Home › Forums › EA Studio › EA Studio Tools and Settings › EA Studio Tools and Settings: Updates

- This topic has 33 replies, 2 voices, and was last updated 1 year, 10 months ago by

Alan Northam.

-

AuthorPosts

-

-

February 22, 2017 at 11:46 #435466

Stoyan Stoyanov

ModeratorThis topic focuses on Updates related to the Tools and Settings in EA Studio.

P.S. Please use the Reply button if you want to reply to a specific comment. This would make the topic organized and easier to navigate through and will reduce number of duplicate questions.

-

May 1, 2017 at 21:16 #1427

Jade Brown

ParticipantIn this topic we will share the changes made on the EA studio – the Forex trading software. This way everyone will stay updated.

What lately we have is the change in the Acceptance criteria, we have now:

1. Maximum ambiguous bars

2. Minimum net profit

3. Minimum count of trades

-

May 2, 2017 at 15:14 #1428

Jade Brown

ParticipantThese 3 come by default on the Forex trading software and the other you may add to your Acceptance criteria.

-

May 2, 2017 at 15:17 #1429

Jade Brown

ParticipantAlso we have a validation now on Monte Carlo and Multi Market which gives as better Forex strategies and better results when using the Forex trading software – EA Studio!

-

May 11, 2017 at 16:49 #1483

Jade Brown

ParticipantAnd the new tool that exports portfolio of trading strategies into one expert, is it using the Monte Carlo and Multi markets? Sorry if the question is stupid

-

May 15, 2017 at 20:57 #1521

Jade Brown

Participantthe new tool is experimental in the Forex trading Software. Be careful using it. There are no stupid questions when it comes to Forex trading software. Actually your question is not clear. The Monte Carlo and Multi markets are tools to test the robustness of the strategies. So basically you are using these to create the strategies and after that with the new tool, you can export the trading portfolio.

-

June 15, 2017 at 20:01 #1619

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterEA studio is great Forex trading software! I have used it for the last one month and its really simple and easy. The EAs that it exports are working with no any mistakes! Good job for the course Portfolio of Forex Strategies, where i learned how to use it properly. Great job guys!!!

-

July 6, 2017 at 17:58 #1891

Zack Georgiev

ParticipantI have a question about the EA STUDIO, how come it works so fast? Really on moments i start to think that something is wrong there…i hope not. I mean so far i can not see anything wrong but when i compare it with FSB is so so fast!

-

July 6, 2017 at 18:06 #1892

Zack Georgiev

ParticipantIts much faster because it is web based and works only with MT4 indicators. FSB is heavier because it is working on Higher Time Frames and is using custom indicators. The academy is using each Forex trading software and so far nothing wrong there.

-

July 26, 2017 at 15:07 #1934

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterYes, its really fast and when i compare the trades opened in the demo account and after that when i import the fresh data, i see they match, thats all i need see

-

August 6, 2017 at 18:52 #1952

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterDear traders. There are two updates in EA Studio.

1. There is the validation. With this tool you are able to bring back old strategies, collections and even folders with strategies and collection and it will update with the recent historical data. Of course you need to have first to update the data. That saves us a lot of time now, so the old collections are just like new – optimized and tested with the robustness tools.

2. The second is the Trading Session. Now from settings you can set up the closing hours of your broker:

http://s1.postimg.org/mydw560jj/screenshot_360.png

Please have in mind that this will affect to all strategies and not to a single one. Also if you change the broker, make sure you correct it and go over the validation to update with the historical data and the closing hours from the new broker. -

August 6, 2017 at 18:55 #1953

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThe course Portfolio of Forex Strategies will be updated this mounth with more details about the new tools.

-

September 1, 2017 at 12:03 #2123

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello guys,

The course was updated. We have create news from The Forex trading software company – there will be 14 days free trial for EA Studio as well! :) -

December 25, 2017 at 17:59 #3008

Thapelo

ParticipantDear Petko, I saw many new things in the Forex trading software EA Studio – there is a great beck stop and some more things new…actually I am not so sure which are new because I have the license from 1 month, but I think there are some new things. Are you planning to put another update on How to build 100s of Forex Strategies course.

-

January 6, 2018 at 15:20 #3114

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterDear Thapelo,

I have just recorded the video. We will uploaded very soon. Yes, there are quite many new things that help us create better strategies in the Forex trading software EA Studio.

Regards -

August 29, 2018 at 10:09 #5957

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterThe newest feature in the Forex trading software EA Studio is the Walk Forward validation.

That feature helps to filter the strategies, and do a better robustness testing before start trading.

We will update the courses with it.

Cheers

-

September 7, 2018 at 14:09 #6111

Traderzonefx

ParticipantPetko,do you use the feature trading portfolio experts? Did you test it, and if yes,how did you create the strategies for it, same as the regular experts?

-

September 17, 2018 at 12:27 #6270

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Traderzonefx,

yes, actually we just launched the new course which is called Trading Portfolio Expert Advisors + 100 Strategies included

In the course I show how exactly I am using the Portfolio trading feature in EA Studio Forex trading software.

Yes, it is just as a regular Expert Advisors, but the difficulty comes when filtering the results and leaving only the strategies that are currently making profits.

In the course I show the 3 methods to filter the strategies and a trick in the code to eliminate the losing ones.

-

September 20, 2018 at 6:33 #6306

uniedcom

ParticipantSince I am in USA. Any possibility to update EA studio to support the restrictions we endure here.

I really like the simplistic approach Portfolio EA gives you. Can we add two features to the EA Studio which will allow USA specific strategies to be generated.

1. A Setting to optimize for strategies that will trade in one direction at a time. If one strategy opens a long trade then all subsequent strategies will be forced to only open long trades while that first long trade is open. Vice Versa on short trade.

1a. If creating optimized strategies is to difficult, maybe just adding the logic so that with any strategy if the option for one direction is enabled the EA will only open trades in the direction of the current open trade.

2. FIFO option so that it can automatically be included with EA when it generates the code. This should be able to close all open trades from first to last. I do see possible problems with this when multiple strategies are used in a single EA for profitability.

2.a It would be nice to just have this as an automatic option even if generating individual EA’s.Just these two Features will allow Strategies to be developed for USA brokers. The first one might be a little more complicated to develop but FIFO should not be a hard feature to add.

Thank you for an amazing Solution and the videos you have produced. I especially like your most recent one and your tip for using the Validator for Demo Testing.

Keep up the good job.

-

September 20, 2018 at 10:24 #6307

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

I am am very glad to hear that you liked the videos and the course. Yes, currently it is a bit of issue trading portfolio of EAs on one currency pair in USA.

1. Actually here you are trying to fir the trading into the FIFO rule which would be very wrong. The idea of trading different strategies in one Portfolio is to diversify the risk. If you have a long entry, and all the rest EAs open long trades because of the first entry, and the price goes down? Obviously there will be a huge loss because all the positions are on the opposite direction.

1a. The Forex Strategy Builder Pro has the option to add to a trade. And that is different. When you use one strategy/expert advisor and it opens trade, with the FSB Pro you can select if you want to add to the position on the next same direction signal. You can add up to 20 times. This is much more applicable because the entries would be from the same strategy, and every next opened trade will confirm the direction. Actually I show that in the Top 5 Forex Strategies course, and 3 of the strategies are with adding option.

2. There is much better solution here, and Forex Software LTD is working on such Forex trading software. Since it is a “know how”, I can not share it before it is released. It will solve the problem, and it will change in total the algorithmic trading. However, I am not sure when it will be ready, not sure if it will be during 2018 at all.

But once it is ready, I will make sure that all my students know about it. because it will be game changing.

The solution at the moment for you is to create different portfolios for the different currency pairs. If you can test them on a Demo account with an international broker, and select only the best 1 performer per currency. After that you can place the selected EAs into live account with local broker. Since they are on different assets, it will not be against the FIFO rule.

Kind regards,

-

September 22, 2018 at 4:10 #6390

uniedcom

ParticipantNow I am even more excited please put me on whatever list you need to for when you release the better solution that you can notify me and if you need a beta tester I will be willing to test for you also.

In the mean time I will do my best with what I have to work with now. I saw that feature in the FSB Pro I will use that to build my strategies then. Until I can find a broker that will allow trading with EA Studio robots.

I did have another question. In one of your courses you set the acceptance criteria on the Reactor for min 300 trades. Do you adjust this amount for different time frames and if so can you share those amounts for the different time-frames please.

Thanks

-

-

September 22, 2018 at 10:14 #6392

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

For sure, I will let anyone what the new feature/software is available, because it will be useful to everyone, not only the US citizens.

Actually with FSB Pro, you are able to create more professional and complicated EAs.

Make sure to watch the Free videos from the developer of this Forex trading Software:

https://eatradingacademy.com/forex-strategy-builder-software/

Also, I have made a long video/article about it sometime ago:

About the min count of trades, it depends on the Historical data you have. The more data, the more min count of trades you can set in the Acceptance criteria.

So if you place 300, and you see that you have many strategies generated, you can stop and set it to 400, and than to 500. Until you find some value in the middle, not to limit the reactor of having no strategies, and in the same time to have enough strategies to work on.

The idea of the min count of trades is that the more we have, the more reliable the becktest is. Obviously we want to trade a strategy that showed profitability over 300-400 consecutive trades, and not over 20-30.

Let me know if there is something else.

Beautiful weekend ahead!

-

September 23, 2018 at 6:09 #6407

uniedcom

ParticipantThank you for the information above. Are the courses on udemy?

Okay I just discovered that Oanda only provides 180 days of historical data. https://www.oanda.com/fx-for-business/historical-rates. There also seems to be a problem with the quality of data from Oanda https://mechanicalforex.com/2015/12/oandas-not-so-good-1m-data-can-you-trust-your-own-brokers-historical-data.html

If I wanted more data I would need to pay $75 per month which I find a little excessive. Is 180 days enough to build strategies?

Can I use something like this rather for historical data http://www.histdata.com/download-free-forex-data/ to create strategies from?

I just need to find another broker I think. Do you have any experience with paxforex.com? I am able to setup an account with them and they support hedging etc.

Thanks for all your help and advice.

-

September 23, 2018 at 22:55 #6411

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

Yes, we have our courses on Udemy as well, the very same as on our website.

It is the best to have the History data from your broker, and not downloading it from somewhere.

For sure you do not need to pay for History data. Just leave your Meta Trader opened, and with the time it will collect you the data.

You can always save it from your Meta Trader, or if you change computer, you can transfer it. Go to Files-open data folder-history. And you will see the server of your broker. You can save this file from time to time.

Kind regards

-

September 23, 2018 at 22:55 #6412

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello,

Yes, we have our courses on Udemy as well, the very same as on our website.

It is the best to have the History data from your broker, and not downloading it from somewhere.

For sure you do not need to pay for History data. Just leave your Meta Trader opened, and with the time it will collect you the data.

You can always save it from your Meta Trader, or if you change computer, you can transfer it. Go to Files-open data folder-history. And you will see the server of your broker. You can save this file from time to time.

Kind regards

-

April 20, 2020 at 8:57 #45406

Ilan VardyModerator

Ilan VardyModeratorHi Petko,

As the EA Studio app gets updated with new features, do you change the course material? For example, if there is a course that was recorded in 2017, where only the generator was available, may have better settings that can be used now using the reactor and additional acceptance criteria.

In other words, do you still use the same settings on EA Studio for currency pairs that you used 2 or 3 years ago. If you do use new settings, could you maybe add them as a PDF resource on the courses?

Thanks,

Ilan

-

April 20, 2020 at 14:31 #45418

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHello Ilan,

I make sure to update the courses regularly. I have actually re-recorded completely the 2 oldest courses – The Top 5 Forex EAs, and the Top 10 EURUSD strategies course.

Also, some of the updates don’t change the program, it just improves the traders’ experience. More, there are often updates that we don’t understand about – it is on the backend. For example, there was an update that improved the speed of the generator.

-

April 29, 2020 at 9:39 #46584

Ilan VardyModerator

Ilan VardyModeratorHi Petko,

Do you perhaps have a document where you have the settings you use in EA Studio for each currency pair – eg. Monte Carlo, Walk Forward, Acceptance criteria for different pairs? I mean, the settings that you have found are best for each pair. In each of your courses I’ve done, I’ve noticed there are some settings that are the same, but others that differ.

Thanks again,

Ilan

-

April 30, 2020 at 9:24 #46607

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Ilan,

honestly, I don’t have such a table. I used to have but I noticed that following the same criteria brings me to similar strategies…something I want to avoid.

So I mix the criteria every time I use the Reactor. This way I see different strategies that increase risk diversification.

Yes, I Stick around 500 counts of trades and 1.2 PF but from there I try to add different robustness tests or additional criteria.

-

May 6, 2020 at 8:17 #47066

Ilan VardyModerator

Ilan VardyModeratorHi Petko,

I have been creating EAs for multiple currency pairs using the settings you suggested above. I am using both Generator and Reactor.

My

Generator settings are 20% OOS, Net Balance, Working time of 600 minutes. Acceptance criteria Count of trades: 500, profit factor 1.2 and In and Out of Sample set to 1. In the courses you teach 1.1, but it seems the platform now only accepts full digits – i.e. 1, 2, 3, etc.

Reactor settings are Monte Carlo validation, with Count of tests at 20, and Validated tests at 80%.

What I am finding once my EAs have been created and I’ve put them onto a demo account, is that many strategies are similar – they open at the same point, but the TP and SL are slightly higher or lower. Is this normal? You teach that the strategies should be different to achieve different results.

What can I change to achieve this, and would you recommend any different or additional acceptance criteria when creating my EAs, for example minimum R-squared at 70-75%?

Thanks in advance,

Ilan

-

May 8, 2020 at 7:20 #47329

Ilan VardyModerator

Ilan VardyModeratorHi Petko,

Thinking about my question above some more, I think (and please correct me if I am wrong) that what I should do is check the strategies in EA Studio, and compare the long and short entry conditions to see if they have the same or similar conditions?

Thanks,

Ilan

-

May 9, 2020 at 15:03 #47473

Petko AleksandrovKeymaster

Petko AleksandrovKeymasterHey Ilan,

Good question here which is important to make it clear.

You see the same entry point because the EAs from EA Studio work on the bar opening. And if you trade on M15, this means that when there is a signal from few of the EAs in one bar, they all will open on the opening of the next bar, which looks like the same signal but it is not. It is the same moment and price.

If you keep the correlation analyses checked in the settings, there is no way that you will generate strategies with the same entry or exit rules.

-

June 25, 2023 at 19:53 #178001

Alan Northam

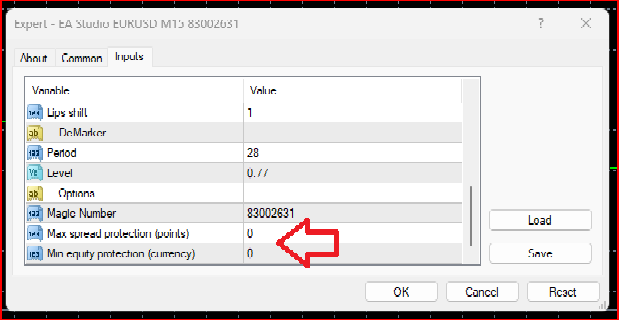

ParticipantApproximately two weeks ago “Max spread protection” and “Min equity protection” was added to the Expert Advisor Properties dialog box.

Let’s look at each of these individually to see how they work:

Max spread protection – The spread, or the difference between the bid and ask price of an asset (currency pair), can be large at times and can affect the daily profits and losses of a trader’s brokerage account. During the first couple of hours following the opening of the foreign currency market each day the spread of assets can become quite large. Further, some FX brokers use variable spreads during the day based on the volatility of the foreign exchange markets. now traders can control the maximum spread to limit the effect higher spreads can have on their accounts. As an example: By setting the “Max spread protection” to 50, traders can now limit the spread to 5 pips. What this means is when the spread increases above 5 pips the Expert Advisor (EA) will not place a trade. The only time when an Expert Advisor will open or enter a trade position is when the spread is below 5 pips.

Min equity protection – There will always be a period of time when an Expert Advisor will undergo a drawdown. Sometimes the drawdown will be shallow and sometimes can be quite severe. This addition to the EA Properties box can help protect a trader’s account from a severe drawdown. As an example let’s see how this works: Let’s say you set the “Min equity protection” to $300. This means that if the equity in your account today is $5000 then the maximum drawdown will be limited to $4700. So here is what will happen: When your account draws down to below $4700 any open position will be closed and the Expert Advisor will be removed from your MetaTrader chart window.

*Always test new options on a demo account before using them on a live account to verify they are working as expected!

**Personally, I do not like the idea of using dollars to set the minimum equity protection. I would rather it be in percent of equity. I have requested this option to be added. -

October 17, 2023 at 18:57 #205256

Alan Northam

ParticipantTo update to the latest version of EA Studio use Ctrl + F5.

-

-

AuthorPosts

- You must be logged in to reply to this topic.