Forum Replies Created

-

AuthorPosts

-

Alex C

ParticipantI understand that an Equityline can’t go straight up. What I saw over the last weeks is that the active portfolio seems to make profits big profits on Monday and if it doensn’t the rest of the week is catastrophic (10%-20%). Also Friday’s seem to be profitable 80% of the time, do you consider eg. only putting EA’s on specific days when you see that other days aren’t profitable?

I also read about drawdowns of strategies and timing to put them in the market, running strategies on demo accounts and putting them up live when they have a drawdown on demo because you expect a recovery. Does anyone take this into practice or not?

Can someone tell help me determine how much robots I can best put on my 500$ account with 1:30 leverage and how I can calculate this for myself? I see that indexes and gold have a lot of impact on my strategy performance as the minimum lotsize is 0,10 for indices and gold tend to move more. What can I do about that on a small account?

Alex C

ParticipantThanks for your answers…

With a 1:30 leveraged account and using 0.01 lotsize how much should I have on my account, because using the process you describe it is never a fixed amount of EA’s.

Also US30 has a minium lotsize of 0.10 on my broker, Gold and indexes tend to skew my results because of their pip value which is bigger…

Do you use an EA to manage risk, like closing all positions when the 5% is reached? Do you then wait for a month to put new EA’s in the market? IF you use an EA could you please share it? Do you also apply a max risk per EA?

Alex C

ParticipantHi Samuel,

I took the Gold, Dow, EURUSD, GBPUSD, Crypto course, and the portfolio course I run them on demo and go through the steps like showed in the course… I run them on 3 different brokers. After posting it only went down, no positive weeks anymore… still in profit but I’m confused …

Can you also help determine what the minimum balance should be on a 1:30 leveraged account per trading pair/EA?

And what about Gold & Dow, how much should I add for each running EA? I have trouble understanding how you can determine that based on leverage etc….

Alex C

ParticipantHi,

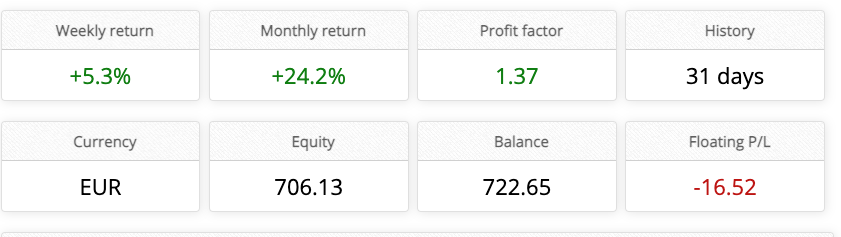

I’m new here and started taking Petko’s courses. I ran the strategies created in the courses and tested them for more than a month managing them as shown in the videos on a weekly/monthly basis. I’m very happy with the past month:

I have a couple of questions:

- What settings should I use to generate strategies for OIL/BRENT & DAX? How can I determine the SL/TP range, I saw some people talking about it but I don’t understand how they come up with those numbers

- Is there a way to generate EA’s taking 50% profit and let the rest run with a ATR trailing stop? Or adding an external EA that could manage this? Or is this not a good Idea?

- Do you close positions on Friday on your live accounts or not?

Alex C

ParticipantAre you going to make a course/EA for OIL, DAX and/or FTSE?

-

AuthorPosts