Best EA for Prop Firms: Introduction

Hello traders and welcome to our ultimate guide on the Prop Firm Robots App. In this guide, we will show you how we use the app to find the best EAs to pass prop firms challenges. We will give you detailed information on everything you need – from navigating the app to effectively using Expert Advisors with prop firms. If you’re ready, let’s get started.

The Origin of the Prop Firm Robots App

The Prop Firm Robots App was inspired by the creation of the Top 10 Robots App, a web-based application available on the EA Trading Academy website. The initial idea came from using the EA Studio software, which creates trading strategies based on historical data from various brokers. By selecting a data source and starting the Generator, the software can create hundreds of strategies within seconds, which are then stored for further evaluation against a variety of metrics.

Creating and testing these strategies was time-consuming. We were placing the strategies on demo accounts and connecting them to FXBlue to monitor their performance. Then we would regularly move the best strategies in current market conditions into live accounts. Although the trading itself was automated, managing it still took a lot of effort. This challenge led to the idea of developing a more efficient solution.

The Birth of the Top 10 Robots App

To simplify this process, our team created the Top 10 Robots App. This web app automated the generation and testing of strategies. Our servers generate strategies, around the clock which are then tested and validated using historical data from multiple brokers. The top strategies are selected and displayed on the app and traders can instantly download the Expert Advisors for MetaTrader 4 or MetaTrader 5 with a single click, eliminating the need for programming knowledge and ensuring that advanced trading strategies are accessible to everyone. If you want to learn more about the strategy generation process check out our Top Robots 10 app guide.

Creation of the Prop Firm Robots App

The success of the Top 10 Robots App and feedback from users led to the creation of the Prop Firm Robots App. This new app builds on the strengths of Top 10 Robots App, incorporating strategy generation and selection processes designed specifically for prop firm trading challenges. The goal was to provide traders with a tool that simplifies the process of passing prop firm challenges.

Getting Started with Prop Firm Robots App

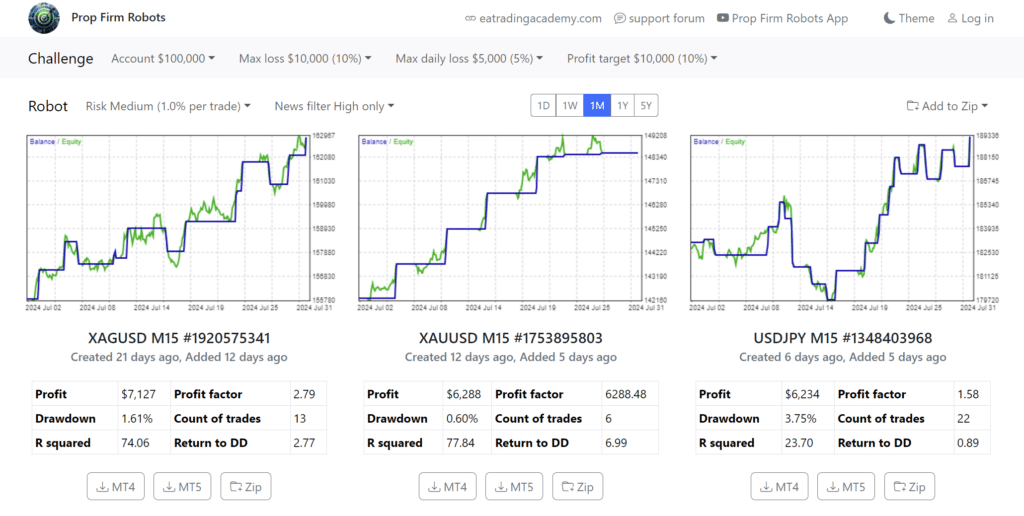

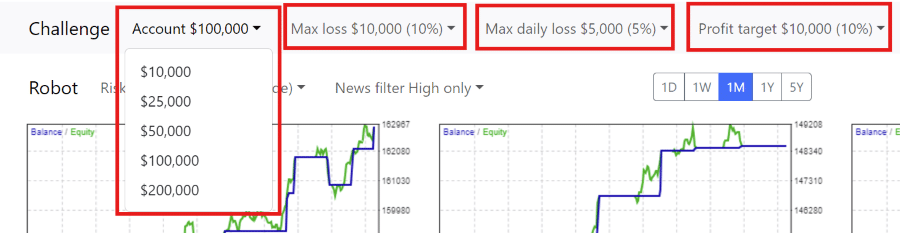

The Prop Firm Robots App is designed to help traders see the performance of various Expert Advisors. You can set your trading challenges, such as the initial balance and risk levels, and the app does the rest. For example, if you choose a $10,000 challenge with a 6% max loss, the app will automatically adjust its settings to fit these parameters.

Setting Up Your Trading Challenge

First, open the Prop Firm Robots App. Choose your desired challenge size and set the maximum daily loss and overall loss limits. For a $10,000 challenge, you might set a daily loss limit of $500 and a total loss limit of $1,000. The app will then adjust the profit target and other settings accordingly.

To select the EAs to use with your specific challenge, navigate to the challenges section near the top of the app. Here, you can select the challenge and your trading goals and risk appetite. Setting the correct parameters is crucial to ensure you select the correct EAs and settings for your particular needs. As you select the options available, you’ll see the backtest results may change accordingly.

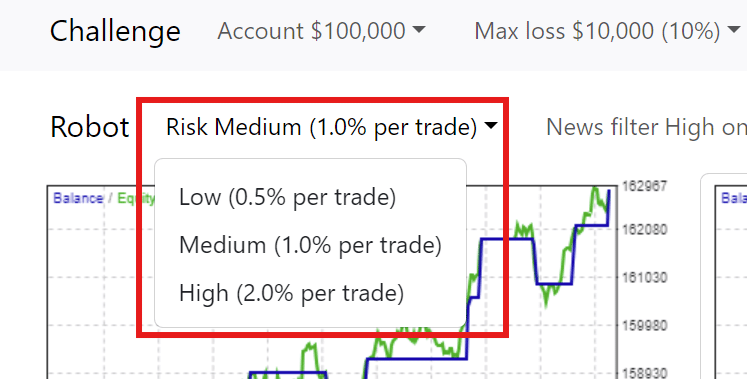

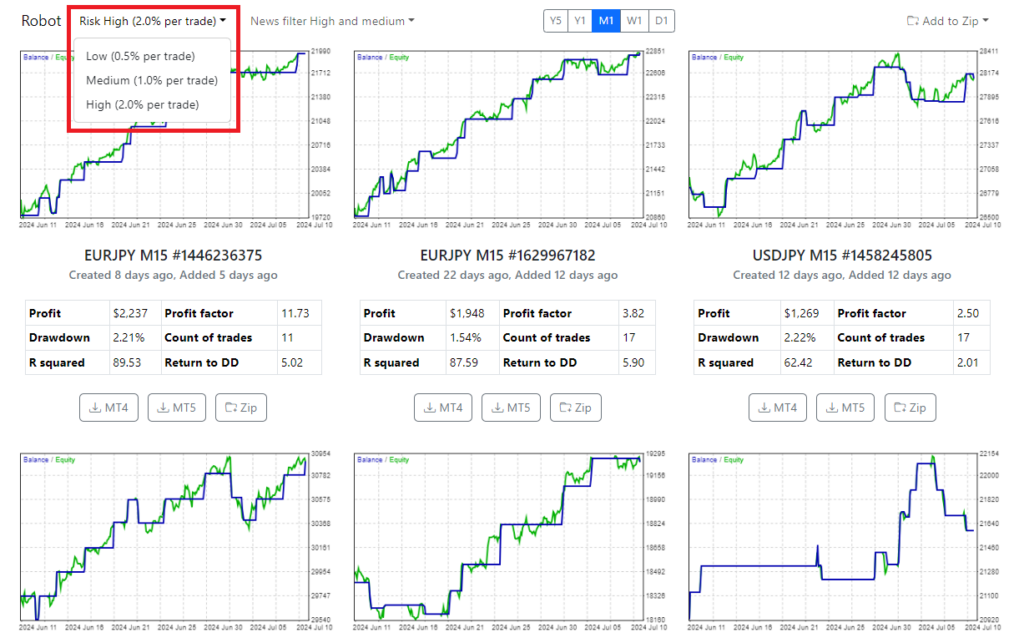

Choosing Your Risk Level

Decide on your risk level: low, medium, or high. If you choose medium risk, each trade that hits the stop loss will lose no more than 1% of your account. Higher risk levels will increase this percentage, but also the potential profits. Understanding your risk tolerance is essential for long-term success in trading.

Medium risk is often a balanced approach for many traders. It allows for reasonable gains without exposing the account to excessive risk. On the other hand, low risk is suitable for conservative traders who prefer steady growth over time. High risk is for aggressive traders aiming for significant returns but prepared to handle higher volatility.

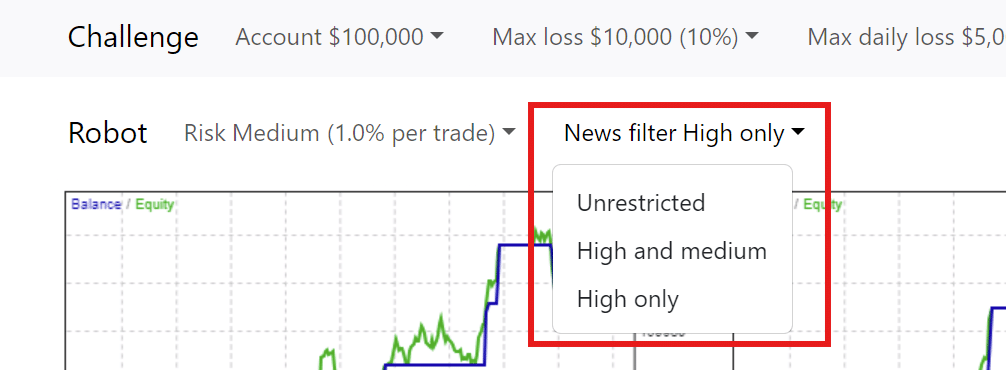

Using the News Filter

To avoid high-impact news events that can cause market fluctuations, use the news filter. Set it to disable trading during these times, ensuring your strategies remain effective and your risk is minimized. The news filter is a valuable tool that prevents the EAs from opening new positions when significant economic announcements are expected. This helps to avoid unexpected market movements that could negatively impact your trades. Check out our Knowledge Base section about the News Filter to see all the options explained in detail.

The news filter settings can be adjusted to account for high and medium-priority news. For instance, you can set the filter to prevent trades two minutes before and five minutes after high-impact news events. This buffer period ensures that the market has time to stabilize before the EAs resume trading.

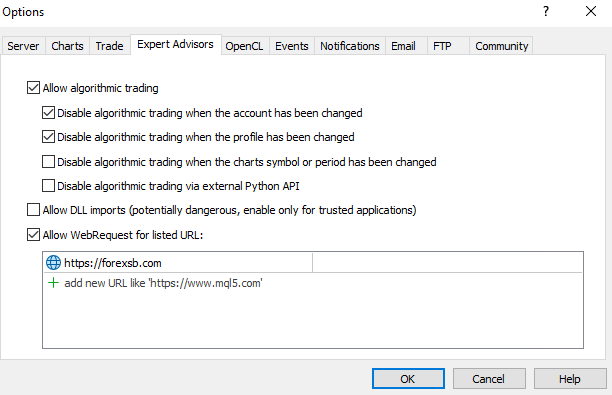

To use the News Filter, on your MetaTrader platform, click on Tools -> Option. Navigate to the Expert Advisors tab. Enable the check box “Allow WebRequest for listed URL“. Add the following URL in the box below: https://forexsb.com. This is the URL of our news service. Note, you only need to do this once. It will apply to all EAs installed, and all of those that will be installed.

The Stats Period

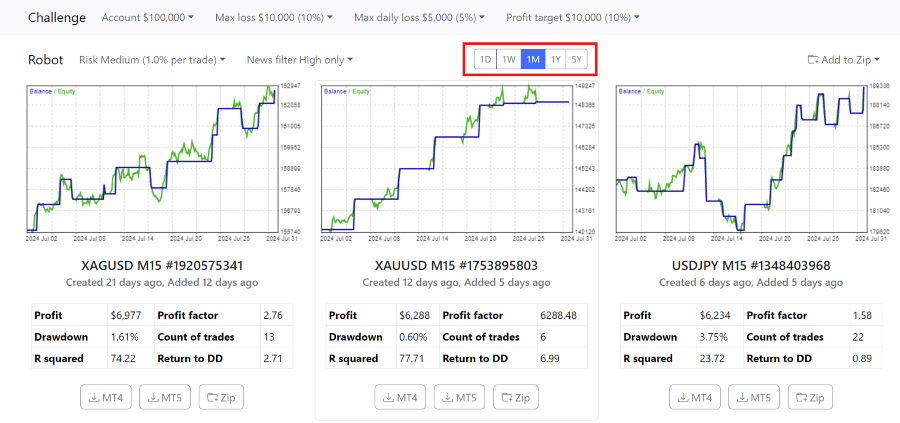

One of the great features of the Prop Firm Robot App is the stats period which allows users to effortlessly identify top-performing Expert Advisors based on their performance over different time frames, eliminating the need for manual testing and tracking. Users can now make informed trading decisions using real-time data on EA performance for daily (1D), weekly (1W), monthly (1M), yearly (1Y) and 5 years (5Y) periods. This feature is very useful when understanding how a strategy has performed, and is currently performing.

Downloading & Installing Expert Advisors

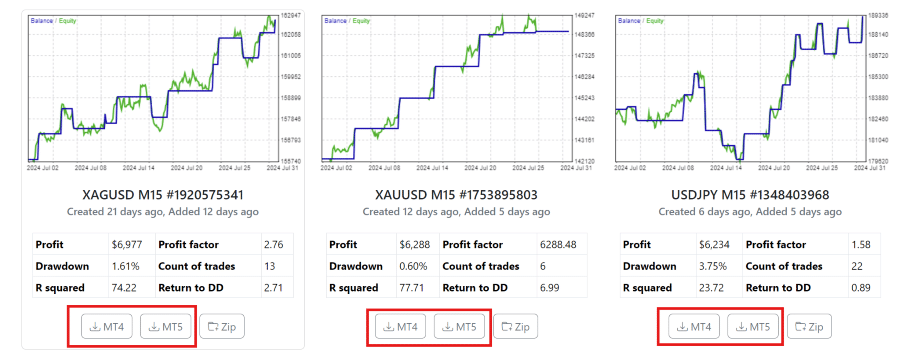

With the Prop Firm Robots app, you can easily download EAs for various currency pairs. To do this, you can select the top performing Expert Advisors from the desired stats period and download them for use in MetaTrader 4 or MetaTrader 5.

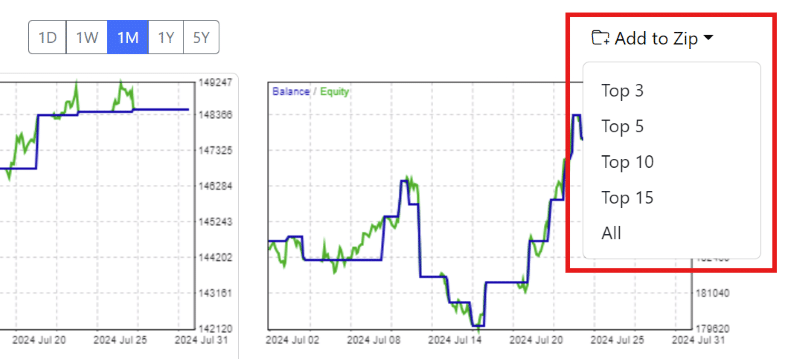

Furthermore, you can download the EAs you need from the Prop Firm Robots App individually or all at once as a zip file.

Setting Up Your MetaTrader Platform

If you select to download more than one EA at a time, you have the option to download these as a Zip file. After downloading the compressed files, unzip them by right-clicking and selecting “Extract All.” Choose a folder to store them and click “Extract.” Once the Expert Advisors are ready, open a demo account with any regulated broker offering the MetaTrader platform or from your chosen Prop Firm. Demo trading is always recommended initially until you become familiar and comfortable with trading on MetaTrader with EAs.

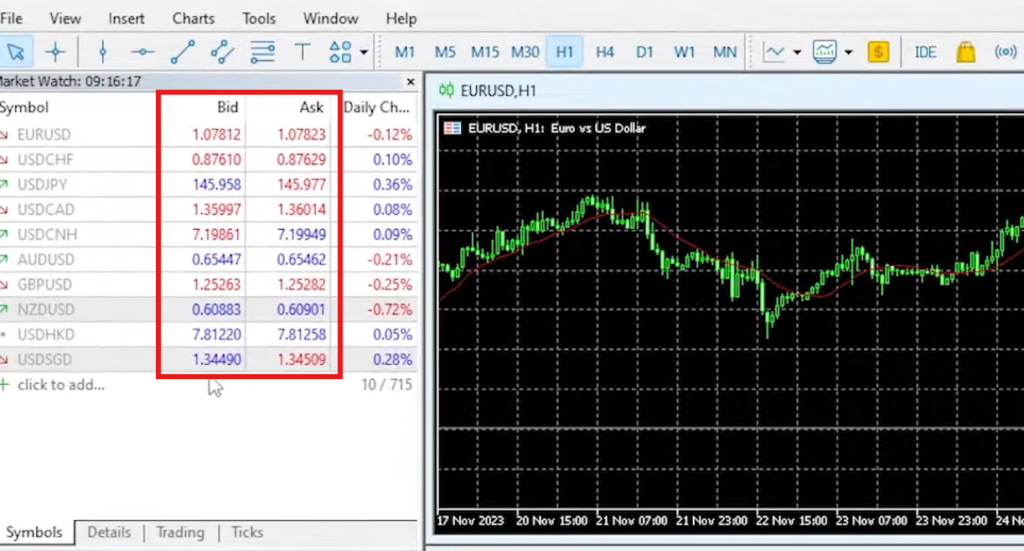

Next, install the MetaTrader platform on your computer or Virtual Private Server. You can install multiple platforms by changing the destination folder during installation. For instance, add a number to the installation folder name to differentiate them. Once installed, open MetaTrader and log into your demo or live prop firm challenge trading account. You’ll know you’re connected when you see the bid and ask prices in the Market Watch window.

Install the EAs on MetaTrader

To install the EAs on MetaTrader, follow these steps:

- Download the EAs from the app.

- Open MetaTrader and go to “File” > “Open Data Folder.”

- Navigate to the “MQL4” (for MetaTrader 4) or “MQL5” (for MetaTrader 5) directory and then to “Experts”, and “Advisors” (For MT5)

- Paste the downloaded EAs into this folder.

- Restart MetaTrader to see the EAs listed in the “Navigator” panel.

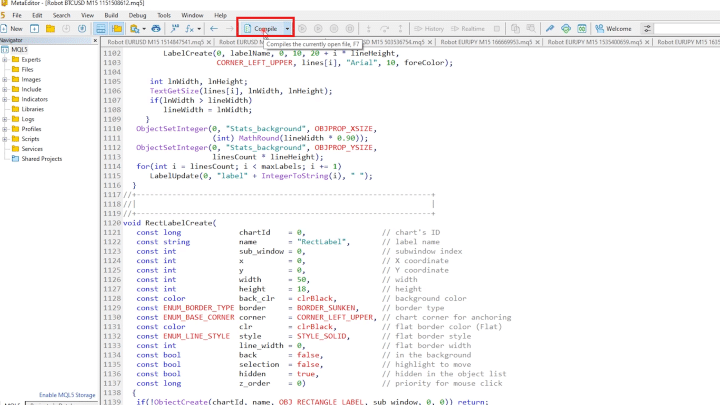

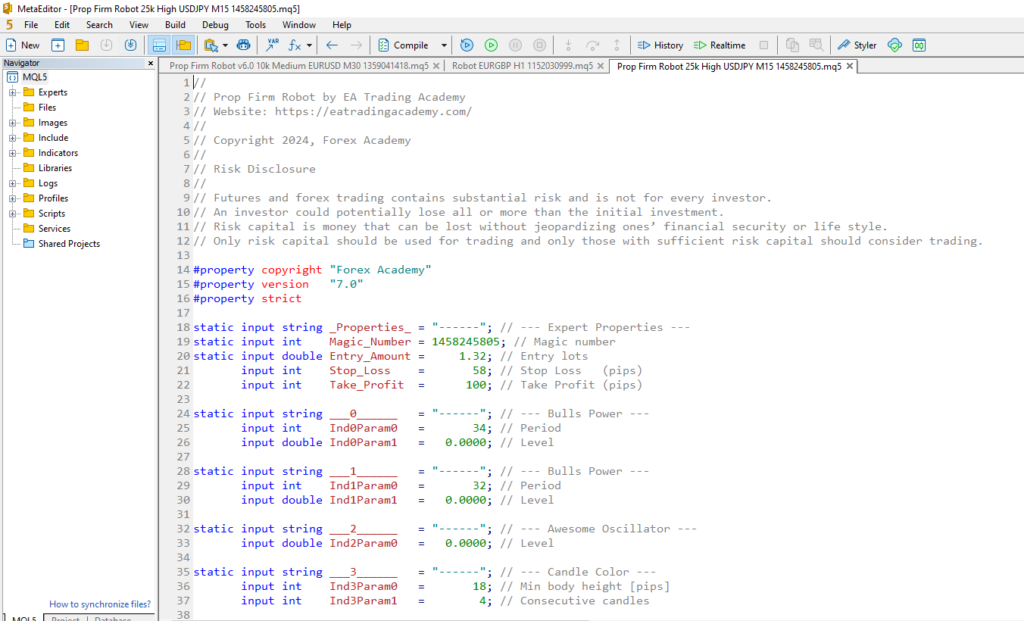

Next, compile the EAs if necessary. Normally, MetaTrader will do this automatically when the platform starts. If you don’t see your EAs in the Navigator window, you can access the source code in MetaEditor and compile the EAs easily to create the ready-to-use file. To do this, simply double-click on the EA in the ‘Experts” or “Advisors” directory, and the associated app, MetaEditor will open the file and the source code will be displayed. You’ll see a button named “Compile” on the top. Simply click on, and the EA will compile in 1 or 2 seconds.

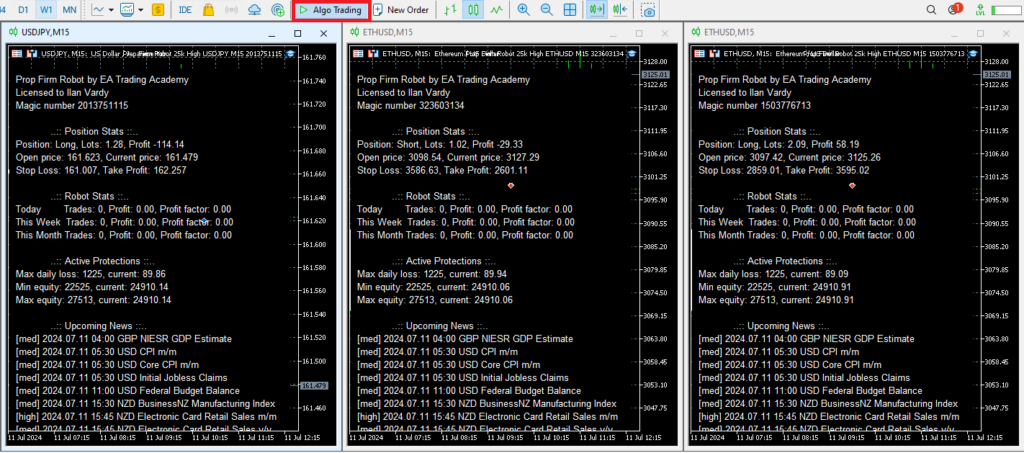

To use the EAs, enable Auto/ Algo Trading, drag and drop them onto the M15 time frame charts, and adjust the settings as needed. Repeat this process for each EA. It is critical to enable the Auto / Algo Trading before placing your EAs onto the charts. This is covered in more detail a little further down in the post.

Using a VPS for Continuous Trading

A Virtual Private Server (VPS) ensures your trading platform runs 24/7. This is important because if your computer disconnects from the internet, the EAs will stop working. A VPS keeps everything running smoothly, even if your home computer is off. Many traders use a VPS because it provides a stable and continuous trading environment.

There are several VPS providers to choose from, offering different levels of performance and pricing. When selecting a VPS, consider factors like uptime guarantee, server location, and customer support. A reliable VPS will help your trading experience by making sure your EAs run without interruption.

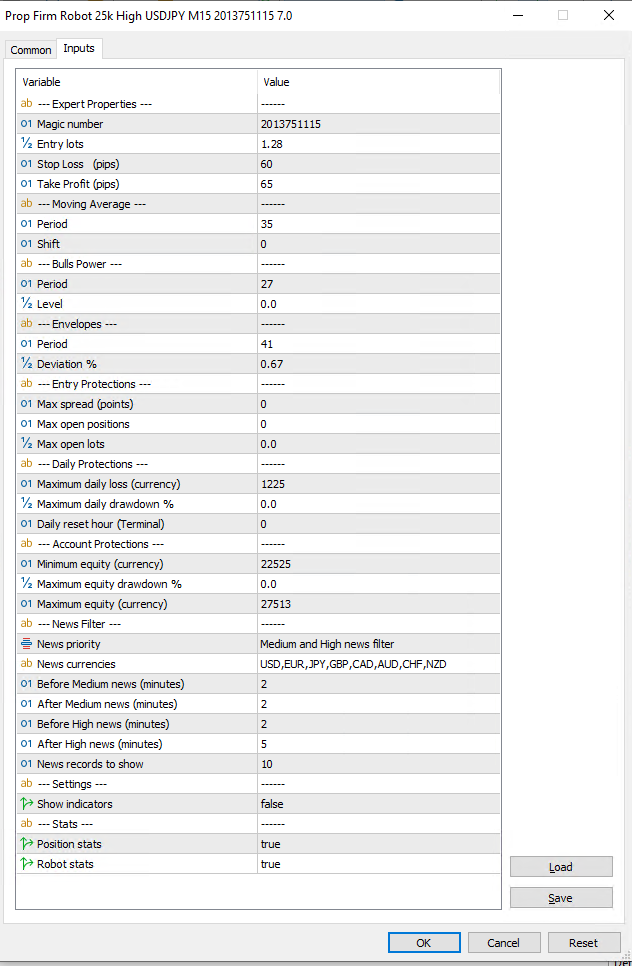

Understanding Expert Properties

Each EA has specific settings that can to be adjusted to match your trading strategy. These settings include lot size, stop loss, take profit, and trading hours. It’s important to review and customize these settings before starting the EAs to ensure they align with your trading goals.

Each EA has specific properties you can adjust:

- Entry Lots: Set the lot size for new positions. This is crucial for managing risk and ensuring that your trades are sized appropriately for your account.

- Max Spread: Prevents new entries if the spread exceeds a set value. This helps avoid entering trades during periods of low liquidity or high volatility.

- Max Open Positions: Limits the number of open trades. This prevents overexposure to the market and helps manage risk.

- Max Open Lots: Limits the total volume of open trades. This ensures that your account doesn’t take on too much risk at any given time.

Daily & Account Protections

These settings help manage risk by closing all trades if certain conditions are met:

- Maximum Daily Loss: Closes all trades if the account reaches a specified loss for the day. This helps prevent significant losses in a single trading session.

- Minimum Equity: Stops trading if the account equity falls below a set amount. This protects your account from further losses if the market moves against you.

- Maximum Equity: Closes all trades if the account equity exceeds a specified value. This locks in profits and prevents over trading.

Implementing these protections ensures that your account is kept within the rules of the prop firm in the event of unexpected market movements and potential large drawdowns. It’s essential to set these parameters according to your risk tolerance and the rules of the prop firm you have selected to trade with.

News Filter Settings

Adjust news filters to prevent new trades during significant economic events. You can set filters for high-priority news or both high and medium-priority news, ensuring your EAs avoid periods of high volatility. It’s worth noting that in the Prop Firm Robots App, the news filter type you selected will already be set up in the EA, but you can change it in the properties of the EA.

For example, setting the filter to disable trading two minutes before and after medium-impact news events provides a buffer period that allows the market to react and stabilize. This minimizes the risk of entering trades during volatile periods caused by news announcements.

If you wish to use the news filter, in your MetaTrader platform, select Tools ->Options. Navigate to the Expert Advisors tab. Select the check box: Allow WebRequests for listed URL. Add the following URL: https://forexsb.com. Click OK.

News filters are essential for preventing trades during volatile periods caused by economic announcements. You can set the filter to account for:

- News Priority: Choose between high-priority news only or both high and medium-priority news.

- News Currencies: Specify which currencies the filter should consider.

- Timing: Set how long before and after news events the filter should be active. For medium news, a common setting is 2 minutes before and after. For high news, it’s typically 2 minutes before and 5 minutes after.

Placing Expert Advisors on Charts

Attach each EA to its respective chart in MetaTrader. Customize the chart settings to your preference, but the most important element is the EA itself. Configure the EA properties such as entry lots, stop loss, and take profit levels, if you wish to change any settings. Again, this has been per-configured by the app, so there is no need to change anything unless you want to.

To attach an EA to a chart:

- Open a chart for the desired currency pair or asset.

- Enable Auto Trading / Algo Trading. – This step is crucial. If you enable Auto / Algo Trading after placing the EAs onto the chart, they won’t trade automatically.

- Drag the EA from the “Navigator” panel onto the chart.

- Adjust the EA settings in the properties window that appears (if you wish to).

- Click “OK” to apply the settings and start the EA.

Ensure that the chart’s timeframe matches the EA’s recommended timeframe for optimal performance.

Backtesting EAs with the Prop Firm Robots App

Backtesting is a crucial step in evaluating the performance of an Expert Advisor. It involves running the EA on historical data to see how it would have performed under past market conditions. This helps traders understand the potential profitability and risks associated with a particular strategy before using it in a live trading environment.

The Prop Firm Robots App simplifies this process significantly. With the app, there is no longer a need for manual backtesting. The app’s servers continuously generate and test hundreds of strategies using historical data from multiple brokers. The results displayed on the app are essentially comprehensive backtests that show how each EA has performed over different time frames.

This automation saves traders a considerable amount of time and effort. Instead of conducting their own backtests, traders can rely on the app’s rigorous testing process. The app presents the best-performing strategies, allowing traders to select and deploy them with confidence. This approach ensures that the chosen EAs are robust and well-tested, providing a reliable foundation for live trading.

Best EA for Prop Firms: Tracking Performance

Tracking performance helps you easily get a general and very specific overview of your EA and account performance. Regularly reviewing the performance metrics allows you to make necessary adjustments to improve your trading results.

We use tools like MyFXBook or FXBlue to track our EA’s performance. We connect our trading accounts to these services to monitor results and adjust our strategy as needed.

Selecting the Best EAs for The Challenge

Selecting the best EAs is done by analyzing their historical performance, potential returns, and consistency. We choose EAs that have performed best over a certain period – for example, over the past week or month. This gives us a good idea of which EAs are performing best in current market conditions.

By using the Prop Firm Robots App’s built-in statistics we see which EAs have been most profitable over the past day, week, month, year, or more long term. We monitor the performance of all EAs and choose the top performers for our trading challenges.

The Scaling System

As our account grows, sometimes we consider scaling our lot sizes. We start with a medium risk setting and increase to high risk once we’ve achieved a certain profit level. This helps to accelerate our progress but remember to manage your risk carefully if you follow the same approach.

Scaling your strategy involves gradually increasing your trade sizes as your account balance grows. This approach allows you to capitalize on your success while maintaining control over your risk exposure.

Real-Life Success Stories

Our traders have successfully used the Prop Firm Robots App to pass trading challenges. For example, in one of the challenges we used several EAs from the best-performing assets for prop firms and passed a $100,000 challenge in just 10 trading days. By carefully selecting and managing EAs using criteria based on our goals, we maximized our profits while minimizing risk.

Advanced Tips & Tricks

Regular Updates

The Prop Firm Robots App gets updated over the weekend with new and improved strategies. Join our community forum to find out when any major updates have been implemented.

Continuous improvement involves staying updated with the latest developments in the app and the trading industry. Regularly review and adapt your trading strategies to maintain a competitive edge.

Managing EAs Daily

We check the Prop Firm Robots App daily to see which EAs are performing best. Then replace under-performing EAs with new ones to keep our strategy fresh and effective.

Daily management ensures that our trading strategy remains optimized. Regularly reviewing and updating our EAs helps maintain strong performance and adapt to changing market conditions.

Advanced users can customize EAs to enhance their functionality and better align with specific trading strategies. However, be cautious and only make changes if you are confident in your coding abilities.

Common Issues & Troubleshooting

Common issues include connection problems, incorrect settings, or unexpected market behavior. Double-check your setup and consult the app’s support resources. Regular updates and reviews help resolve common problems and maintain optimal performance. We also have a large and growing community of traders and mentors that are always happy to share and assist in solving any issues that may arise. Join our specific forum topic and post any questions you may have,

Conclusion

The Prop Firm Robots App is a user-friendly tool designed to help traders pass prop firm challenges. It offers trading strategies that are accessible to both beginners and experienced traders. With its simple interface, you can set up, manage, and optimize your trading strategy without needing programming knowledge. The app updates regularly, providing top-performing Expert Advisors based on current market conditions. Its risk management features, such as adjustable risk levels and news filters, allow you to align your trading approach with your specific goals and risk tolerance. The supportive community and success stories offer valuable insights and encouragement. By using the Prop Firm Robots App, you can improve your trading strategies, manage risks effectively, and increase your chances of passing trading challenges.