Forum Replies Created

-

AuthorPosts

-

Matthew Roberts

ParticipantThanks for the reply, Petko!

Unfortunately, right after the EAs made that $13,000, it had a 7-day losing streak and created a -$3,000 loss from the initial balance on the account. Then it went back up to a measly $900.00 profit the next day and that’s when I pulled the plug for the free retry. ($16,000 is the profit target in this situation with true forex funds)

In a previous post on a different thread, I was doing a similar process with 10 – 100 pips SL and TP. I was struggling to find enough strategies that fit the acceptance criteria.

Samuel suggested I increase it to 20 – 200 SL and TP.

I was able to find enough strategies then and so I kept that criteria ever since.

This is a good point. If I cut my losers early it would be better.Assuming I’m able to get the criteria to generate enough.

Maybe a stop loss of 10 – 100 and a take profit of 101-200 or a take profit of 20 – 200 or something like that would be better.

Looking forward to Samuel’s reply as well if you have the time to do so. 🙂

Matthew Roberts

ParticipantOther important notes

In tools:

Correlation analysis threshold 0.98

Detect balance lines correlation: on

Detect strategies with similar trading rules: on

Trading session: open to all hours of every day

Data Horizon:Maximum Data Bars: 200,000

Minimum Data Bars: 300

Use start date limit: 32 months ago from the day I generate

Use end date limit: 2 months ago from the day I generate

Validator 1:

I take all of the collections I just made and run them through these settings.

Acceptance criteria: Profit Factor 1.2

Out of Sample: In sample

No Normalization or Monte Carlo this time.

Use start date limit: 2 months ago from the day I generate

Use end date limit: 1 month ago from the day I generate

Validator 2:

I take all of the collections that passed Validator 1 and run them through these settings

Acceptance criteria: Profit Factor 1.2

Out of Sample: 50% OOS

No Normalization or Monte Carlo this time.

Use start date limit: 1 month ago from the day I generate

Use end date limit: the day I generate

Then I pick the top 10 strategies for each pair and export a portfolio.

I immediately place them onto the challenge account.The idea here is to create strategies that profited for long periods of time and are still profitable for the last 2 months and profitable bi-weekly last month.

The performance is never as good as the backtest but that’s the whole idea behind forex I think. As I’ve heard from a user in Popov’s forum “You can’t train algebra.”

Anyways I run these strategies for exactly 2 weeks. I delete them, then create new strategies using the same generation settings.

By the way, I’m now doing this through Express generator cuz I can do almost the entire process with a single click of a button.

It was very tedious to do this before hand.

Matthew Roberts

ParticipantOptimize Strategies

Full Data Optimization: Off

Walk Forward Optimization: Off

Normalization: OnNormalization:

Remove Take Profit: Off

Remove Needless Indicators: On

Reduce Stop Loss: On

Reduce Take Profit: On

Normalize Indicator Parameters: On

Out of Sample: 30%

Numeric Value Steps: 20

Search Best: Net Balance

Normalize Preset indicators: Off

Use Common Acceptance Criteria: On

Perform robustness testing in next postMatthew Roberts

ParticipantIn the reactor generate new strategies

1. Historical Data

Data Source: Premium

Symbols used: EURJPY, CADJPY, USDJPY, and GBPJPY.

Timeframe: H1

2. Strategy Propertiesentry lots: 0.60 (I’m using 200,000 USD settings 1:30 leverage)

Trade Direction: Long and Short

Opposite Entry Signal: Reverse

Stop Loss: Always Use

Stop Loss Type: Fixed

Stop Loss Min (pips): 20

Stop Loss Max (pips): 200

Take Profit: Always Use

Take Profit Min (pips): 20

Take Profit Max (pips): 200

3. Generator SettingsSearch Best: Net Balance

Out of Sample: 30% OOS

Max Entry Indicators: 4

Max exit indicators: 2

Generate strategies with Preset Indicators: Off

Use Common Acceptance Criteria: On

Common Acceptance CriteriaComplete backtest:

Minimum Profit Factor: 1.2

Minimum Count of trades: 300

In Sample (training) part:Minimum Profit Factor: 1.2

Out of Sample (trading) part:Minimum Profit Factor: 1.2

Continued into optimization on next post

Matthew Roberts

ParticipantSorry for the lengthy post and thank you to anyone who chooses to read it.

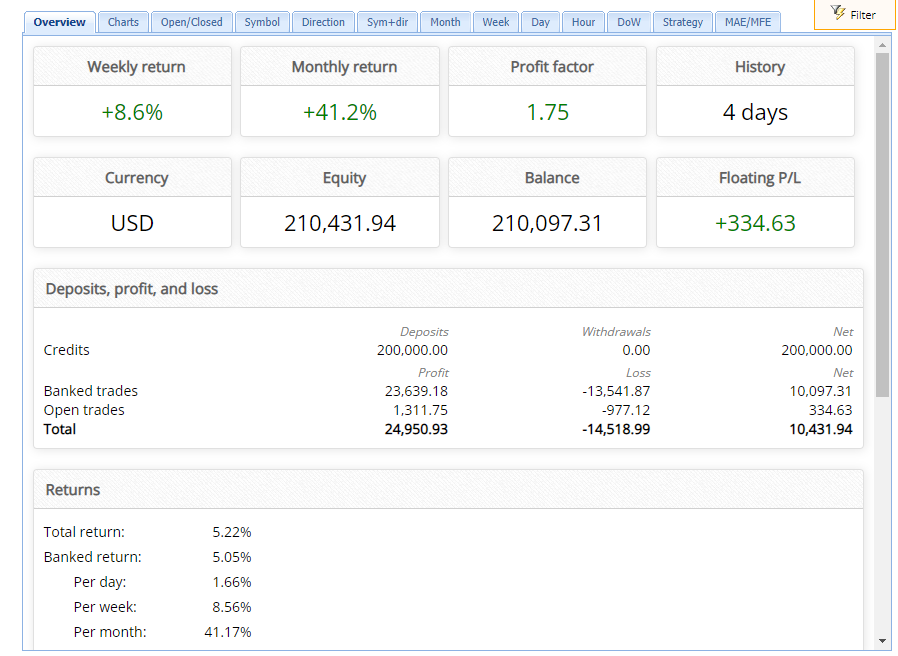

I have an update on my $200,000 challenge.

I was unsuccessful in creating enough profits to pass the challenge with my initial form of strategy generation. I was always ending in profit so that is good.

The profit was never enough to pass through, so I would get free retries. Excellent!!

I came really close one time, like within $3,000.00 close then I hit a drawdown phase that ate up all my profits and it put me straight into the negative.

The account got back into the positive with 4 days left on the challenge.

So, I took the bots off just in case another drawdown was coming.

This earned me another free retry.

Then I thought to myself, I’ve ended in profit twice and not created enough profits to pass why don’t I switch things up?

I couldn’t help myself and tried doing things differently… The different thing didn’t work and it failed lol.

I should have followed my initial instincts and kept it the same.

Anyways, it’s back to the demos for me.

I’d like to try switching up my strategy generation process to find strategies that perform better.

I’ll share what was “almost working” and how I was generating strategies that ended in profit but were not quite hitting the targets.

It was a process that I started trying a while ago and Samuel suggested a few things to help out in a previous forum post.

So, thanks Samuel for your input, I got a lot closer to passing an FTMO challenge because of you!

Maybe you or someone else has some more insight for me to adjust even further to get closer to that FTMO dream. The next post will have settings.

Matthew Roberts

ParticipantYes!!! I’m actually looking for a course on this as well.

I’ve been using True Forex Funds. They only have an 8% profit target, and no minimum days traded.

The issue with them is there is no demo.

I have a 200k challenge and have completed 2 free retries in a row.

I have passed a challenge multiple times on FTMO’s demo using the same method.

I’m just waiting for the market to hit the right conditions and I should pass the real one soon 🙂

I’ve posted my results so far below.

I’m using only JPY currencies.

10 USDJPY

10 GBPJPY

10 AUDJPY

10 CADJPY

Matthew Roberts

ParticipantActually, I had 5 of them generate enough on H1. So I stuck with those 5 only.

I have decided I’d still like to do more testing on M15 pairs before placing them on my FTMO trial.

Anyways here are the results of the last 4 days doing only H1 pairs.

I still have 11 more pairs to test out on H1 to see if I can generate enough.

The way things are looking though, I’m very happy with the results I see below.

If this does end up being consistent, the saying goes “If it ain’t broke, don’t fix it.”I can always do more testing, but I want to focus the majority of my efforts on what is working.

Matthew Roberts

ParticipantSamuel,

Just wanted to pop in and say thanks for the suggestions. Going 20-200 helped me find more strategies and I played around with each pair a bit.

I first tried 24 months data, 30% OOS, H1 strategies, 300 trades, minimum PF 1.2, normalizer 30% OOS, Monte Carlo 1.1 PF 80% valid.

if I found enough strategies, great I ran with it.

Most didn’t, so I moved on to 30 months and if I found enough strategies I ran with it!

If not, then I switched the time frame from H1 to others and found that most that didn’t work on H1 worked on M15.

If after that I still could not find enough strategies, I gave up on the pair.

I found 7 of the 8 I tested to generate enough strategies. NZDUSD was not a success. Any ideas on that pair?

Anyways, I’ve been generating 1 pair per night. I put 5 pairs on an account so far. The account is up $7600.00 as I am typing this.

The max drawdown so far is $5600.00.

If this continues like this, I’ll be trading for a proprietary trading firm very soon.

Thank you Petko for making this forum available to us and thanks Samuel for the help 🙂

Matthew Roberts

ParticipantI’m doing H1 time frame.

10 to 100 TP and SL.

That’s a good idea to see which pairs will create more strategies.

Could you further explain why 20 – 200?

Matthew Roberts

ParticipantHey Samuel, I tried diversifying and made a small amount of profit on month 4.

I added BTCUSD, GBPJPY, and NAS100. Using the top 10 strategies.

gbpjpy I found I had to increase the amount of time to years to generate enough strategies with 300 count trades 30% out of sample.

that’s said, all else equal it was my highest winning pair in fact the demo account made about 7500 in a month in just that pair alone.

BTCUSD has been the big loser this month almost losing all of that 7500 and nas100 was barely a winner. With that said, maybe I should venture into more forex pairs.

I like to follow the rule atleast 10 to 15 trades per month for a strategy and I couldn’t get eurusd to generate enough strategies at 300 count trades at 24 months, then I tried 30 months and still couldn’t. Anything past 30 months is less than 10 strategies per month and I’m really not interested in that pair any more.

Any thoughts on what forex pairs might be able to generate enough strategies with 300 count of trades in 24 months?

I think I’ve mentioned this before but just in case:

Profit factor required for acceptance is 1.2 in and out is sample 30%.

minimum count trades 300

Matthew Roberts

ParticipantHey Samuel, I should have been more clear. I was using risk settings meant for a 100,000 FTMO account. The max draw down I had for a day in the system was 4125.00 which passes the FTMO max draw down of 5% per day requirements. And the max draw down overall was never even close to the 10% allowed at FTMO.

I’m finding that my system seems stable enough to not lose money, but it’s not making enough money to pass a prop firm challenge.

I’m looking for that extra boost in profits. I’ve seen that Petko aims for 50% per month using eastudio… that’s absolutely amazing. I’d love to reach a point where I can gain even 15% consistently. This way I can be sure to beat a prop firm challenge and get going full time in my forex career freeing me up to pursue my music dreams.

Petko, any suggestions?

Matthew Roberts

ParticipantMy equity drawdown is fine.

In fact, my equity was so high at one point I would have passed a $100,000 proprietary trading firm challenge phase 1. But phase 2 I would have failed.

I do a brand new system every 2 weeks and get rid of the old bots not caring how they would have performed.

I read in other forums that Petko aims for about a 50% return every month.

I’m curious for any suggestions on how I might change it up to gain results similar to that.

Currently, I’m doing the same method I was using, however, I’m adding more assets to see how that works.

I’m interested in adding XAUUSD.

Any suggestions on SL and TP limits and how much backtest data should I be using to get to a minimum of 300 trades without getting the what I like to call “can’t generate enough strategies” message.

Matthew Roberts

ParticipantHi Petko,

I am making no changes to the strategies. No manual entries, exits or modifications are being performed.

As for why I change my lots it’s in attempt to compound my account with the profits. For example a person with $100,000 could trade larger lots than a person with $10,000.

See below for how I am scaling it.

Every time I run a new batch of bots I’ll input the below formula to decide which lots all of the robots in the portfolio will trade at for the 2 week period I run them.

I am essentially adding extra lots as my account size scales up or down.

The exact formula

initial lots = (Beginning Balance / 1000)/100

new lots used = initial lots + ((Current account balance – Beginning Balance)/2000)

So my beginning balance was $10,000 so the first 2 week period I ran .10 lots on the portfolio and gained $6500.

After that I made new bots and plugged in the new lots used formula.

.10+{[($16,582.10-$10,000)/2000]/100} =.1329105

I always round down so I used .13 lots on the second round and so on until I posted here.

Any other suggestions as to what might be causing some of these periods to not be profitable?

Matthew Roberts

ParticipantI’d like to update you.

It’s been 3 months since I shared my strategy that I was going to test on a demo.

Here’s an update with the profits and losses of the demo.

Starting Balance

$ 10,000.003/24/2022 – 4/7/2022

$ 6,582.10

4/7/2022 – 4/21/2022

$ (2,037.61)

Month 1 Total

$ 4,544.494/21/2022 – 5/5/2022

$ (1,160.98)

5/5/2022 – 5/19/2022

$ 4,132.21

Month 2 Total

$ 2,971.235/19/2022 – 6/2/2022

$ (3,325.80)

6/2/2022 – 6/21/2022

$ 83.52

Month 3 Total

$ (3,242.28)Ending Balance

$ 14,273.44The contract size is 10 on my broker. I started with .10 lots.

At the end of every 2-week period, for every 2000 I gained or lost, I increased or decreased my lot size by 0.11.

I’m not happy enough with my results to trade live as month 3 was a total bust.

Any suggestions?

My demo is still in profit which is great!Matthew Roberts

ParticipantI’d like to hear how many months of data Petko recommends. I’ve always heard having more time for more trades is more robust, however, having too much of a time period reduces potential profits. That’s why I stuck with 13 months and 300 trades.

My new game plan for testing is going 15 months backwards to 2 months backwards.

300 count trades.

PF >= 1.2 in sample and out of sample.

normalize 30% OOS (all boxes checked except for remove take profit.)

Monte Carlo 80% 1.1 profit factor last 2 boxes checked.

I’ll generate a pool of about 1000 strategies to run through the validator from 2 months to 1 month ago.

All the strategies that had PF >=1.2 will be downloaded into a new collection. (This will be my last step before a mock demo)

Then I’ll run the new collection through the validator from 1 month ago to half a month ago.

all the strategies that had PF >=1.2 will be downloaded into a new collection.

At this point, if it was real-time I’d consider the strategy acceptable to go on a demo account (it’s going to be a “live” demo account.)

I’ll run it through the validator one last time to see if it was profitable from half a month ago to today. (This would be the point if it was a real account that I’d repeat the process and swap out the bots for new ones)

I’d like to find a way to make consistent profits every month with this and I’m gonna get there!

All please let me know if you have any suggestions for me and I’ll let you know how this testing goes.

-

AuthorPosts