Home › Forums › Trading Courses › Last Month best Robots + 30 EAs Every Month – providing fxblue results

- This topic has 4 replies, 2 voices, and was last updated 11 months, 1 week ago by

Jacek.

-

AuthorPosts

-

-

September 20, 2024 at 2:36 #310730

Jacek

ParticipantHi, I have just finished that course. The example EAs used in it generated about 17% profit in 5 days. That is really a great result!!

However, I went to fxblue.com to check on that account and for the next 3 days those EAs didn’t trade, but right after that started sliding down. The end result after about 30 days went down to $727 (278% down from the starting $1k). Do you maybe know what happened?

Also, would it be possible to include a link to the fxblue previous month stats with each new EAs release? It would be also really nice to get some notes which EAs were removed from the package / and when. It would be really helpful for us noobs to better understand how to manage those packages (whether we did the same, whether there are new approaches, etc.).

I really love that course!!! Totally enjoyed it and am looking forward to starting my forex experience.

-

September 23, 2024 at 12:02 #311618

Ilan VardyModerator

Ilan VardyModeratorHi Jacek,

We don’t link the EAs to FXBlue – we link the account the EAs are trading on. If you would like to see the performance of an EA for any previous period, the easiest would be to import it back into EA Studio. You don’t need a license for this. In terms of which EAs were removed, every month we select the best performers of the previous month, and you can easily see if any have performed well for a longer period by looking at the magic numbers.

Thanks,

Ilan -

September 25, 2024 at 3:36 #311986

Jacek

ParticipantThank you Ilan,

I live in US, so there are not that many brokers to choose from. All those brokers have leverage maxed at 50, plus don’t permit hedging. I have 3 demo accounts from tastyfx / IG running on a local machine (no VPS yet), and that gives me around 150 ms roundtrip. I use two of those accounts to run EAs from your 2 courses (“21-Day Ultra …” and “Last Month best …”). one account so far is slightly in red, the other circles around no profit / loss. There are plenty of small trades made / closed, though. Is it possible that those EAs are suffering because of those US restrictions?

Thank you,

Jacek

-

September 26, 2024 at 18:13 #312335

Ilan VardyModerator

Ilan VardyModeratorHey Jacek,

I know, trading in the States is tough, with the hedging and FIFO rules. The EAs are created with a leverage of 1:100 as a settings. Be that as it may, it’s very normal for accounts to be in the red when trading many EAs on an account. The idea is to keep all of the EAs in a demo account, keep track of their performance using EA Studio, and only trade those currently profiting in current market conditions in a “live” account. While you’re practicing, open another demo account, and try this method. Keep in mind that every EA will go through drawdowns. Even the most profitable strategies over an extended period had periods of drawdowns and stagnation. The idea again, is that the others compensate for those periods by being profitable. I can’t say if they’re suffering due to US restrictions, but a VPS in another location would help you identify if that’s the case. You won’t need to do a KYC until you trade live.

Hope this helps,

Ilan -

September 26, 2024 at 23:57 #312396

Jacek

ParticipantHi Ilan,

Thank you for the feedback. I have few related questions.

As far as the leverage, can I assume that if for a non US-restricted (i.e., 1:100) $10k account the EntryLot should be set to 0.1 (as an example), then for a US account that runs with 1:50, the EntryLot should be lowered to 0.05 to run with the same safety? Or this should be compensated in another way?

As far as running 2 demo accounts, this is basically what I described in the other post. However, as on avg, those EAs are making about 8 trades per month, fine-tuning the initial restriction will take a month or so, not prematurely eliminate good EAs with a one-off trade. Therefore, I mentioned that including some info (a screenshot with how those robots performed up to release time) would eliminate that initial startup delay.

As far as hedging being not permitted in the US (tastyfx will manipulate trades if hedging is detected), what can we do to those EAs to comply with that restriction? Do we need to modify the code to block either buys or sales (checked one EA, and it is a simple code modification to permanently enable just one direction). From what I have seen so far (not much), I saw that some EAs offer three options: 1. B&S, 2. B, 3. S. It looks to me that for your EAs, maybe “either B or S” (exclusive OR) may work better than B/S only.

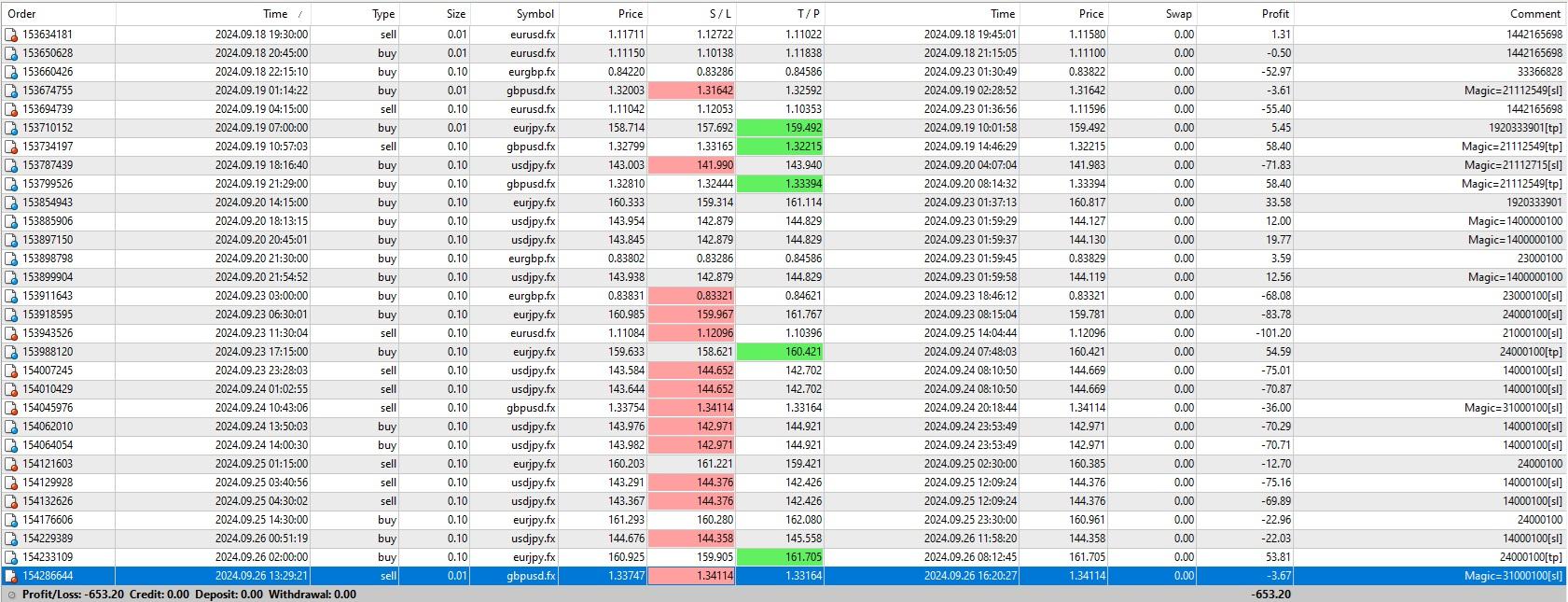

Right now, my both accounts are in red, but not much (both are $10k demo accounts). One is down to about $9.5k with pending -$50 (5 robots), where the other is at down to $9.8k with another -$200 pending (3×10 robots). There are not enough trades to select the best, as there are really no clear winners yet.

I will be opening a live account in the next few days (with tastyfx / US-IG), and will be getting a VPS (tastyfx has free VPSes for $2k+ accounts, if not then most likely Hyonix).

Thank you,

Jacek

PS.

Here is a screenshot of one of those accounts (5 robots from “21-Day Ultra Algo Program …” course).

By the way, either the first or the second day I had to manually close abandoned transactions, as I changed the Magic Number. Although, the rest also shows the trend.

Again, that demo account is running for about a week, so all that info is not that much statistically significant yet.

-

-

AuthorPosts

- You must be logged in to reply to this topic.