downward direction over the last three days. Since this currency pair was still pointing down going into the close on Friday I have no confidence it will turn upward next week. For this reason I will replace this currency pair. The other two pairs have been flat for the last two days following a slight downward trend. This could be a sign they are about to turn upward so I will keep them in the portfolio. If they continue to move downward in the first few days of next week I may go ahead and replace them as well. I will have to wait and see!

As we go into the final three weeks of the year the performance of currency pairs may not perform well as the big speculative traders close out their losing trades for tax purposes. As a result we could see losses in our accounts, hopefully not! However, the good news is that in early January we could start seeing some nice profits in our accounts as the big speculative traders take the funds generated by closing out losing trades in December start to reinvest those funds into new positions.

I am still in the process of shaping this account into a profitable portfolio so I can use it in a live trading account. Trading is a process!

Alan,

-

December 18, 2024 at 11:31 #384491

Alan Northam

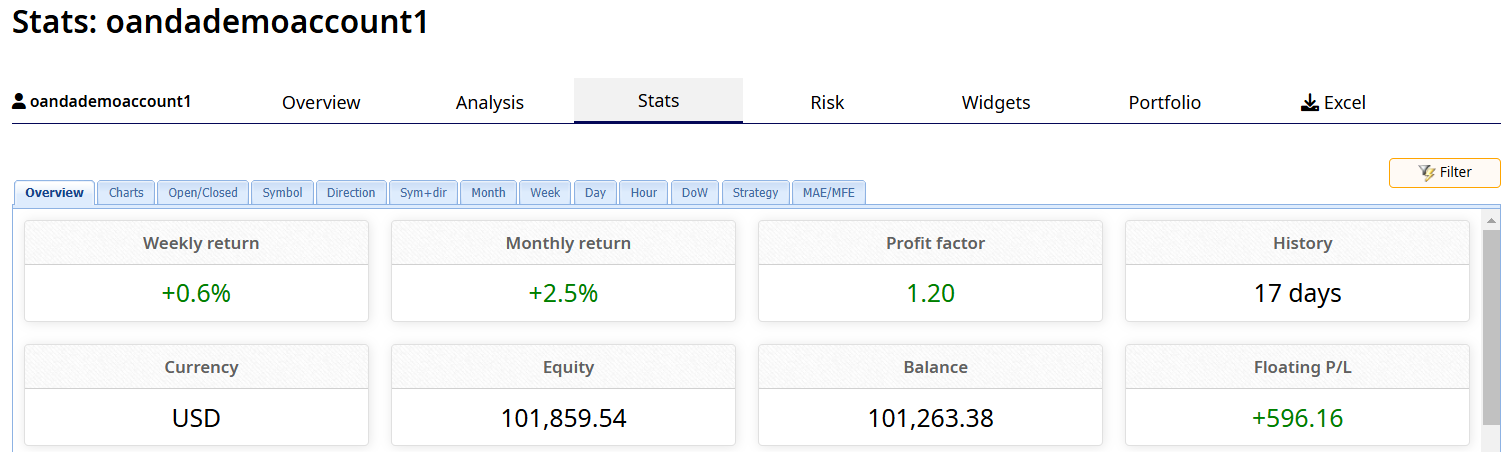

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

Here is a quick mid-week update on the Top 10 app robots trading on my Oanda dot com demo account. This account has now been trading for 17 days showing a calculated monthly return of 2.5%. So far this account has made a lot of progress compared to last week.

Alan,

-

December 20, 2024 at 18:44 #384926

Mark Kamrath

ParticipantThanks for the info, good to see progress, for sure. Especially in December!!

-

December 22, 2024 at 15:52 #385216

Alan Northam

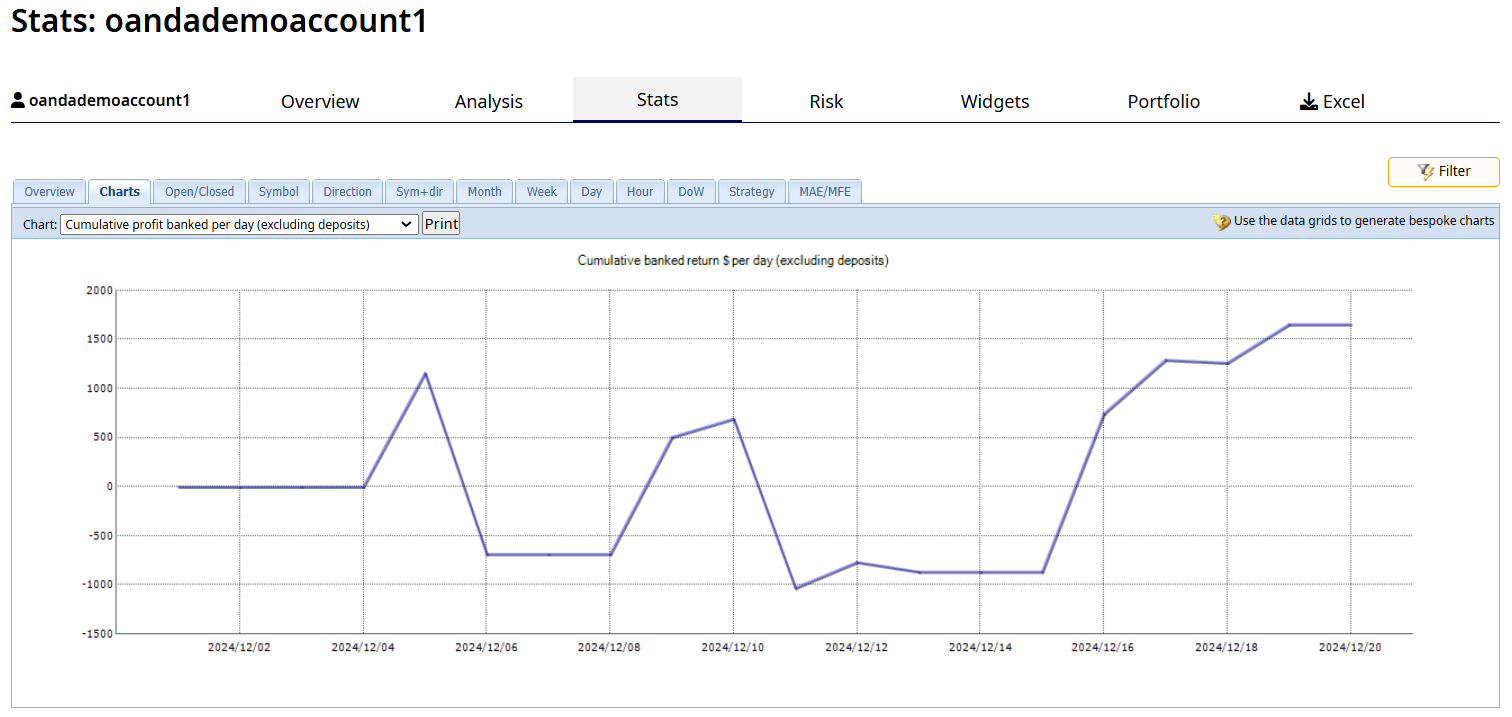

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

With this first graphic I decided to start at the top level and work downward into the details. This first graphic shows a balance of 101,652.73 compared to last weeks balance of 99,105.36 for a weekly profit of 2,547.37. I chose to compare balances as they represent the closed trades. This first graphic also shows a calculated monthly return of 2.7% based upon the history of 19 days.

This next graphic shows the balance line over the last 19 days. In the first several days this graphic shows the balance line moving in an up and down direction making lower highs and lower lows indicating a downward trend. However, the last several days shows the balance line moving upward and making a new higher high, an indication the downward trend has ended.

This final graphic shows the individual balance lines of all five traded assets. Note USDJPY has been moving in a nice upward trend over the last 19 days. EURUSD and GBPUSD have been trading in a horizontal direction over this same time period. Note also USDCHF and EURJPY can be seen moving in a downward direction for the first two thirds of the time period. However, over the last one third of the time period of 19 days EURJPY has been flat while USDCHF is starting to move upward. Since none of these five assets are now moving in a downward direction I have decided to continue trading these same assets this next week.

This last week this demo account has made significant progress. It will now be interesting to see how this account performs this next week knowing it is Christmas week. I expect trading to be light this next week as many of the big traders, who are the ones that really moves these markets, will be taking some vacation days. So, it will be interesting to see what progress this account can make during this Christmas week.

Note: I do not have any plans on continuing to report the progress of this demo account on the forum after this year.

Alan-

-

January 10, 2025 at 18:53 #425439

Francesco

ParticipantHi everyone

is it possible to have the codes of EAs that after downloaded have worked well in demo or real for a consistent period of time? I think everybody with great experience with an EA should share it with community.

Francesco

-

January 10, 2025 at 22:50 #425467

Alan Northam

ParticipantHi Francesco,

Yes it is possible. You can see that by looking at EAtradingacademy’s Top 10 robots app and select the time period you are interested in. Then you can view the balance lines of some of the robots to see how they have performed over that period of time. Keep in mind that these robots are being traded using the Blackbull historical data. When downloading any of these robots and trading them with other brokers the performance can vary drastically. For this reason it is better to download all the robots to a demo account with the broker you plan on using and then monitoring their performance for a period of time and then select the robots that are working best with your broker to trade in a live account.

Hope this helps!

Alan,

-

January 11, 2025 at 21:21 #425581

Francesco

ParticipantHi Alan

I know what you said, but the problem is the big number of EAs that we can download from Top 10 robots app almost daily… my VPS is saturated and cannot keep in running the new EAs that are added to app.. so my idea was that the pairs could be divided into members that are interested in do this work and then share the results if they are noticeable.

-

January 12, 2025 at 10:43 #425637

Alan Northam

ParticipantHi Francesco,

Thanks for responding! I don’t understand why your VPS could be saturated. Are you sure its a VPS problem or are you using MT4? All you need to do is to run one instance of MT5 and upload all the robots to it. With MT5 you can upload up to 99 Expert Advisors. Any VPS should be able to handle this. What VPS are you using? Are you using MT4 or MT5? What broker are you using? Are you in the US?

Alan,

-

-

-

-

January 12, 2025 at 13:17 #425662

Alan Northam

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

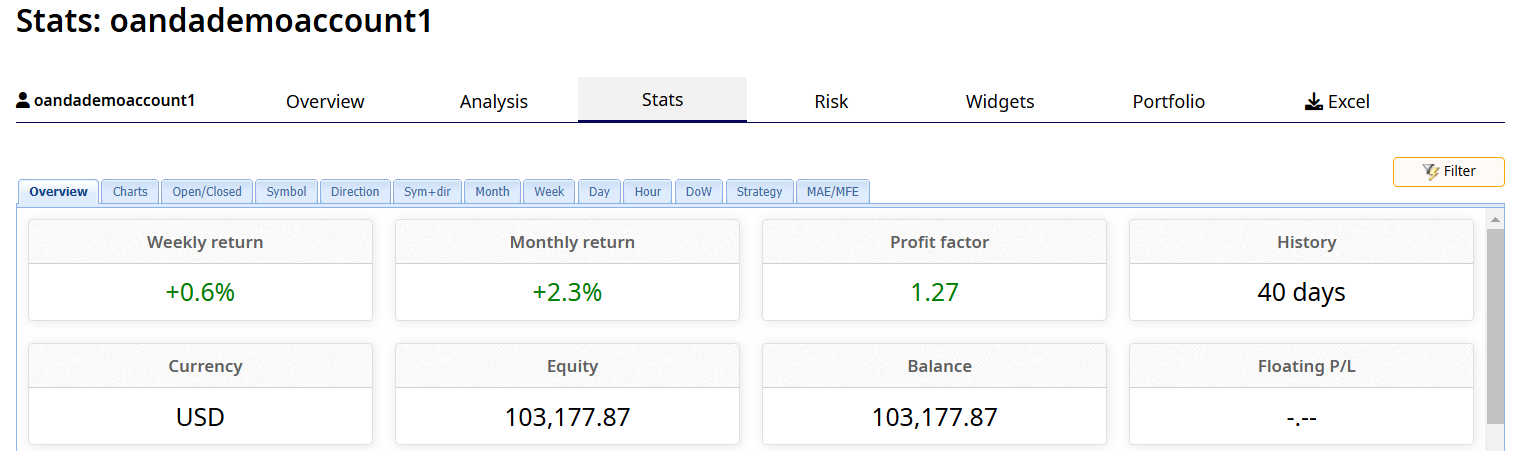

It has been 40 days now since I started this Oanda dot com demo account test using the EATradingacademy Top10 app robots so I thought I would go ahead and do an update.

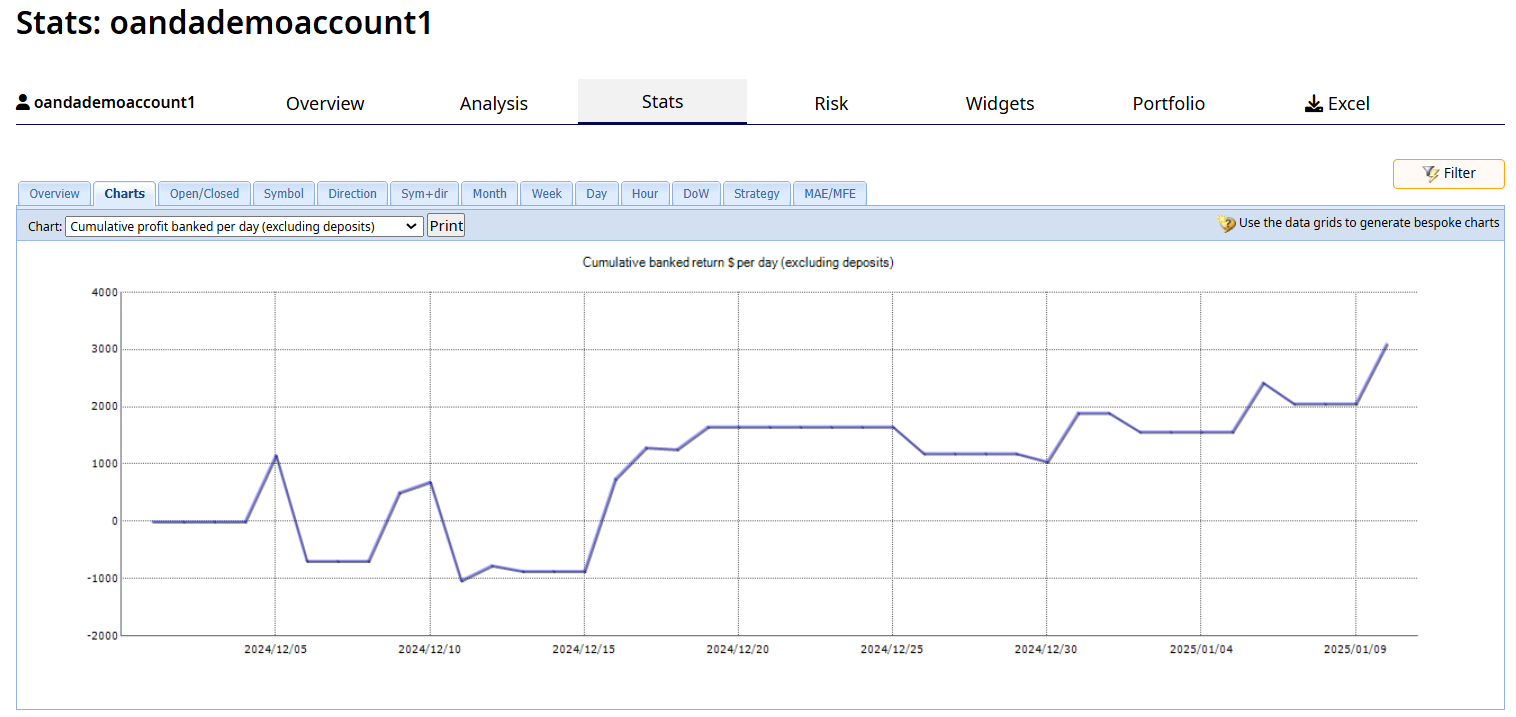

This first graphic shows a calculated monthly return of 2.3%. This graphic also shows a total equity of $103,177.87. Since this account started with a $100,000 it can be calculated this demo account has $3177.87 profit or a profit of 3.1% over the last 40 days.

This next graphic shows the balance line over the last 40 days. The first part of this graphic shows the demo account had a rocky start moving in an up and down direction making lower highs and lower lows indicating a downward trend. From December 20 through the end of the year the balance line moved mostly sideways. This is an indication of the lack of trading activity of the big traders during the Christmas holidays. Now that Christmas and New Years is over the balance line has started moving in an upward direction making higher highs and higher lows indicating an upward trend.

This account seems to be making good progress. Keep in mind when I selected the Top10 robots to use in this demo account I only had about two weeks of historical data to use in the Strategy Tester in selecting the best performing robots. I have not made any changes to the robots since I selected them 40 days ago.

As to this demo account only having a monthly return of 2.3% is just used to show progress. A higher monthly return could be easily achieved by doubling the lot size to 2.0 lots.

Overall, at this point I am satisfied with the results I am getting using the Top10 robots on an Oanda demo account in the US contending with the FIFO requirements, the lack of significant historical data and using the MetaTrader Strategy Tester to make the selection of robots.

Alan-

-

January 26, 2025 at 14:00 #428214

Alan Northam

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

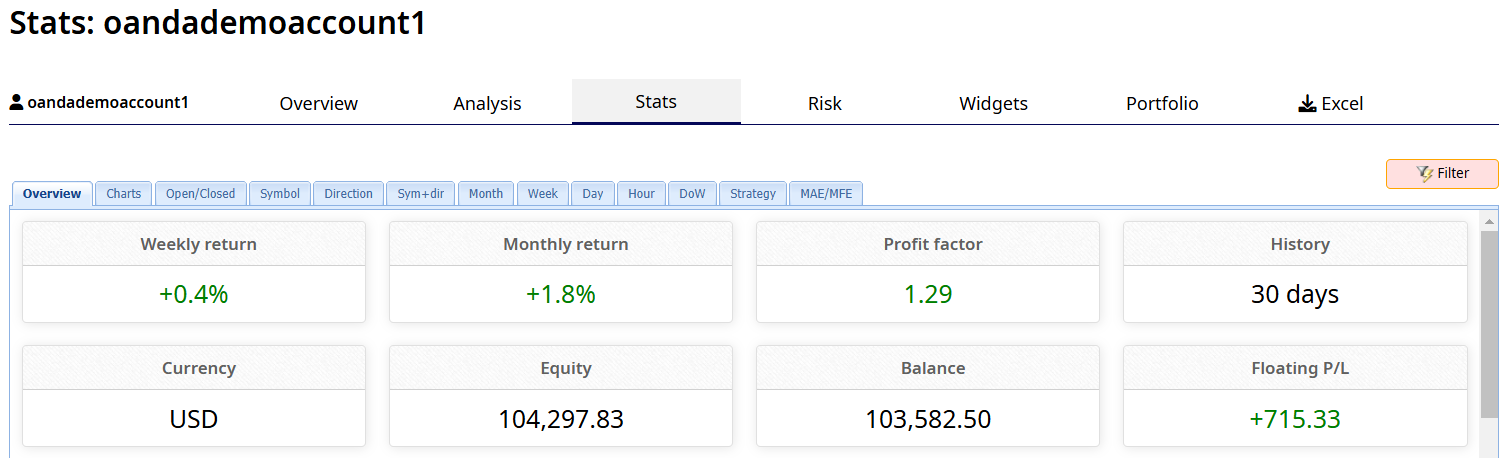

It has been 54 days now since I started this Oanda dot com demo test account using the EATradingacademy’s Top10 app robots. The following is a quick update.

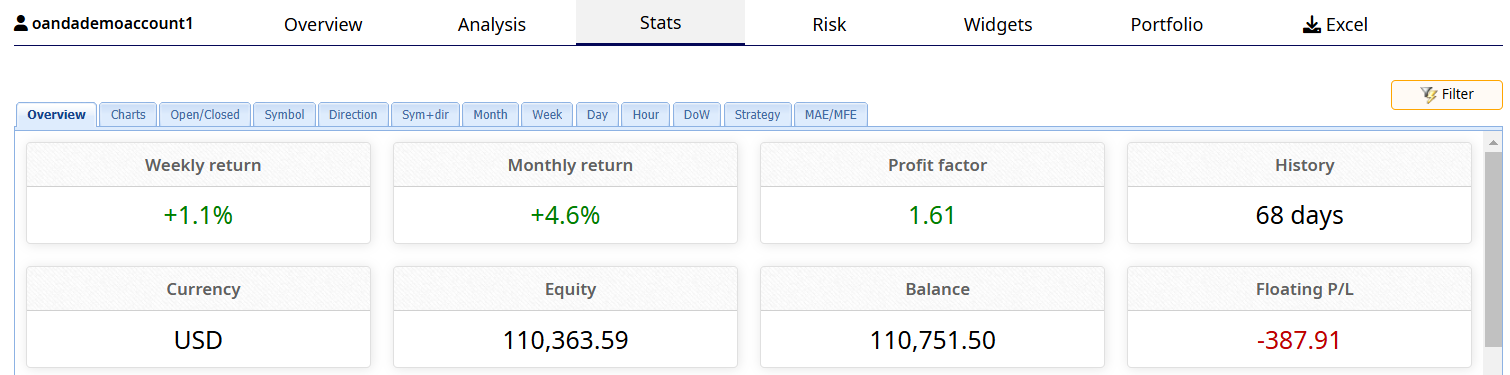

This graphic shows the stats over the last 30 days. This test account shows a monthly return of 1.8% using a total lot size of 5 (1 lot for each of the five assets). Since the account size is 100K the lot size could have easily been greater without margin problems. For example should the lot size have been doubled it would have indicated a 3.6% return over the last 30 days. However, it is not the purpose of this demo account to optimize its return but to simply test if using the Top 10 robots on an Oanda broker trading account in the US could be profitable.

Also notice this demo account has $715 in open trades. Once these trades are closed the Monthly Return should be improved.

So far I am happy with the progress of this test account.

I will show detailed update at the end of the month.

To view the Top10 robots click here.

Alan,

-

January 27, 2025 at 18:10 #428460

Alan Northam

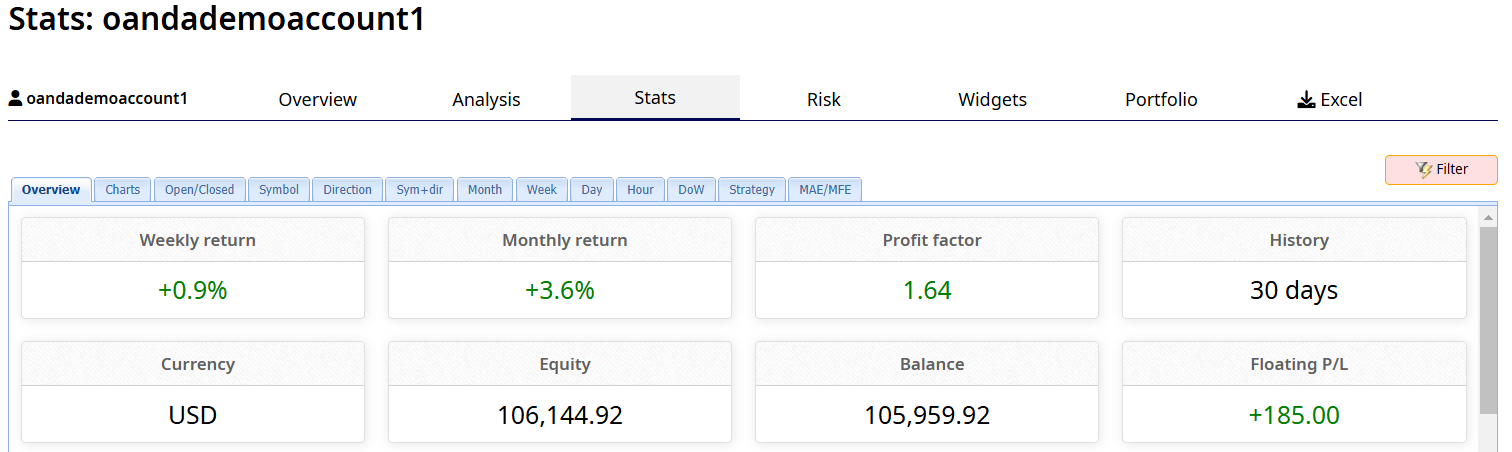

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

Just a quick update: Several open trades were closed recently which has now improved the 30 day statistics. Note the Monthly Return has bumped up from 1.8% yesterday to 3.6% today, also Profit Factor has increased to 1.64. Currently this test account has open trades equaling $185. Once these are closed I would expect the monthly return to improve somewhat again.

Alan,

-

February 1, 2025 at 15:04 #429345

Alan Northam

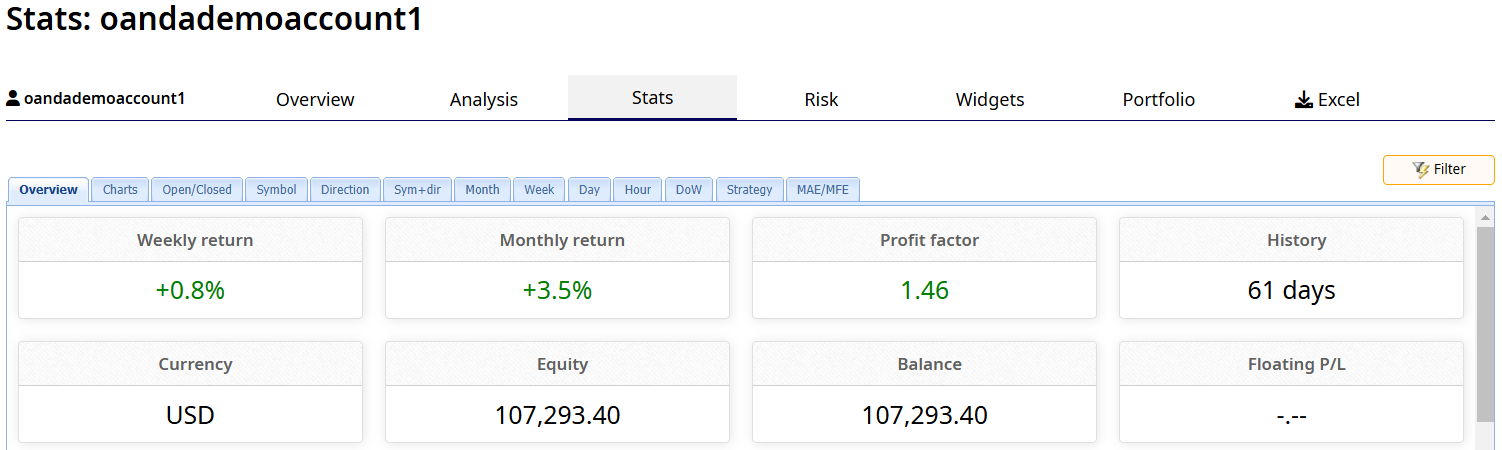

ParticipantHi Guys!

One of the problems with using the Top10 app EA’s with the Oanda dot com broker is that these EA’s have not been tested using Oanda’s historical data. Please keep in mind that each broker/prop firms historical data is not the same and Expert Advisors will perform differently. Therefore when using historical data that has not been tested with the expert advisors it cannot be depended upon that choosing the top performing EA’s from the Top10 app will perform as expected. For this reason I had to choose the EA’s from the Top10 app in a different way. To learn how I did this refer back to the beginning of this thread where I explain my process.

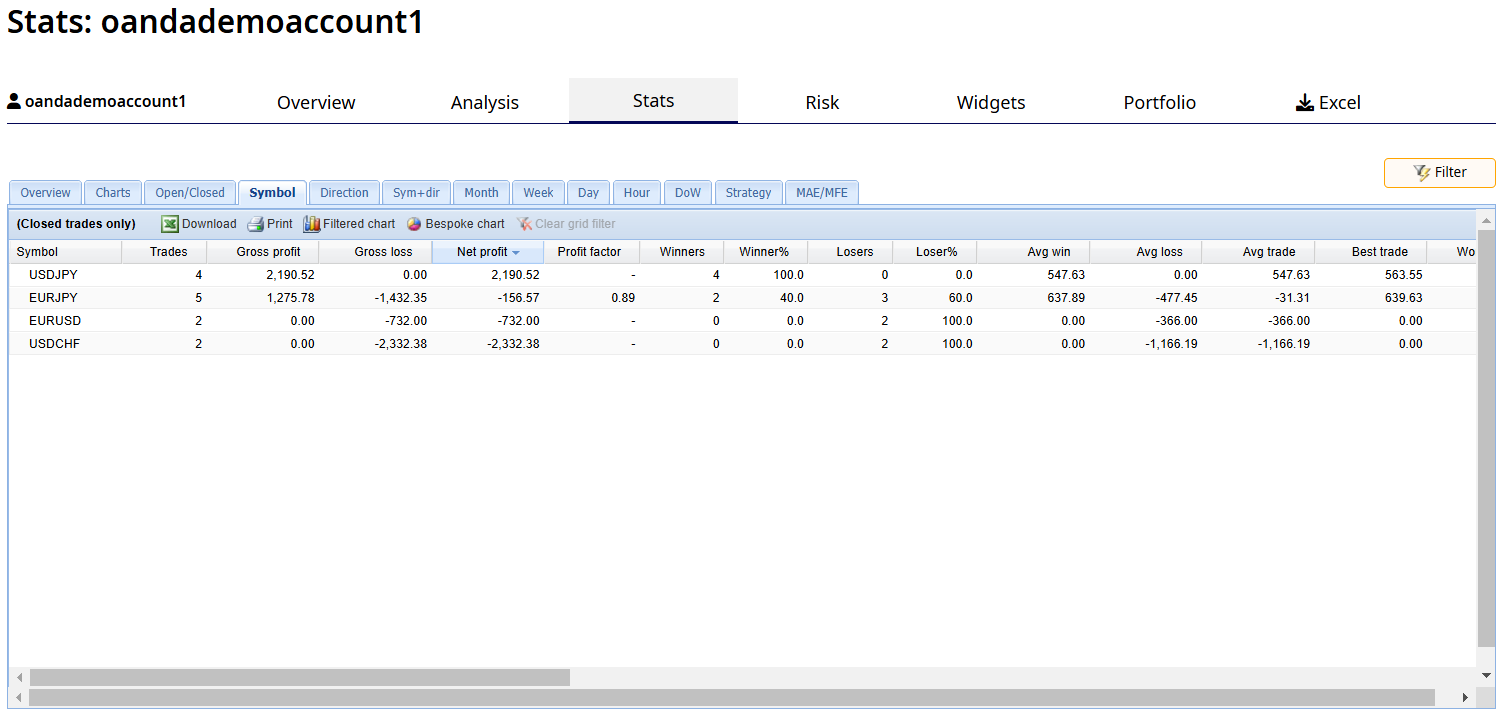

This first graphic show the performance of the Top10 app EA’s since the beginning of this Oanda dot com test demo account. This graphic shows this account has gained $7,293.40 with a calculated monthly return of 3.5%.

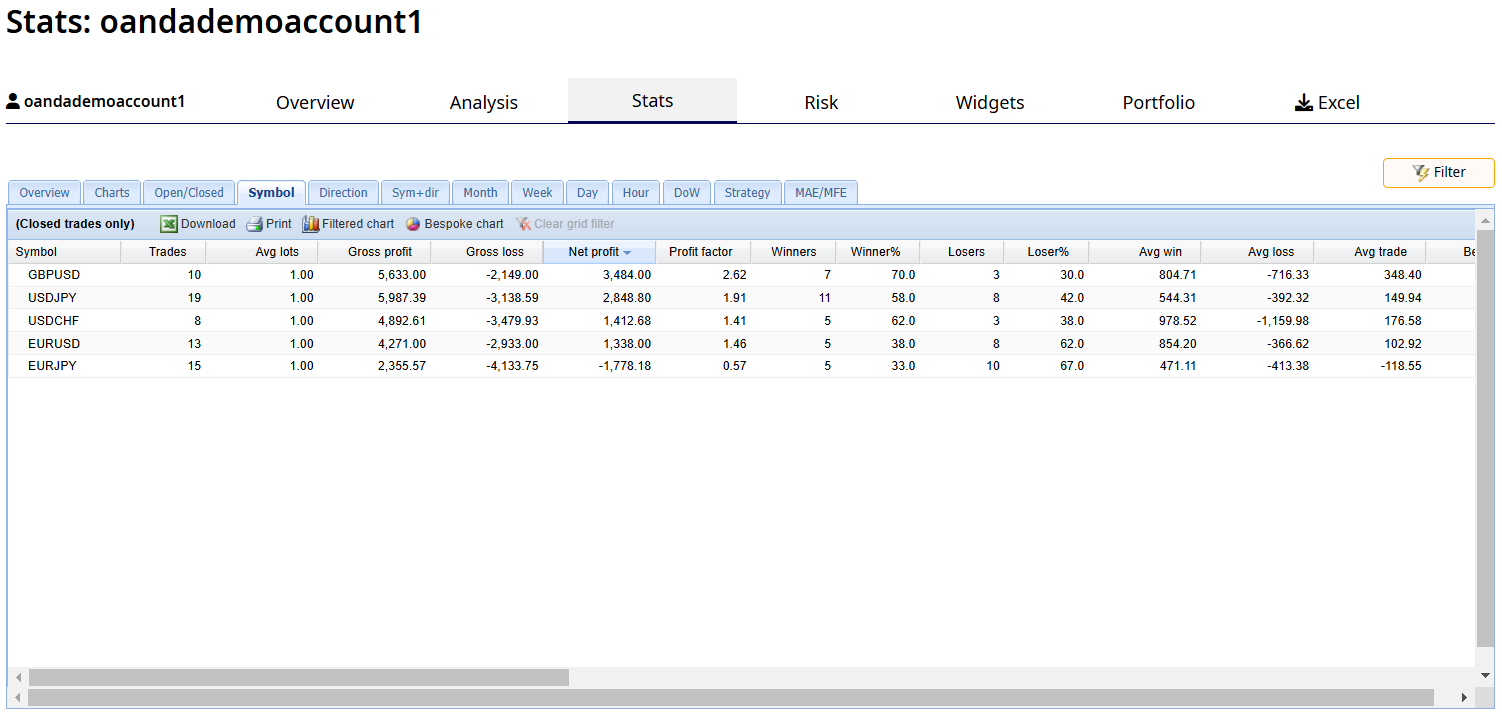

This second graphic shows each of the assets that have been in this demo account since day one. This graphic also shows the statistics for each of these assets.

This third graphic show the balance line of this demo account since its beginning.

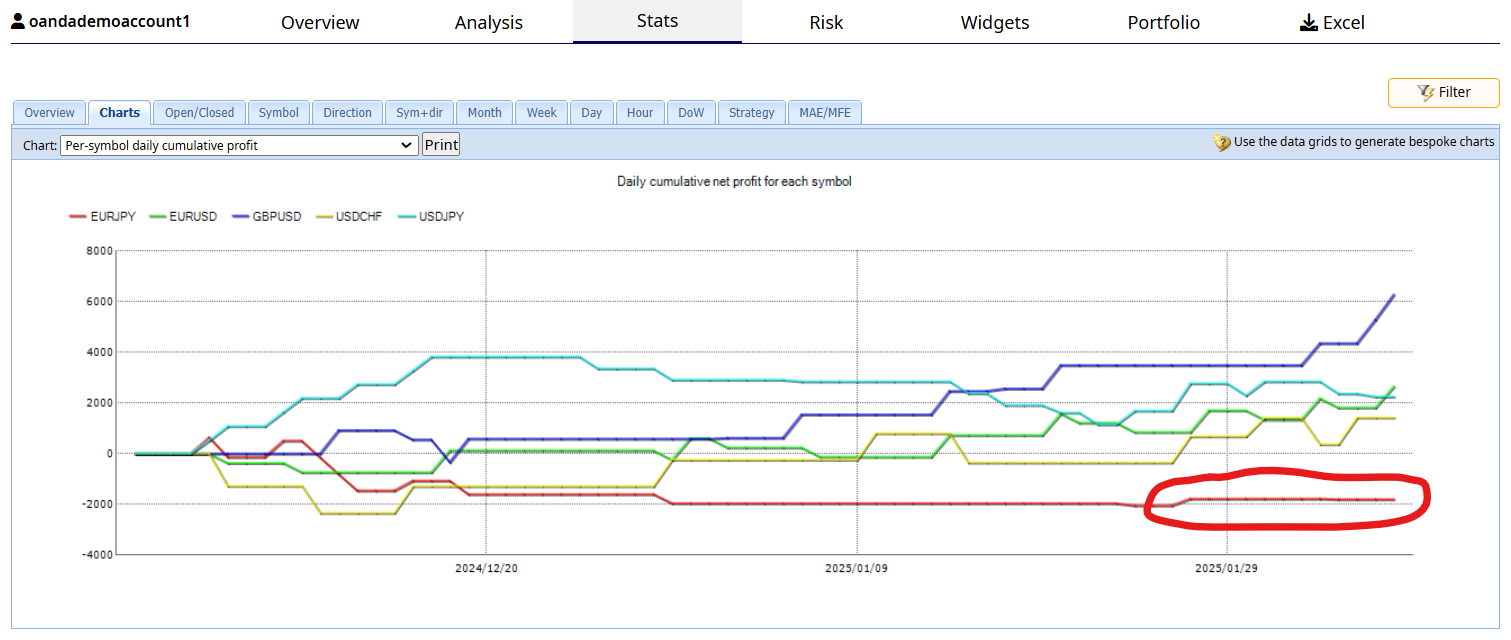

This last graphic shows the balance line of each of the assets. This graphic shows EURJPY as being the underperformer. Since this is a test demo account I plan on leaving this asset in the account to see if it will start to perform well. However, if it starts to move lower by next weekend I may remove it.

To view the Top10 robots click here.

Alan,

-

February 1, 2025 at 17:03 #429377

Alesamo

ParticipantHello Alan, thanks for sharing. How are you managing the EAs? Every week there are new bots in the Top10-App, are you replacing older ones with the new EAs or are you still using the ones you downloaded when you started your test? If you are replacing EAs, are you closing open positions? And what timeframe are you using for your EAs (1W, 1M, 1Y, 5Y)? Thanks again for your insights!

-

February 1, 2025 at 19:43 #429394

Alan Northam

ParticipantHi Alesamo, Thanks for your comments and questions. I am still using the same robots I downloaded when I started the test. I have thought about starting a second test demo account using my Oanda broker so as to validate the methodology in selecting the Top10 app robots. Truthfully, I sometimes wonder if my efforts of sharing my methods of trading robots is of value as it doesn’t seem like I get any response from other traders.

I am using the 15 minute time frame which is my favorite time frame to use.

If I were to replace a robot I would close any open position. The reason is the robot contains an indicator that could force the position to close before it hit the TP or SL. For this reason, as long as a position is open and trading the robot needs to remain active.

Where are you located?

Alan,

-

-

February 1, 2025 at 20:35 #429399

Zoran Čuturilo

ParticipantHi Alan!

A few times I tried to response to you with my tests, but I have a issue with adding screenshots (I was able to do that earlier). I hope it will be fix with support. Stay sharp!

Zoran

-

February 2, 2025 at 0:06 #429422

Alan Northam

ParticipantHi Zoran, Have you tried to clear your browsers cache or tried to use a different browser? Have you contacted support via email?

Alan-

-

-

February 8, 2025 at 10:35 #430888

Alan Northam

ParticipantHi Guys!

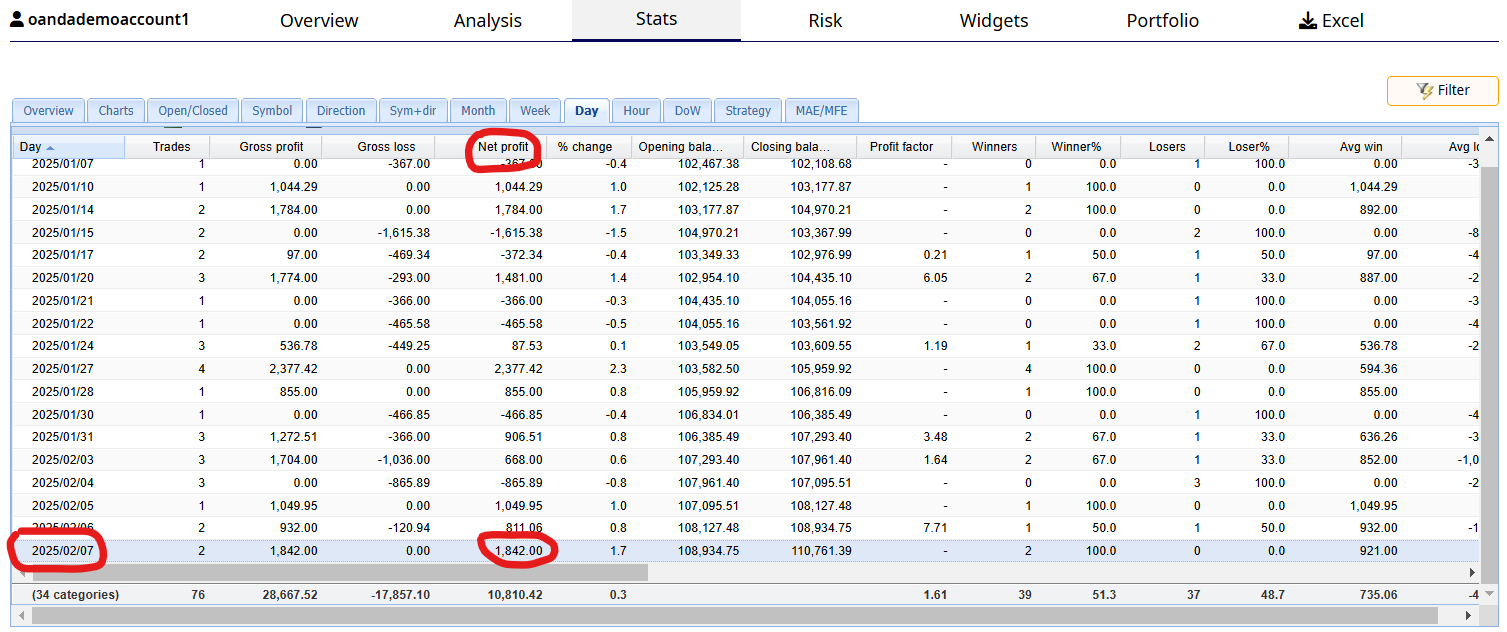

This first graphic show the performance of the EATradingAcademy Top10 App Robots I have selected to use in this Oanda dot com test demo account. This graphic shows this account is now 68 days old and has gained $10,363.59 or 10.4%. This graphic also shows a calculated monthly return of 4.6%. Not too shabby!

Oh, by the way what about Open Positions represented by that negative 387.91 Floating P/L? Well this second graphic shows a closing profit on Friday of $1,842.00 so I am not too worried about this floating loss. It is very possible these open trades could turn into profits before they are closed.

This third graphic show the balance line of this demo account since its beginning. Had a bad beginning but otherwise, Nice!

This last graphic shows the balance line of each of the assets. This graphic shows EURJPY as being the underperformer. However, when I look at the last several days I see this asset may be starting to move higher. So I will continue to keep this asset in the demo account to see if it continues to move upward.

Overall, I am quite happy with the results so far for this demo account!

To view the Top10 robots click here.

To go to the beginning of this thread click here.Let me know what you think!

Alan,

-

March 4, 2025 at 0:49 #438263

bob thomson

Participanthi alan,

I own the top 10 robots since almost one year and if I could turn the time back I wouldn’t have purchased this. The bots are so damn hard curve fitted that I would make money if I inverted the actual trades. very very disappointing. I tried the top 3 monthly top 1 monthly, top 3 yearly, the top ones after testing it on EA studio – nothing. only shitty trades with almost guaranteed losses. I honstley doubt that any reproducible method of making money out of the top 10 robots package exists.

-

March 4, 2025 at 0:57 #438265

bob thomson

Participantand using the same robots until they fail isn’t an option in my opinion because the idea is to stay up to date with the current market not just some random EAs that work (out of luck?).

What I was looking for was a clear strategy how I can be profitable using the top 10 robots app. Clear instructions. Like “only bots that meet criteria xyz” I tried almost everything and since almost one year im still trading on demo only because I don’t have a reliable reproductive strategy to make money in the long run using those bots.

Yes you might have luckily found some good ones, but since there aren’t updated they will fail at some point. That’s what I mean with reducible. The new ones you put on the demo account then might fail immediately. So it seems you also didn’t found any sustainable profitable strategy using this app. That’s so sad since we paid so much. Im very very sad because the Idea was logical to me. But those bots even with the new out of sample filter seem to be curve fitted.

Oh and btw: it is easy to show me profits and argue that those bots are profitable. Yes, some are but no one will give clear instructions how to reproduce it. They run 10 Demo accounts with different bots and if one is profitable they show you those results while the other 9 accounts imploded.

-

March 4, 2025 at 19:48 #438435

Zoran Čuturilo

ParticipantHi Bob!

Try NDX 100, it is ONLY instrument that works right now. Start looking in 1Y, smoothe line, drowdown less than 3%, must be in 1M and 1W chart. 5-6 of them put in demo, after 5 trades you will decide what to do with them. Best of them install in live account with the SAME broker. Before deploying them, TEST in MT5 for 1Y, 1M and 1W with real (yours) delays and other options. They are active mostly during first NY Kill Zone. Good luck!

Zoran

-

-

-

March 3, 2025 at 10:52 #438120

Zoran Čuturilo

ParticipantHi!

I have a doubt. I have one extremely active and best profitabile robot (profit factor only 1,29) on demo account. When I put him on live account and test him on MT5 tester on 1Y, 1M and even 1W, results are so bad, that I was urgently disable him in order to protect account. What to do? What is more realistic picture?

Thanks. -

March 4, 2025 at 1:08 #438268

bob thomson

Participantthank you

-

March 4, 2025 at 4:21 #438281

Alan Northam

ParticipantHi Bob,

Sorry to hear you are having problems being successful using the Top10 app robots. The problem I see with using the Top10 app robots is that they are created and tested using Blackbull historical data. The problem with historical data is that it is difference with with many difference forex brokers. So, you have two options. One option is to use the Blackbull forex broker, or two, test the robots with your broker. This is what I did. I downloaded all the Top10 robots and backtested them all with Oanda to find which ones produced a nice balance line. From this test I then picked the best performing ones to trade. Notice with the Top10 robots I am trading on Oanda I call it a test. This is because I want to test them for about four to six months before trading them on a live account. This test account is still doing very well with a balance of $110,500 or 10% over the last 90 days.

Hi Zoran,

When you move a robot from a demo account to a live account there are two things you should do. One is to make sure you are using the same broker for both the demo and live accounts. Secondly, keep the robot on the demo account and also on the live account. This will let you know if the demo account and the live account are using the same historical data. By doing this when you see the live account in a drawdown you can check the demo account to see if it is also going through the same drawdown. What you did by moving from a demo account to a live account and found that with the live account the robot starting losing you don’t know if the live account is the problem or if it is just going through a drawdown. If you find the demo account and the live account produce different results you can always use a trade copier. I use the free trade copier from FXblue to do this very thing. I test all my robots with just one broker and when I want to trade them with a different broker, such as a prop firm, I use a trade copier.

Guys, also note I am no longer using the forum or adding content. I do however, get an email when you guys post something so I can still respond to questions but I will not be adding content once a week.

Alan-

-

-

April 24, 2025 at 19:47 #448802

devgabriel300

ParticipantHey Alan,

Does Blackbull work in the US? whenever i try to create account it says not available in your region.

Secondly, do you use VPS or you leave your PC on 24/7? My VPS can only handle 4-6 MT4/MT5 app. This restrict me from creating multiple demo account for different scenarios.-

April 24, 2025 at 21:07 #448812

Alan Northam

ParticipantHi devgabriel300,

The broker Blackbull does not allow for US traders.

The problem I have found with VPS’s is they only allow for about 4 or 5 Metatrader terminals.I have over 20 Mt4 and MT5 terminals running continuously so to have 4 or 5 VPS’s is extremely costly. I found it more economical to run my Metatrader terminals on my own pc. So what I did was to purchase a separate pc. I actually bought a used pc off the internet. I have it connected to a battery backup. I also use T-Mobile Home internet connected to my pc connected to the battery backup. This device gets its internet from the cell tower instead of a hard wired internet connection. The problem with hard wired internet connections is they go down a few times a year. Cell towers hardly ever go down! Even if you just use your normal internet connection and it goes down a couple times a year and stays down for 24 hours each time that is still an uptime of 99.24%.

Hope this helps!

Alan,

-

-

April 24, 2025 at 22:03 #448818

devgabriel300

ParticipantYes it does, It makes sense now, cos getting additional VPS was an expensive option. I will use your technique. Thanks for sharing.

-

May 21, 2025 at 15:55 #452446

Lukáš Kozubík

ParticipantHello Marin,

I recently bought a pack of 10 top EAs. Could you advise me on how long it is optimal to evaluate the EA? Right now I am testing the top 5 EAs from each pair according to monthly statistics. Thank you for your advice and good luck!

Lukáš

-

May 28, 2025 at 10:24 #453430

Wahed Kamel

ParticipantGood

-

June 20, 2025 at 2:38 #457067

R&Y Trading

ParticipantConsistent performance from Top 10 Gold EAs for over 1 year.

Purchased Petko Top 10 Gold EAs and been running all 10 (Yearly EA) in a Demo and selecting the top 5 for live account for over a year.

Even if you are lazy like me and just leave all 10 in the live account you still made significant profits. Limiting to top 5 and checking weekly on all EAs and cherry picking the best gives you even better results. Also, every week I see if there are any new Top 10 yearly EAs and add to demo and once I get a good few months of profits, I also add them.https://www.fxblue.com/users/petkotop10goldea_dec

Password: 1045867It’s a 1K AUD account on Pepperstone, been going since Jan 25. My other older Demo accounts were cancelled by Pepperstone in their last cleanup. Just returned +326.6% profit (Closed profit: +3,145.98) as of 20/06/2025.

Basically, give it time, there are some weeks of downtown (traffics in April was bad !), but month on month it’s making good money on small balance of 1K AUD.-

June 20, 2025 at 10:26 #457105

Lukáš Kozubík

ParticipantHello,

thank you very much for your information!!!

-

-

July 25, 2025 at 1:19 #462845

Alesamo

ParticipantObviously, this forum is dead as a mouse… Anyone here with a strategy that works with the Top-10-EAs?? I am testing several strategies for months, but to be honest I can’t find a tactic that really works, it’s up and down, and again up and down… Even more frustrating is the fact that the Petko and his team imho don’t give a s**t about bringing the Top-10-EAs to the next level… What about other symbols like AUDCAD? What about the long promised “portfolio solution”? I am following their channel, what I can see recently is that they are mostly focussing on presenting expensive third party EAs (even some with quite questionable websites), of course all with an affiliate link… It’s frustrating that customers who paid quite a substantial amount for the Top-10-EA (like myself) don’t get any attention after a purchase…

-

August 8, 2025 at 17:01 #465126

Maria DochevaKeymaster

Maria DochevaKeymasterHello Alesamo,

Thank you for your honest feedback and for being a part of our community. I understand your frustration with the current performance of the Top-10 EAs and the feeling that progress might be slow.

Please know that we are committed to continually improving the EAs and developing new solutions, including the long-awaited portfolio approach. These developments take time, as we prioritize stability, reliability, and compliance with prop firm rules.

Regarding other symbols like AUDCAD, we are actively testing and optimizing strategies across various pairs. That’s also why we offer carefully tested third-party robots—to provide our clients with a wider variety of trading options while we continue developing our own solutions.

About the third-party EAs: we are doing our best to offer a variety of robots to our clients, but only after successful testing and thorough evaluation. Our aim is to provide additional tools that can complement our core products and help traders find what works best for their style.

Your investment and trust are important to us, and I encourage you to reach out with any specific issues or suggestions so we can assist you more directly. We appreciate your patience and continued support as we work to bring the best possible tools to our traders.

-

-

July 25, 2025 at 12:30 #462908

Zoran Čuturilo

ParticipantI could not be more agree with Alesamo. Just look at the results of “100k Project”.Where are Top 10 EAs and what scores they achieve?

My goal was to cover expenses of buying Top 10 EAs and move on. I success that, but with hard work, making my own strategy based on my mistakes and YouTube clips. Paying 149 euro/month for VIP Club is tooooo much expensive. I paid that amount and less for lifetime access in other communities.

First, forget about demo account for testing. Many times I saw that some EA is a Rock Star on demo account, but when I put it on live, it is a Looser. Solution is to open small real account for testing.

Conditions to choose EA from Top 10 App is that you are chasing profit out of sample and EA must be on Y, M and W table. I noticed that EAs from Top 10 EAs have a very tiny lifetime, so you must catch the peak: after 5 trades, you make decision if it goes to main live account.

Condition to remove EA is to calculate Risk to Reward Ratio (RRR) a that higher round number is amount of consecutive losses which I am ready to loose.

Hope that help a little bit.

Zoran

-

August 8, 2025 at 18:51 #465141

Samuel Jackson

ModeratorHi Alesamo, I agree with the flaws currently in the approach many take to the top 10 app. I have been trading EAS successfully for a good while now (See here for examples (https://eatradingacademy.com/forums/topic/many-prop-firm-challenges-passed-with-ea-studio/) and I also just received payout on a 100k FTMO funded account. ALL using EA Studio portfolios that I developed myself.

The top 10 app gets ALOT right but its approach also has flaws. Would you be open to trying a different approach than you are using? Also what other software do you have access to?

Sam

-

August 9, 2025 at 13:40 #465224

Alesamo

ParticipantHello Maria, hello Sam, thanks a lot, I really do appreciate that you as a team are seeing the current issues with the Top-10-App and you are working on improvements. That said – I tried really various approaches, also those recommended by you in your YT channels, so far I haven’t found one that looks promising/consistent. And yes, of course I am open to try different approaches, if you have any suggestions please let me/us know… In general I am using some commercial EAs from the MQL market place with quite some success, these are almost all grid/martingale EAs, however, and with the Top-10-App I really wanted to shift away from these a bit because of the inherent risk of these…

-

August 9, 2025 at 15:48 #465235

Samuel Jackson

ModeratorHi Alesamo, yes I agree that the risks of the grid martingales are concerning and I personally step away from these too.

Rest assured I will definitely be working on improving the back end of this tool over time but for now let’s get something that will work better with what we have got.

So for approach one. Let’s try this approach:

1 – Only trade EAs that have an OOS trade count of 20+ trades as shown on the top 10 app

2 – Also instead of changing EAs after a set period of time such as putting them on each week or month, lets trade them until they either exceed their maximum drawdown or consecutive losses according to the 5 year results (could also use a shorter window of 1 year too).

-

August 9, 2025 at 15:53 #465237

Samuel Jackson

ModeratorAlso, you can make a habit of downloading the top EAs from the APP regularly and putting them on your own incubator account and using fx blue to wait until you get your own 20 trade history.

This would let you have additional strategies as they are selected based on best recent performance and so change often but this may let you find others that are actually able to perform well over time.

One demo account should be fine as you can have 99 EAs running and should simply remove any that haven’t shown profitable performance after 20 trades (or something similarly sensible) as maybe a monthly clean up task.

Let me know how that sounds and let me know how you get on? Also if you want to share anything you have done already then we can further discuss and make some tweaks

-

August 16, 2025 at 13:26 #466445

Alesamo

ParticipantI started a new demo account with your proposed process, i.e. with all FX EAs that have at least 20 OOS trades. The problem – for now, only 4 out of ALL EAs meet this criteria, but let’s see… On top of that I started back in June to download weekly all new EAs and I am testing these also on meanwhile 2 different demo accounts (due to the 99 EA restriction I had to start another one recently). I am also using those EAs from these 2 accounts that have a positive PF as well as 20+ trades, unfortunately, these are also not many (also only 4 to be precise, all others that have 20+ trades are negative). What I also noticed – those EAs that perform ok (i.e. have 20 trades and a positive PF) can meanwhile not any longer be found in the Top 10 App, i.e. these were already replaced by others…. Will report a few weeks back how this new approach is developping… Anyone else here that maybe has a successful process and is willing to share? Thanks.

-

August 18, 2025 at 12:17 #466655

Maria DochevaKeymaster

Maria DochevaKeymasterHello Alesamo,

Thanks a lot for sharing your detailed update and for taking the time to test this approach so thoroughly. It’s really helpful to see how you’re structuring your process and the challenges you’re facing with the limited number of EAs meeting the criteria.

We’ll be very interested to hear how things develop over the next few weeks with your demo accounts. Please keep us posted on the results—your insights will definitely be valuable for everyone here.

-

-

August 18, 2025 at 19:11 #466755

Samuel Jackson

ModeratorHey Alesemo, yes thats a great start. Less is okay though, you just need a few trading at a time. If you get up to 10 then great but 3 is fine too. Also great to hear about results after a few weeks but also remember that a few months performance is much more important and really even what the max stagnation is for the strategies too.

-

-

AuthorPosts

- You must be logged in to reply to this topic.